- Revision History

- Overview

- Optional Uptake of New Features (Opt In)

- Feature Summary

- Common Technology and User Experience

- Financials

-

- Advanced Collections

- Assets

- Budgetary Control

- Cash Management

- Expenses

- Federal Financials

- General Ledger

- Joint Venture Management

- Lease Accounting

- Payables

- Payments

- Receivables

-

- Channel Revenue Management Integration with Receivables for Claim Creation and Settlement for Receipts Created Using Spreadsheet or SOAP Services

- Custom Data Points and External Data Source Integration for Credit Management Using a REST API

- Enhanced Message Content in Transactions Delivered Using Email

-

- Revenue Management

- Subledger Accounting

- Tax

- Regional and Country-Specific Features

- IMPORTANT Actions and Considerations

This document will continue to evolve as existing sections change and new information is added. All updates appear in the following table:

| Date | Product | Feature | Notes |

|---|---|---|---|

| 29 JUL 2022 | Payables | Creation and Management of Supplier Invoices with Retainage Payment Terms |

Updated document. Added further tips and considerations. |

| 24 AUG 2021 | Expenses | Detection of Duplicate Expenses | Updated document. Added opt in expiry date. |

| 30 JUL 2021 | Financials for the Americas | Fiscal Attribute Import for Transactions with the Same Transaction Number |

Updated document. Delivered feature in update 21B. |

| 13 MAY 2021 | Expenses | Detection of Duplicate Expenses | Updated document. Made this an opt in feature. |

| 13 MAY 2021 | Intercompany | Intercompany Clearing Account Generation Without Segment Value Security for Existing Accounts | Updated document. Delivered feature in update 21B. |

| 13 MAY 2021 | Intercompany | Descriptive Flexfield Improvements on Intercompany Spreadsheets | Updated document. Delivered feature in update 21B. |

| 30 APR 2021 | Joint Venture Management | Updated document. Revised feature information. | |

| 30 APR 2021 | Joint Venture Management | Task and Expenditure Type Overrides on Project Costing Adjustments |

Updated document. Clarified business benefits. |

| 05 MAR 2021 | Created initial document. |

This guide outlines the information you need to know about new or improved functionality in this update, and describes any tasks you might need to perform for the update. Each section includes a brief description of the feature, the steps you need to take to enable or begin using the feature, any tips or considerations that you should keep in mind, and the resources available to help you.

Join Oracle Cloud Customer Connect

Please take a moment to join the Cloud Customer Connect forums for Financials Cloud. Oracle Cloud Customer Connect is a community gathering place for members to interact and collaborate on common goals and objectives. This is where you will find the latest release information, upcoming events, or answers to use-case questions. Joining takes just a few minutes. Join now!

https://cloud.oracle.com/community

Security and New Features

The Role section of each feature identifies the security privilege and job role required to use the feature. If feature setup is required, then the Application Implementation Consultant job role is required to perform the setup, unless otherwise indicated. (If a feature doesn't include a Role section, then no security changes are required to use the feature.)

If you have created job roles, then you can use this information to add new privileges to those roles as needed.

Give Us Feedback

We welcome your comments and suggestions to improve the content. Please send us your feedback at oracle_fusion_applications_help_ww_grp@oracle.com.

Optional Uptake of New Features (Opt In)

Oracle Cloud Applications delivers new updates every quarter. This means every three months you'll receive new functionality to help you efficiently and effectively manage your business. Some features are delivered Enabled meaning they are immediately available to end users. Other features are delivered Disabled meaning you have to take action to make available. Features delivered Disabled can be activated for end users by stepping through the following instructions using the following privileges:

- Review Applications Offering (ASM_REVIEW_APPLICATIONS_OFFERINGS_PRIV)

- Configure Oracle Fusion Applications Offering (ASM_CONFIGURE_OFFERING_PRIV)

Here’s how you opt in to new features:

- Click Navigator > My Enterprise > New Features.

- On the Features Overview page, select your offering to review new features specific to it. Or, you can leave the default selection All Enabled Offerings to review new features for all offerings.

- On the New Features tab, review the new features and check the opt-in status of the feature in the Enabled column. If a feature has already been enabled, you will see a check mark. Otherwise, you will see an icon to enable the feature.

- Click the icon in the Enabled column and complete the steps to enable the feature.

