Improve Profitability and Gain Insights with Oracle Profitability and Balance Sheet Management

By Yogendra Singh and Chris Spofford, Oracle

As cloud technology matures, financial institutions are migrating finance, treasury, and compliance functions away from on-premise systems. According to IDC, the worldwide financial applications market is forecast to reach $44.7 billion by 2025, with the cloud portion of that market growing by 13.9% through 2025. In addition, our global modernization of finance survey conducted with IDC revealed that more than half (54%) of finance executives indicated that financial planning and performance software are the most important tools necessary to build modern finance capabilities.

Oracle, a leader in integrated solutions across finance, treasury, and financial planning and analysis, has launched its Profitability and Balance Sheet Management Cloud Service suite. It includes multi-dimensional profitability management, profitability analytics, funds transfer pricing (FTP), asset liability management (ALM), balance sheet planning and optimization, and a stand-alone account-level cash flow engine service. These cloud-native SaaS services provide the necessary tools to assist financial institutions in measuring and meeting risk-adjusted performance objectives and price products to reflect their actual risk. They also help financial institutions better understand how their institutions are impacted by threats to changes in interest rates, liquidity, capital adequacy, and exposure to market rate volatility.

Benefit from your move to Oracle Cloud

Benefit from the same comprehensive profitability and balance sheet management capabilities you use today, plus realize the advantages of running cloud-native, true SaaS services on Oracle’s highly secure cloud infrastructure. Moving your on-premise applications to the Cloud lowers your total cost of ownership, increases your agility, and improves your productivity.

Performance

- Increased flexibility and reliability when you run your applications on the Oracle Cloud

- High performance at a lower cost versus deployments running on-premises or other cloud infrastructures

- Shared infrastructure that empowers your entire business to run faster and scale up (or down) to meet peak compute demands with ease

Security

- Enterprise-grade security at every level of the stack, ensuring user isolation, and data encryption at every stage of the life cycle

- Fine-grained security controls, compliance, and visibility through comprehensive log data and monitoring solutions

Cost savings

- Hardware cost savings, increased business flexibility, and greater efficiencies in the short- and long-term

