This document will continue to evolve as existing sections change and new information is added. All updates appear in the following table:

| Date | Module | Feature | Notes |

|---|---|---|---|

| 31 MAR 2022 | Intelligent Account Combination Defaulting for Invoices | Updated document. Revised Steps to Enable. | |

| 28 OCT 2022 | Intelligent Account Combination Defaulting for Invoices | Updated document. Revised Steps to Enable. | |

| 06 OCT 2022 | Created initial document. |

This document outlines the features in Oracle AI Apps for Financials and describes any tasks you might need to perform for this service. Each section includes a brief description of the feature, the steps you need to take to enable or begin using the feature, any tips or considerations that you should keep in mind, and the resources available to help you.

GIVE US FEEDBACK

We welcome your comments and suggestions to improve the content. Please send us your feedback at oracle_aiapps_doc_feedback_grp@oracle.com.

DISCLAIMER

The information contained in this document may include statements about Oracle’s product development plans. Many factors can materially affect Oracle’s product development plans and the nature and timing of future product releases. Accordingly, this Information is provided to you solely for information only, is not a commitment to deliver any material, code, or functionality, and should not be relied upon in making purchasing decisions. The development, release, and timing of any features or functionality described remains at the sole discretion of Oracle.

This information may not be incorporated into any contractual agreement with Oracle or its subsidiaries or affiliates. Oracle specifically disclaims any liability with respect to this information. Refer to the Legal Notices and Terms of Use for further information.

Column Definitions:

Report = New or modified, Oracle-delivered, ready to run reports.

UI or Process-Based: Small Scale = These UI or process-based features are typically comprised of minor field, validation, or program changes. Therefore, the potential impact to users is minimal.

UI or Process-Based: Larger Scale* = These UI or process-based features have more complex designs. Therefore, the potential impact to users is higher.

Features Delivered Disabled = Action is needed BEFORE these features can be used by END USERS. These features are delivered disabled and you choose if and when to enable them. For example, a) new or expanded BI subject areas need to first be incorporated into reports, b) Integration is required to utilize new web services, or c) features must be assigned to user roles before they can be accessed.

| Ready for Use by End Users Reports plus Small Scale UI or Process-Based new features will have minimal user impact after an update. Therefore, customer acceptance testing should focus on the Larger Scale UI or Process-Based* new features. |

Customer Must Take Action before Use by End Users Not disruptive as action is required to make these features ready to use. As you selectively choose to leverage, you set your test and roll out timing. |

|||||

|---|---|---|---|---|---|---|

| Feature |

Report |

UI or |

UI or |

|

||

Adaptive Intelligence for Financials

Intelligent Account Combination Defaulting for Invoices

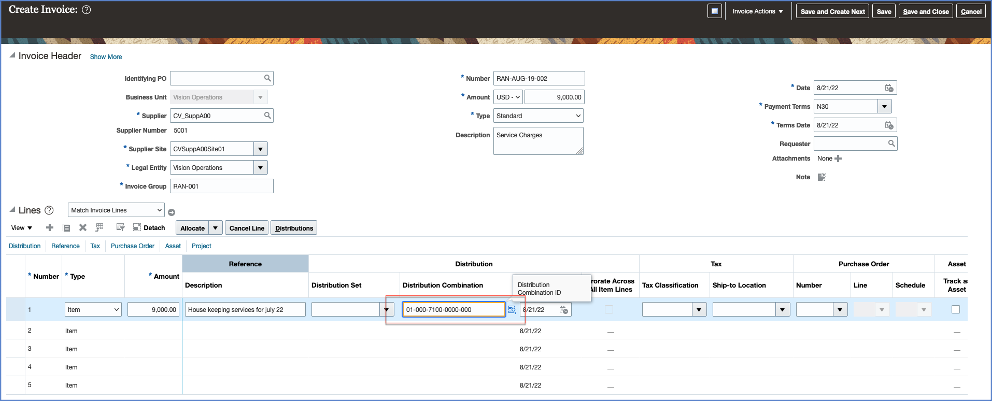

Experience intelligent defaulting of accounting information for no-PO invoice lines. This feature uses Al and machine learning algorithms to predict and default segment values of the account code combination on accounts payable invoice lines. AI and machine learning use the historic data patterns and the specific influencing factors for each segment to predict their value.

When the user places the cursor on the distribution combination field for an unmatched invoice line, the segment values are defaulted if the prediction for the segment exceeds the dynamically calculated confidence score threshold. Once any segment values are defaulted, the distribution combination field is highlighted for user review. If a segment is not defaulted, or an incorrect segment is defaulted, the user can enter the relevant value for the missing segment or correct the incorrect defaulted segment value. The Al and machine learning algorithms learn from these edits and use the information to improve the prediction accuracy.

These are some of the business benefits of this feature:

- Significantly reduce invoice entry time and accelerate the process of making invoice ready for payment

- Reduce “think time” for Accounts Payable analysts

- Allow user to focus on data accuracy rather than data entry

- Improve the user experience

- Allow AI to improve the prediction accuracy for segments by learning from the user edits

Distribution Combination Defaulted by Al and Machine Learning Algorithms

Steps to Enable

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Financials

To enable this feature, an administrator must follow these steps:

- Create the necessary users and roles.

- Set up the connections to integrate with AI Apps for ERP.

- Monitor the model training status and download the evaluation reports.

- Complete the feature opt-in.

For details, see AI Apps Implementation Workflow.

Tips And Considerations

- All relevant data in the header and line fields should be entered before the AI prediction is invoked.

- At least 3 months of invoice history should be available for satisfactory rendering of predictions by the AI models. Additional invoice history will be beneficial to improve the prediction performance.