For more information and detailed instructions on opting in to new features for your offering, see Offering Configuration.

Opt In Expiration

Occasionally, features delivered Disabled via Opt In may be enabled automatically in a future update. This is known as an Opt In Expiration. If your cloud service has any Opt In Expirations in this update, you will see a related tab in this document. Click on that tab to see when the feature was originally delivered Disabled, and when the Opt In will expire, potentially automatically enabling the feature. You can also click here to see features with current Opt In Expirations across all Oracle Cloud Applications. Beyond the current update, the Financials forums on Cloud Customer Connect have details of Opt In Expirations upcoming in future updates.

Column Definitions:

Report = New or modified, Oracle-delivered, ready to run reports.

UI or Process-Based: Small Scale = These UI or process-based features are typically comprised of minor field, validation, or program changes. Therefore, the potential impact to users is minimal.

UI or Process-Based: Larger Scale* = These UI or process-based features have more complex designs. Therefore, the potential impact to users is higher.

Features Delivered Disabled = Action is needed BEFORE these features can be used by END USERS. These features are delivered disabled and you choose if and when to enable them. For example, a) new or expanded BI subject areas need to first be incorporated into reports, b) Integration is required to utilize new web services, or c) features must be assigned to user roles before they can be accessed.

Common Technology and User Experience

Service Excellence Continuing Investments

Our ongoing investment in service excellence has a focus on overall usability, resiliency, performance, and security. This work is based on monitoring performance trends, reviewing common use patterns, analyzing service requests, and participating in many discussions with customers.

In this update, our on-going investment in service excellence includes improvements in the following areas:

Usability

- Index File for Generic SAF-T Extract: To help upload the CSV generated by the generic SAF-T solution to the IDEA Audit software, we have built an index file available on My Oracle Support: Note 2753649.1.

Performance

- Intelligent performance optimization for Multi Period Accounting Process: Introduced SQL hint injection mechanism based on customer data shape for the Multi Period Accounting process to deliver faster throughput when CBO does not choose the optimal plan.

- Performance improvements while accounting voided payments associated with invoices having a large number of distributions.

- Performance improvements in US 1099 Invoice Exception report.

- Performance improvements in the create and print transaction flow: Paying customer LOV on Create Invoice page, View Image button on Review Transaction page, and Print Transaction process.

Resiliency

- Resiliency and Diagnostic Improvements for Fiscal Documents for Brazil: This includes tax calculation for the fiscal documents in the Return to Vendor flow and date discrepancies between the fiscal documents and the source transactions.

- Fixed time out issue of Payables Unaccounted Transactions and Sweep.

Steps to Enable

You don't need to do anything to enable this feature.

Descriptive Flexfield Improvements on Intercompany Spreadsheets

The following additions have been made to the Intercompany spreadsheets.

-

The Intercompany receiver distribution descriptive flexfield is now available in both the Single and Multiple Batch spreadsheets.

-

The Intercompany Single and Multiple Batch spreadsheets are enhanced to include the context field for all the descriptive flexfields. This ensures that the copy feature will replicate the context information to the new rows.

Manual editing of intercompany transactions is now reduced because you can capture receiver distribution descriptive flexfields directly on the spreadsheets.

You can also copy rows in the intercompany spreadsheets and the context values will be properly replicated to the new rows reducing the need for updates.

Steps to Enable

You don't need to do anything to enable this feature.

Intercompany Clearing Account Generation Without Segment Value Security for Existing Accounts

If you create intercompany clearing account combinations before entering transactions, segment value security will not be applied to these accounts when they are submitted for processing. This only applies to the intercompany receivables and payables account generated by the application.

You can now approve an intercompany transaction even if you don’t have access to the intercompany receivables and intercompany payables accounts as long as these accounts were created prior to creating and submitting the transaction.

- Simplifies configuration and assignment of segment value security rules for Intercompany users. You no longer require segment value security for both provider and receiver intercompany clearing accounts.

- Reduces manual processing steps as a single user can submit an intercompany transaction for processing even if they don't have segment value security for both the provider and receiver clearing accounts.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

Create all intercompany receivables and payables account combinations before beginning transaction processing.

