Waafi Bank launches its digital-only operations on OCI

September 20, 2022 | 7 minute read

Authored by Kellsey Ruppel, principal product marketing director at OCI, and Kelvin Boey, master principal cloud architect of Cloud Engineering at Oracle.

The authors want to thank the Waafi Bank Ltd team and their partners for their contributions.

The shift to digital and online banking is the most prevalent trend in the financial services industry today. The industry is witnessing a continued, aggressive focus on digitization and the adoption of new technologies to bring in operational efficiencies, enhance speed-to-market, and deliver superior customer experiences.

Banks are cutting down spending on branches to invest in self-service digital channels as mobile and online banking become more popular among customers. In today’s era of unprecedented convenience and speed, consumers don’t want to trek to a physical bank branch to handle their transactions. Digital devices packing the power of smartphones are making it increasingly possible for banks to offer targeted services to customers.

Goals for cloud migration

Waafi Bank was looking at providing a secure and robust infrastructure to implement their Core Banking System. Waafi Bank needed a robust cloud infrastructure that provided the flexibility to match resources to unpredictable demands without a huge capital expenditure (capex) investment. The infrastructure also had to be secure and compliant with various standards and regulatory requirements.

Waafi Bank turned to Oracle Cloud Infrastructure (OCI) for the performance and operational efficiencies that they couldn’t achieve with another cloud provider. With the infrastructure considerations, Waafi Bank also needed a comprehensive solution for database security and compliance because they store and process sensitive financial data and personally identifiable information (PII).

The cloud was the best option because it allowed Waafi Bank to scale according to business growth and lower the cost of investment. The cloud also enabled the bank to ensure disaster recovery and business continuity and speed up the delivery of products to its customers.

Suite of Oracle products used

OCI includes all the services needed to migrate, build, and run IT in the cloud, from existing enterprise workloads to new cloud native applications and data platforms. Waafi Bank used the following OCI services and technologies:

- Compute: OCI Compute provides fast, flexible, and affordable compute capacity to fit any workload need from performant bare metal servers and virtual machines (VMs) to lightweight containers.

- OCI Block Storage: Reliable, high-performance block storage designed to work with a range of VM and bare metal instances. With built-in redundancy, block volumes are persistent and durable beyond the lifespan of a VM and can scale to 1 PB per Compute instance.

- OCI File Storage: OCI File Storage is a fully managed elastic file system built for the cloud that enables customers to migrate their enterprise workloads to the cloud. Every file system scales automatically to accommodate the growth of up to 8 exabytes. File Storage eliminates the need to provision capacity in advance, so customers pay only for the capacity they need.

- OCI Object Storage: OCI Object Storage enables you to securely store any type of data in its native format. OCI Object Storage is ideal for building modern applications that require scale and flexibility, as it can be used to consolidate multiple data sources for analytics, backup, or archive purposes.

- Network load balancer: OCI Load Balancing service enables you to distribute web requests across an array of servers and automatically route traffic across availability domains, resulting in high availability and fault tolerance for applications or data sources.

- Oracle WebLogic Server for OCI: WebLogic for OCI lets customers deploy Java applications to the cloud with a few clicks. Achieve higher performance and gain power to manage, scale, and secure applications across global cloud regions at lower cost than on-premises.

- Oracle Database service: Oracle Database service allows organizations to create and manage full-featured Oracle Database instances in OCI. IT teams provision databases on VM with block storage volumes providing cost-efficient cloud database services with a choice of Oracle Database editions.

- OCI domain name system (DNS): This service lets you create and manage your DNS zones. You can create zones, add records to zones, and allow OCI’s edge network to handle your domain's DNS queries.

- Oracle Identity Cloud service: Oracle Identity Cloud service provides an innovative, fully integrated service that delivers all the core identity and access management capabilities through a multitenant cloud platform.

- Oracle Cloud Guard: Oracle Cloud Guard, including the new threat detector, detects misconfigured resources, insecure activity across tenants, and malicious threat activities and provides security administrators with the visibility to triage and resolve cloud security issues.

