- Revision History

- Overview

- Optional Uptake of New Features (Opt In)

- Feature Summary

- Common Technology and User Experience

- Financials

-

- Assets

- Budgetary Control

-

- Additional Budgetary Control Transaction Information

- Budget Hierarchy Updates While Control Budget Is Active

- Carry Forward Open Purchase Orders for Budgetary Controlled Non-Sponsored Projects

- Connected and Integrated Budget Revisions with EPM Planning Financials

- Enterprise-Level Budgetary Control Options

-

- Cash Management

- Expenses

-

- Configurable Spend Authorization Workflow Rules Using Additional Project Attributes

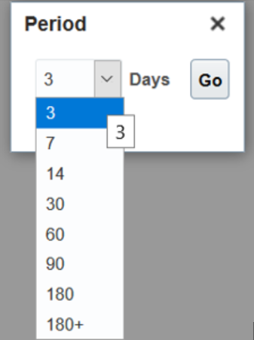

- Digest Email Updates to Display Predefined Number of Expenses

- Keyword Audit for Expense Reports

- Number of Attendees Capture When Expense Is Above Designated Limits

- Travel Provider Integration Using Expense Travel Itineraries REST API

- Expenses Mobile Application

- Expenses Digital Assistant

-

- Automatic Synchronization of Expense Types and Synonyms to Oracle Digital Assistant

- Manual Submission of Expense Reports from Oracle Digital Assistant

- View Expenses Requiring Attention in Oracle Digital Assistant

- Withdrawal of Automatically Submitted Expense Reports from the Expense Report Approval FYI Notifications

-

- Federal Financials

- General Ledger

-

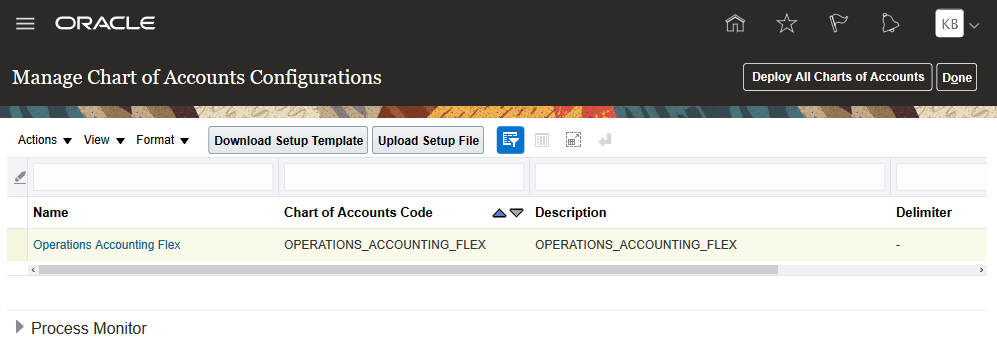

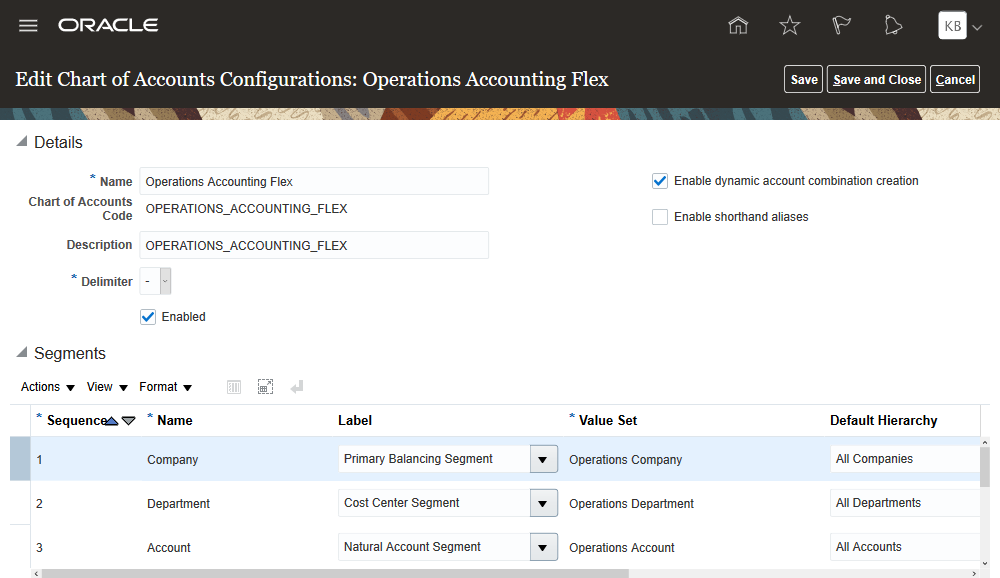

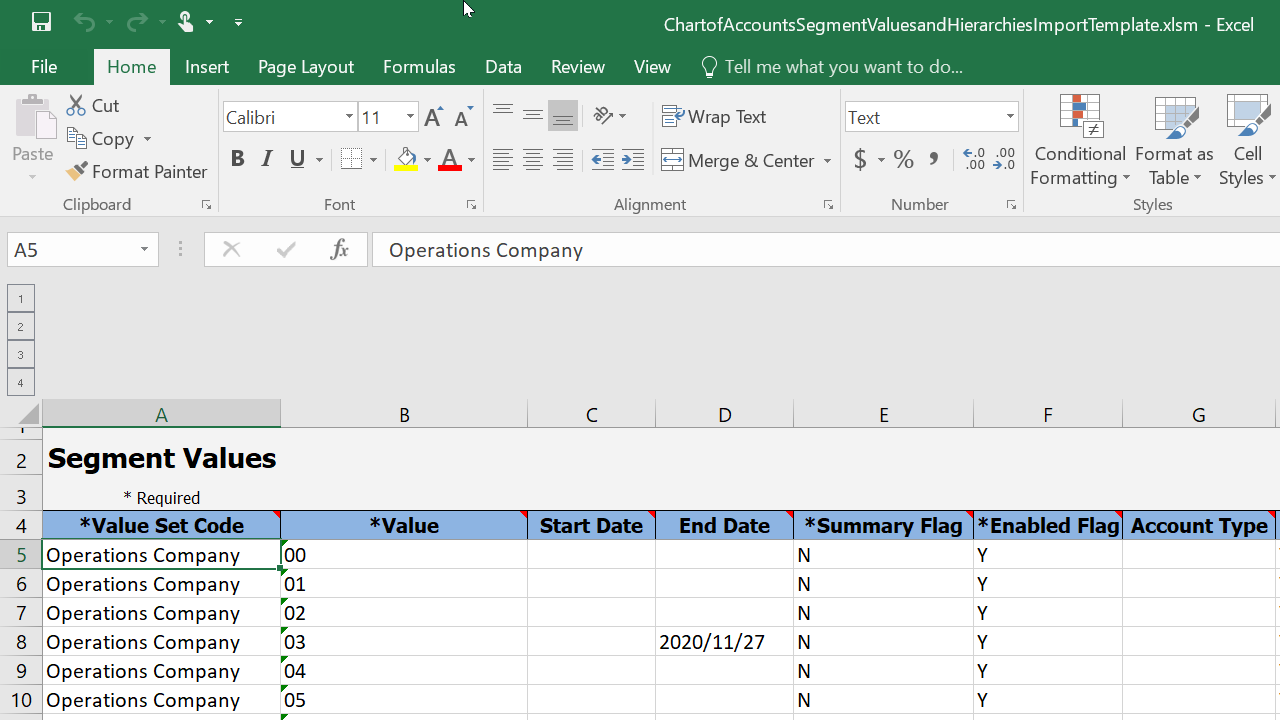

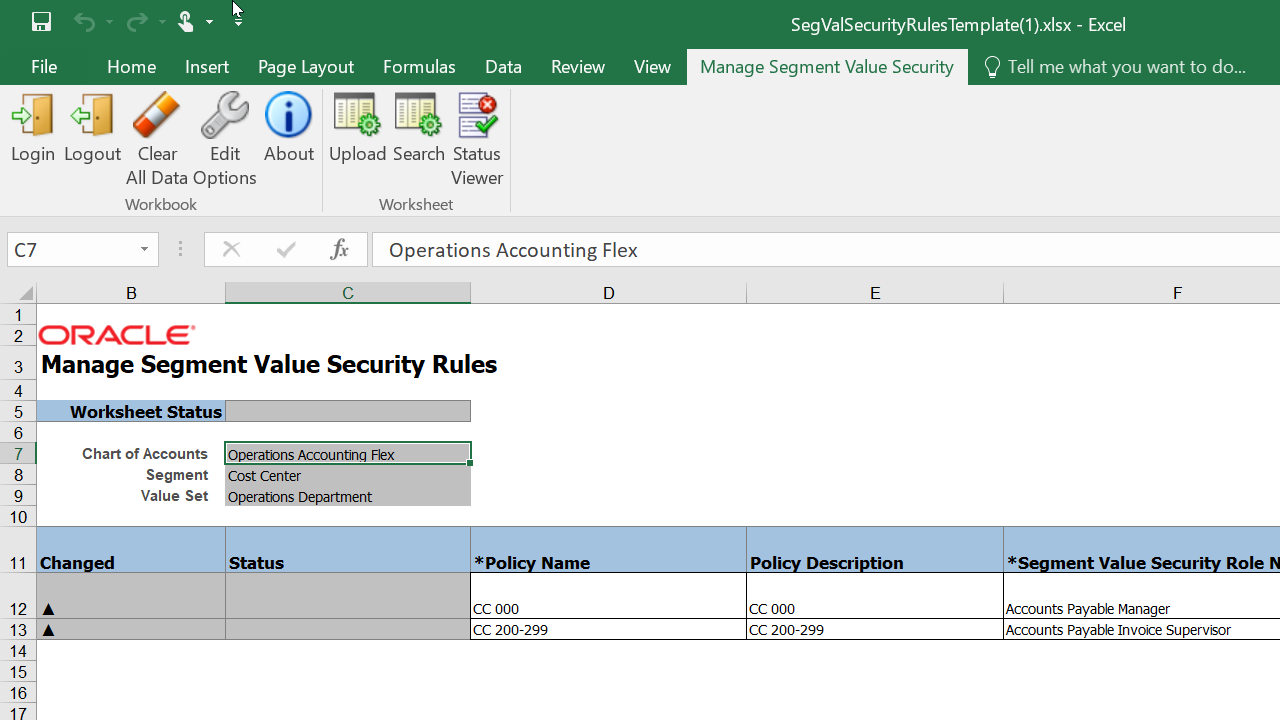

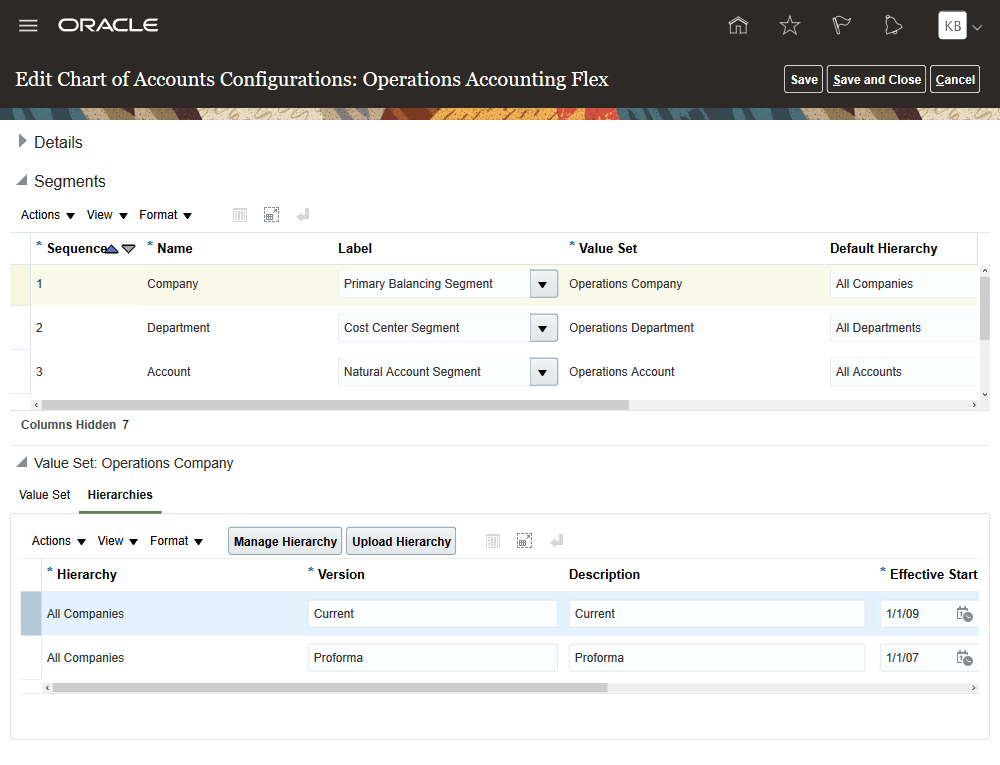

- Definition and Maintenance of Chart of Accounts and Related Configurations

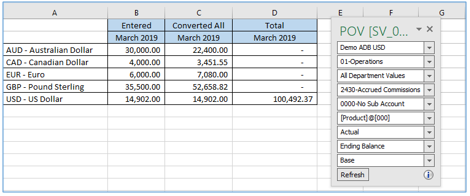

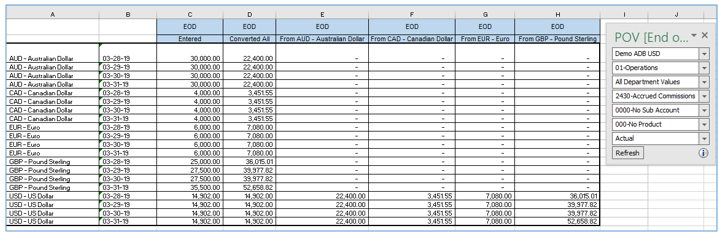

- Entered and Converted Currency Balances Side by Side in Financial Reporting

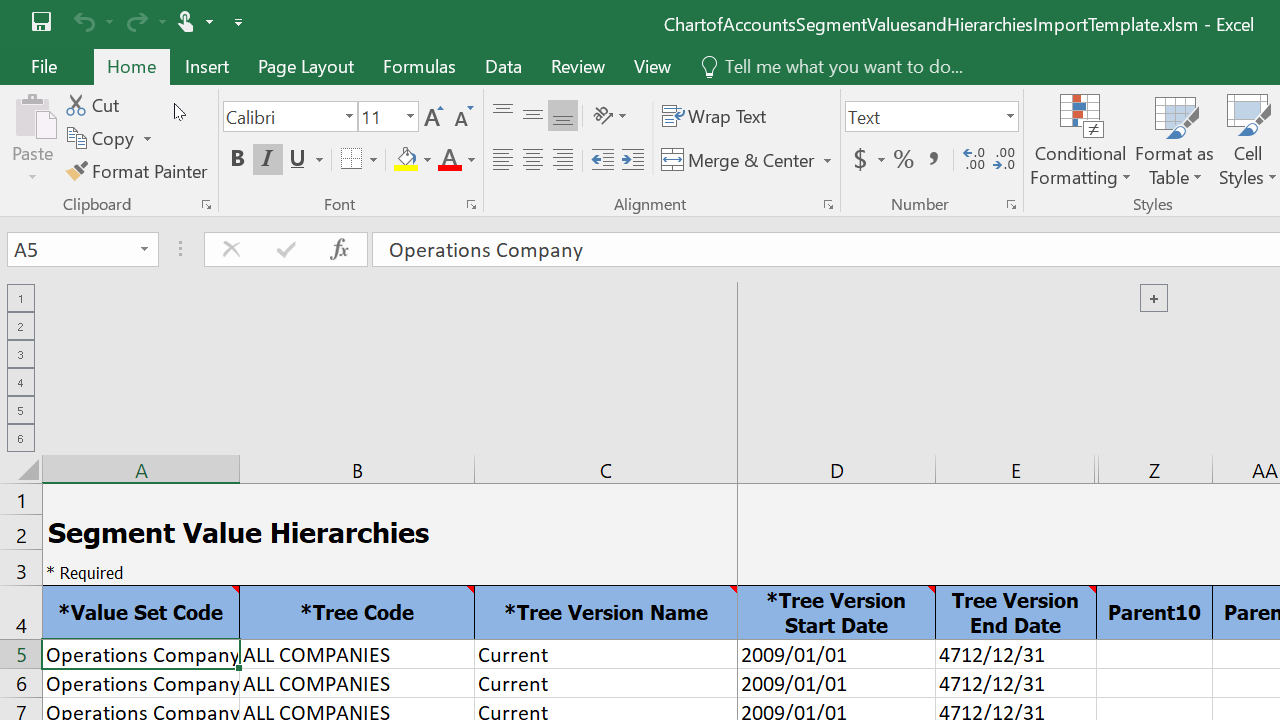

- Option to Publish Hierarchies for All Value Sets

- Prevent General Ledger Period Closure When Open Subledger Periods Exist

- Rapid Implementation Improvement to Create Separate Value Sets for Primary Balancing and Intercompany Segments