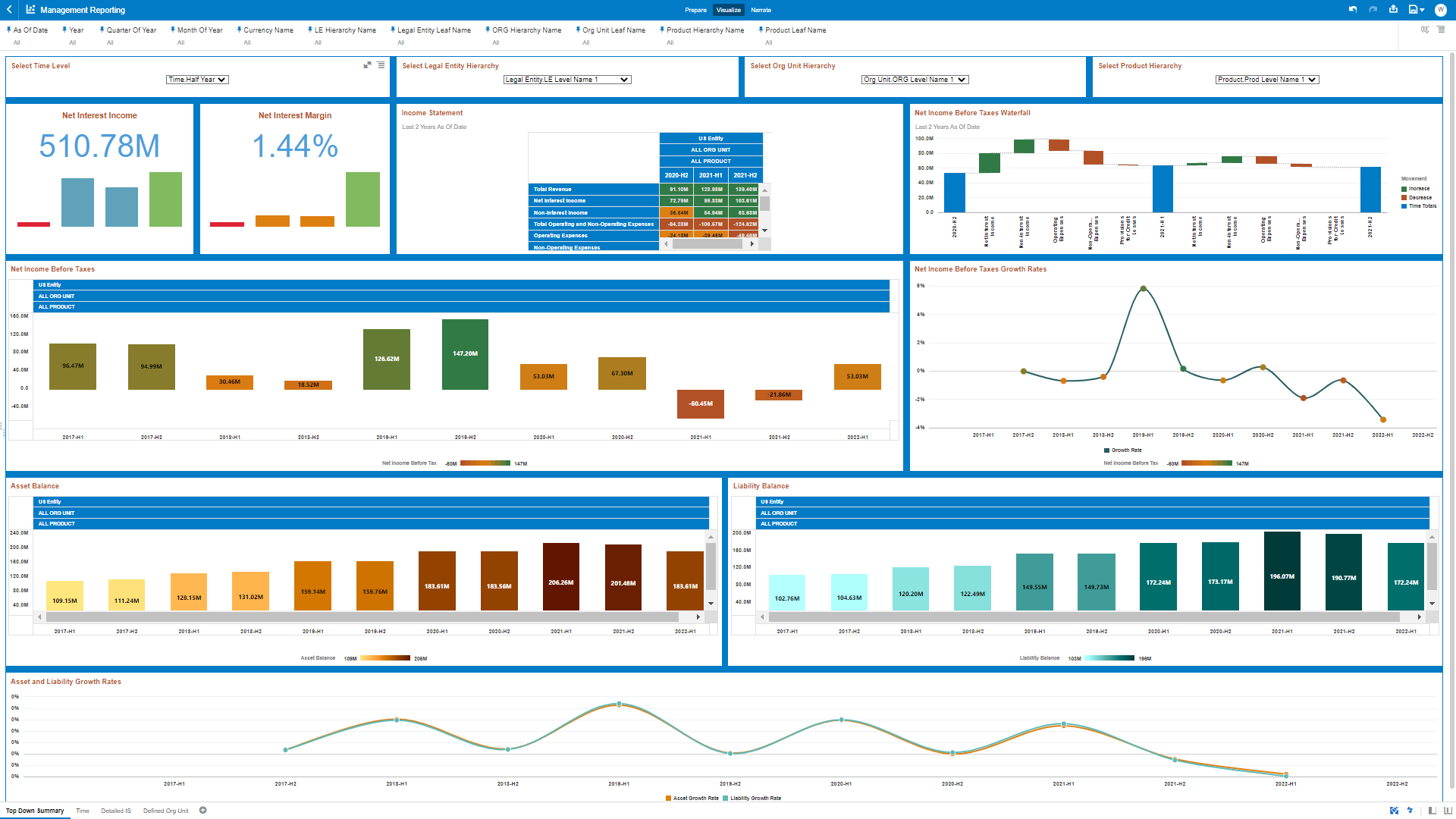

Profitability management

Address profitability challenges in today’s dynamic business environment, with inherent volatility, rising interest rates, and changing customer behavior with Oracle’s Profitability Management Cloud Service. It provides robust and highly scalable cost allocation functionality and multi-dimensional profitability analytics and reporting to understand the true drivers of profit and risk in your portfolio.

- Develop and analyze full P&Ls at any level of detail using custom allocation logic to manage the allocation of costs and fees efficiently

- Improve operations with reporting to help you understand the data and results, monitor processing, and ensure timely and accurate results

- Accurately assess profitability across multiple dimensions, identify and track trends and cost structures of the most profitable customers, products, organizational units, and lines of business

- Easily identify trends and opportunities and enhance decision-making with Oracle Analytics and Data Visualizations

Funds transfer pricing

Understand what drives enterprise performance and determine the spread earned on assets and liabilities by utilizing industry-leading transfer pricing methods with Oracle’s Funds Transfer Pricing Cloud Service. It accurately assesses profitability along the customer, product, channel, and business lines and centralizes interest rate risk for effective management.

- Accurately price the cost of funds by assigning multiple FTP rates comprised of base and add-on rates

- Understand your actual exposure to interest rate risk when calculating funding charges and credits for each account record for each component FTP rate and posting offset entries to your funding center

- Identify break events and calculate their actual economic gains and losses, incenting lines of business to recoup costs and increase revenue

Asset liability management

Address increasing regulations requiring multiple techniques to measure exposure to liquidity and interest rate risk accurately. Oracle’s Asset Liability Management Cloud Service offers an accurate view of profitability, earnings stability, and overall balance sheet risk exposure. It provides an integrated framework for high-end ALM analytics, dynamic interactive dashboards, intuitive reporting, alerts, and scenario-based what-if analysis.

- Accurately model any financial instrument in any currency down to the account level via a high-performance, scalable, standard cash flow engine

- Calculate market values, incomes, equity, and capital as well as liquidity levels, trends, and ratios in a variety of scenarios

- Forecast the future using full income simulation with profitability, including FTP forecasting and combine income simulation with interest rate gap and liquidity in a single forecasting concept

Cash flow engine

In recent years, the usage of cash flow projections has expanded across risk and balance sheet management teams—a trend largely attributed to evolving regulations and increased interaction among risk and finance functions. Oracle’s Cash Flow Engine Cloud Service is a stand-alone service that calculates daily cash flows using daily forecasted interest rates at the individual account level. This enables deeper analysis, supporting a variety of use cases, including liquidity, stress scenarios, and many others.

- Generate account-level cash flows using unique payment and repricing characteristics

- Produce daily cash flows using daily forecasted interest rates at the individual account level

- Improve insight into branch liquidity and cash on hand

- Create an analytics-driven strategy to help chase late payers promptly and regularly

Balance sheet planning and optimization

Current market dynamics make it even harder to forecast future performance accurately while assuming forward-looking risk. With Oracle’s Balance Sheet Planning and Optimization Cloud Service, financial institutions can gain a complete picture of balances and spreads, including a wealth of related cash flow information for each budgeting and reporting period, such as:

- Accurately plan net interest margin incorporating cash flow processing and FTP for current and new books of business

- Capture forecasts from planning analysts using pre-built planning forms and business rules

- Access integrated historical performance metrics, including net interest margin, risk-adjusted return, spread from transfer rates, allocated costs, and capital

A trusted leader in integrated technology and cloud

For over 30 years, Oracle has set the standard in the financial services industry for running integrated analytical applications across finance, risk, treasury, FP&A, and compliance. Our new Profitability and Balance Sheet Management Cloud Services suite can help financial institutions to achieve management excellence in delivering deeper business insights with a lower total cost of ownership. Oracle’s cloud-native SaaS architecture combines performance and balance sheet management applications into a single, seamlessly integrated framework.