Key Resources

Campaign Management for Early Payment Discount Offers

Onboard suppliers into an early payment discounts program via email-based campaigns. Suppliers can respond directly from the email. The responses are automatically processed and applied in payment process requests. Suppliers can either accept a one-time offer, enroll into a standing offer, decline the offer, or unsubscribe from the campaign.

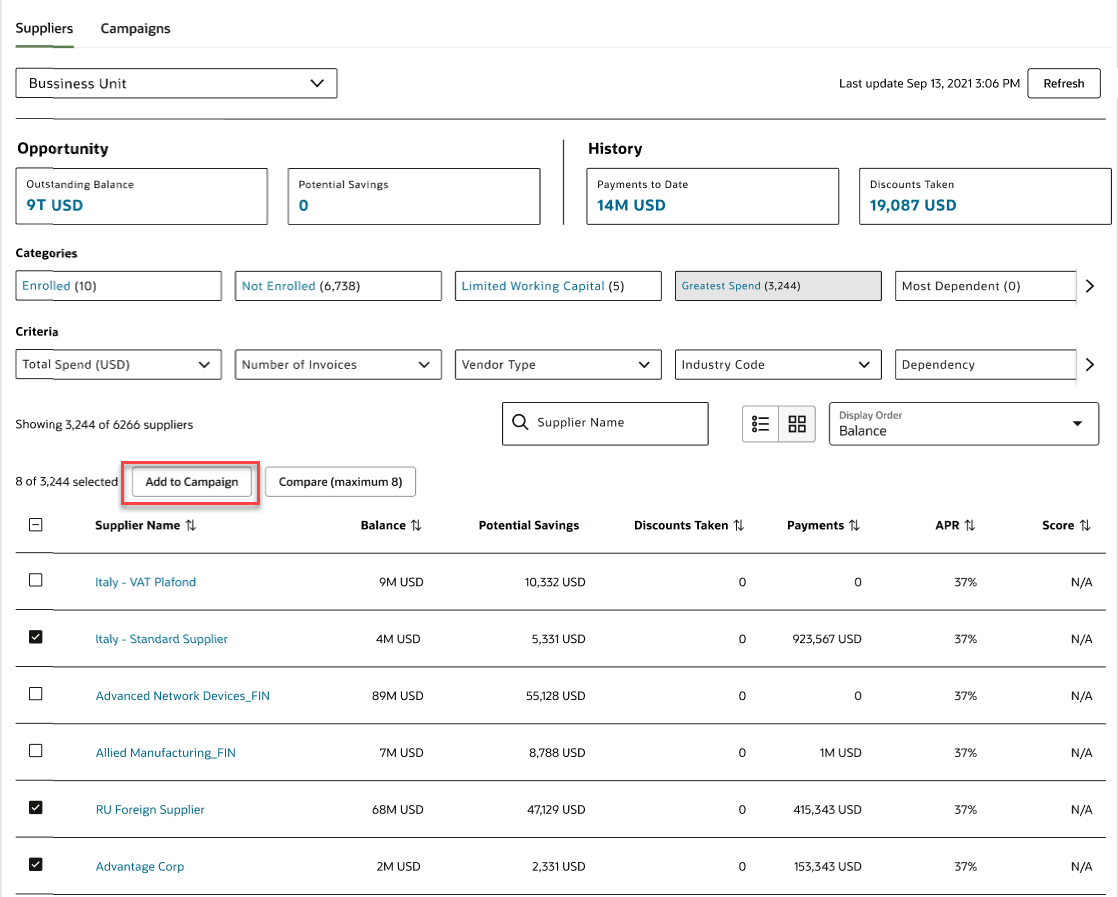

This feature provides an automated process for onboarding suppliers into the early payment discount program. Create a campaign to define the offer terms and duration. Identify suppliers to target for an early payment discount campaign by applying selection criteria on the Payment Discounts page in Oracle AI Apps for ERP.

Create Campaign

Add Suppliers to Campaign

Configure the email template according to business requirements, including the email verbiage, email subject, and sender name and address. The email contains all of the details required for a supplier to take an informed decision including the currently eligible invoices, discount calculation, and actions available. Suppliers can take action directly from the email and the responses are automatically processed and applied in payment process requests.

Suppliers can choose one of the following responses:

- Accept a one-time offer: Only the invoices that are ready for payment are listed in the email and selected for early payment. Other eligible invoices may be included in future email offers.

- Enroll into a standing offer: All invoices are paid early on the same terms going forward.

- Decline the offer: Invoices aren’t accelerated for payment. Eligible invoices may be included again in future email offers.

- Unsubscribe: No further emails will be sent to the supplier for this campaign.

After suppliers accept a one-time offer or enroll into standing offers, Payments Managers can select all applicable early payment invoices when initiating payments on the Submit Payment Process Request page in Oracle Payables.

The benefits of this feature include the following:

- Automated onboarding of suppliers into an early payment discount program

- Extend early payment discount offers to all targeted suppliers with just one click at the required frequency

- Automated processing of accepted early payment discount offers

- Buyers can get a higher return on investment in comparison to alternative investments for available working capital

- Suppliers can access additional short-term working capital

Steps to Enable

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Financials

Before using campaigns for early payment discount offers, an administrator must complete these prerequisites:

- Set up the connections that integrate with AI Apps for ERP.

- Enable the FSM Opt-in Early Payment Offers and enable it for Standing Offers.

- Configure the template for email campaigns.

Follow the steps described in the AI Apps Implementation Workflow topic of the Getting Started with Your Financials Implementation guide.

Key Resources