- Validations of Date and Number Values Captured Using Descriptive Flexfields

-

- Joint Venture Management

-

- Data Security for Joint Venture Management

- Joint Venture Additional Information in Receivables Invoice

- Joint Venture and Project Management Enhanced Data

- Joint Venture Definition Improvements

- Transactions Identified by Specified Segment

- Usability and Navigation Improvements for Joint Venture Management

-

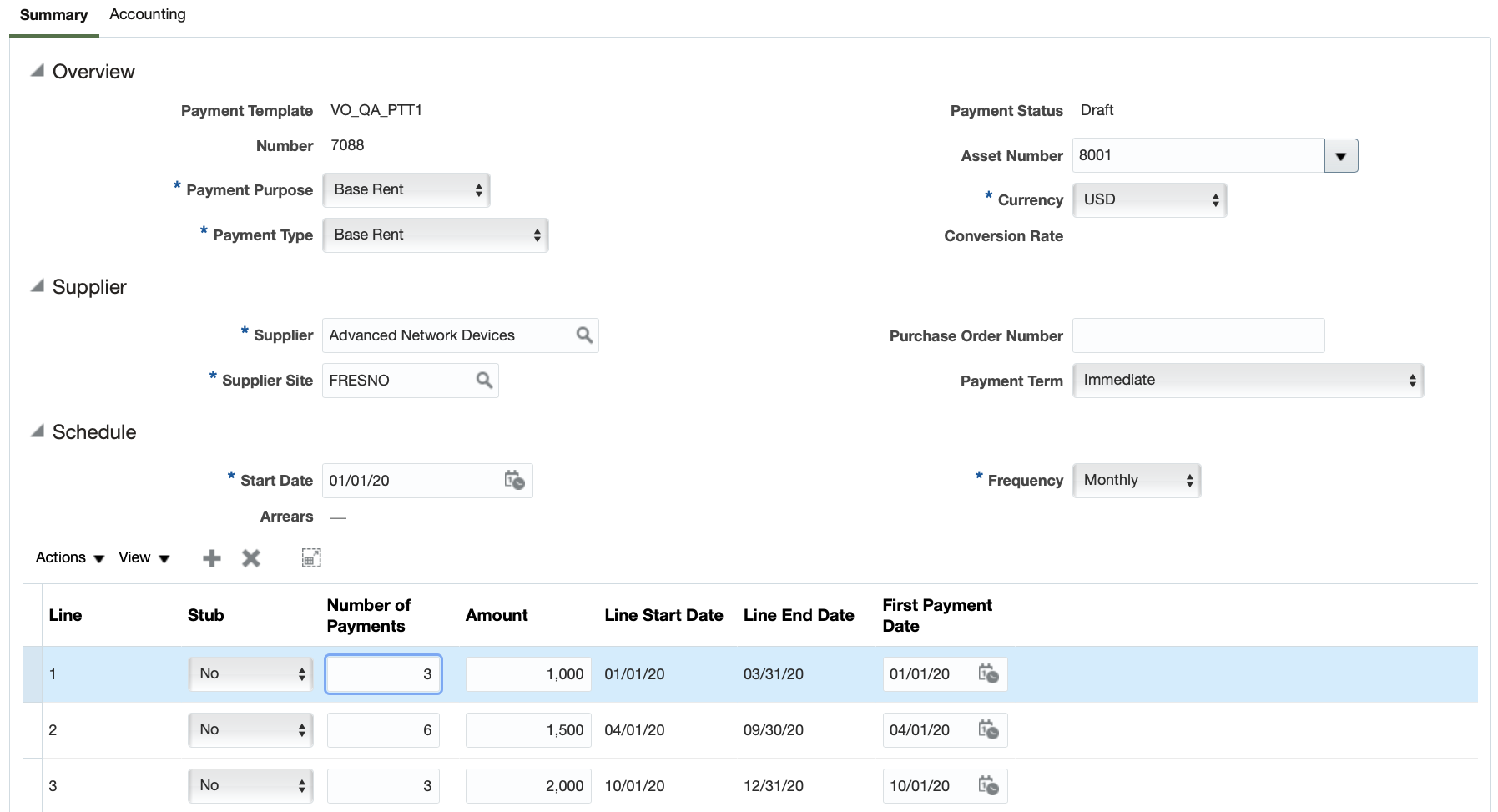

- Lease Accounting

- Payables

-

- Additional Tax Drivers in Supplier Portal for Accurate Tax Calculation

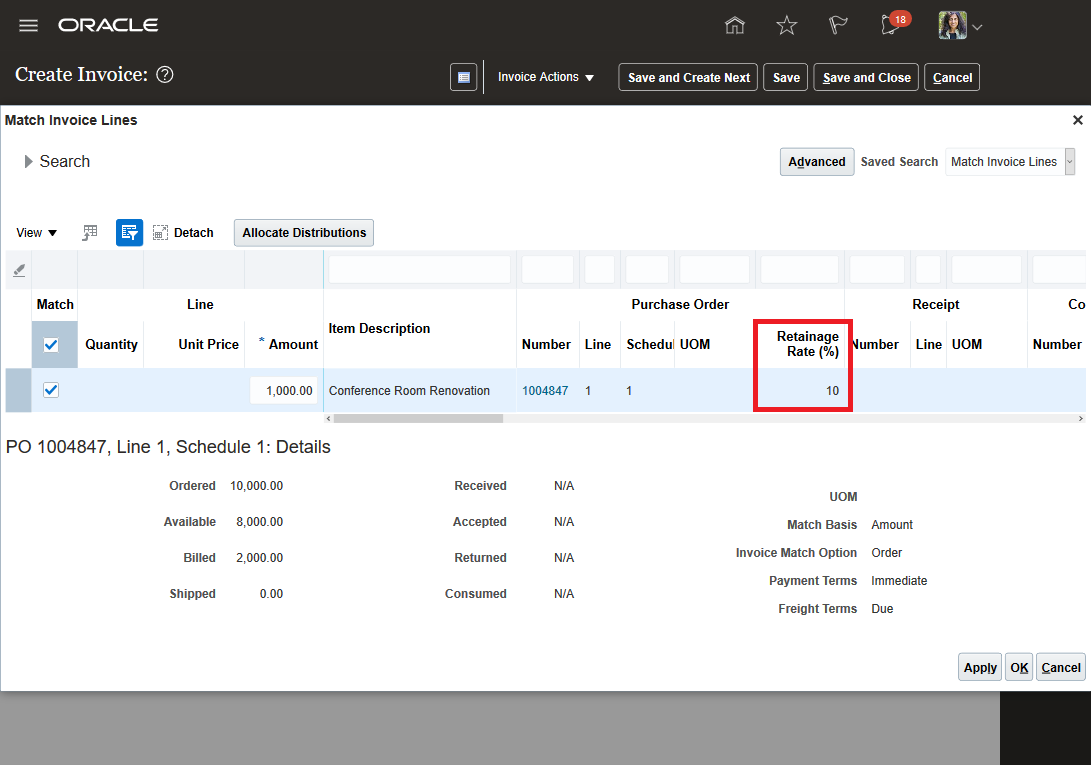

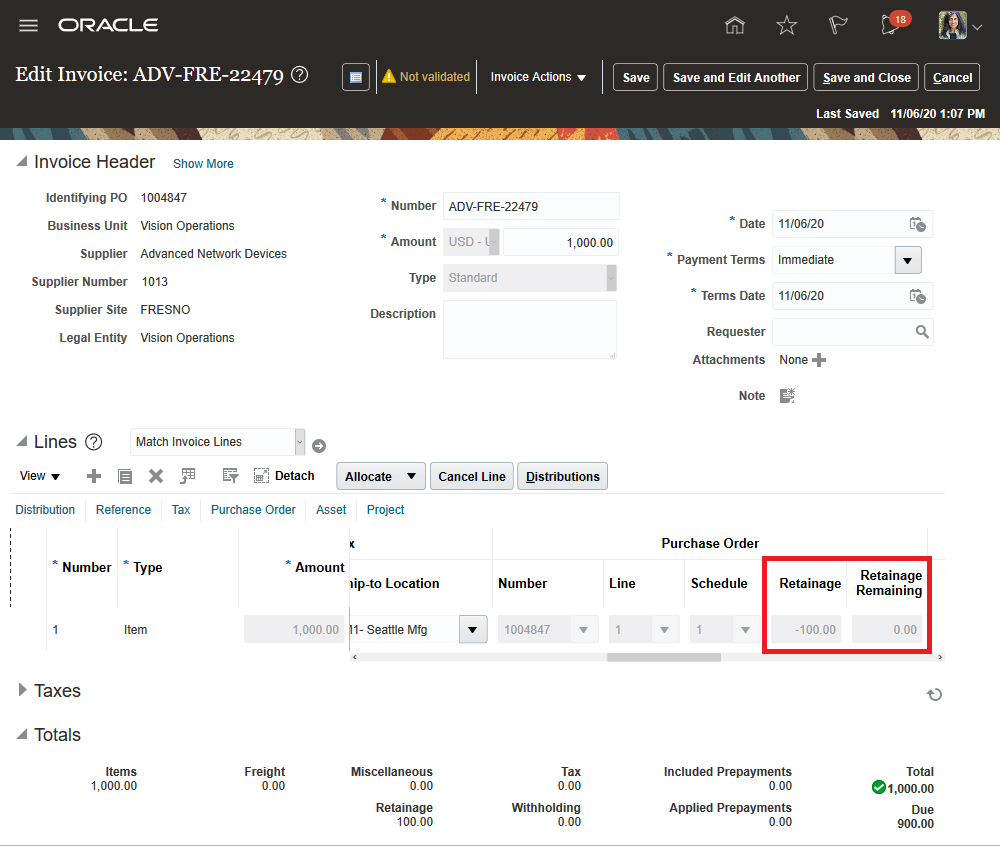

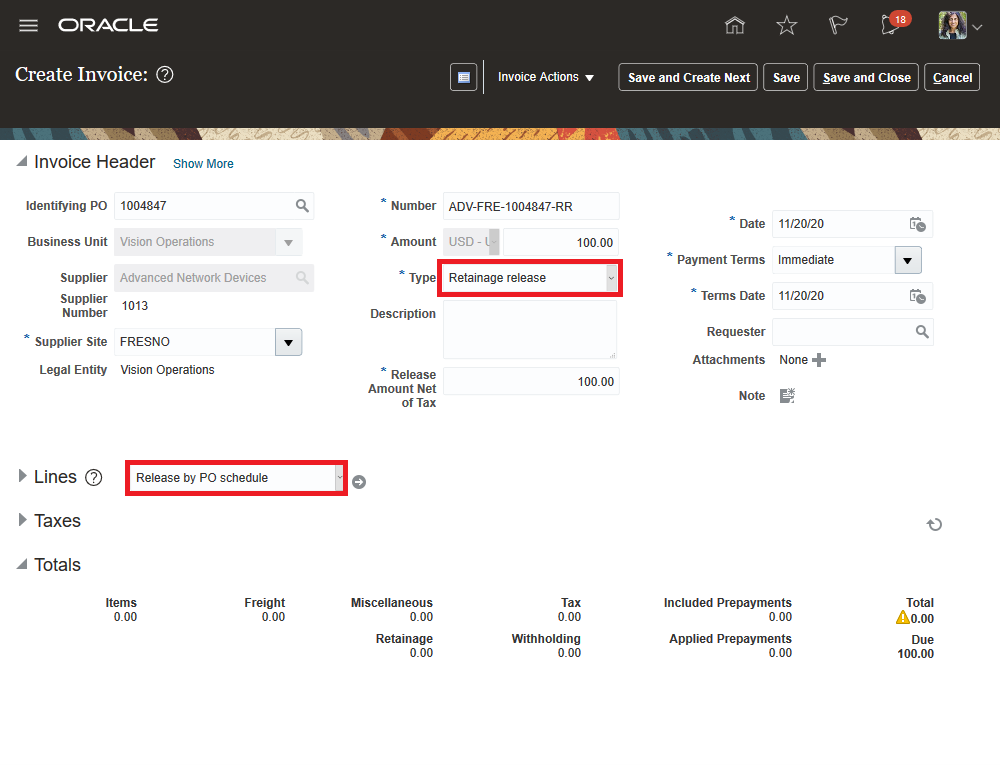

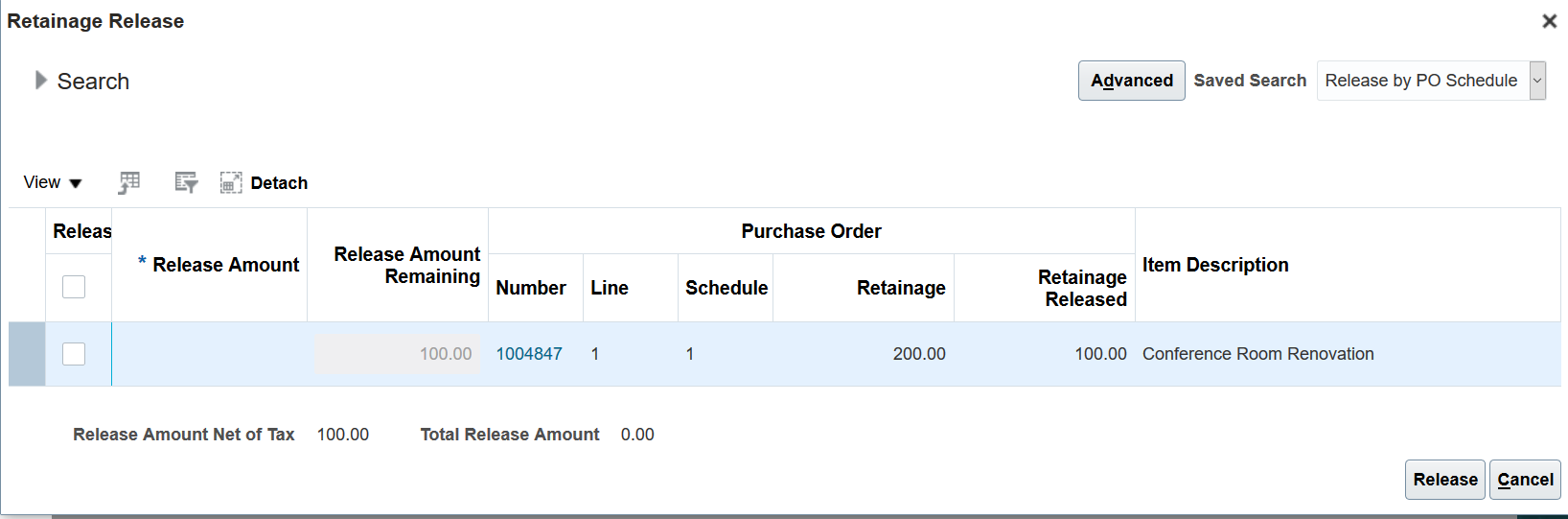

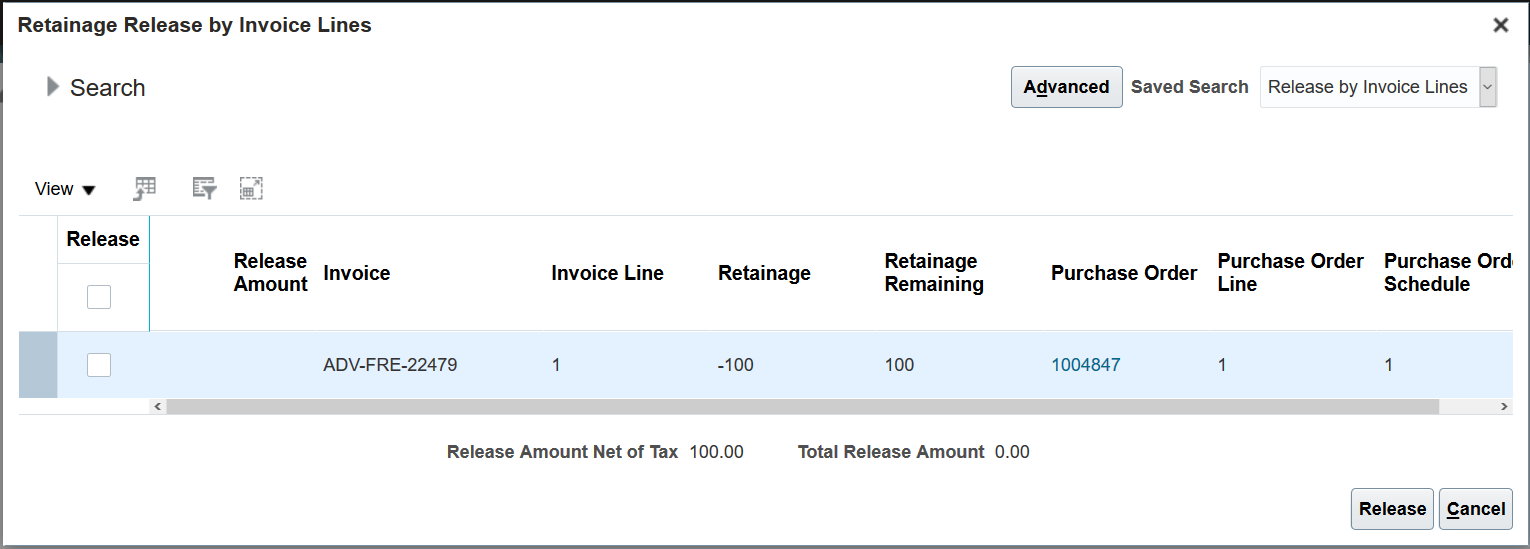

- Creation and Management of Supplier Invoices with Retainage Payment Terms

- Electronic Filing of Forms 1099-MISC and 1099-NEC for Tax Year 2020

- Modifications to Employee Bank Account Creation

- Performance Improvements in Manage Invoices Page

- Supplier Invoice Import with Remittance Bank Account Details

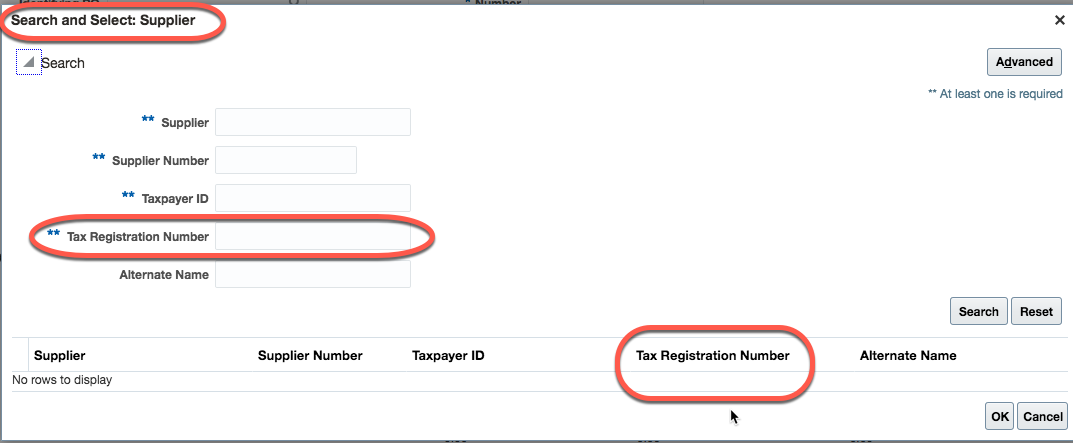

- Supplier Search Using Tax Registration Number During Supplier Invoice Creation

-

- Payments

- Receivables

-

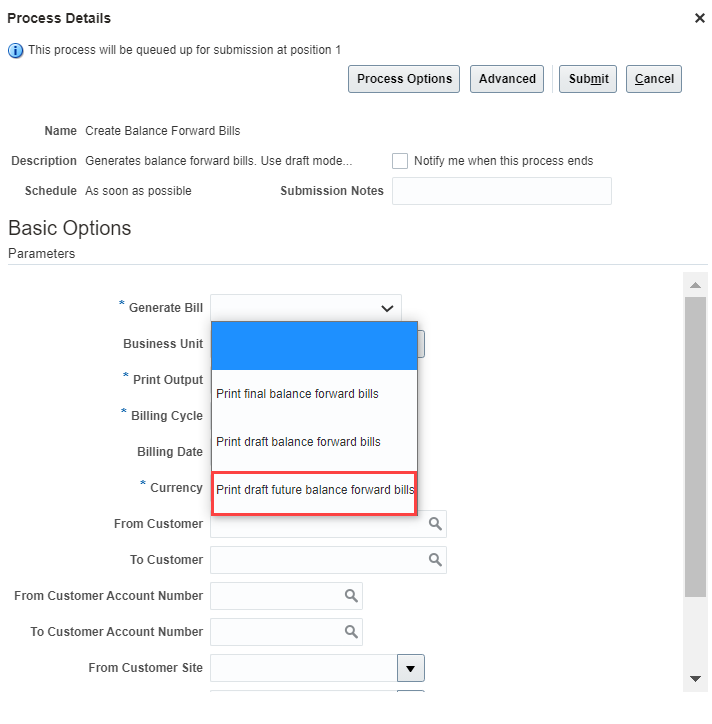

- Balance Forward Billing in Advance of the Billing Cycle End Date

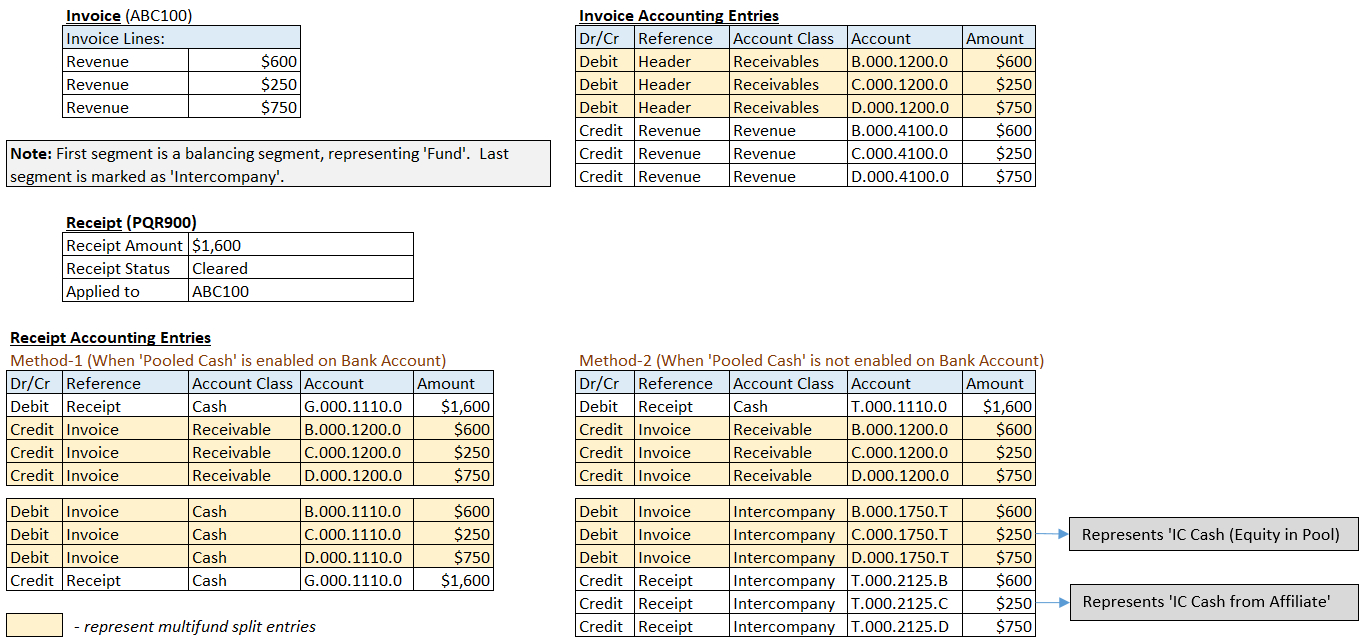

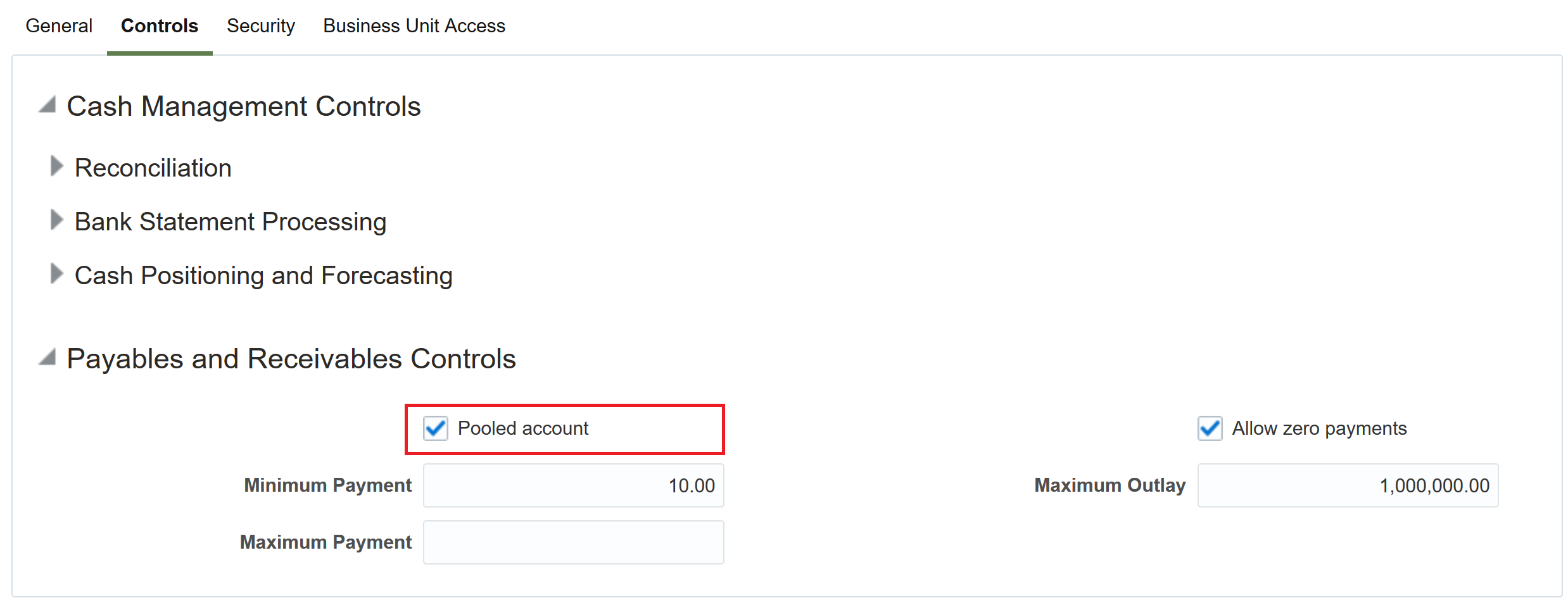

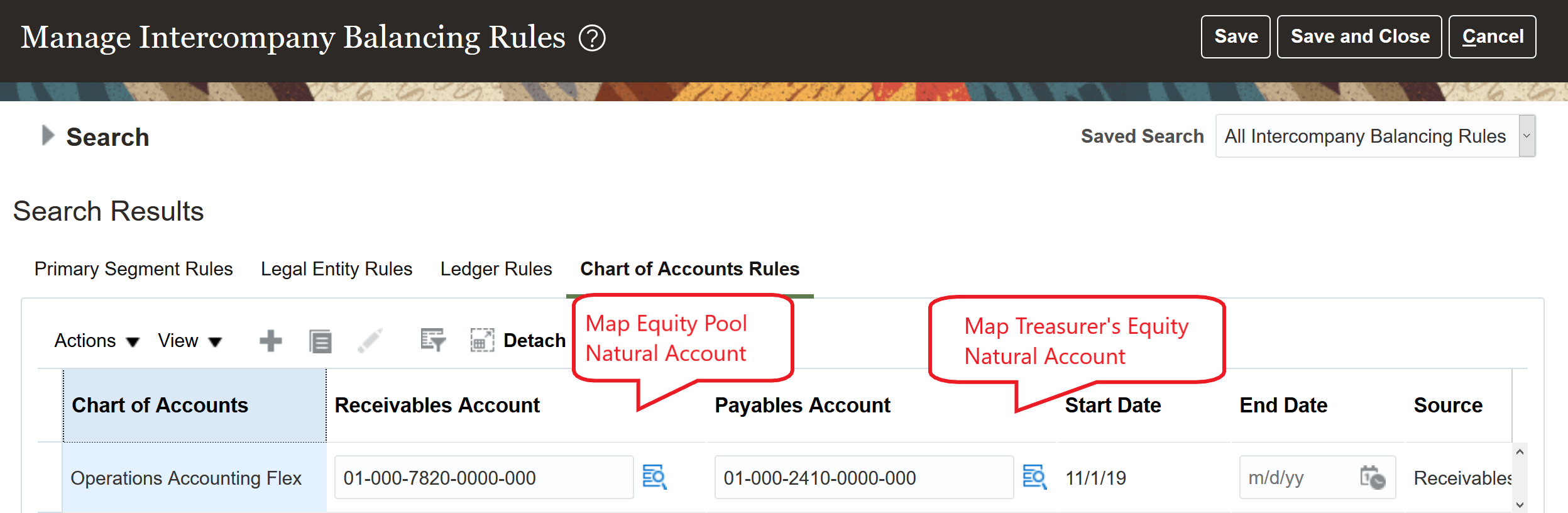

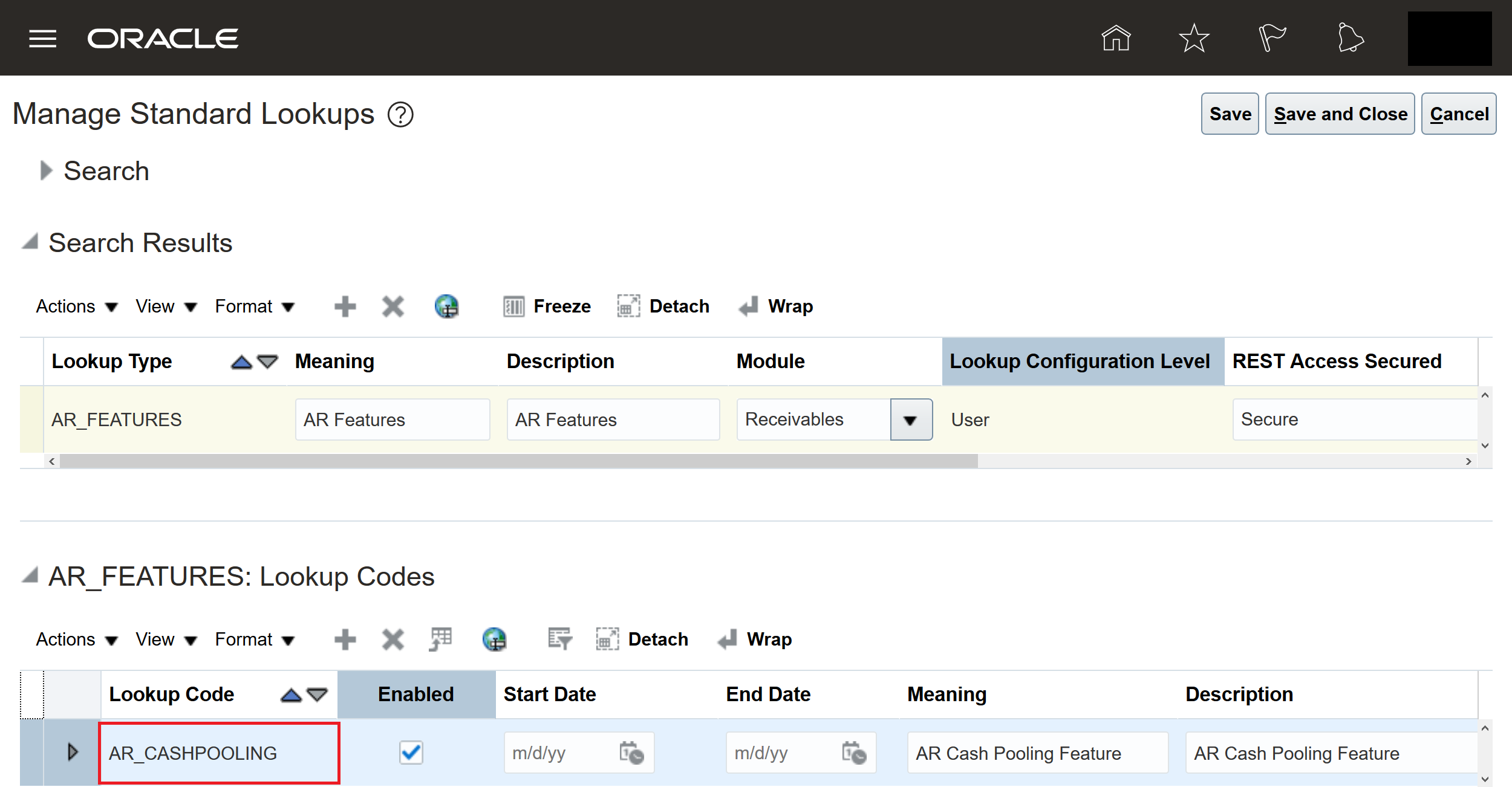

- Cash Pooling for Receivables Multifund Accounting

- Open Receivables Search Enhancements for Manual Receipt Application

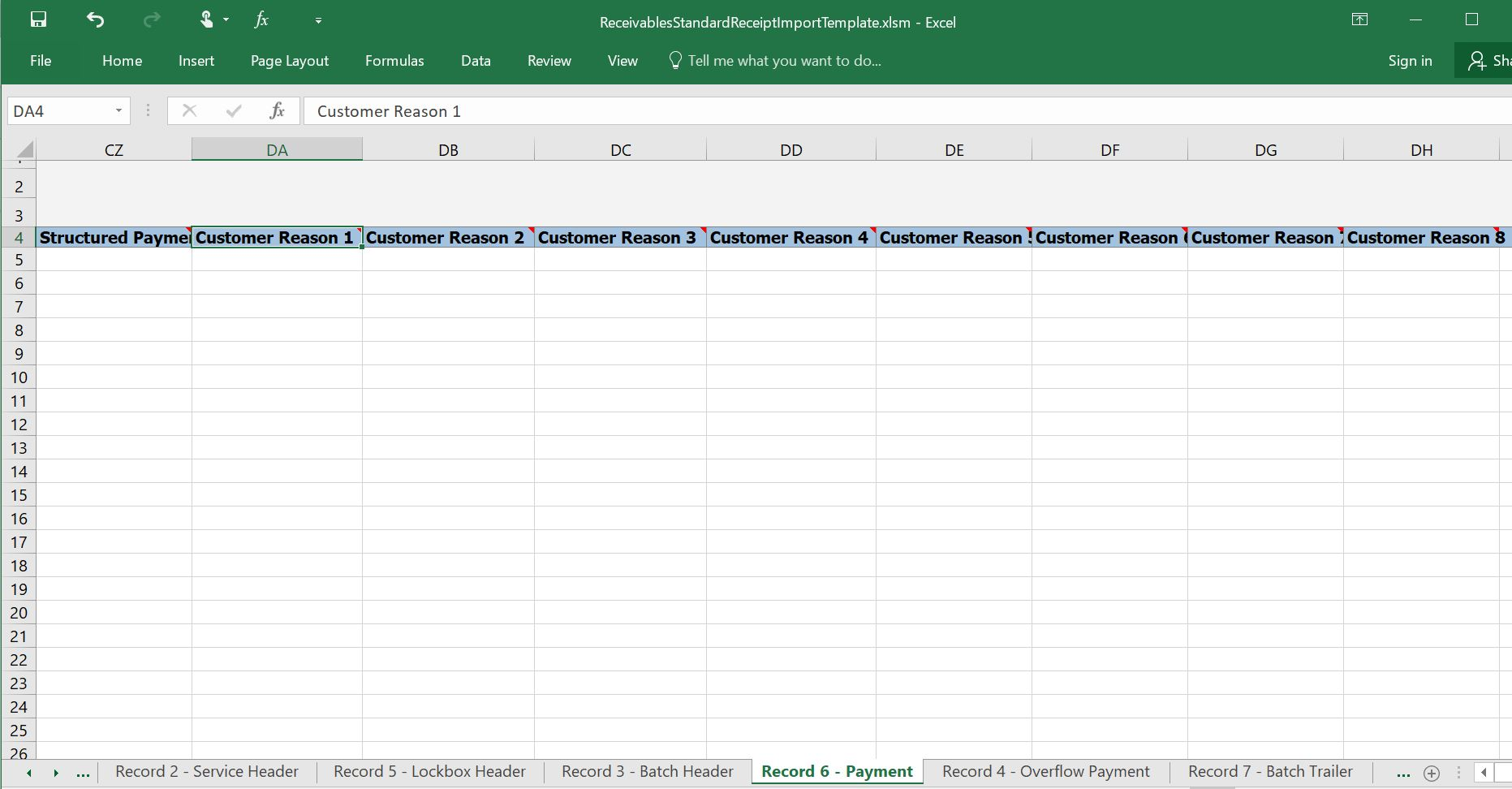

- Oracle Channel Revenue Management Integration with Oracle Receivables for Claim Creation and Settlement for Lockbox Receipts

- Oracle Channel Revenue Management Integration with Oracle Receivables for Invoice-Related Claim Creation and Settlement

- Receivables Customer Account Activities REST API

-

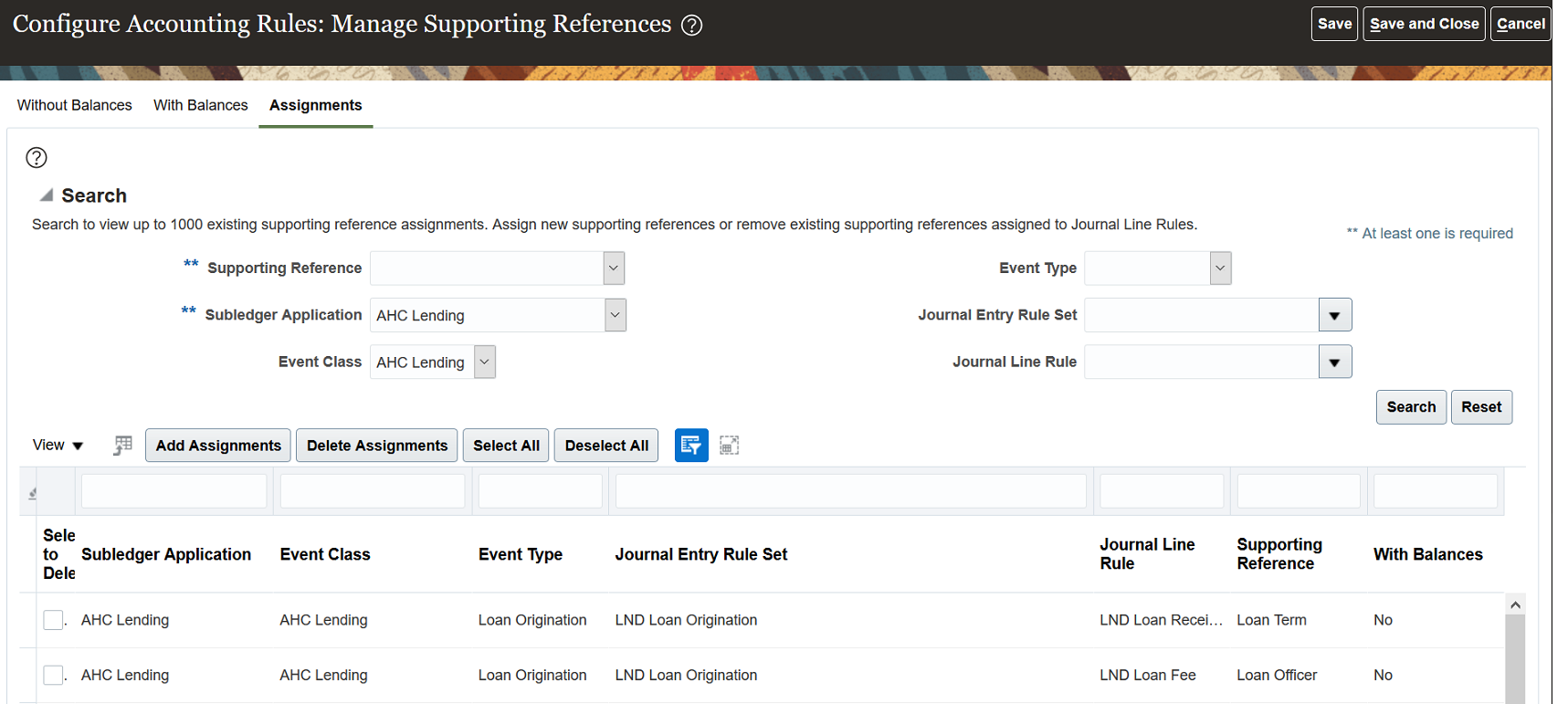

- Subledger Accounting

- Revenue Management

- Transactional Business Intelligence for Financials

- Regional and Country-Specific Features

- IMPORTANT Actions and Considerations

This document will continue to evolve as existing sections change and new information is added. All updates appear in the following table:

| Date | Product | Feature | Notes |

|---|---|---|---|

| 16 MAR 2022 | Payables | Modifications to Employee Bank Account Creation | Updated document. Revised feature information. |

| 24 SEP 2021 | Budgetary Control | Connected and Integrated Budget Revisions with EPM Planning Financials |

Updated document. Added information to Tips and Considerations. |

| 30 APR 2021 | Budgetary Control | Connected and Integrated Budget Revisions with EPM Planning Financials | Updated document. Added information to Tips and Considerations. |

| 02 FEB 2021 | General Ledger | Option to Publish Hierarchies for All Value Sets | Updated document. Delivered backported feature in update 21A. |

| 29 JAN 2021 | Assets | Manage Leases Page Enhancements | Updated document. Delivered feature in update 21A. |

| 29 JAN 2021 | Budgetary Control | Connected and Integrated Budget Revisions with EPM Planning Financials | Updated document. Delivered feature in update 21A. |

| 29 JAN 2021 | Payables | Electronic Filing of Forms 1099-MISC and 1099-NEC for Tax Year 2020 | Updated document. Delivered feature in update 21A. |

| 14 DEC 2020 | IMPORTANT Actions and Considerations | Updated document. Added information on Reporting Web Studio. | |

| 04 DEC 2020 | Created initial document. |

This guide outlines the information you need to know about new or improved functionality in this update, and describes any tasks you might need to perform for the update. Each section includes a brief description of the feature, the steps you need to take to enable or begin using the feature, any tips or considerations that you should keep in mind, and the resources available to help you.

Join Oracle Cloud Customer Connect

Please take a moment to join the Cloud Customer Connect forums for Financials Cloud. Oracle Cloud Customer Connect is a community gathering place for members to interact and collaborate on common goals and objectives. This is where you will find the latest release information, upcoming events, or answers to use-case questions. Joining takes just a few minutes. Join now!

https://cloud.oracle.com/community

Security and New Features

The Role section of each feature identifies the security privilege and job role required to use the feature. If feature setup is required, then the Application Implementation Consultant job role is required to perform the setup, unless otherwise indicated. (If a feature doesn't include a Role section, then no security changes are required to use the feature.)

If you have created job roles, then you can use this information to add new privileges to those roles as needed.

Give Us Feedback

We welcome your comments and suggestions to improve the content. Please send us your feedback at oracle_fusion_applications_help_ww_grp@oracle.com.

Optional Uptake of New Features (Opt In)

Oracle Cloud Applications delivers new updates every quarter. This means every three months you'll receive new functionality to help you efficiently and effectively manage your business. Some features are delivered Enabled meaning they are immediately available to end users. Other features are delivered Disabled meaning you have to take action to make available. Features delivered Disabled can be activated for end users by stepping through the following instructions using the following privileges:

- Review Applications Offering (ASM_REVIEW_APPLICATIONS_OFFERINGS_PRIV)

- Configure Oracle Fusion Applications Offering (ASM_CONFIGURE_OFFERING_PRIV)

Here’s how you opt in to new features:

- Click Navigator > My Enterprise > New Features.

- On the Features Overview page, select your offering to review new features specific to it. Or, you can leave the default selection All Enabled Offerings to review new features for all offerings.

- On the New Features tab, review the new features and check the opt-in status of the feature in the Enabled column. If a feature has already been enabled, you will see a check mark. Otherwise, you will see an icon to enable the feature.

- Click the icon in the Enabled column and complete the steps to enable the feature.

For more information and detailed instructions on opting in to new features for your offering, see Offering Configuration.

Opt In Expiration