- Oracle Data Safe: Oracle Data Safe empowers organizations to understand data sensitivity, evaluate data risks, mask sensitive data, implement and monitor security controls, assess user security, and monitor user activity, all in a single, unified console. These capabilities help to manage the day-to-day security and compliance requirements of Oracle databases, both on-premises and in the cloud.

- Oracle Cloud Observability and Management Platform: A suite of services for immediate interrogation of assets and allows for machine-learning automation to create actionable insights. It spans all tiers of services, from web to app servers to databases, and drills into underlying compute, storage, and networking layers.

- Oracle Content Management (OCM): OCM helps everyone in your business manage, create, and activate various types of content, including websites, documents, videos, and graphic assets, in one cloud native system. With access to a flexible, scalable, and secure content management system, you can create consistent content in a collaborative environment and make it available to all elements of your digital, employee, and customer experiences.

Waafi Bank also has the following applications hosted on OCI:

- Oracle FLEXCUBE Universal Banking: Oracle FLEXCUBE is a real-time, online, comprehensive banking solution that supports the changing landscape of retail, corporate, and investment banking needs with strong conventional banking and Islamic banking capabilities.

- Oracle Financial Services Analytical Applications (OFSAA): Quickly respond to market dynamics and regulatory requirements. Use financial services analytics software to integrate insights from advanced analytics and data management tools to drive profitability, accelerate financial reporting, mitigate risk, and improve compliance.

- Oracle Banking Digital Experience (OBDX): A highly customizable, context-aware, omnichannel digital banking solution that can integrate with any core processor and service all lines of business. Oracle Banking Digital Experience helps banks complete their digital strategies without requiring a one-size-fits-all approach.

Migration path and Oracle solution

Waafi Bank conducted discussions to highlight technical and commercial benefits of running Oracle on Oracle. They detailed OCI’s security design, including isolated network virtualization, automated security, and always-on encryption, and the performance benchmark. OCI has always been the platform of choice for Waafi Bank because they’re running an Oracle banking solution. Waafi Bank conducted a four-week proof of concept on FLEXCUBE and OBDX on OCI and found the results to be promising. In three months, they completed deployment and testing on OCI, FLEXCUBE, OBDX, and OFSAA, which the Oracle Cloud Lift services team and partner JMR InfoTech performed.