Intercompany Descriptive Flexfield Transfer to Receivables and Payables

Transfer Intercompany descriptive flexfield information to Receivables and Payables. Transfer batch and provider descriptive flexfields to Receivables. Transfer transaction and receiver distribution descriptive flexfields to Payables.

- Intercompany Transaction Batches descriptive flexfield is transferred to the Receivables Invoice Lines descriptive flexfield

- Intercompany Transaction Headers descriptive flexfield is transferred to the Payables Invoices descriptive flexfield

- Intercompany Transaction Distributions

- Provider descriptive flexfield is transferred to the Receivables Line Distributions descriptive flexfield

- Receiver descriptive flexfield is transferred to the Payables Invoice Lines descriptive flexfield

Capture additional reference information about Intercompany transactions, such as serial numbers, and transfer this information to Receivables and Payables transactions. You can view and use this information in Receivables and Payables.

Steps to Enable

To enable this feature, perform the following steps:

- Enable the Descriptive Flexfield Transfer option on the related Intercompany transaction types. You can only enable this option on Intercompany transaction types that also have the Invoicing option enabled, because this option enables Intercompany transactions for transfer to Receivables and Payables.

- In the Manage Descriptive Flexfields page, configure Intercompany, Receivables, and Payables descriptive flexfields:

- Define the Receivables Invoice Lines descriptive flexfield to match the Intercompany Transaction Batches descriptive flexfield definition.

- Define the Payables Invoices descriptive flexfield to match the Intercompany Transaction Headers descriptive flexfield definition.

- Define the Receivables Line Distributions and Payables Invoice Lines descriptive flexfields to match the Intercompany Transaction Distributions definition.

Key Resources

- Refer to the Oracle Applications Cloud, Implementing Applications documentation for information on Descriptive Flexfields.

Role Information

You will need the Application Administrator role to configure descriptive flexfields and complete the Intercompany transaction types setup.

Oracle Fusion Cloud Applications Suite provides a digital assistant built on the Oracle Digital Assistant (ODA) platform. The digital assistant delivers an intelligent conversational experience for employees to complete key tasks and quickly access information across Fusion Applications. For information about the complete set of current capabilities, see the Oracle Digital Assistant: Oracle Skills documentation.

For ERP, the digital assistant helps finance and operational professionals easily navigate and identify data and business insights that is contextual, relevant, and thoughtful. In update 21B, ERP has digital assistant capabilities for expenses, project time capture, and project management using channels including SMS, Oracle Web, and Microsoft Teams.

Look for enhancements and expansion to additional roles and business processes in future updates.

To learn more, review the update 21B features in the Oracle Financials Cloud and Oracle Project Management Cloud What’s New documents. In addition, see the topic: Getting Started with Oracle Digital Assistant for Cloud Applications for setting up the assistant.

The Oracle Expense Assistant is a skill within the Oracle Fusion Applications Digital Assistant that lets you create and manage your expenses using a conversational experience. It uses conversational channels such as native SMS, Slack, or Microsoft Teams on your mobile device to guide you through common expense tasks. As you interact with the assistant, it directly communicates with the Oracle Expenses web application to perform the tasks.

Conversational Expense Creation with Microsoft Teams

Create expense items from Microsoft Teams using conversational phrases, such as meal 30$ today, or create a taxi expense. Employees can also perform these actions: upload a receipt to create an expense; modify an existing expense; view the status of an expense report.

When employees create expenses using conversations in the Microsoft Teams channel, Oracle Digital Assistant (ODA) automatically predicts expense types from the information provided in the conversation using natural language processing. ODA works as an assistant that is encapsulated within an application on Microsoft Teams - which ultimately enables users of Expenses Assistant to take advantage of additional capabilities specific to the Microsoft Teams user experience. The Expenses Assistant on Microsoft Teams groups together similar information; this information is related to the expense creation process and includes: expense types, currency types, merchant names, and user-entered expense dates. In addition, users can now modify existing expenses using Expenses Assistant on Microsoft Teams.

Submitting an Expense Using the Digital Assistant in Microsoft Teams

Business benefits include:

- Saves time by streamlining the expense process.

- Saves money by reducing expense process errors that often require manual intervention.

- Delivers a better user experience by offering users the ability to process expense reports based on their personal or organizational preferences, i.e. using Microsoft Teams to process expenses.