Occasionally, features delivered Disabled via Opt In may be enabled automatically in a future update. This is known as an Opt In Expiration. If your cloud service has any Opt In Expirations in this update, you will see a related tab in this document. Click on that tab to see when the feature was originally delivered Disabled, and when the Opt In will expire, potentially automatically enabling the feature. You can also click here to see features with current Opt In Expirations across all Oracle Cloud Applications. Beyond the current update, the Financials forums on Cloud Customer Connect have details of Opt In Expirations upcoming in future updates.

Column Definitions:

Features Delivered Enabled

Report = New or modified, Oracle-delivered, ready to run reports.

UI or Process-Based: Small Scale = These UI or process-based features are typically comprised of minor field, validation, or program changes. Therefore, the potential impact to users is minimal.

UI or Process-Based: Larger Scale* = These UI or process-based features have more complex designs. Therefore, the potential impact to users is higher.

Features Delivered Disabled = Action is needed BEFORE these features can be used by END USERS. These features are delivered disabled and you choose if and when to enable them. For example, a) new or expanded BI subject areas need to first be incorporated into reports, b) Integration is required to utilize new web services, or c) features must be assigned to user roles before they can be accessed.

Common Technology and User Experience

Service Excellence Continuing Investments

Our ongoing investment in service excellence has a focus on overall usability, resiliency, performance, and security. This work is based on monitoring performance trends, reviewing common use patterns, analyzing service requests, and participating in many discussions with customers.

In this update, our on-going investment in service excellence includes improvements in the following areas:

- Messages: Improved error and warning messages for Payables invoice processing.

- Usability: Instructions and sample data for the Mass Additions File-Based Data Import templates; enhanced type ahead suggestions for lists of values in key business areas in Budgetary Control, Payables, and Receivables; improved Service Request logging process for Budgetary Control issues.

- Performance: Resiliency improvements for Customer and Supplier Balance Netting; improved search selection for payment processing.

Steps to Enable

You don't need to do anything to enable this feature.

Simplified Workflow Rules Configuration

The Simplified Workflow Rules Configuration feature provides spreadsheet-based templates to define workflow rules for the Payables Invoice Approval and General Ledger Journal Approval workflows. Workflow administrators can download any of the available templates for each workflow, enter the rule information and upload the rules using the Manage Workflow Rules in Spreadsheet task.

The templates provide an easy-to-use layout to capture all the information required to define workflow rules. In update 21A, you can specify a rule priority for the rules defined using these templates.

Rule Priority

Each of the templates available for the Payables Invoice Approval and General Ledger Journal Approval workflows contain sample rules for typical use cases for these workflows. In update 21A, additional sample rules have been added to the following templates to demonstrate different rule scenarios:

- Invoice Approval Sample Template 1

- Invoice Approval Sample Template 2

- Invoice Approval Sample Template 3

The rule priority column in the Approvers section of the templates allows you to define the order in which the rules within a block are executed when transactions are being processed through the workflow.

Workflow administrators can use the additional sample rules added in the Payables Invoice Approval workflow templates as examples of how to translate their approval policy into rules using the templates.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

- Review the 'Manage Workflow Rules Using a Spreadsheet' topic in Oracle Help Center to get familiar with the Simplified Workflow Rules Configuration feature.

- When entering the rules information in the template, all rules are assigned a default rule priority of 'Medium'. If required, you can choose a different rule priority using the available list of values.

- Refer to the Sample Rules section in the Instructions sheet of the Payables Invoice Approval workflow templates to view details of the additional use cases for which sample rules have been added in templates.

Key Resources

- 'Manage Workflow Rules Using a Spreadsheet' topic in Oracle Help Center.

Use the Workflow Rules Report to review the workflow rules configured in Oracle Business Process Management (BPM) for Payables Invoice Approval, General Ledger Journal Approval, and Expense Report Approval workflows. This report was first introduced in update 18C. In update 21A, you can also use the report to validate the workflow rules against recommended best practices. Wherever the rules deviate from best practices, you can use the suggested recommendations to make the necessary corrections.

Workflow administrators can use this report to ensure that any rules defined or modified in Oracle Business Process Management (BPM) for Payables Invoice Approval, General Ledger Journal Approval, and Expense Report Approval workflows adhere to recommended best practices.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

For additional details about this feature, please click here.

Role Information

- Financial Application Administrator

Workflow Transaction Console Security by Product or Workflow

Secure the Workflow Transaction Console by restricting the workflow administrator or business user view of transactions either by product or workflow.

Currently, the Workflow Transaction Console displays the transactions related to all the financials workflows (Invoice, Journals, and Expense Reports). This feature lets you restrict the workflow administrator to view only the transactions related to specific product or workflow.

Steps to Enable

The following steps describe how to modify the security policies assigned to the predefined duty role and to create a transaction security profile to secure transactions by product or workflow.

- Log in to Security Console and navigate to the Roles page.

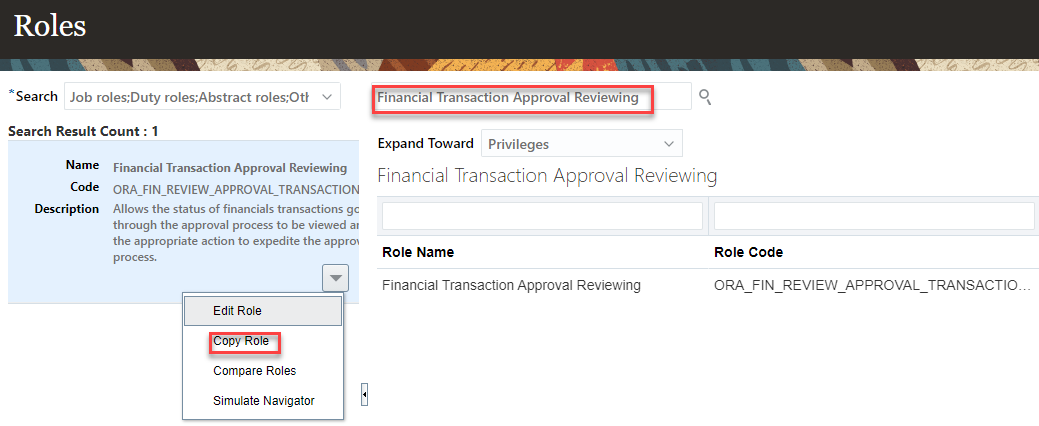

- Create a custom duty role. Search for the predefined duty role Financial Transaction Approval Reviewing and select Copy Role from Search Result drop down. Then select "Copy top role" to create the new role.

