Getting Risk Adjustment Right in IFRS 17: Understanding Different Calculation Methods

Ashwini Gupta, Senior Principal Product Manager

In this article we focus on the different calculation methods involved with selecting an appropriate methodology to successfully manage the reporting standard. Risk adjustment is a significant factor in how profit from insurance contracts is reported and transpires overtime.

Risk adjustment under IFRS 17

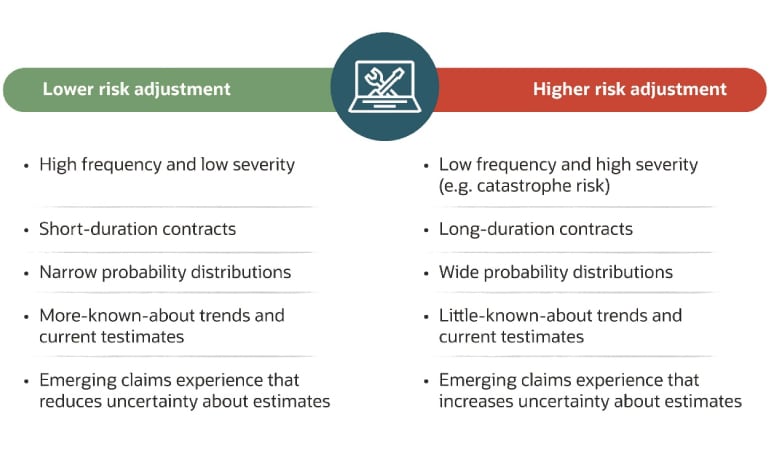

Risk adjustment is one of the primary calculations in IFRS 17 disclosures. The standard requires the risk adjustment to reflect the compensation an entity requires for bearing the uncertainty associated with non-financial risks.

Risk adjustment is one of the three blocks in IFRS 17 matrices. However, it is built structurally to be the depository of the 'margin for adverse deviation' and therefore expected to be a major contributor to profits emerging during the life of the contract. Companies consider different methodologies for calculating risk adjustment to ensure its release in an orderly and consistent manner.

IFRS 17 standard does not prescribe any specific techniques on calculation methodologies; insurance companies are free to adopt their own, subject to the below qualitative rules (in paragraph B91 of IFRS 17) to ensure consistency in risk adjustment.

In terms of calculations and disclosures, entities are required to calculate risk adjustment at the IFRS 17 contract group level and provide reconciliation from the opening to closing balances of risk adjustment within disclosures. Insurance companies are also required to disclose the calculation methodology and the confidence interval of the risk adjustment until the run-off of the liabilities.

Methodologies to calculate risk adjustment

IFRS 17 is a principle-based accounting standard and gives companies the freedom to choose an appropriate calculation method.

There are four potential methods to compute risk adjustment: cost of capital approach, value at risk approach, scenario value at risk approach, and the margin for the adverse deviation approach.

Cost of capital approach

Cost of capital is the same approach that has been prescribed for risk margin computation under Solvency II. The calculation of risk margin is stated as:

Here, the risk capital is calculated by summing up the combined risk requirement for risk pairs. The risk requirement for the risk pairs is the multiplication of the two individual risks' capital requirement with the correlation between the two. The risk capital is multiplied by the cost of capital rate of 6% as prescribed by the Solvency II directive. As required under the directive, for calculating the risk capital for individual risks, the confidence level is set at 99.5th percentile.

After having invested heavily in Solvency II, these entities would naturally leverage their Solvency II processes for the calculation of risk adjustment while simultaneously avoiding repetitive Solvency II and IFRS 17 production work.

There are significant differences between the two calculations conceptually, including the risks covered, parameterization of the risks, contract boundaries, and the granularity at which the two numbers are needed. Insurance companies will need to consider all the above differences while adopting their current Solvency II methodologies.

Value-at-risk (VaR) approach

Under the Solvency II standard formula, a stress test and correlation approach is used and calibrated by the European Insurance and Occupational Pensions Authority (EIOPA). These calculations cover all risks, and the confidence level is set at the 99.5th percentile over a one-year time horizon. Insurers use individual stresses and correlation matrices, where the correlations are applied to the difference between the base run and different stresses.

For IFRS 17, these stresses can be calibrated suitably in line with how risk is priced and the horizon over which the stress is applied. The present value of future cash flows calculated for each group is the best estimate for VaR calculation. And the calculation would be repeated with margins added to different assumptions. The differences between 'with margin' runs and the best estimate run are aggregated using suitable correlation matrices. However, similar to the capital approach cost, insurers will need to consider only the non-financial risks.

Scenario VaR approach

Alternatively, insurance companies can use scenarios with different assumptions that appropriately include correlations between risks. This alternative is more suitable, where the modelling capabilities and data is limited. What is needed? A single run separate from the base best estimate run to arrive at the given scenario's result. The most important part is to arrive at suitable scenarios for the calculations. There are statistical techniques available to arrive at such scenarios. However, this approach comes with its limitations, like the subjectivity. Too much dependence on an expert judgement can lead to difficulty in explaining the results.

The margin for adverse deviation approach

This is the most basic and, computational ability-wise, least demanding approach. Many regulatory jurisdictions allow the use of approaches involving explicit margins on all assumptions for reserving and other purposes. The amount over and above the base estimate is explicitly calculated and known as “margin for adverse deviation.”

Insurers using such methodologies for reserving can use their calculations and processes for IFRS 17 risk adjustment calculations.

So what calculation method is right for my business?

The choice of method for an insurance company will depend on their computational capabilities, familiarity with the approach, and flexibility while meeting the IFRS 17 requirements. Apart from these, go with an approach that produces consistent results year over year, is aligned with other matrices, and uses existing data and processes.

Oracle helps insurance companies navigate these complexities with its globally recognized IFRS 17 and LDTI Analyzer solution. Built on Oracle's integrated risk and finance architecture, it provides out-of-the-box capabilities for data aggregation, discounted liability calculations, measurement of market risk benefits (MRB), and amortization of deferred acquisition costs (DAC). It can also seamlessly integrate with finance and actuarial applications, enabling accounting, performance management, risk management, and reporting from a single platform.

Oracle Financial Services helps organizations meet their business needs without compromising the ability to meet the needs of future generations. Financial institutions can derive benefits such as cost reduction, security improvements, and increased agility from SaaS adoption while being mindful of their Environmental, Social, and Governance (ESG) goals.