Navigating the GenAI Future: How CFOs Can Maximize Finance Productivity

Keith Causey, Senior Vice President, Cloud ERP Transformation and Development | April 29, 2024

Causey, a CPA, has held senior executive finance, accounting and information technology roles in hospitality and entertainment, manufacturing, and communications companies.

In the rapidly changing finance landscape, the rise of artificial intelligence (AI) and generative AI (GenAI) presents a transformative opportunity in the enterprise. For chief financial officers, steering our organizations through these waters is a welcome challenge to drive substantial productivity gains and value. We’ve previously written about the role GenAI plays in changing everything for the finance organization. Here, we’ll focus on productivity, the availability of AI-driven capabilities to spur immediate gains, and what’s on the near-term horizon in terms of harnessing the power of GenAI to propel our finance teams toward new heights of productivity and efficiency.

Productivity Gains: The Untapped Gold Mine

Studies predict global productivity gains from AI alone will exceed $7 trillion over the next decade, yet only a fraction of companies—30% or less—are fully utilizing AI in finance. We're sitting on a gold mine, and the time to act is now.

For the finance organization, significant productivity gains are ready for the taking with traditional AI already embedded into the leading cloud native ERP platforms that integrate software and infrastructure. Traditional AI allows for automation, and for numerical predictions and insights, which are further enhanced with GenAI narratives. Today, these systems are automating nearly all aspects of end-to-end transaction flows, including:

- Intelligent data recognition for data ingestion

- Data matching to speed transaction processing

- Reconciliations that occur in the background as processing takes place

- Anomaly detection to help reduce risk

- Real-time predictive analyses for proactive financial management

- Advanced financial controls to monitor for cash leakage and fraud

- Supplier intelligence for improved sourcing and evaluation

And so much more.

Green Shoots of Productivity

To illustrate the impact of automation in the finance function, here are a couple of concrete examples of how companies are driving productivity gains. First, transactional processing has become heavily automated and is on a path to becoming fully touchless. The Oracle Fusion Cloud ERP customer base is replete with organizations using AI-powered intelligent data recognition and automated matching capabilities to substantially increase the number of payables processed electronically. For example, one automotive company achieved greater than 90% automation with near perfect first-time accuracy across millions of transactions.

Second, customers running on Oracle Cloud ERP regularly decrease the time for their accounting close, and those using embedded AI capabilities such as anomaly detection with insights and automated accruals and reconciliations see even greater benefits. One hospitality powerhouse saw upwards of 50% efficiency gains, including substantially reducing manual journal entries and reconciliations, and the use of manual spreadsheets. Beyond these productivity gains, the company reaped the added benefit of reduced audit time and effort due to the resulting higher quality finance data. These gains allowed the finance team to focus on higher value activities including continuous process improvement, innovation, and achieving the highest value from the Cloud ERP platform itself.

Productivity Gains: What’s Next

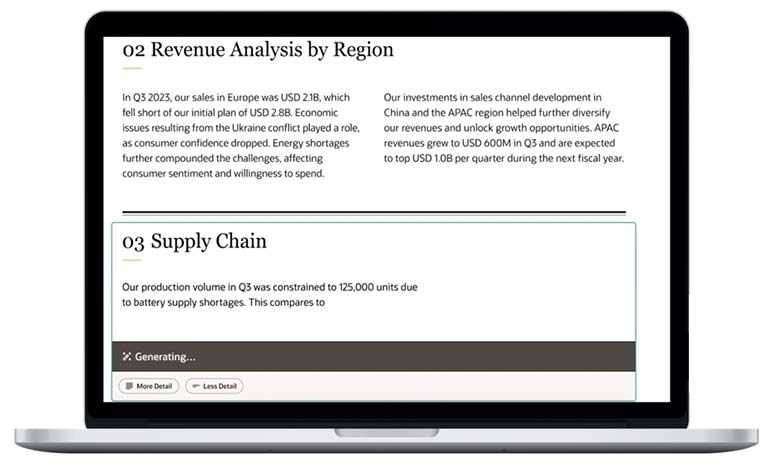

Looking forward, it’s exciting to think about how we’ll combine the strengths of existing traditional AI with generative AI narratives to help further increase productivity. GenAI helps to increase the value of traditional AI by producing and analyzing text and visuals to provide contextual conclusions and recommendations. GenAI will deliver these insights by helping to create new content such as reports, charts, infographics, slides, and even images and videos—content that finance professionals can review, refine, and elaborate upon. Productivity can be further improved through easier access to information leveraging the application of GenAI, using natural language to quickly access data—including data that is confidentially protected by cloud native ERP security. This can lead to increased self-service, faster ideation, and more innovation.

GenAI can be applied to allow us to take the next step and go beyond traditional AI. For finance professionals, this translates to helping them provide richer context and actionable explanations to drive fact-based decisions. GenAI can be applied to help them craft text that explains variances and trends, composing contextual commentary to explain forecasts produced by predictive models, and enabling an understanding of the key factors driving the predictions while providing actionable suggestions on a proactive basis.

We will apply GenAI to produce draft narratives for internal and external financial reporting purposes, and eventually have conversational experiences with GenAI acting like a virtual employee to help query for information for simple data retrieval, visualization, and more sophisticated analysis and action. GenAI can also be applied to provide the kind of contextual assistance needed to achieve touchless business-to-business activities between suppliers, buyers, banks, and logistic providers.

With GenAI, the prospects for fully automating more finance activities and further enhancing productivity grow exponentially. With this progress, our goal of touchless operations in a continuous finance function becomes more of a reality.

Steering Toward a Productive Future

Increasing productivity is a fantastic first step by itself. As CFOs we should also strive to enhance value derived from our team’s higher skill sets. This will involve a shift toward using AI to support actions and activities that align with strategic objectives—things such as increasing revenue, reducing costs, maximizing cash flow, improving collections monitoring and tactics, and even making suggestions to improve negotiating tactics, for buyers or sellers. We should also focus on centralizing non-strategic activities, fostering innovation, and enabling timely decision-making.

With a clear vision, adept change management, and strategic technology choices, we can lead our organizations toward a future where finance isn't just a support function but a driving force for productivity and innovation—an organization that guides the enterprise toward smarter decision-making and strategic achievements.

Bottom line: GenAI is not a new technology to adopt; this is now about reshaping the way finance functions.

Let's embrace the future, where finance becomes a catalyst for change, powered by the limitless potential of GenAI.

For more on how CFOs can power GenAI predictions with ERP, see Capitalizing on GenAI: How CFOs Can Turn Real-Time Insights into Proactive Decisions.