Copy Duty Role

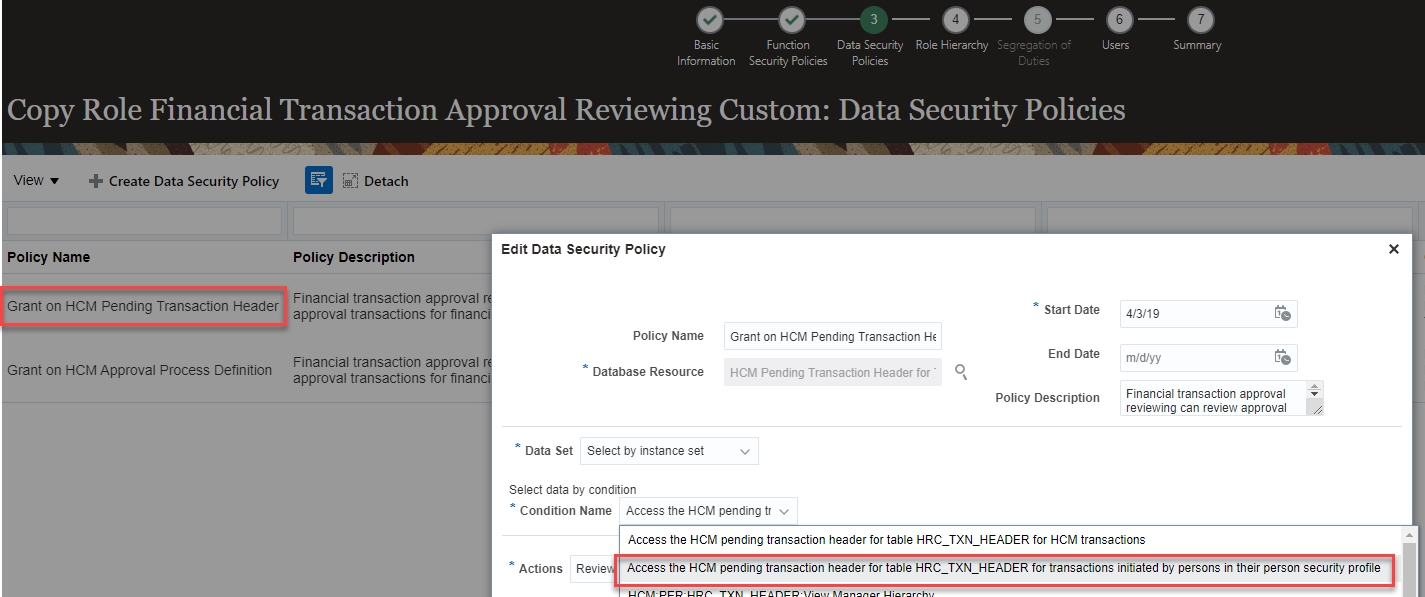

- In the Edit Data Security Policy window, select Access the HCM pending transaction header for table HRC_TXN_HEADER for transactions initiated by persons in their person security profile from the Condition Name field drop-down and click OK.

Edit Data Security Policy

- In the Edit Data Security Policy window, select Access the HCM pending transaction header for table HRC_TXN_HEADER for transactions initiated by persons in their person security profile from the Condition Name field drop-down and click OK.

Edit Data Security Policy

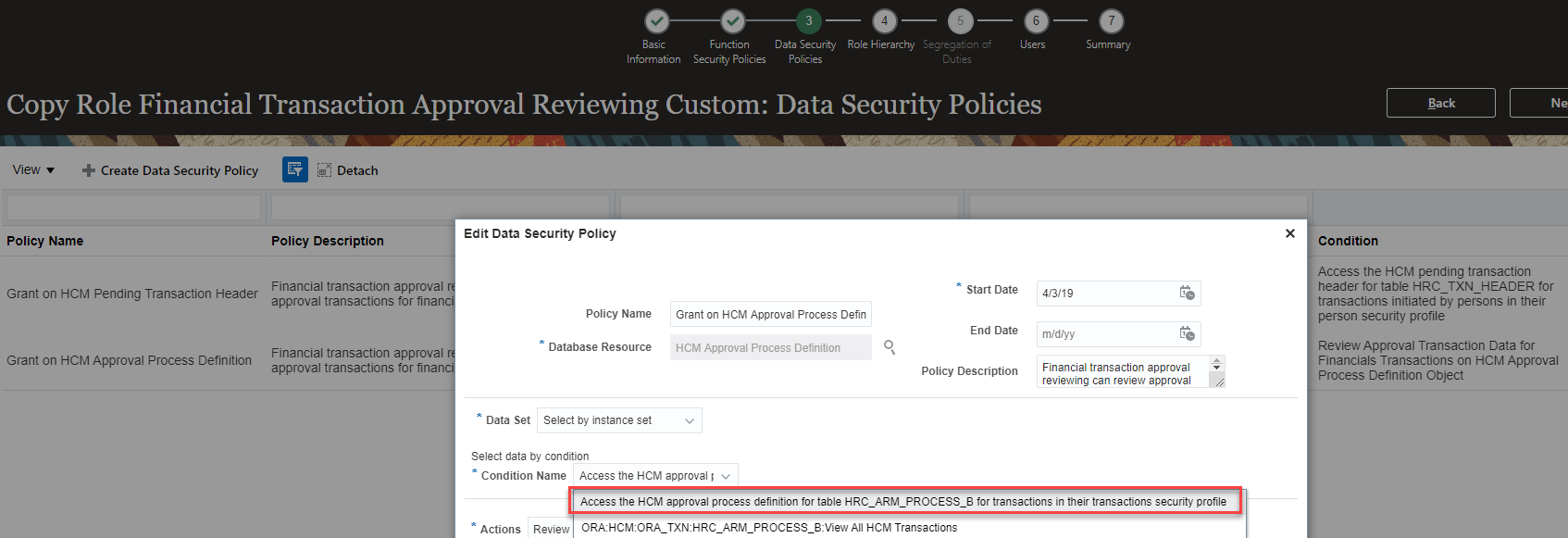

- Select Grant on HCM Approval Process Definition security policy. In the Edit Data Security Policy window, Select Access the HCM approval process definition for table HRC_ARM_PROCESS_B for transactions in their transactions security profile from the Condition Name field drop-down and click OK.

Edit Data Security Policy

- Select Summary tab and click the Submit and Close button.

- Search for the job role Financial Application Administrator and Copy Role. Assign the modified duty role which was created in step1 and remove the predefined duty role Financial Transaction Approval Reviewing from the newly created job role.

- Create Transaction Security Profile in HCM.

Create Transaction Security Profile

- Enter Name and Description for the Security Profile. Click the Create icon. Select FIN in Family LOV, Accounts Payables in Category LOV, Invoice Approval in Sub Category LOV. Click Save and Close.

Create Transaction Security Profile

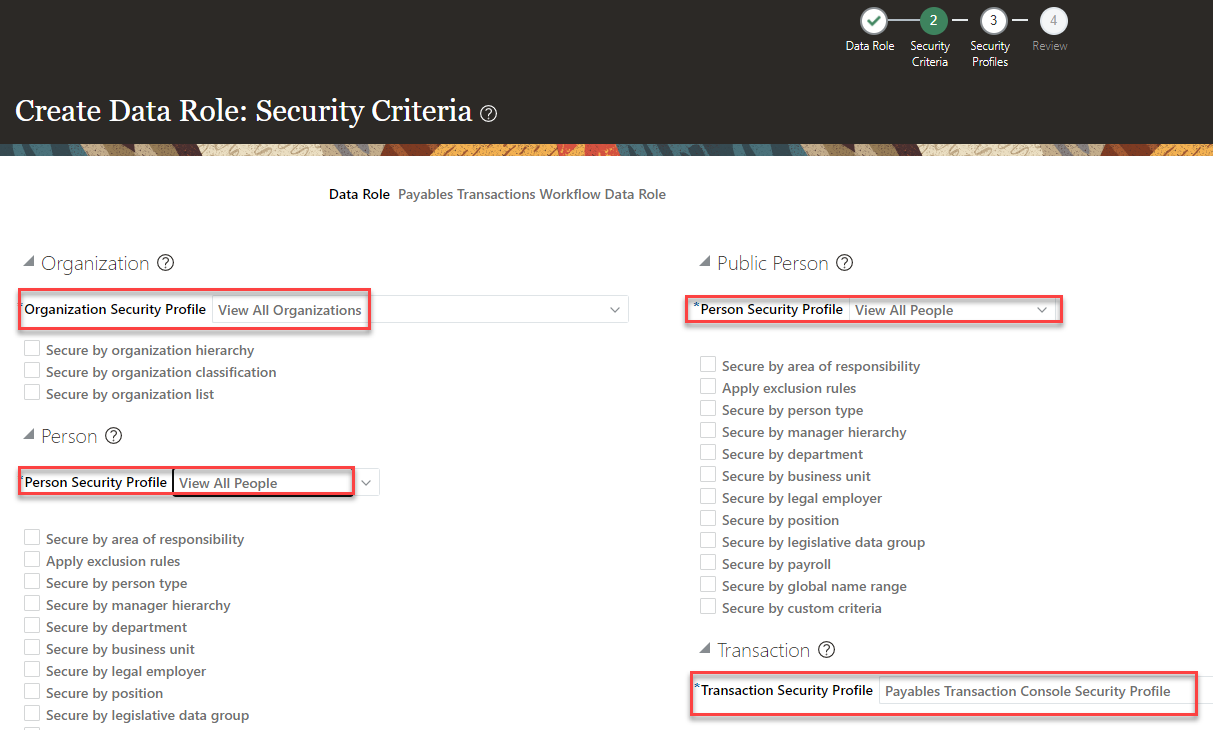

- Create a data role and assign job role to the security profile. Select Organization Security Profile value as View All Organizations, Person Security Profile under Person as View All People, Person Security Profile under Public Person as View All People, Transaction Security Profile as Payables Transaction Console Security Profile. Click Review > Submit.

Create Data Role

- Assign Data Role to the user.

Role Information

Users with Financials Application Administrator role can access the workflow transaction console.

Allow Expense Type Account as Asset Clearing Account for GASB 34

Public sector entities complying with GASB 34 can set up a unique expense type clearing account for each asset category assigned to an asset book and automatically assign the asset category by default to the invoice lines from Payables.

Select an expense type account as an asset clearing account in the category setup. You can specify a unique expense type asset clearing account (natural segment) for each asset category and automatically default the asset category to invoice lines transferred from Payables using this account as the Payables Clearing account.

If you do not have a unique clearing account for each category, then Payables transfers the invoice lines to Assets either without an asset category or an asset category that has the least Category Identifier. You can update the asset clearing account in category setup before adding any assets to the category in the asset book.

This feature allows you to automatically default the asset category to invoice lines transferred from Payables for GASB 34 asset books.

Steps to Enable

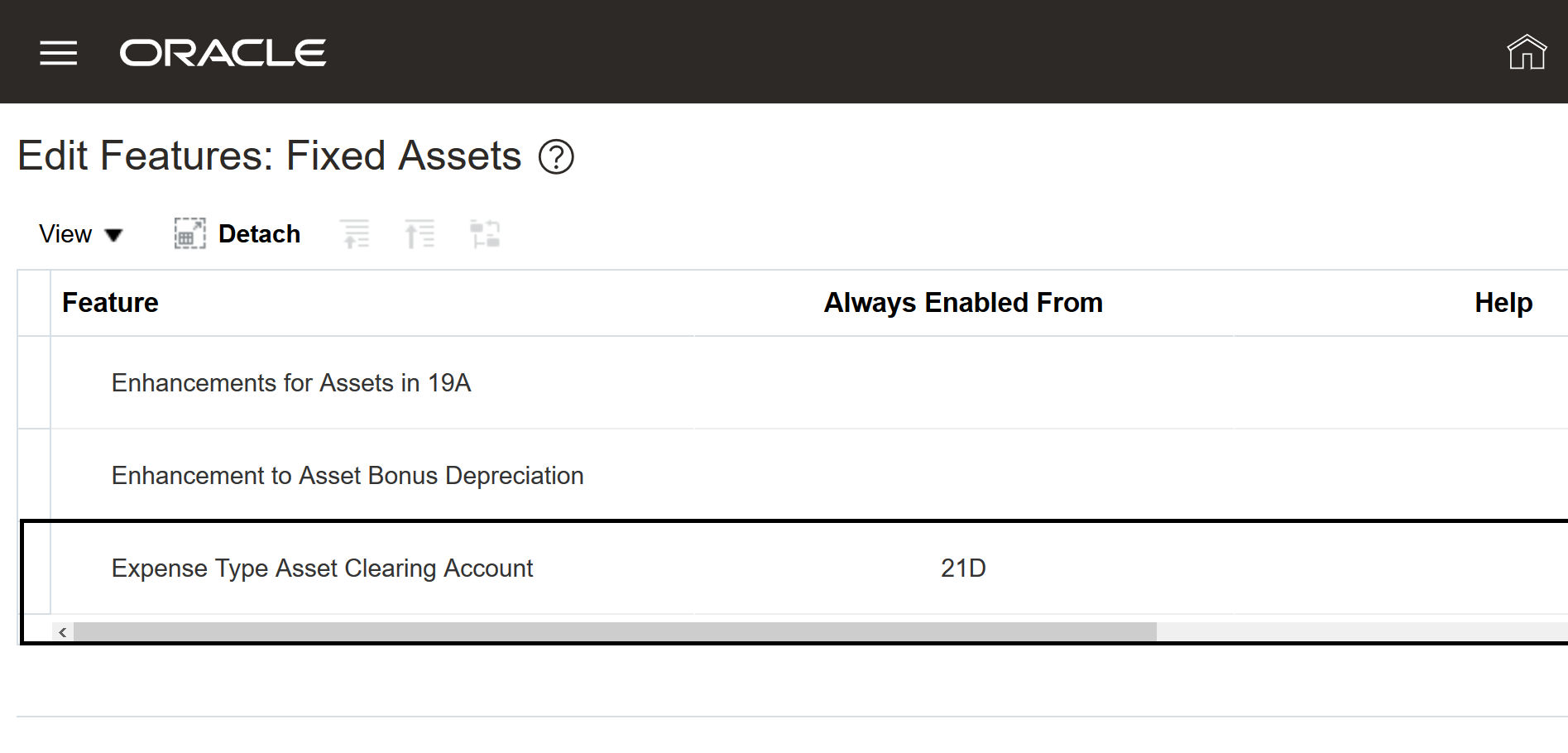

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Financials No Longer Optional From: Update 21D

- To enable the feature, complete the following steps.

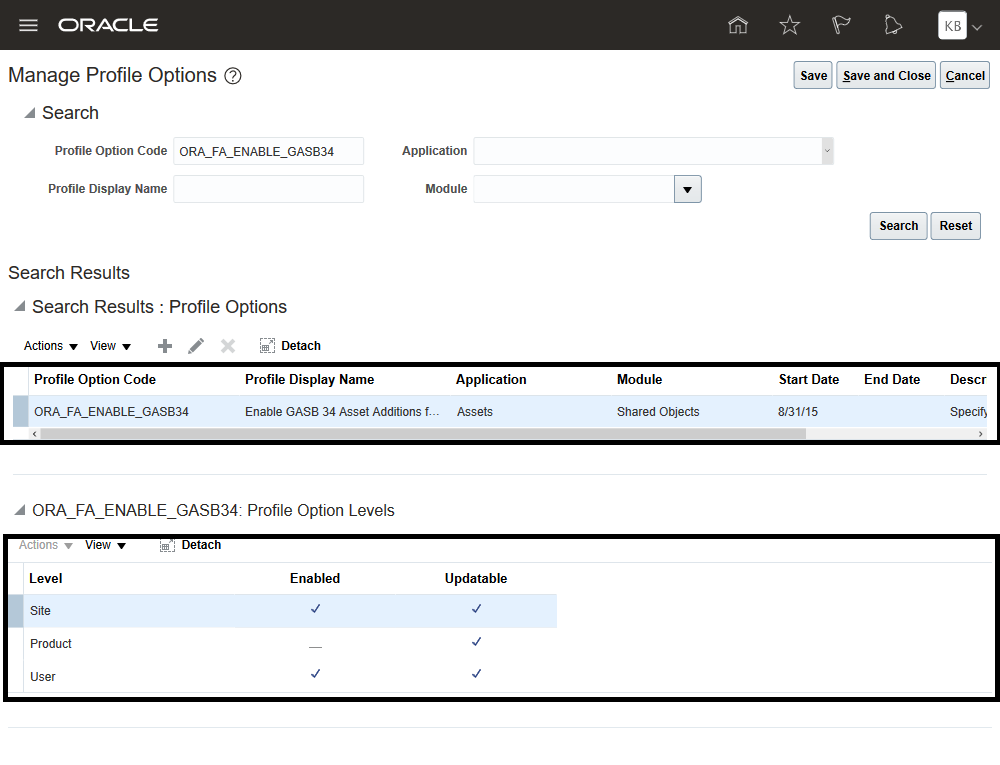

- Enable the ORA_FA_ENABLE GASB 34 (Asset Additions for Assets) profile option to control the Create Mass Additions process from the Invoice work area. You can select one of the profile levels to replace the standard program.

- Site: All users

- User:Only the assigned user

- Product:Assets

Key Resources

- GASB 34 Asset Accounting white paper published on My Oracle Support.