- Increases compliance with an organizations’ expense reporting policies and processes by providing an easier way to process employee expenses.

Steps to Enable

To enable Microsoft Teams for the Expenses Digital Assistant, you need to create a Microsoft bot in one of the following three ways:

- Directly in Microsoft Teams, using App Studio.

- Through Azure Bot Service, which requires having a Microsoft Azure account. See Azure Bot Channels Registration for the setup details.

- Through Microsoft Bot Framework, which requires having an Office 365 account at a level of E1 or higher. See Bot Framework Channels Registration for the setup details.

The first of these options - using App Studio in Microsoft Teams - is the most straightforward. To set up a bot channel registration through App Studio, create the following:

- A Microsoft Teams app. This app is the container for the bot that you create and is how you access the bot in Teams.

- A bot. This is the artifact within the app that communicates with Oracle Digital Assistant

Here are the steps:

- Go to https://teams.microsoft.com and log in with your Microsoft account.

- In the left navigation, click the App Studio icon.

NOTE: If the App Studio icon isn't shown, do the following to add it:

- In the left navigation of the service, click the Search field and then search for and select App Studio.

- Click the Add button. The icon for App Studio should appear in the left navigation.

- In App Studio, select the Manifest Editor tab. Click the Create a New App button.

- On the App details page, fill in the Short Name field with the name you want to use for the app as it will appear in Microsoft Teams. This app will encapsulate the bot, which you will create later.

- Under Identification, click Generate to create an app ID.

- Fill in all required fields including Package Name and Version.

- In the left navigation of the page, under the Capabilities section, select Bots followed by Set up.

- On the Set up a bot page, with the New bot tab selected, do the following:

- Enter a name for the bot.

- Select My bot supports uploading and downloading of files.

- Select the Personal scope.

- If you intend the channel to be used for group chats, also select Team and/or Group Chat.

NOTE: Selecting the Team scope enables the bot to be added to a team. Selecting Group Chat enables the bot to be added to an ad hoc group created by users.

- Click Create bot.

- Once the bot is created, a tile will appear at the top of the page with the bot name and a generated ID below it. Copy the ID and save it in a text file.

IMPORTANT: You will need this ID when you create the channel in Digital Assistant.

- Click Generate new password. Then copy the password and save it in the text file where you saved the ID.

- In the left navigation of the page, under the Finish section, select Domains and permissions. Under Valid domains add any domains that the bot's users may be coming from.

- Leave App Studio open in your browser.

NOTE: Later, you will complete the registration with a webhook URL that you get when you create the channel in Digital Assistant.

Tips And Considerations

To use this feature, ensure that you have downloaded the latest Expenses skill for Microsoft Teams from the Digital Assistant store. Refer to the Upgrade Digital Assistant section in the Getting Started with Oracle Digital Assistant for Cloud Applications guide to learn more about upgrading the Expenses skill and/or using the the Expenses skill for Microsoft Teams.

Key Resources

- To learn more about Oracle Digital Assistant Expenses skill, refer to the Expense Assistant section in the Using Expenses guide

Frequently Asked Questions and Tips in Oracle Digital Assistant

Use Oracle Digital Assistant to allow employees to ask questions and seek tips using conversation.

Examples of this feature are “show me how to upload a receipt,” or “ask a question.” This provides users with an alternative learning path that is quick and easy way to communicate answers to the most commonly-asked questions related to using the Expenses Digital Assistant. Users can also access a list of tips and best practices about using Expenses Digital Assistant.

Shows the Kinds of Tips the Expenses Digital Assistant Will Provide

Business benefits include:

- Provides a learning path within the application, for new and existing users of the Expenses Digital Assistant.

- Saves users time by learning to use Expenses Digital Assistant and completing the overall expense report process.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

- To learn more about the ODA Expenses skill, please review the “Expense Assistant” section in the Using Expenses guide.

Number of Attendees Recording for Expenses with Oracle Digital Assistant

Capture the number of attendees when meals and entertainment expenses surpass the designated limits specified by the company policy. Auditors can view the cost per attendee when auditing the expense.

This feature allows users to include the number of attendees required for an expense that surpasses the designated limits specified by company policy, such as expenses for meals and/or entertainment purposes. This feature also allows auditors to view the cost per attendee when auditing the expense to ensure compliance with company policies.

