Oracle Unity Customer Data Platform for banking

No bank has ever claimed to lack data, but most would agree that having all of it organized around their customers—in ways that can improve the customer experience (CX)—is one way to use it best.

Financial institutions continue to be saddled with a plethora of disconnected sources of data and systems to deploy insights across business units. Only a fraction of respondents have a central system for collecting, processing, analyzing, and deploying insights organization-wide."—Digital Banking Report, "Building a Strong Data and Information Strategy," March 2021.

Customers are interacting with banks through whatever method is most convenient for them—call center, website, portal, or live chat. No matter how they choose to engage, their journey will never be linear, making it necessary to follow them as they navigate, remain relevant, and stay as frictionless as possible.

What banks can gain with a customer data platform

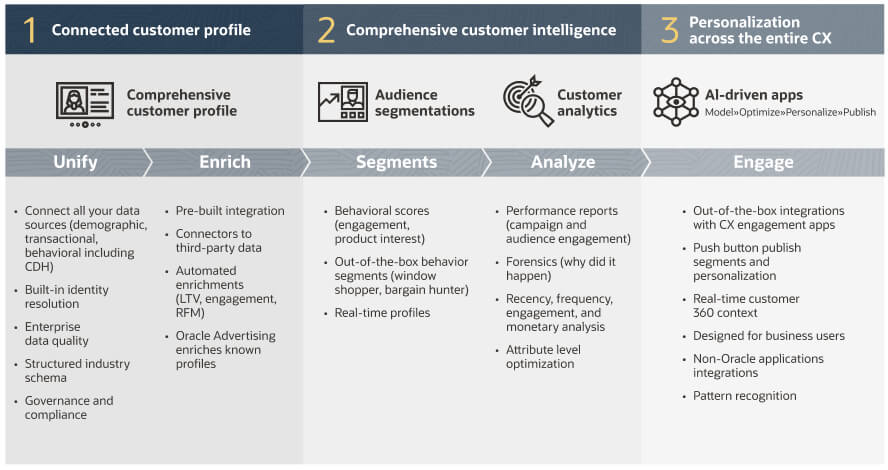

A CDP, as defined by the Customer Data Platform Institute, creates a persistent, unified customer and prospect database accessible to other systems. It’s a packaged platform that comes with prebuilt components and data models, so that marketers and other business stakeholders can segment, analyze, and activate their data—with little to no IT involvement. In fact, go-to-market teams can easily share and activate data—and change or add system sources—without disrupting the CDP.

Banks that use a CDP can ingest and stitch together customer and prospect data—in all its detail—from virtually any source in real time. This includes third-party sources. A CDP helps unify siloed data around a single customer view, yielding clean, organized, and comprehensive "golden records" of all knowable customer data—purged of inconsistencies and inaccuracies. Which means that there is an easily identifiable, fundamentally correct view of the customer’s data that can be used at the point of engagement.

With a CDP, customer records are easily accessible, on demand and in real time, so marketing, sales, and customer service operations can ensure personalized and highly relevant customer interactions at every touchpoint.

IDC MarketScape: Worldwide CDPs Focused on the Financial Services Industry 2023 Vendor Assessment

Find out why Oracle is a Leader in CDPs for Financial Services industry.

CDPs in banking—harness customer data for more personalized marketing campaigns

Based on the level of data maturity, financial services organizations can gain new insights about their customers and develop real-time, tailored campaigns.

Source: Frost & Sullivan, "The Adaptive Bank: A Evolutionary Approach to Customer Experience," (PDF) 2021.

Banks can use a customer data platform to:

- Create a primary customer list that spans both CRM and back-office transactional data.

- Enhance the primary customer list with digital engagement data, such as web tracking tools, email marketing applications, and mobile apps, that is currently stuck in the execution channels.

- Further enrich the primary customer list with second- and third-party data to have the richest and timeliest dataset available to predict customer intent.

- Ensure your adtech and martech applications are seamlessly connected to transition anonymous visitors to known customers as fast as possible.

- Leverage these rich customer profiles to deliver personalized interactions across marketing, sales, and customer service processes, in all channels, at scale to improve conversion, increase cross-selling, increase net promoter scores (NPS), and strengthen customer loyalty.

With Oracle Unity Customer Data Platform marketers can deliver highly personalized experiences

Not all customer data platforms are created equal. Oracle Unity unifies the front (CRM)- and back-office and is focused on the entire banking customer experience throughout marketing, sales, onboarding, and service. It’s important to identify and consolidate all the data used to engage a specific customer and it’s crucial to ensure that that data can be used in real time by business users and at any interaction point.

For banking customers, behavioral indicators become key real-time traits that identify intent and context as the customer moves between engagement channels. For example, if a customer indicates interest in buying a car or a home, you can suggest the right offer to that customer at the right moment. The customer’s expectations are met, resulting in commercial rewards for you at the same time.

Oracle Unity Customer Data Platform provides an easier way to prepare data through its UX and the customer APIs that are used for orchestration purposes. It also provides a machine learning framework to support capabilities, such next-best action or next-best offer. It makes all CX applications, Oracle’s or a third-party CX solution, smarter by giving them real-time access to holistic customer profiles, enabling actionable intelligence and real-time decision-making. In effect, Oracle’s CDP makes your existing application investments in core banking and regulatory reporting solutions more valuable by using that data to create more intelligent customer propositions.

Oracle Unity Customer Data Platform for banking—feature highlights

Data quality

Data is cleaned and de-duped, creating a golden customer record that continually incorporates the best attributes from the strongest sources.

Data enrichment

Data is enhanced by second- and third-party sources for accuracy and completeness of address and profile elements.

Data analysis

Clean, complete, and accurate data is leveraged to analyze and segment customers intelligently.

Data action

Using the unified customer profile, you can consolidate all of your high-quality data to deliver contextually relevant data and prescriptive actions to apps and sellers.

Data integration

A comprehensive set of connectors for Oracle and non-Oracle CRM and back-end applications enable faster deployments and time to market. Native integration with Oracle Financial Services analytical applications gives those customers the ability to use that data to drive key use cases leveraging profitability, current and predicted loan-to-value ratio, risk, compliance, and aggregated financial data.

Interested in a 1:1 demo of Oracle Unity Customer Data Platform?

Related Oracle products

The following products complement Oracle Unity Customer Data Platform for banking.