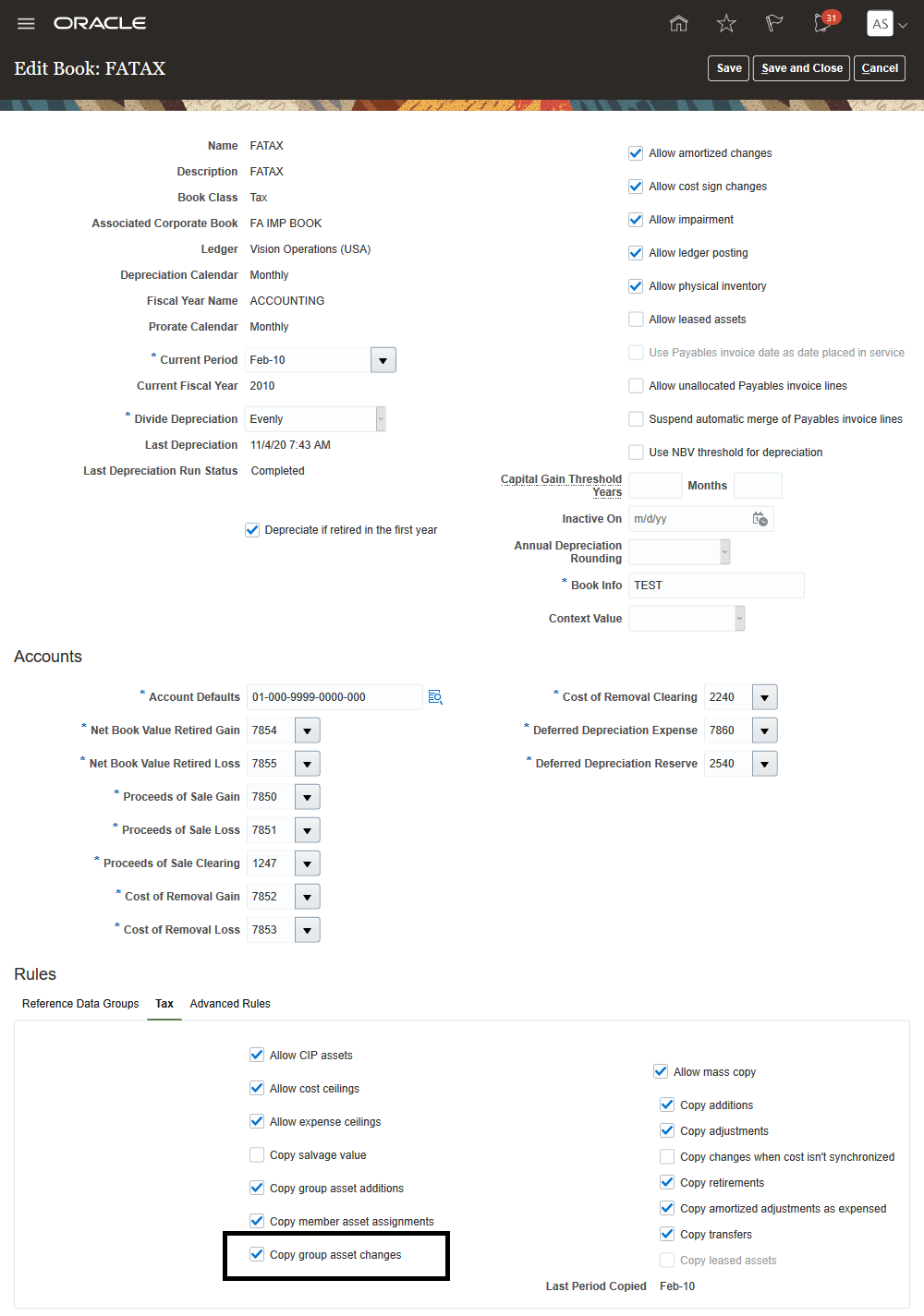

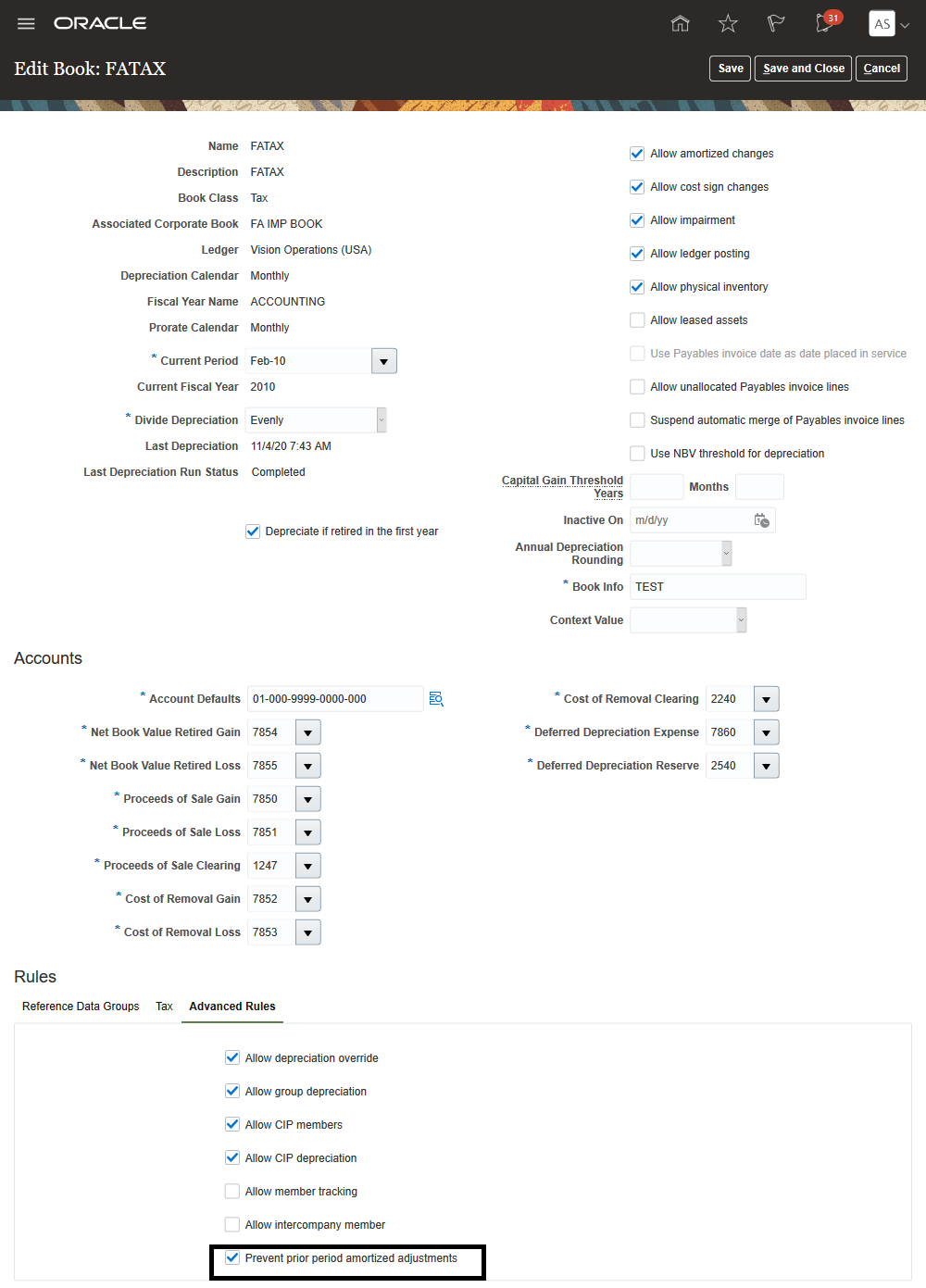

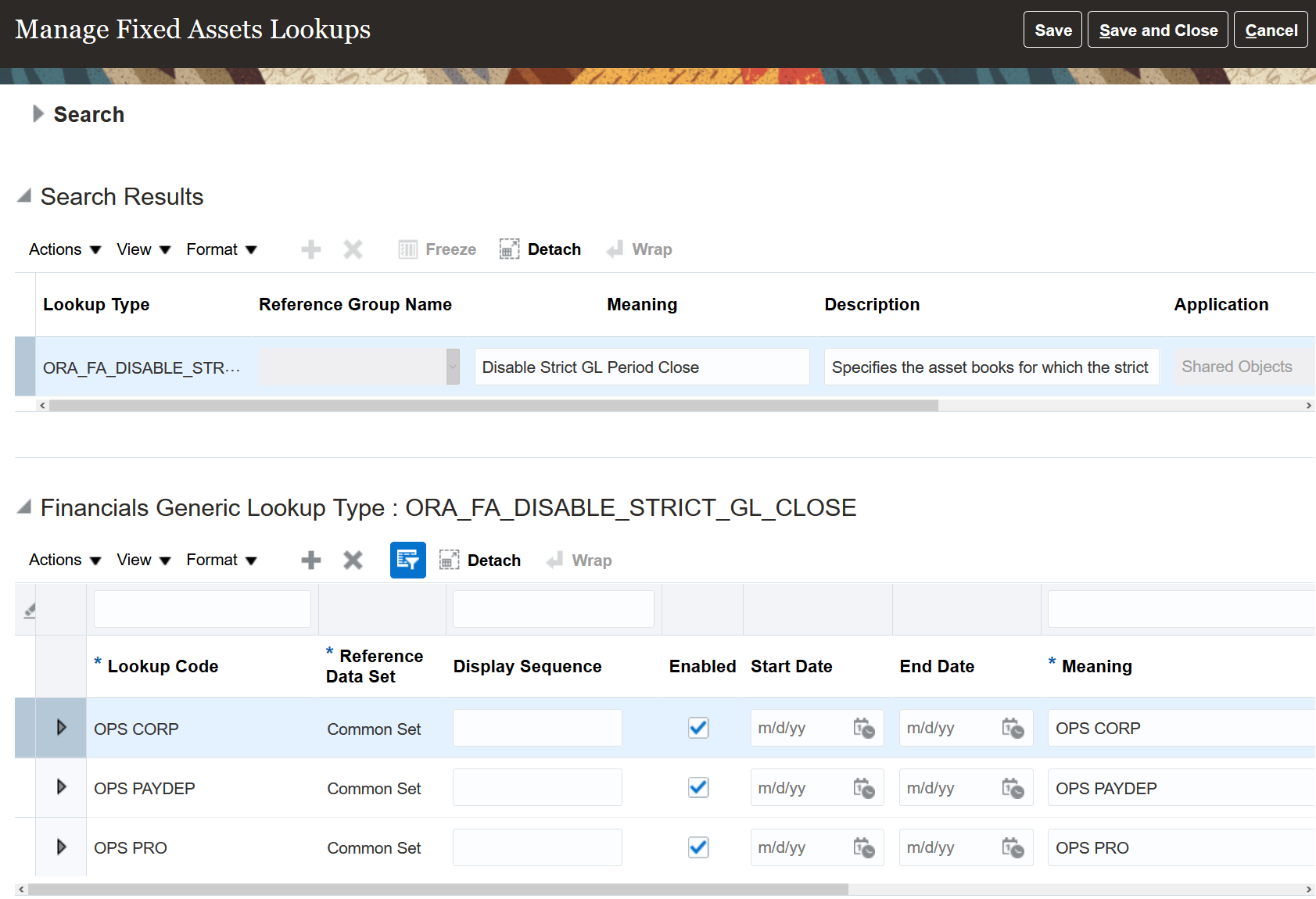

The Create Book page now includes two additional options: Prevent prior period amortized adjustments and Copy group asset changes.

PREVENT PRIOR PERIOD AMORTIZED ADJUSTMENTS

This option applies to both corporate and tax books. When you enable this option the amortized start date for any adjustment transactions must fall only within the current open period.

When you enable this option for the tax book but not for the corporate book, the amortized adjustments in the corporate book aren’t copied to the tax book if the amortization start date of the adjustment falls in any closed tax book periods.

COPY GROUP ASSET CHANGES

This option applies only to tax books. When you enable this option, the following member asset assignment changes are copied from the corporate book to the tax book.

- Transferring a member asset from one group to another.

- Changing a member asset to a standalone asset or a standalone asset to a member

This feature allows you to prevent prior period amortized adjustments in corporate and tax books, and to copy changes to the membership of group assets in tax books.

Steps to Enable

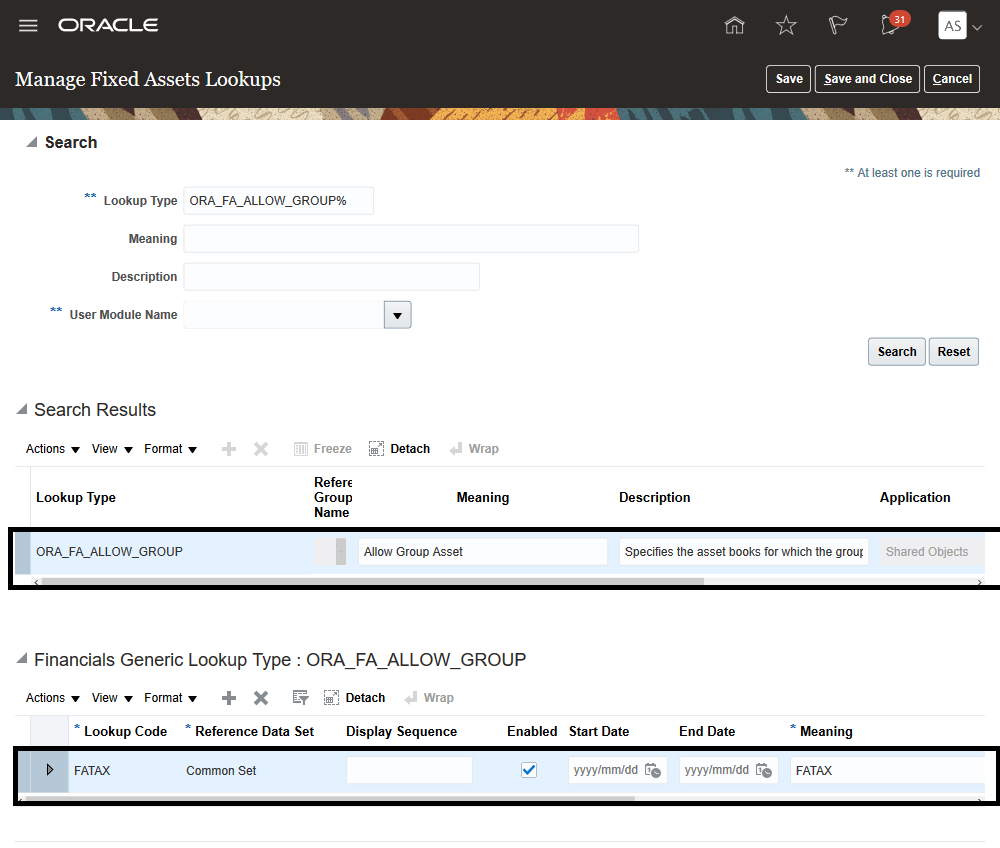

- The options are displayed using lookup.

- In Setup and Maintenance, go to the task Manage Fixed Assets Lookups.

- Search for the lookup type ORA_FA_ALLOW_GROUP.

- Enter your asset book name as the lookup code.

- In the Create Book page, when creating a tax book, enable the Copy group asset changes option.

- In the Edit Assets page in the Advanced Rules Tab, enable the Prevent prior period amortized adjustments option.

Employee Search and Select LOV Enhancement

You can now search for employees with at least one of the following attributes. Previously you could search for an employee only by name only.

- Person Number

- Name

Employee detail changes apply to the following pages:

- Edit Source Line page

- Add Assets page

- Adjust Assets page

- Transfer Assets page

- Retire Assets page

- Perform What-if Analysis page

- Create Distribution Set page

- Transfer Source Line page

- Mass Adjustments page

- Mass Transfer page

- Mass Retirements page

Employee Search and Select List of Values:

You can search for employees by Employee Name, Employee Number, and Email ID.

Steps to Enable

You don't need to do anything to enable this feature.

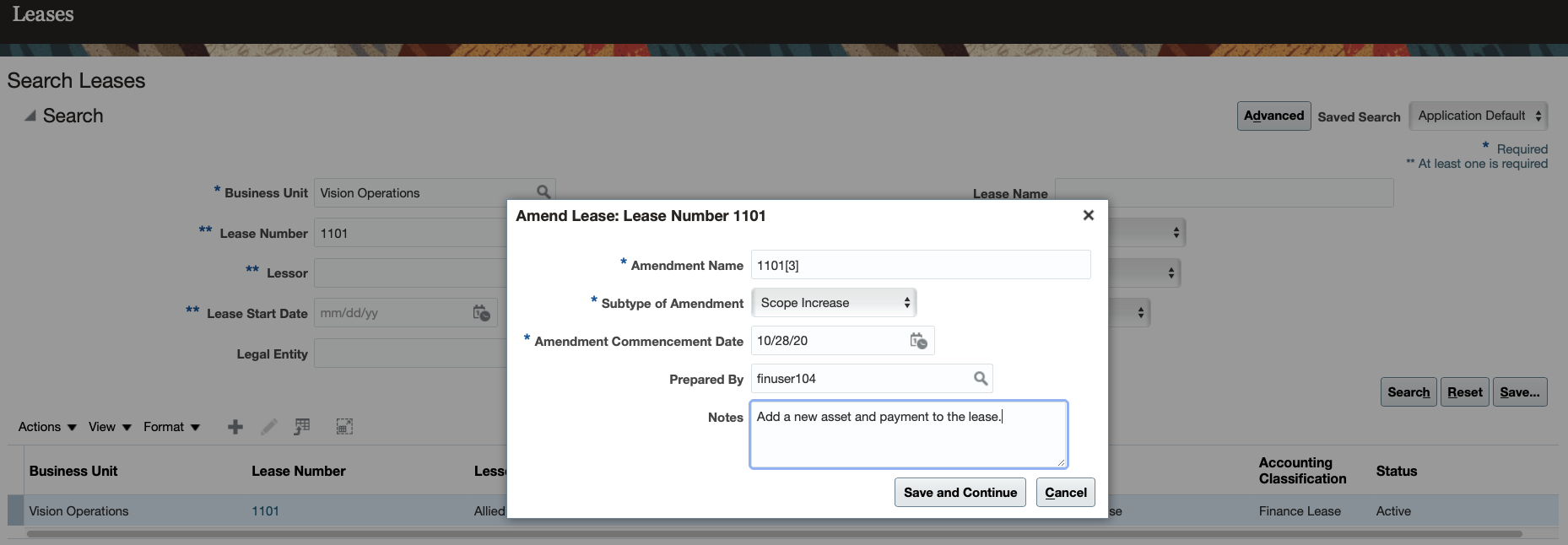

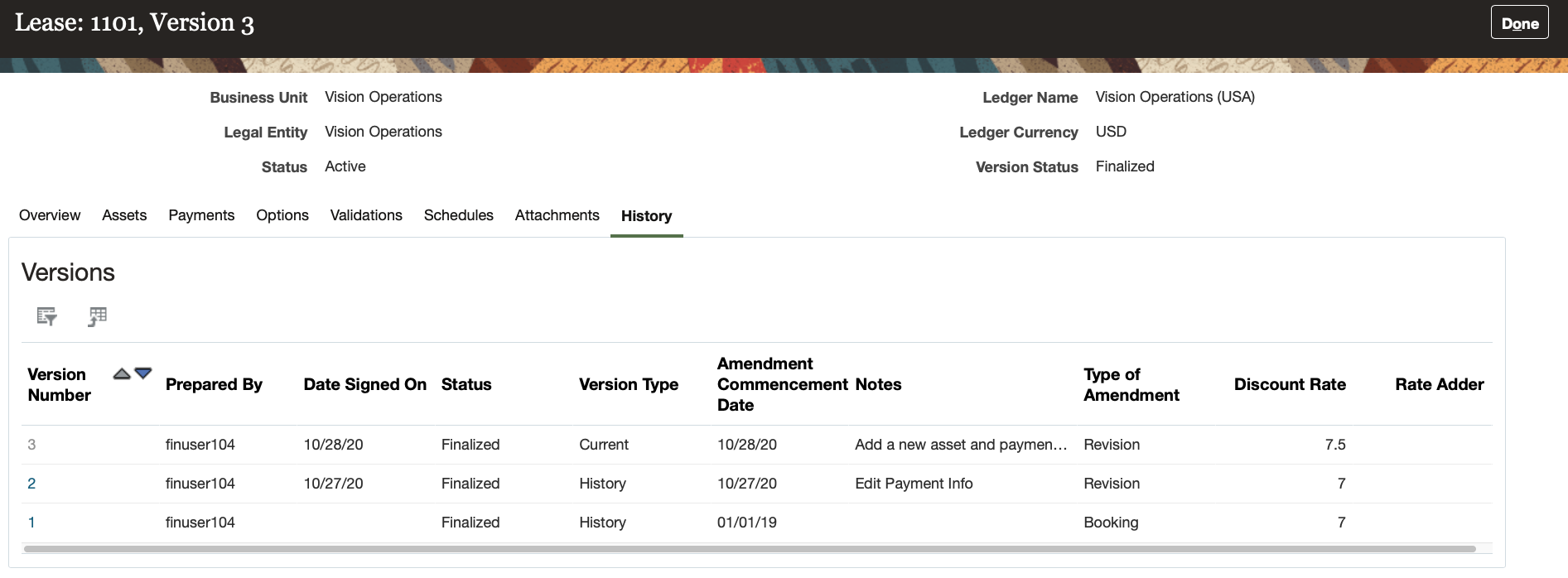

Manage Leases Page Enhancements

In the Manage Leases page, you can view up to 10,000 leases in a spreadsheet after exporting leases to Excel. By default, the leases are sorted by creation date, from newest to oldest.

You can process asset leases more efficiently by viewing up to 10,000 leases in a spreadsheet after exporting leases to Excel.

Steps to Enable

You don't need to do anything to enable this feature.