Business benefits include:

- Saves money by reducing expense process errors, which typically require manual intervention and additional reviews.

- Improves the review of key expense report details.

- Increases compliance with an organization’s expense reporting policies and procedures.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

- To learn more about the ODA Expenses skill, review the “Expense Assistant” section in the Using Expenses guide.

Approval Rules Navigation for Financial Workflows in Workflow Transaction Console

Use approval rules navigation in the Workflow Transaction Console to edit the rules for Invoice, Journal, Expense, and Holds Resolution workflows, and to enable the Alert Initiator on Error option to send notifications to the workflow initiator for failed workflow notifications.

The Approval Rules page in the Workflow Transaction Console allows you to:

- Navigate to the Workflow Rules page to edit rules for Invoice, Journal, Expense, and Hold Resolution workflows.

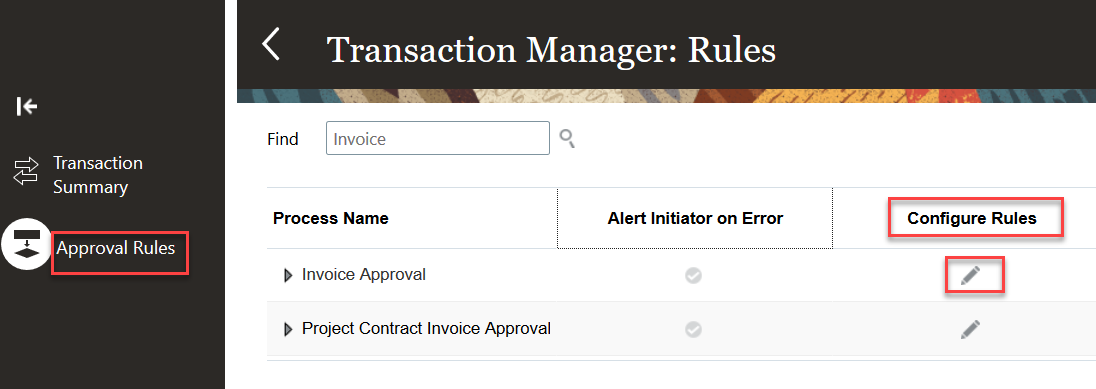

Approval Rules Page

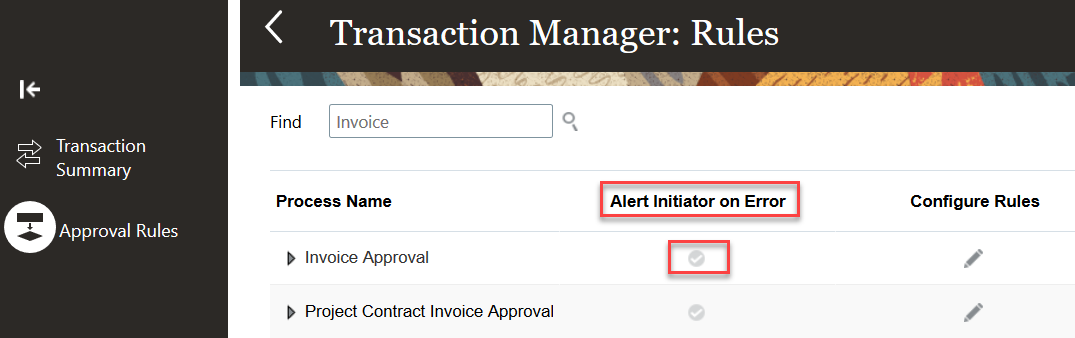

- Enable the Alert Initiator on Error option to send error notifications to the workflow initiator when an approval task fails in the Workflow Transaction Console.