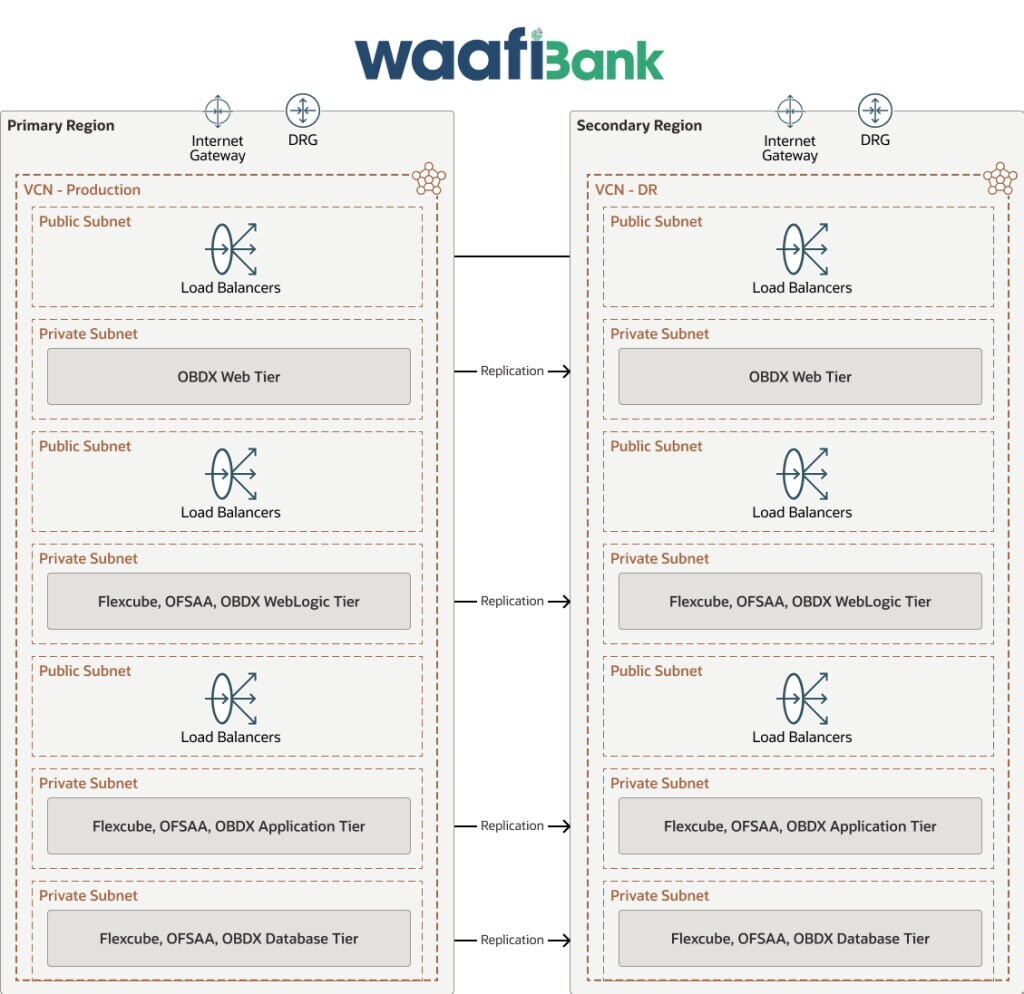

Figure 1: Waafi Bank reference architecture

Waafi Bank chose to use Oracle Data Safe, native to OCI, for its extensive set of database security and compliance features like database activity auditing and data masking. They especially enjoyed that all the capabilities came in a single, unified console.

Waafi Bank selected OCI for the following reasons:

- OCI is optimized for Oracle workloads, outperforming Amazon Web Services (AWS) and Azure

- Seamless integration between layers (Applications, database, infrastructure, and security)

- OCI’s security-first design principles provide complete built-in security controls

- Performance backed by service level agreements (SLA)

- Single vendor support for entire technology stack provides peace of mind

- Oracle Cloud compliance program ensures OCI actively complies with ever-changing regulatory requirements

Results achieved with OCI

Waafi has invested in OCI and a suite of Oracle Financial Services Solutions including FLEXCUBE for Islamic Banking, Oracle Financial Services Analytical Applications (OFSAA), and Oracle Banking Digital Experience (OBDX).

As an easy-to-operate platform that minimizes downtime, OCI delivered unmatched performance for Oracle workloads with seamless integration across Waafi Bank’s more stack. OCI integrates and automates security, and this ensures the bank doesn’t have to hire additional resources.

“OCI complies with stringent standards set by the industry and different governments,” said a representative from Waafi Bank. “From compliance certifications to various jurisdictions across the globe, and other industry bodies—they all speak highly of OCI’s compliant approach.”

The flexibility of the Oracle solution that includes Weblogic Server, Enterprise Database Services, Oracle Content Management, and Observability and Management provides the bank with more room to customize based on its needs. Its agility also allows the bank to optimize and boost costs and performance. Oracle Data Safe allows the bank to manage the day-to-day security and compliance requirements more effectively and efficiently for their Oracle databases. With OCI’s core banking, Waafi Bank can implement deliverables faster and serve customers better.

Waafi Bank can now rapidly deploy resources to meet demands, thanks to OCI’s ability to scale up and provide flexible costing, and only pay for what it consumes. This pay-per-use pricing model without a huge upfront capex investment and no infrastructure maintenance cost is yielding huge cost savings for Waafi Bank.

Explore more Oracle Cloud Infrastructure customer technical case studies and try Oracle Cloud Free Tier.