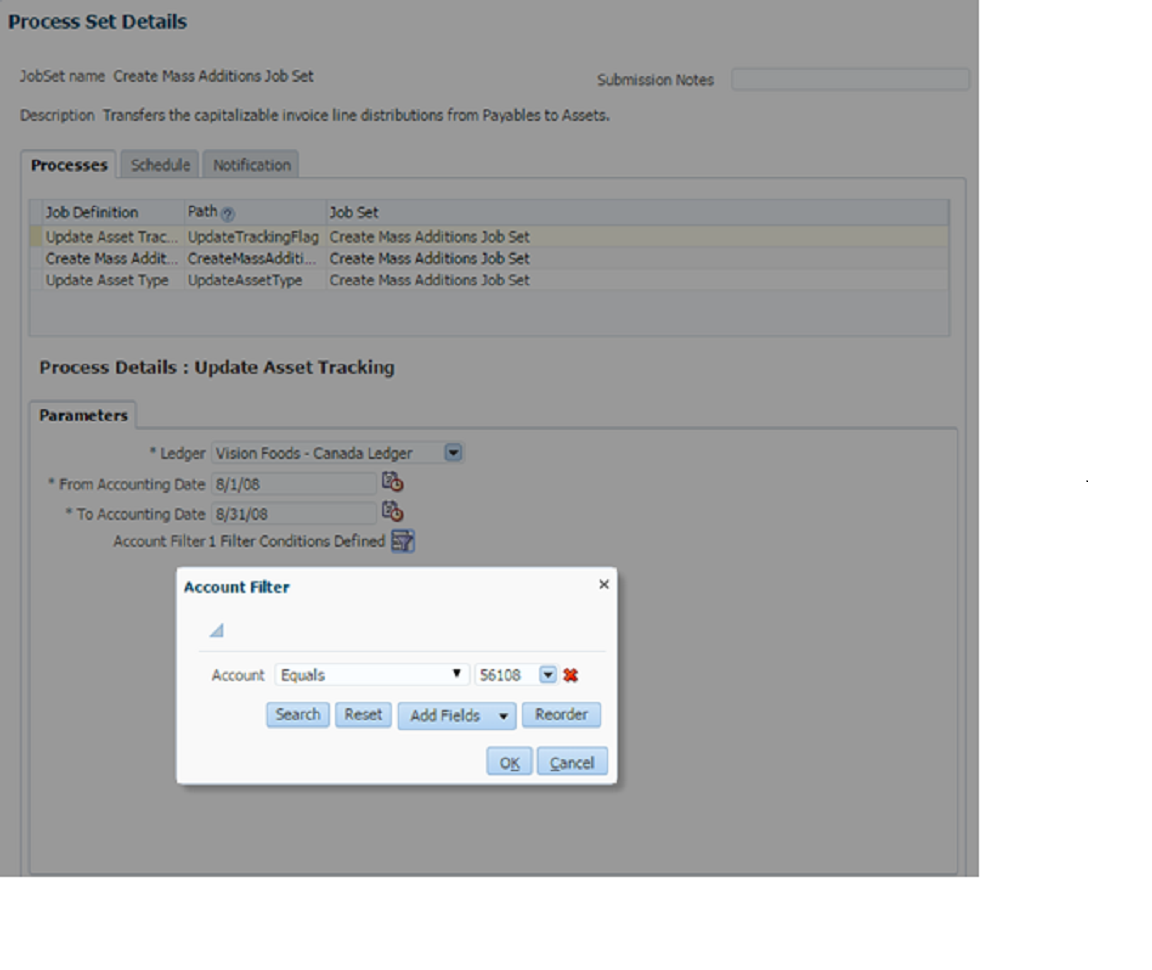

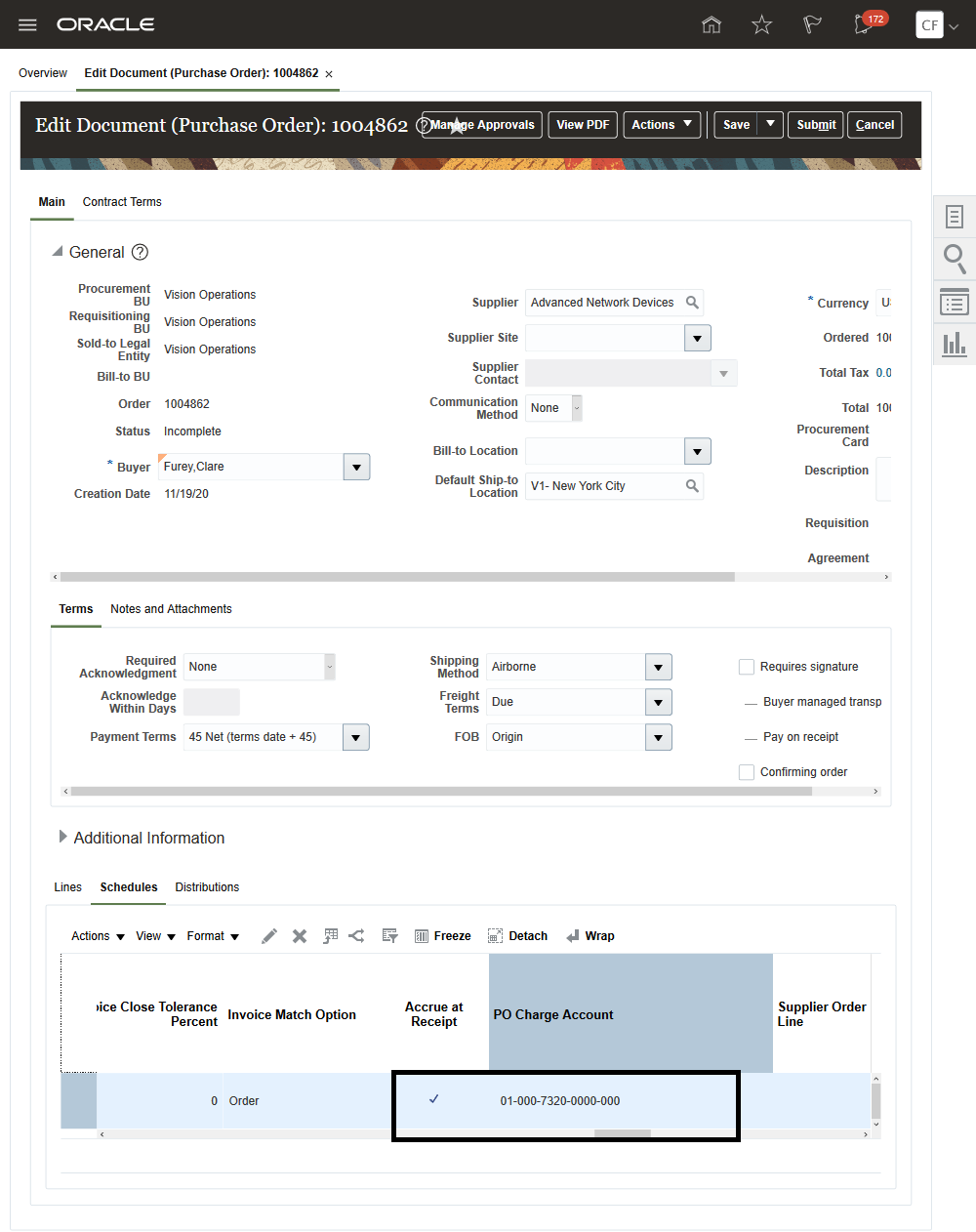

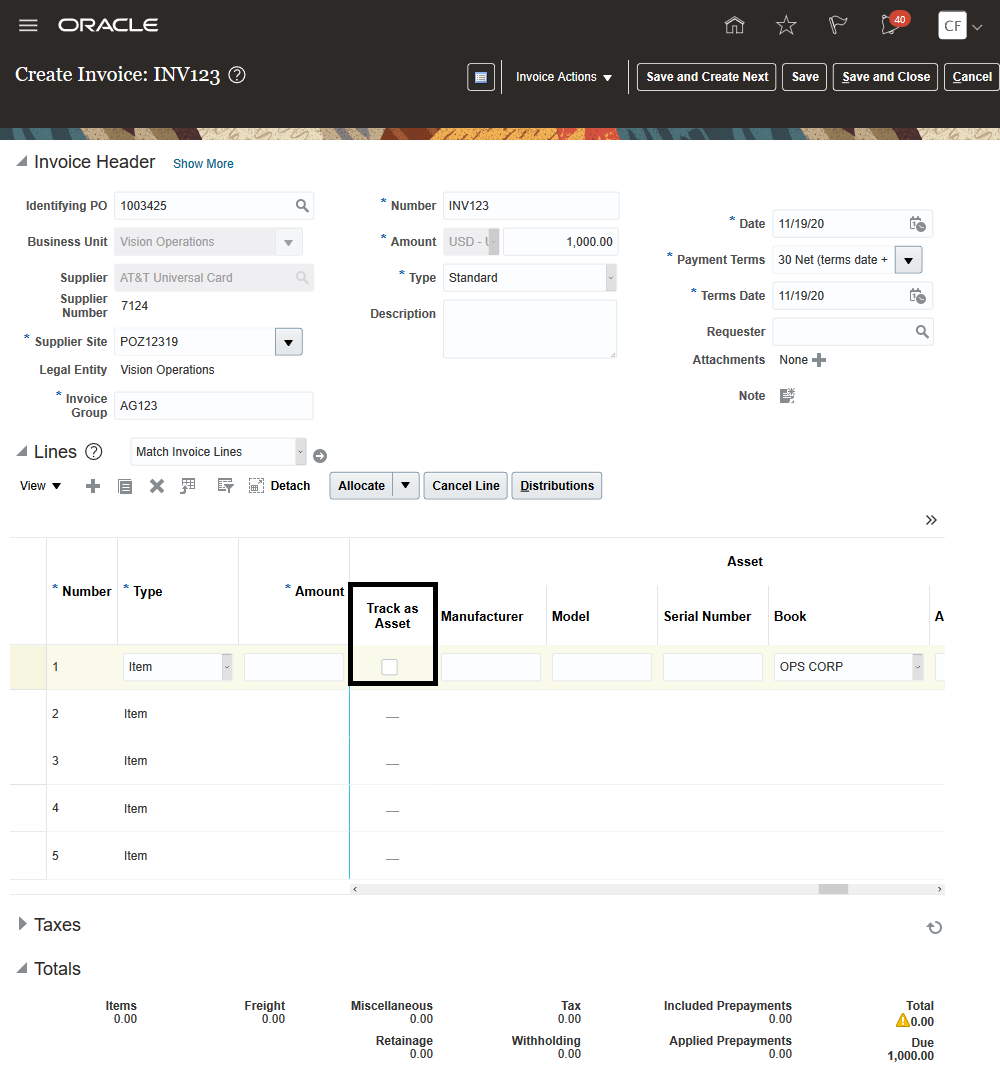

Transfer of Accrue at Receipt Invoices for GASB 34 Primary Ledger

The Update Asset Tracking process within the Create Mass Additions job set now checks whether the Accrue at receipt option is enabled in the purchase order when enabling the Track as Asset option in Payables.

The Track as Asset option is enabled when the expense account you provide when running the job matches:

- Purchase Order charge account for invoice lines that accrue at receipt (Accrue at receipt option is enabled).

- Invoice distribution account for invoice lines that accrue at period end (Accrue at receipt option is not enabled).

Before this enhancement the Update Asset Tracking process updated the Track as Asset option by matching the provided expense account with the invoice distribution account. As a result, invoices lines with the Accrue at receipt option enabled were charged to the expense account in the receipt transaction accounting and customers used either the Accrue at period option or a unique AP Accrual Liability account for capital asset purchases.

After running the job set when the Track as Asset option is enabled for Payables invoice lines, invoices are transferred to Assets as follows:

- Invoices Matched to Accrue at Receipt of Yes: The expense account entered as a parameter matches with the PO distribution account (in PO_DISTRIBUTIONS_ALL) of the invoice line distribution.

- Invoices Matched to Accrue at Receipt of No: The expense account entered as a parameter matches with the distribution account (in AP_INVOICE_DISTRIBUTIONS_ALL) of the invoice line distribution.

- Unmatched invoices: The expense account entered as a parameter matches with the distribution account (in AP_INVOICE_DISTRIBUTIONS_ALL) of the invoice line distribution.

This feature allows you to transfer all types of invoices, including invoices that accrue at receipt from Payables to Assets.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

- Create Mass Additions Job in the Scheduled Processes page

- Accrue at receipt option enabled and PO Charge Account in the Create Purchase Order page

- Enable Track as Asset option in the Create Invoices page

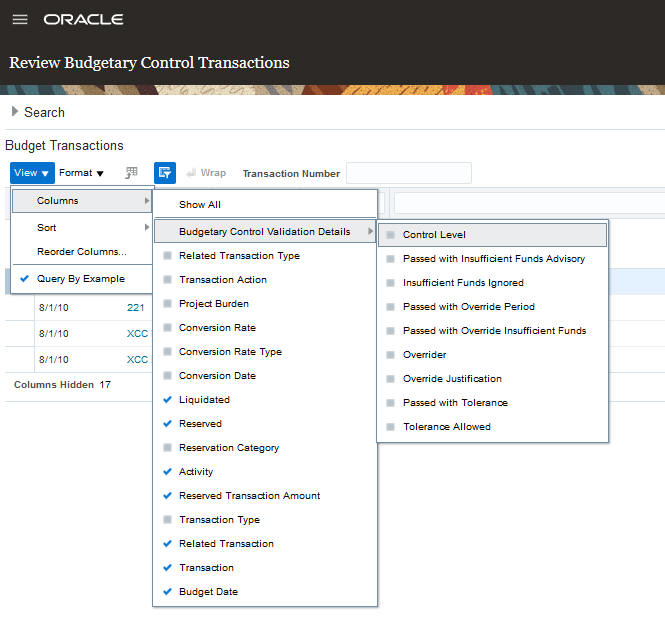

Additional Budgetary Control Transaction Information

Gain more understanding of budgetary balances with additional budgetary control validation transaction attributes on the Review Budgetary Control Transactions page. This includes an indicator when transactions are overridden due to insufficient funds.

Review Budgetary Control Transactions

The new columns on the Review Budgetary Control Transactions page help you understand the budgetary control validation details for reserved transactions. Here are some scenarios:

- The reason why a transaction passed validation with a warning:

- Passed with insufficient funds advisory

- Insufficient funds ignored

- Passed with override period

- Passed with override insufficient funds

- Overrider and override justification when passed with override

- Passed with tolerance

- Tolerance allowed when passed with tolerance

- Control level applied during validation

- Related transaction type

- Transaction action

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

The new budgetary control validation columns are not displayed by default. To add them to your personal view, click View > Columns and select the columns.

Role Information

Budget Manager role is needed to access the Review Budgetary Control Balances page.

Budget Hierarchy Updates While Control Budget Is Active

Use the Refresh Tree for Budgetary Control process to add values to a budget account hierarchy while the control budget is in use. You must still close the control budget before running the process for all other tree changes. The log and output file has been enhanced to include additional error messages for common configuration issues.

Control budgets can stay in use when adding to the budget account hierarchy. You can make these changes without closing the control budget:

- New detail values to an existing branch

- New parent and details values to an existing branch

- New branch with new parent and detail values

Refresh Tree for Budgetary Control processing errors is enhanced with improved messaging in the log and output files to list tree change errors that prevent it from being used for budgetary control.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

You must close control budgets for these types of tree changes:

- Replacing an existing parent value with a new parent value

- Moving a detail value to a new parent value

- Removing a parent value

- Removing a detail value

- Removing a branch

Key Resources

- Managing Tree Hierarchies in Oracle Fusion Budgetary Control support note 2014771.1

Role Information

- Financial Application Administrator role is needed to run the Refresh Tree for Budgetary Control process.

- Budget Manager role is needed to access the Manage Control Budget page.

Carry Forward Open Purchase Orders for Budgetary Controlled Non-Sponsored Projects

Use the Carry Forward Open Purchase Orders process to move purchase orders associated with budgetary controlled non-sponsored projects from one budget year to another. The process automatically updates the budget date to the corresponding budget year for these purchase orders.

Budget year-end processing has been simplified for purchase orders that impact non-sponsored project control budgets. A non-sponsored project control budget is a project control budget without an award. The Carry Forward Open Purchase Order process will automatically move these purchase orders to the new budget year. Run the process in draft mode to review which purchase orders will be carried forward automatically and choose to let the system process them or manually update the purchase orders that need additional attention.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

- Purchase orders that impact sponsored project control budgets will not be processed automatically. A sponsored project control budget is a project control budget with an award.

- There is no impact on burden amounts as the expenditure item date isn’t changed. The Carry Forward Open Purchase Orders process updates only the purchase order budget date. When the expenditure item date also needs to be updated, the purchase order should be reviewed and updated manually.

- Project control budget changes are centralized in Project Portfolio Management. Budget adjustments created automatically for chart of accounts based control budgets will not be done automatically for projects control budgets.

- If a budget adjustment is required for a project, use the following report information to update the budget balance for the project control budget by creating and baselining a new project budget version in Project Portfolio Management:·

- Not Attempted Budget Entries Details layout of the Carry Forward Purchase Order

Key Resources

- Managing Budgetary Control Carry Forward support note 2705986.1

Role Information

Budget Manager role is needed to run the Carry Forward Open Purchase Order process.

Connected and Integrated Budget Revisions with EPM Planning Financials

Prepare draft revisions to an approved EPM Planning Financials budget and verify against the funds available before the budget change is submitted. You can either approve or reject budget revisions before control budget balances are updated. You can drill down from EPM Planning Financials budget balances to view budget revision details on the Review Budget Entries page.

Meet legislative requirements in the US state and local public sector market with integration of management and operational budget tasks across Budgetary Control and EPM Planning Financials.

- Accurately manage budget revisions by simultaneously validating against operational budget and consumption balances.

- Maintain control and visibility with approvals and budget revision versions.

- Ensure compliance by validating budget changes against budgetary control policies.

- Improve insight into budget management with access to planning data and tools.

Steps to Enable

Steps are required in EPM Planning Financials and Data Integration to enable this feature.

Tips And Considerations

-

The Budget Revisions feature is in the Financials module of EPM Planning.

-

Additional configuration is required in EPM Cloud Planning and Data Management to set up the budget revisions feature and to map the budget data from EPM Planning Financials to Budgetary Control. Refer to the Key Resources section for references and additional details.

-

A new control budget with Source Budget Type of EPM Financials module (Not Hyperion Planning) is needed for integration with EPM Planning Financials. In the 21B update, existing control budgets can be converted to EPM Planning Financials module when the source budget type is Other or Hyperion Planning.

-

The control budget currency and calendar period names must align with the ledger. Control budget segments must include all chart of accounts segments. In 21C, you can use different period names and not all chart of account segments are required for the control budget. See the Budgetary Control Budget Balance Synchronization to Different Period Names and Non Budgeted Segments feature in the 21C What’s New for more details.

-

You can continue to use source budget type Hyperion Planning for new or existing control budgets. Budgetary control validation is performed during the submission of budget import.

-

Create a budget scenario with the same name as the control budget with the EPM Financials module to avoid errors in budget synchronization.

- Additional header and line level attributes for EPM Budget Revisions can be added using descriptive flexfields.

Key Resources

EPM Planning

- Setting Up Budget Revisions and Integration with Budgetary Control in Administering Planning Modules

- Integrating Budget Revisions with Budgetary Control in Administering Data Integration

- Working with Budget Revisions and Integrating with Budgetary Control in Working with Planning Modules

Budgetary Control

- Enterprise Performance Management Financials Module in Using Financials for the Public Sector

General Ledger

- Define Scenario Dimension Members in Implementing Enterprise Structures and General Ledger

Role Information

- Budget Manager role is needed to manage Budgetary Control.

- EPM Planning Administrator to enable budget revisions and set up data mapping.

Enterprise-Level Budgetary Control Options

The Enterprise Options section in the Manage Budgetary Control and Encumbrance Accounting page is used to enable enterprise-level budgetary control options. The expiring Opt In for these three features will be moved permanently to this page in 21C:

- Enable Additional Budgetary Control Liquidation Validation 19C

- Enable Control Budget Security 19C

- Synchronize Hierarchy Maintenance across Budgetary Control and General Ledger 20C

View and maintain the Budgetary Control system options in one common place. This new region is displayed above the Ledger and Business Unit Options in the Manage Budgetary Control and Encumbrance Accounting page.

Manage Budgetary Control - Enterprise Options

Uses these system options to enable Budgetary Control functions.

| Budgetary Control System Options | Enable System Option to do: |

|---|---|

| Budget to summary accounts in General Ledger | Budget to the same summary account in General Ledger as in Budgetary Control. |

| Synchronize hierarchy maintenance | Automate the maintenance of account hierarchies to ensure they remain the same in General Ledger and Budgetary Control. |

| Additional budgetary control liquidation validation | Fail budgetary control validation when the liquidation of a transaction doesn't impact the same control budget as originally reserved. |

| Secure control budget definitions | Limit users who can update control budget definitions on the Manage Control Budget page. |

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

- Your enterprise feature setting values default to a corresponding budgetary control system option in Manage Budgetary Control. In update 21A and 21B, all system options are maintained in the My Enterprise Feature page, except for the Budget to summary accounts available in the General Ledger system option. This option is maintained in the Manage Budgetary Control page.

Enterprise Feature Budgetary Control System Options 21A and 21B

Update Feature in Enterprise Feature page

21C

Update System Options in Manage Budgetary Control

Enable control budget security Secure control budget definitions Yes Yes Enable additional budgetary control liquidation validation Additional budgetary control liquidation validation Yes No update allowed, unless this feature is not enabled Synchronize hierarchy maintenance across Budgetary Control and General Ledger Synchronize hierarchy maintenance Yes Yes Budget to summary accounts in General Ledger No, update in Manage Budgetary Control Yes - In update 21C, the Enterprise Offerings features will expire and system options will be maintained in the Manage Budgetary Control.

Key Resources

- Using Financials for the Public Sector Book, Enterprise Options chapter

Role Information

The Budget Manager role is needed to access the Manage Budgetary Control page.

Automatic Reconciliation of Bank Accounts for a Bank, Bank Branch or Legal Entity

Use the additional options available on the Autoreconcile Bank Statements process to submit the reconciliation of bank statements belonging to a bank, a bank branch, or a legal entity. You can also use a wildcard character to submit the reconciliation process.

The bank statements of all the bank accounts of the selected bank, branch, or legal entity will be automatically reconciled.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

Scheduled automatic reconciliation processes won't get updated with the new parameters. The new parameters need to be selected as per the business requirements before rescheduling the process.

Role Information

You don't need any new role or privilege to set up and use this feature.

Notional and Physical Cash Pools

Review the consolidated cash balance and cash positioning for the cash pool.

Use the cash leveling proposals in the cash positioning to Initiate bank transfers from the subsidiary account to the concentration account for zero balancing. You can also initiate the bank tranfers from concentration account to subsidiary accounts for maintaining the target balances.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

You must clear the existing cash position data & resubmit the cash position data extraction process to review the updated cash position after initiating the bank transfers using the cash leveling proposals.

Key Resources

- Related Help: Cash Positioning and Forecasting in the Oracle Financials Cloud Using Payables Invoice to Pay, or Oracle Financials Cloud Using Receivables Credit to Cash guides

Role Information

To use this feature, you need this privilege or one of the roles:

- Privilege Name and Code:

- Manage Cash Pool - ORA_CE_MANAGE_CASH_POOL_PRIV

- View Cash Pool - ORA_CE_VIEW_CASH_POOL_PRIV

These privileges are already attached to the Cash Manager job role (ORA_CE_CASH_MANAGER_JOB).

Reconciliation of Third-Party Rollup Payments

Reconcile consolidated third-party rollup payments transferred from Payroll and reported in bank statements.

Third-party payments can be rolled-up using the Run Third-Party Payment Rollup process. As part of the roll payments, multiple payments from different employees are grouped together and paid to the third-party with single payment transaction. These payment transactions are transferred to Cash Management using the Transfer Payments Information to Cash Management process.

Cash managers can review and reconcile third-party rollup payment transactions both automatically or manually. These payment transactions are included in the reports: Cash to General Ledger Reconciliation; Cash in Transit; Cash Forecasting.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

- Submit the Transfer Payments Information to Cash Management process to transfer all payments from Payroll to Cash Management, including the third-party rollup payments.

- After receiving the bank statement file from the bank, reconcile payroll payments automatically.

Key Resources

Related Help:

- Third-Party Rollup Payments in the Administering Global Payroll guide

- Submit Cash Management Reports in the Oracle Financials Cloud Using Payables Invoice to Pay, or Oracle Financials Cloud Using Receivables Credit to Cash guides

- Manage Reconciliation in the Oracle Financials Cloud Using Payables Invoice to Pay, or Oracle Financials Cloud Using Receivables Credit to Cash guides

- Cash Positioning and Forecasting in the Oracle Financials Cloud Using Payables Invoice to Pay, or Oracle Financials Cloud Using Receivables Credit to Cash guides

Role Information

You don't need any new role or privilege access to set up and use this feature.

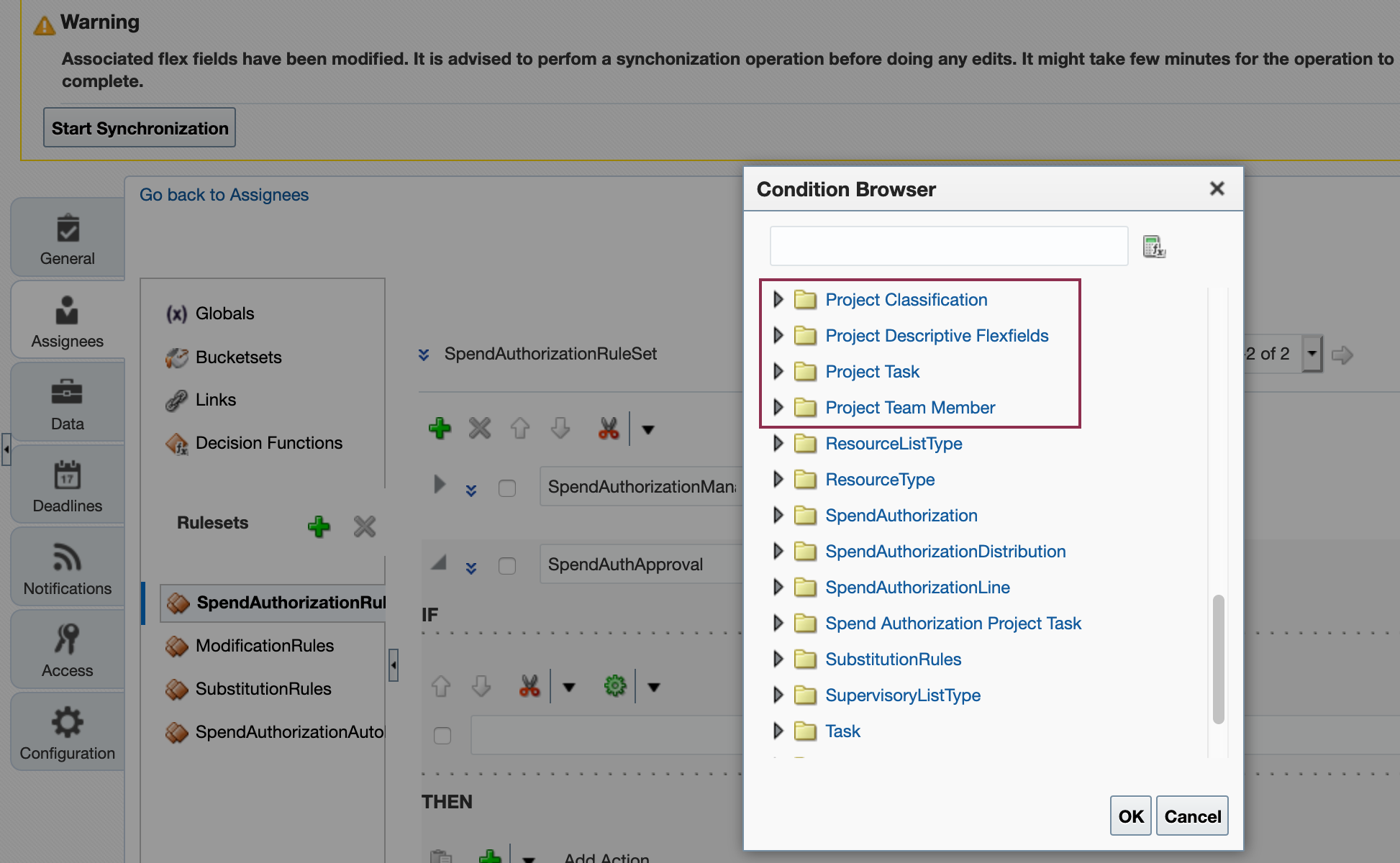

Configurable Spend Authorization Workflow Rules Using Additional Project Attributes

Use project-related attributes to configure approval rules in the Spend Authorization Workflow. These attributes let you route spend authorization approval notifications to project team members, project task manager, and the hierarchy of the project task manager.

Here’s a list of project-related attributes that workflow administrators can use to configure spend authorization workflow rules:

| Folder | Attributes |

|---|---|

| Project Classification |

|

| Project Team Member |

|

| Project Task |

|

Four New Folders in Spend Authorization Approval

Project related attributes enable companies to route spend authorization approval to additional project team members who oversee funds management.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

Click Start Synchronization on the BPM Rules Configuration page to synchronize project-related descriptive flexfield information with the BPM workflow configuration. This operation lets you configure workflow rules using project and task descriptive flexfield details.

Role Information

You don't need a new role or privilege access to use this feature.

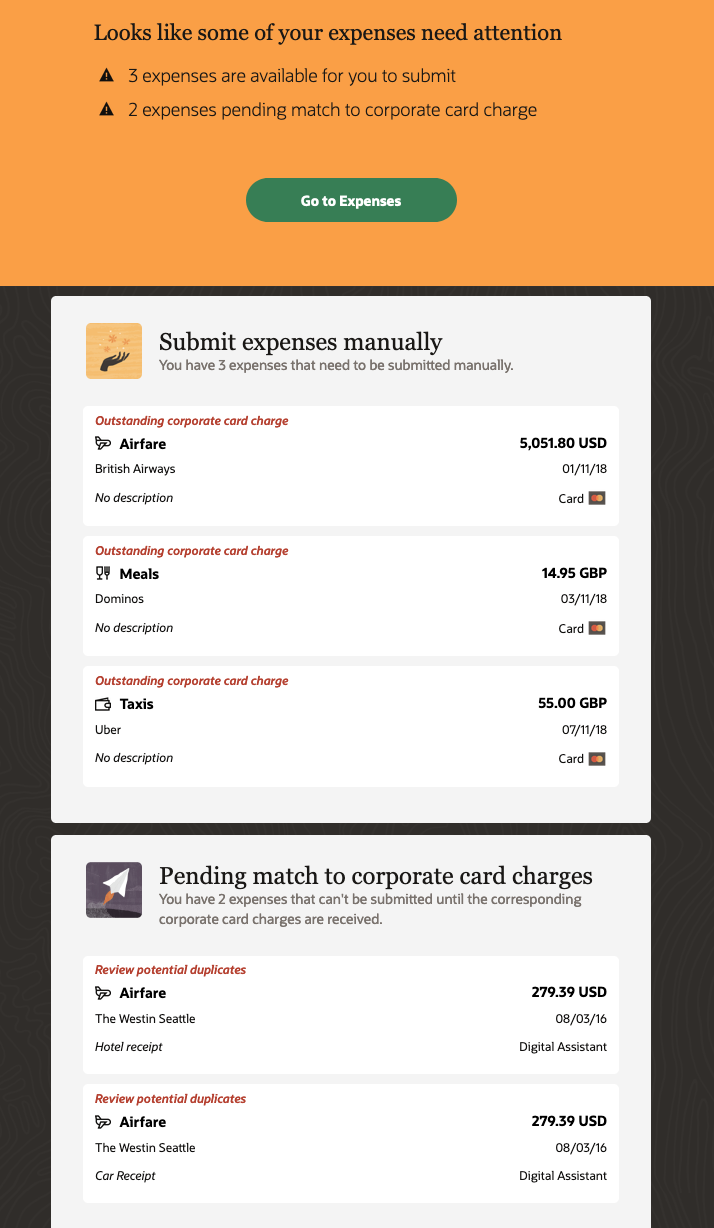

Digest Email Updates to Display Predefined Number of Expenses

To improve usability, limit the number of expenses displayed under each section in the digest email to three when there are more than three expenses that require the employee's attention. Employees can access additional expenses by clicking the link in each section to review the expenses in the Travel and Expenses work area.

The concise email notification allows employees to quickly preview the items that require attention or are ready for submission.

Digest Notification

Steps to Enable

You don't need to do anything to enable this feature.

Role Information

You don't need a new role or privilege access to use this feature.

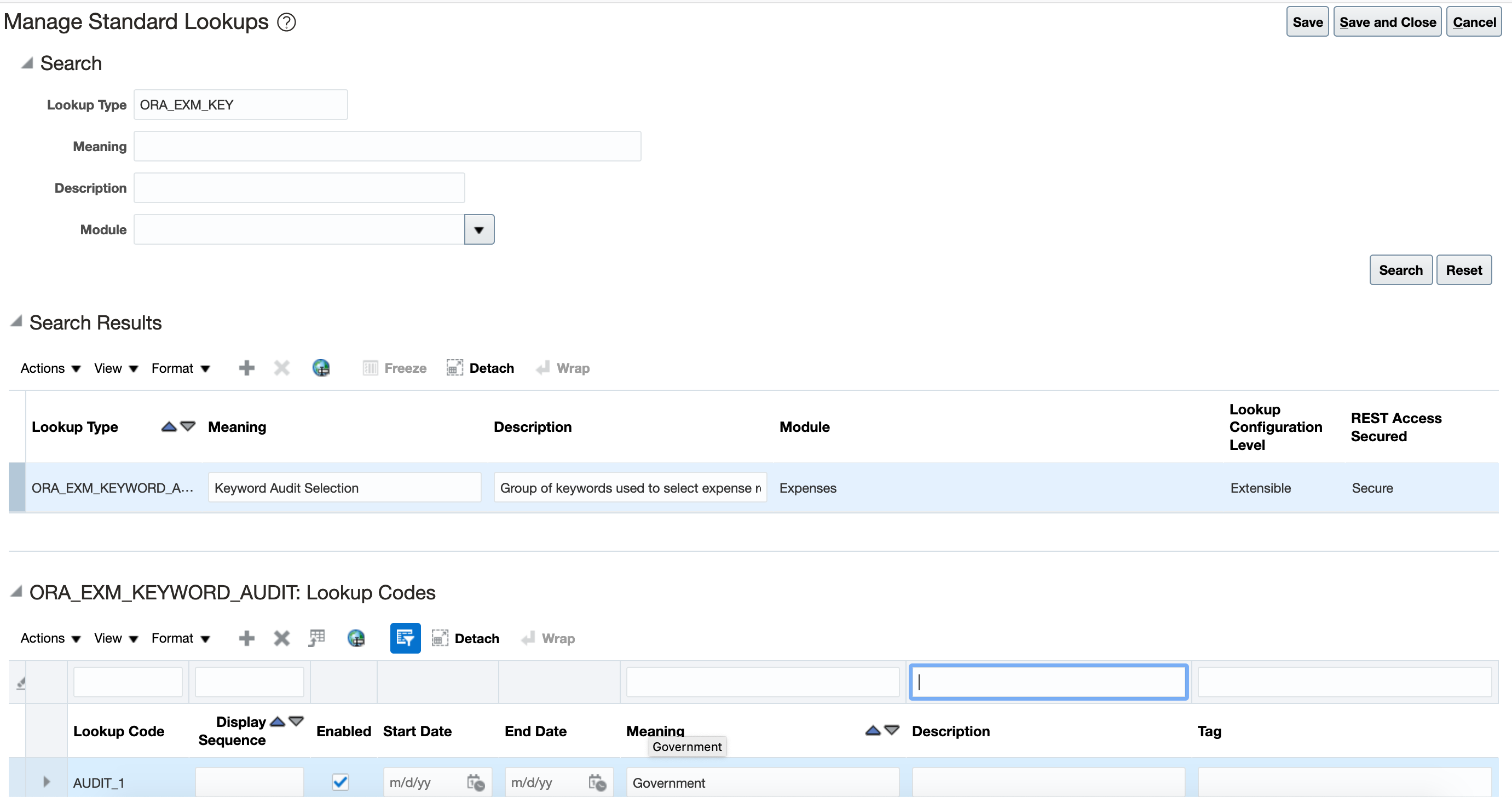

Keyword Audit for Expense Reports

Identify expense reports containing specific keywords and route them for audit. Administrators can create the list of keywords that meet their company's auditing needs.

Keyword audit is a new audit rule included in the set of expense report audit selection rules. You can define a score percentage to include exact matches and similar matches. When enabled, all expense reports containing the keywords in any of the following fields are selected for audit:

Expense Report

- Purpose

- Expense report level descriptive flexfields of Character type, such as ATTRIBUTE_CHAR_1 through ATTRIBUTE_CHAR_15

Expense Items

- Description

- Justification

- Merchant Name

- Expense item level descriptive flexfields of Character type, such as ATTRIBUTE_CHAR_1 through ATTRIBUTE_CHAR_15

A 100% score percentage selects all reports that exactly match one or more keywords. A score percentage less than 100% selects reports that contain words similar to the keywords that you defined. Expense reports are selected for audit at the time of submission. A new audit reason, Keyword Violation, is added to identify reports selected for audit based on keyword match.

Keyword audit enables companies to identify noncompliant expenses that require additional review by auditors. Keyword audit provides these benefits: identify expenses, such as purchases and subscriptions, from merchants excluded by a company; identify expenses from conferences and events that a company wants to review for compliance; and monitor expenses involving specific organizations.

Steps to Enable

There are two tasks to enable keyword audit.

- Add keywords to the preconfigured keyword lookup or create a new lookup and add keywords.

- Create an audit selection rule and activate the rule.

To add keywords to the keyword lookup, perform the following steps:

- Sign in as an expense manager.

- From the Setup and Maintenance work area, navigate to the Manage Standard Lookups page.

- Search for the ORA_EXM_KEYWORD_AUDIT lookup.

- Add each keyword that you want to audit as a lookup meaning. For example, if you have three keywords that you want to audit, then create three lookup meanings.

- Click Save and Close.

Create Keywords

To create an audit selection rule, perform the following steps:

- Sign in as an expense manager.

- From the Setup and Maintenance work area, navigate to the Manage Expense Report Audit Selection Rules page.

- Select the Create icon to create a new Expense Report Audit Selection Rule page.

- On the Create Expense Report Audit Selection Rule page, select applicable audit rules.

- Select the Audit expense reports with keywords option.

- Then, select an audit lookup and enter the score percentage.

- Click Save and Close.

- From the Setup and Maintenance work area, navigate to the Manage Expense Report Audit and Receipt Rule Assignments page to assign the rule to a business unit.

- Select the business unit.

- In the Expense Report Audit Selection Rule section, assign the new rule, start date, and end date.

- Click Save and Close.

Tips And Considerations

- Create an audit keyword lookup specific to each business unit to support requirements specific to that business unit. In an audit keyword lookup for a business unit, include generic keywords and business unit specific keywords.

- All disabled lookup values are not included in the audit selection.

- If you have an active audit selection rule and you want to add the keyword audit rule, then you must create a new audit selection rule, select existing criteria and the keyword audit rule and assign the rule to corresponding business units.

Key Resources

Role Information

To enable keyword audit, you need the Expense Manager role.

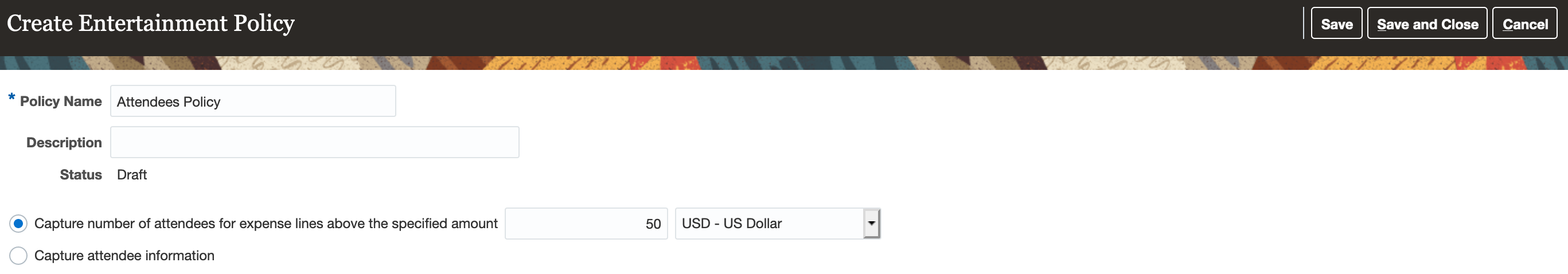

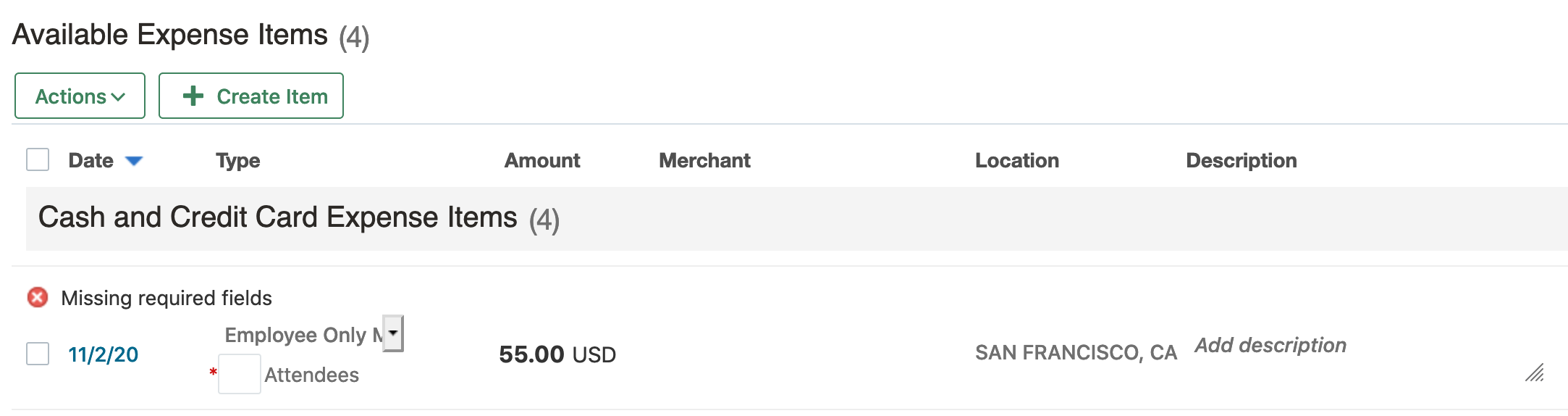

Number of Attendees Capture When Expense Is Above Designated Limits

Capture the number of attendees when meals and entertainment expenses surpass the designated limits specified by the company policy. Auditors can view the cost per attendee when auditing the expense.

For ease of entry, the Number of Attendees field is available in the Expenses work area and on the Create Expense page. While employees are entering expenses, the Number of Attendees field is blank. If the expense amount is above the designated limit, the Number of Attendees field is enabled and required. However, if the expense amount is within the designated limit, the Number of Attendees field is set to 1 when the expense is saved.

An entertainment policy that captures number of attendees can be assigned to any expense type.

Companies can improve the expense entry experience, by requiring its employees to enter the number of attendees only when an expense is over the limit.

Steps to Enable

To capture of number of attendees for expenses, perform the following steps:

- Sign in as an application implementation consultant.

- From the Setup and Maintenance work area, navigate to the Manage Policies by Expense Category page.

- In the Manage Policies by Expense Category page, select the Entertainment option from the Create Policy button.

- Select the Capture number of attendees for expense lines above the specified amount option

- Enter the limit above which you want to require employees to enter the number of attendees.

- Click Save and Close.

- In the Manage Policies by Expense Category page, select the newly created policy and click the Activate button.

- Navigate to the Manage Expense Report Template page and select the template of the expense type.

- Drill down to the expense type.

- In the Policies tab, click the Add Row icon in the Attendees Policy region to assign the newly created policy.

- Select the policy from the Policy Name drop down.

- Select the start and end date.

- Click Save and Close.

Number of Attendees Policy

Number of Attendees Entry in Expenses Work Area

Tips And Considerations

If an expense type is assigned an entertainment policy that captures number of attendees and a rate policy is also associated with that expense type, then the amount limit specified for requiring the number of attendees must be less than or equal to the daily and the single instance rate limits.

Key Resources

Role Information

To enable number of attendees, you need one of these roles:

- Expense Manager

- Application Implementation Consultant

- Financials Administrator

Travel Provider Integration Using Expense Travel Itineraries REST API

Create trips, travel itineraries, and reservations, such as air, hotel, and car rental, using the Expense Travel Itineraries REST API. Travel providers other than Getthere can integrate with Expenses using the Expense Travel Itineraries REST API.

When integrated, companies create the travel itineraries in Expenses application using the Expense Travel Itineraries REST API and run the Import Travel Itineraries process at scheduled intervals in validate mode to publish the itineraries to employee's Travel and Expenses work area.

Companies can integrate with their existing travel providers to allow employees to view their itineraries in the Expenses application and create expense reports from travel itineraries thereby simplifying expense reporting for employees.

Steps to Enable

Review the REST service definition in the REST API guides, available from the Oracle Help Center > your apps service area of interest > REST API. If you're new to Oracle's REST services you may want to begin with the Quick Start section.

To enable the REST integration with travel providers, perform the following:

- Create the details of the travel partner in the Manage Travel Partner Integrations page. You must use the travel partner name as defined in this page when invoking the REST API.

- Set the Enable Travel option to Yes for the specific business unit or the customer site in the Manage Expenses System Options page.

- Create a user with the Travel Administrator role. Invoke the REST API using this user's credentials.

- Create your own code to invoke the REST API. This code contains the following components:

- Invoke the travel provider's API to retrieve the itineraries for a specific time period.

- Transform the itinerary data to match the payload format of the Expense Travel Itineraries REST API if needed.

- Post the itinerary data to the Expenses application by invoking the Expense Travel Itineraries REST API. You can create and update travel itineraries.

- Review the itineraries rejected by the Expense Travel Itineraries REST API if any and take action.

- Run the Import Travel Itineraries process at scheduled intervals in validate mode to publish the itineraries to Employee's Travel and Expenses work area.

To create the travel provider in the Expenses application, perform the following steps:

- Sign in as a travel administrator.

- From the Setup and Maintenance work area, navigate to the Manage Travel Partner Integrations page.

- Click the Create icon to create a travel partner integration.

- Select Third party from the Corporate Online Booking Provider drop down list.

- Enter the travel partner name. Note that you also provide this name in the Expense Travel Itineraries REST API.

- Enter the default booking site URL if you allow employees to access the travel partner's booking tool directly from the Expenses work area. Additionally, you can configure booking sites and booking site URLs that are specific to each country.

- Click Save and Close.

Travel Partner Creation

To enable employees to view travel itineraries, perform the following steps:

- Sign in as an application implementation consultant.

- From the Setup and Maintenance work area, navigate to the Manage Expenses System Options page.

- Set the Enable Travel option to Yes.

- Click Save and Close.

You can set this option at the implementation level on the Manage Expenses System Options page, which applies to all business units. Alternatively, you can specify exceptions for specific business units on the Create System Options:Specific Business Unit dialog box.

Key Resources

- Watch Travel Provider Integration Using Expense Travel Itineraries REST API Readiness Training.

- Expense Travel Itineraries REST API section in the REST API for Oracle Financials Cloud guide.

Role Information

To integrate with a travel provider using the Expense Travel Itineraries REST API, you need the Travel Administrator role.

Flight Class Policy Enforcement in Expenses Mobile Application

Enforce flight class policies for airfare, such as whether an employee is eligible for business class, in Expenses Mobile Application. If company policy permits expense report submission with policy violations, employees are prompted to provide a justification. If not, employees must correct the expense items that contain policy violations.

The mobile application validates airfare expenses for policy violations and requires a justification if the company allows submission with policy violation. The application displays an error message on the View screen if the company does not permit the flight class of the purchased ticket.

Flight Class Policy Validation

Enforcing airfare policies on the Expenses mobile application enables employees to fully complete entry of airfare expenses and submit them directly from the mobile application.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

To use this feature, ensure that you have downloaded the latest Expenses mobile application.

Key Resources

- Watch Improved Policy Enforcement and Location Entry in Mobile Application Readiness Training.

- Refer to the Set Up an Airfare Policy topic in the Oracle Financials Cloud Implementing Expenses guide to learn how to set up an airfare policy.

Role Information

You don't need a new role or privilege access to use this feature.

Location List of Values in Expenses Mobile Application

Select expense location from a list of values in the Add Expense and Add Mileage screens in Expenses mobile application. The list of values varies depending on the location list configuration for the business unit. Employees can select the correct location instead of manually entering the location.

When employees navigate to the Add Expense screen and the Add Mileage screen, the GPS location of the employee appears by default. Employees can select the expense location from the list of values. The location list of values depends on the setting for the Enable Expense Location Level option on the Manage Expenses System Options page. When the Enable Expense Location Level option is set to Country, the location list of values displays all countries. When the Enable Expense Location Level option is set to Country and State or Province or All Locations, the location list of values displays all countries and all states or provinces in each country.

The location list of values has three sections: GPS location; Recent Locations, consisting of the three most recently used locations; and All Locations, consisting of all locations in alphabetical order. Additionally, the list of values provides a search bar at the top of the list. Employees can manually enter a location if needed.

Location Level Setting

Selection of expense location from a list of values ensures accuracy and enforcement of the correct policy when expense policies are based on location.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

Role Information

You don't need a new role or privilege access to use this feature.

Mandatory Fields Highlighted in Expenses Mobile Application

View all mandatory fields for an expense in the Add Expense, Add Mileage, and Submit Expense Report screens in the Expenses Mobile Application. The mandatory fields vary depending on the expense type configuration. Employees have a clear understanding of what is mandatory before submitting an expense.

Earlier, the application alerted employees about the missing information only when they saved their expenses. Employees can now easily identify these mandatory fields as soon as they navigate to the tasks:

- Date

- Type

- Amount

- Attachment

- Description

- Justification

- Project and task

- Category-specific mandatory fields:

- Accommodations: Merchant, Checkout date

- Airfare: Merchant, Flight Type, Flight Class, Ticket Number, Departure City, Arrival City

- Car Rental: Merchant

- Entertainment: Merchant

- Mileage: Starting Location, Destination, License Plate Number, Start Odometer Reading, End Odometer Reading

- Miscellaneous: Merchant

Steps to Enable

You don't need to do anything to enable this feature.

Role Information

You don't need a new role or privilege access to use this feature.

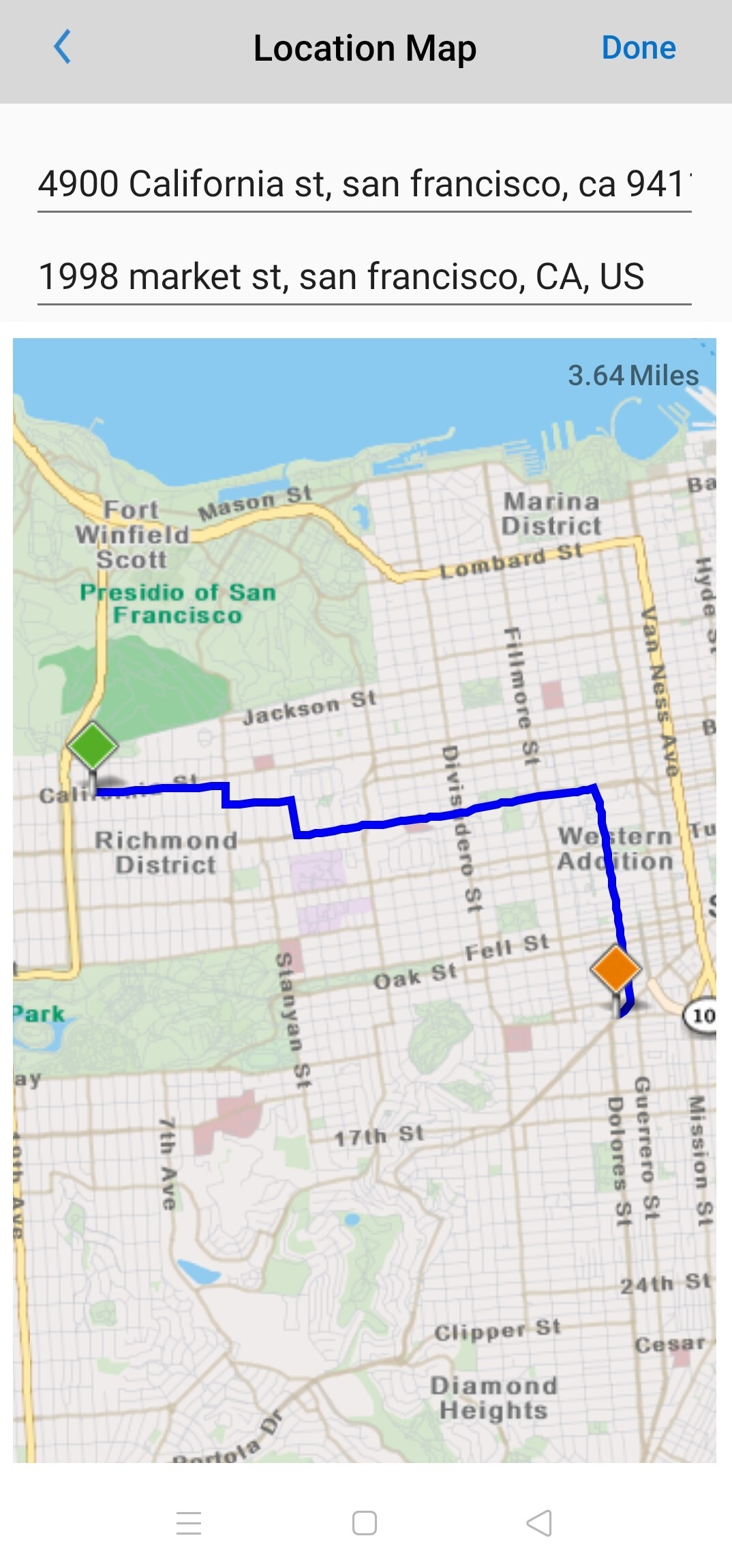

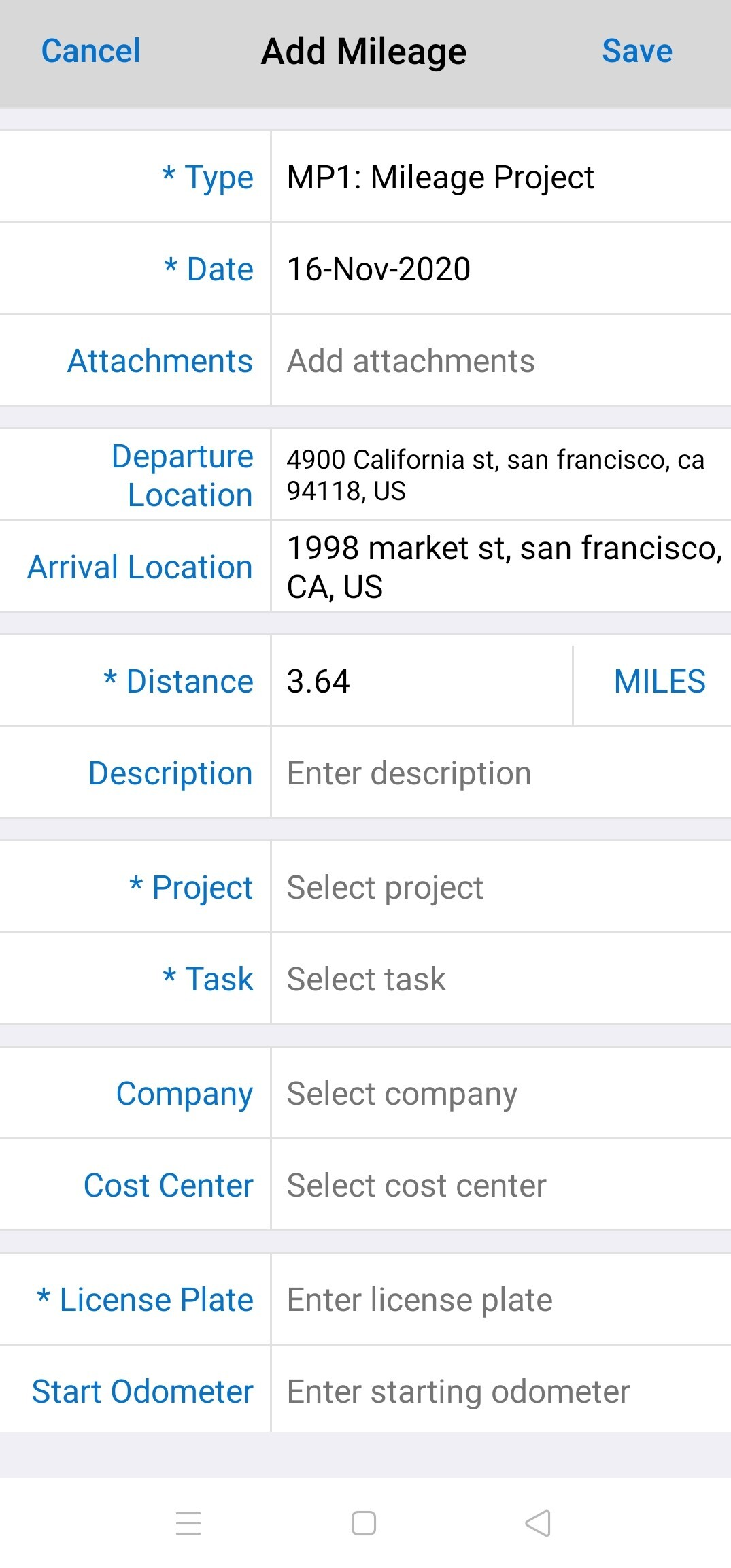

Oracle Maps Cloud Service for Expenses Android Application

Calculate trip distance in mileage expense entry in the Expenses Android application using Oracle Maps Cloud Service. Additionally, use mileage tracker to track the commute distance and automatically create a mileage expense.

When Oracle Maps Cloud Service is enabled for your business unit, the Expenses Android application displays Oracle Maps when an employee selects a mileage expense type and taps the Departure Location field or the Arrival Location field. As the employee starts typing, the Location list displays suggestions when applicable. Employees can select a location from the list or enter the locations manually. When departure and arrival locations are entered, the map calculates the distance. When the employee returns to the Add Mileage screen, the distance field is populated with the calculated mileage.

The Mileage Tracker option in the springboard allows you to track your trip from the beginning to the end and create a mileage expense. From the Mileage Tracker option, click the Start button to start tracking. When you reach the destination, click the Stop button. The application automatically creates a mileage expense and then prompts you to confirm the expense.

Oracle Maps in Add Mileage Screen

Add Mileage Screen

Oracle Maps Cloud Service is not available to you if you have subscribed to Fusion Expenses Cloud Service and one or more of the following services: Fusion for United States Government Cloud Service with part number B87366, Fusion for United Kingdom Government Cloud Service with part number B87368, Fusion for European Union Restricted Access with part number B91905.

Enabling maps for mileage expenses and mileage tracker in the Expenses Android application improves usability, reduces errors, and provides Android users the same capabilities as the Expenses iOS application.

Steps to Enable

You don't need to do anything to enable this feature.

Role Information

You don't need a new role or privilege access to use this feature.

Automatic Synchronization of Expense Types and Synonyms to Oracle Digital Assistant

Automatically download expense types for all business units to Oracle Digital Assistant and associate preconfigured synonyms to expense types to improve expense type prediction.

When employees create expenses using conversations, Oracle Digital Assistant automatically predicts expense types from the information provided in the conversation using natural language processing. To facilitate expense type prediction, the Digital Assistant stores all expense types and their preconfigured synonyms for these expense types. You can add synonyms in the Synonyms for Expense Types section of the Manage Auto Submission and Matching Options page to improve the prediction. When you add a new expense type in an expense template or add a synonym to an existing expense type, the Expenses application syncs the new expense types and synonyms to the Digital Assistant.

Expense Type Prediction Based on Synonyms

Companies can improve the conversational experience and eliminate additional questions from the Digital Assistant by adding commonly used terms as synonyms for expense types and syncing the synonyms to the Digital Assistant.

Steps to Enable

To automatically sync expense types and synonyms, perform the following steps:

- Sign in as an application implementation consultant.

- From the Setup and Maintenance work area, navigate to the Manage Auto Submission and Matching Options page.

- In the Synonyms for Expense Types section, select the desired expense type and enter more synonyms in the Synonyms field.

- Select No from the Turn Off Auto Sync drop-down list.

- Click Save and Close.

- Sign in as a travel administrator.

- From the Scheduled Processes work area, schedule the Automatically Submit Expense Reports process to run at a desired interval.

Synonyms for Expense Types

Tips And Considerations

If you have already scheduled the Automatically Submit Expense Reports process, you don't need to schedule it again. Based on the options that you enabled in the Manage Auto Submission and Matching Options page, the process can perform these actions:

- Automatically submit reports

- Send digest emails

- Sync expense types and synonyms

Role Information

To enable automatic sync, you need one of these roles:

- Expense Manager

- Application Implementation Consultant

- Financials Administrator

Manual Submission of Expense Reports from Oracle Digital Assistant

Manually submit all available expenses directly from the Oracle Digital Assistant and enter a purpose for the expense report for faster submission of manually created expense reports.

Employees can control the timing of the submission of expenses created using Oracle Digital Assistant by manually submitting expenses directly from the Digital Assistant when they are ready. If the company has enabled automatic expense report submission, employees must first turn off the automatic submission for themselves using conversations such as "Manual submit", "Let me decide when to submit", "Don't submit yet", or "Stop auto submit". When the automatic submission is turned off, employees can submit expense reports using conversations such as "Submit expense" or "Submit my report". The Digital Assistant identifies all expenses that are ready for submission, tells you the total number of expenses and the amount, and asks you for a report name. The Digital Assistant then submits the report. If you say "I don't have a name" or "I don't care", then the Digital Assistant assigns a name and submits the report. You can cancel a manual submission that is in progress by saying "Cancel".

Employees can turn on automatic submission again by using conversation such as "Turn on auto submit", "Auto Submit", "Submit for me", or "Switch to auto". Employees can manually submit all expenses from the Expenses work area at any time.

Manual Submission of an Expense Report

Companies can allow employees to control their own expense submission schedule by allowing them to turn on and off the automatic expense report submission. This is especially useful when employees to want to submit all charges for a trip in a single report.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

To use this feature, ensure that you have downloaded the latest Expenses skill from the Digital Assistant store. Refer to the Upgrade Digital Assistant section in the Getting Started with Oracle Digital Assistant for Cloud Applications guide to learn more about upgrading the Expenses skill.

Key Resources

- Getting Started with Oracle Digital Assistant for Cloud Applications guide

- Expense Assistant section in the Oracle Financials Cloud Implementing Expenses guide

Role Information

You don't need a new role or privilege access to use this feature.

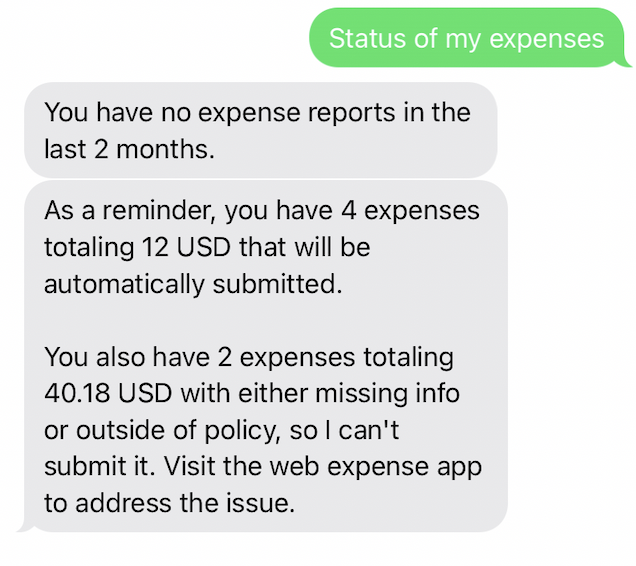

View Expenses Requiring Attention in Oracle Digital Assistant

View details of expenses that require attention using conversation in Oracle Digital Assistant for a simple, easy-to-use experience.

Oracle Digital Assistant informs employees about items that require attention when they inquire the status of expenses or expense reports using conversation, such as "Status of my expenses" and "Where is my last expense report". The Digital Assistant responds back with a list of pending expense reports, the total number of expenses that are ready for submission and the total amount, and the total number of expenses that require correction. Employees can ask for detailed information. The Digital Assistant breaks down the expenses that require attention into the following four categories:

- Missing information or expense is outside of policy

- Pending match to a corporate card charge

- Potential duplicate

- Charges that must be manually submitted

Employees must correct these issues in the Expenses Web application.

Expenses Requiring Attention

Employees can easily identify expenses that require attention, using channels such as SMS, thereby eliminating the need to sign into the Expenses web application.

Steps to Enable

You don't need to do anything to enable this feature.

Role Information

You don't need a new role or privilege access to use this feature.

Withdrawal of Automatically Submitted Expense Reports from the Expense Report Approval FYI Notifications

Withdraw an automatically submitted expense report from the Expense Report Approval FYI Notification. This allows employees to update and resubmit the expense report.

When Oracle Digital Assistant Expenses skill and automatic expense report submission are enabled for your business unit, expense items that you create using the Digital Assistant are automatically submitted for approval. The FYI notification informs the employees that expenses were submitted on their behalf and allows them to withdraw the reports if needed.

The ability to withdraw an automatically submitted expense report from the approval queue enables employees to quickly take the corrective action if an inaccurate expense was submitted.

Steps to Enable

You don't need to do anything to enable this feature.

Role Information

You don't need a new role or privilege access to use this feature.

U.S. Federal Financials is a configurable and flexible solution that enables U.S. Federal agencies to meet Federal financial management system requirements. It supplements Financials and Procurement functionality by providing U.S. Federal specific functionality. The initial release of U.S. Federal Financials will include the features described below. Additional functionality to fully meet mandatory Federal financial management requirements will be provided in upcoming releases.

U.S. Federal Financials accounting provides predefined accounting rules used to created budgetary accounting to comply with Federal accounting requirements in the U.S. Standard General Ledgers.

A predefined accounting method called US Federal will be provided for these Federal accounting rules. There are also predefined mapping codes available for defining mapping sets for U.S. Federal Financials. A natural account code must be chosen for each mapping code based on its description. These natural account codes are used by the Subledger Accounting rules.

Before accounting can be created the following prerequisite configuration must be defined:

- Federal Account Symbols

- Treasury Account Symbols

- Fund Attributes

KEY RESOURCES

- For more information on mapping codes and prerequisite configuration, refer to the Implementing U.S. Federal Financials guide.

- For more information on how to update accounting rules for a subledger application, refer to the Implementing Subledger Accounting guide.

U.S. Federal Invoice Accounting

Generate Federal budgetary accounting for invoices that comply with the U.S. Standard General Ledger requirements. Federal agencies can use predefined accounting rules to meet common accounting needs and configure new accounting rules to meet Federal agency specific needs.

These predefined journal entry rule sets are defined under the US Federal accounting method:

| Event Class | Event Type | Rule Set |

|---|---|---|

| Prepayments | All | U.S. Federal Prepayments |

| Credit Memos | All | U.S. Federal Credit Memos |

| Debit Memos | All | U.S. Federal Debit Memos |

| Invoices | All | U.S. Federal Invoices |

| Prepayment Application | All | U.S. Federal Prepayment Application |

This feature provides these business benefits:

- Supports compliance with U.S. Standard General Ledger requirements

- Includes predefined Federal accounting rules

- Provides the ability to customize predefined rules to meet agency specific needs

Steps to Enable

To complete the setup for invoice accounting, you must ensure:

- Federal Account Symbols are defined

- Treasury Account Symbols are defined

- Fund Attributes are defined

- Natural account values are assigned to predefined U.S. Federal Financials mapping sets.

Key Resources

- Watch Introduction to U.S. Federal Financials Readiness Training.

- For more information on how to update accounting rules for a subledger application, refer to the Implementing Subledger Accounting guide.

Role Information

You don't need any new role or privilege to set up and use this feature.

U.S. Federal Payment Accounting

Generate Federal budgetary accounting for payments that comply with the U.S. Standard General Ledger requirements. Federal agencies can use predefined accounting rules to meet common accounting needs and configure new accounting rules to meet Federal agency specific needs.

These predefined journal entry rule sets are defined under the US Federal accounting method:

| Event Class | Event Type | Rule Set |

|---|---|---|

| Payments | All | U.S. Federal Payments |

| Refunds | All | U.S. Federal Refunds |

This feature provides these business benefits:

- Supports compliance with U.S. Standard General Ledger requirements

- Includes predefined Federal accounting rules

- Provides the ability to customize predefined rules to meet agency specific needs

Steps to Enable

To complete the setup for payment accounting, you must ensure:

- Federal Account Symbols are defined

- Treasury Account Symbols are defined

- Fund Attributes are defined

- Natural account values are assigned to predefined U.S. Federal Financials mapping sets.

Key Resources

- Watch Introduction to U.S. Federal Financials Readiness Training.

- For more information on how to update accounting rules for a subledger application, refer to the Implementing Subledger Accounting guide.

Role Information

You don't need any new role or privilege to set up and use this feature.

U.S. Federal Purchase Order Accounting

Generate Federal budgetary accounting for purchase orders that comply with the U.S. Standard General Ledger requirements. Federal agencies can use predefined accounting rules to meet common accounting needs and configure new accounting rules to meet Federal agency specific needs.

These predefined journal entry rule sets are defined under the US Federal accounting method:

| Event Class | Event Type | Rule Set |

|---|---|---|

| Purchase Orders | All | U.S. Federal Purchase Orders |

This feature provides these business benefits:

- Supports compliance with U.S. Standard General Ledger requirements

- Includes predefined Federal accounting rules

- Provides the ability to customize predefined rules to meet agency specific needs

Steps to Enable

To complete the setup for purchase order accounting, you must ensure:

- Federal Account Symbols are defined

- Treasury Account Symbols are defined

- Fund Attributes are defined

- Natural account values are assigned to predefined U.S. Federal Financials mapping sets.

Key Resources

- Watch Introduction to U.S. Federal Financials Readiness Training.

- For more information on how to update accounting rules for a subledger application, refer to the Implementing Subledger Accounting guide.

Role Information

You don't need any new role or privilege to set up and use this feature.

U.S. Federal Requisition Accounting

Generate Federal budgetary accounting for requisitions that comply with the U.S. Standard General Ledger requirements. Federal agencies can use predefined accounting rules to meet common accounting needs and configure new accounting rules to meet Federal agency specific needs.

These predefined journal entry rule sets are defined under the US Federal accounting method:

| Event Class | Event Type | Rule Set |

|---|---|---|

| Requisitions | All | U.S. Federal Requisitions |

This feature provides these business benefits:

- Supports compliance with U.S. Standard General Ledger requirements

- Includes predefined Federal accounting rules

- Provides the ability to customize predefined rules to meet agency specific needs

Steps to Enable

To complete the setup for requisition accounting, you must ensure:

- Federal Account Symbols are defined

- Treasury Account Symbols are defined

- Fund Attributes are defined

- Natural account values are assigned to predefined U.S. Federal Financials mapping sets.

Tips And Considerations

For more information on how to update accounting rules for a subledger application, refer to the Implementing Subledger Accounting guide.

Key Resources

- For more information on subledger accounting, refer to documentation on Implementing Subledger Accounting for further information on how to update accounting rules for a subledger application.

Role Information

You don't need any new role or privilege to set up and use this feature.

U.S. Federal Payment Processing

U.S. Federal Financials Payment Processing features include capabilities to meet U.S. Federal Prompt Payment requirements and creating U.S. Federal Payment File Formats.

U.S. Federal Payment File Formats

To meet Federal payment file standards, create Payment Automation Manager (PAM) and Secure Payment System (SPS) payment file formats.

These payment formats are supported for Treasury payments:

- US Federal SPS ACH

- US Federal SPS Check

- US Federal SPS Same Day Payments

- US Federal PAM ACH

- US Federal PAM Check

The business benefit of this feature is that it supports creation of Federal payment files that comply with U.S. Treasury standards.

Steps to Enable

To set up federal payment processing:

- Ensure that the Agency Location Codes (ALCs) for the internal bank accounts are already defined.

- Ensure that the federal options for each business unit are already defined.

- To setup SPS payment formats, you must perform these steps:

- Map pay groups to payment types and appropriate check and electronic types on the Manage Payment Type Mapping page.

- Ensure that internal bank accounts are defined with ALCs and Payables Documents with these payment formats:

- U.S. Federal SPS ACH Format

- U.S. Federal SPS Check Format

- U.S. Federal SPS Same Day Payment Format

- To setup PAM payment formats, you must perform these steps:

- Map pay groups to payment types and appropriate check and electronic types on the Manage Payment Type Mapping page.

- Ensure that internal bank accounts are defined with ALCs and Payables Documents with these payment formats:

- U.S. Federal PAM ACH Format

- U.S. Federal PAM Check Format

Tips And Considerations

When submitting a Payment Process Request for a SPS or PAM payment file, ensure it includes the following:

- Only one Pay Group

- A payment method of either Check, Electronic, or Wire (SPS)

- Only one Invoice Business Unit

- One of the following Payment Process Profiles:

- US Federal PAM ACH

- US Federal PAM Check

- US Federal SPS ACH

- US Federal SPS Check

- US Federal SPS Wire Same Day Payment

Key Resources

- Watch Introduction to U.S. Federal Financials Readiness Training.

- For more information on Federal payment file formats, refer to the Implementing U.S. Federal Financials and Using U.S. Federal Financials guides.

- For more information on the payment process, refer to the Implementing Payables Invoice to Pay and Using Payables Invoice to Pay guides.

Role Information

You don't need any new role or privilege to set up and use this feature.

Calculate invoice due dates and discount dates, generate interest payments, and take discounts when economically feasible to comply with U.S. Federal Prompt Payment requirements based on configurable rules.

Prompt Payment features include these processes:

- Prompt Payment Date Calculation Process. This is a scheduled process that updates the due date and discount date on open invoices in accordance with Prompt Payment rules. These dates are only updated for invoices with payment terms defined with Prompt Payment enabled. This process optionally generates a Prompt Payment Date Calculation Report.

- Discount Calculation process. This process is automatically invoked for invoices selected by the payment process that are eligible for discounts and have payment terms that are Prompt Payment enabled. The process only takes discounts that are economically beneficial based on Prompt Payment rules.

- Interest Calculation process. This process is automatically invoked for invoices that are paid late by the payment process and have payment terms that are Prompt Payment enabled. The process creates interest invoices with interest amounts in accordance with Prompt Payment interest calculation rules.

The business benefit of this feature is that it supports compliance with the U.S. Federal Prompt Payment Act.

Steps to Enable

To complete the setup for Prompt Payment, you must ensure that these conditions are met:

- A Treasury Current Value of Fund Rate (CVFR) is defined on the Manage Interest Rates page

- Payment terms are defined with the correct Prompt Payment attributes on the Payment Terms page