Alert Initiator on Error

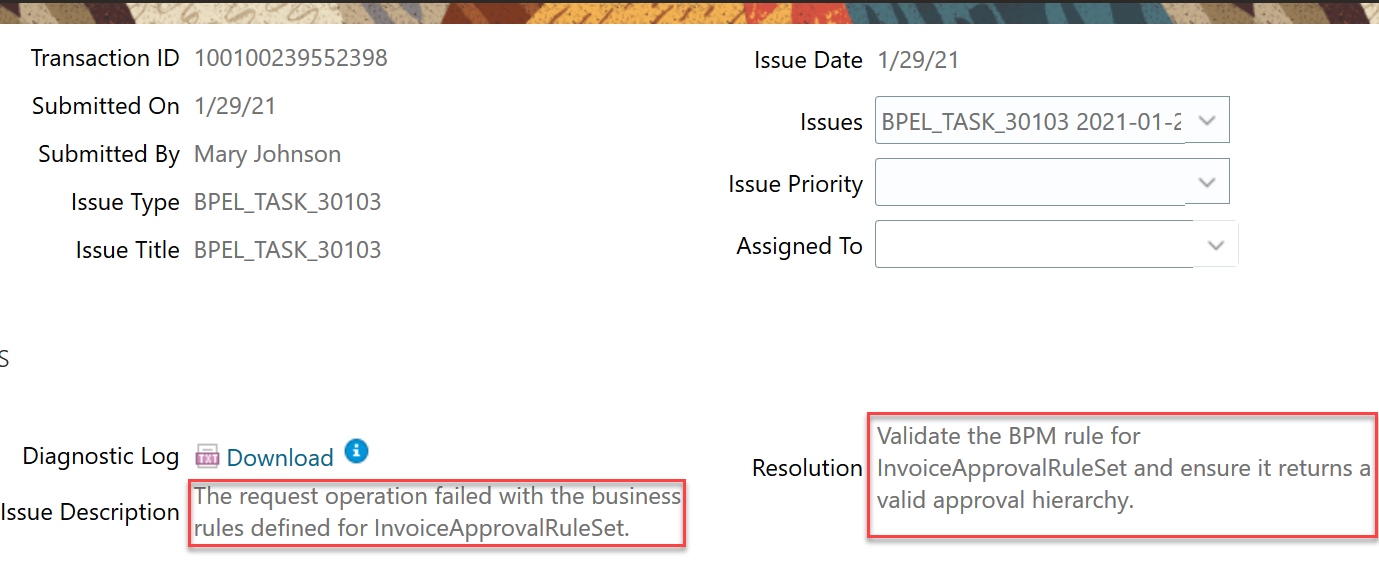

Workflow administrators can use the Workflow Transaction Console to proactively monitor all workflow tasks and resolve the exceptions for the Invoice, Expense, Journal, and Invoice Hold Resolution workflows. The workflow administrator can navigate to the Workflow Rules page from the Workflow Transaction Console to edit the rules for financial workflows.

- Workflow administrators review the issue description and resolution for the failed transactions. If a transaction failed due to incorrect rule configuration, then the workflow administrator can correct the rules and recover the transaction from the point of failure.

View Issue Description and Resolution for Failed Task

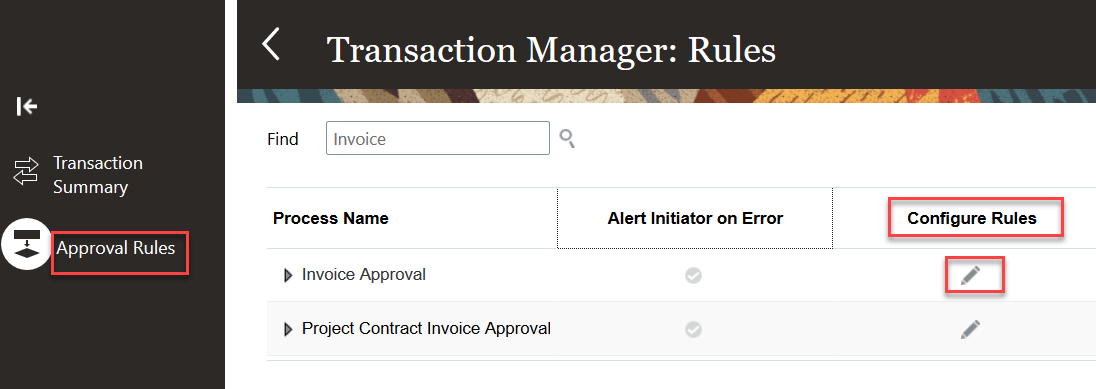

- Navigate to the Approval Rules page from the Workflow Transaction Console to edit the workflow rules for Invoice, Journal, Expense, and Holds Resolution workflows.

Approval Rules Page

- Click the edit icon in the Configure Rules column to navigate to the Workflow Rules page to correct the rules.

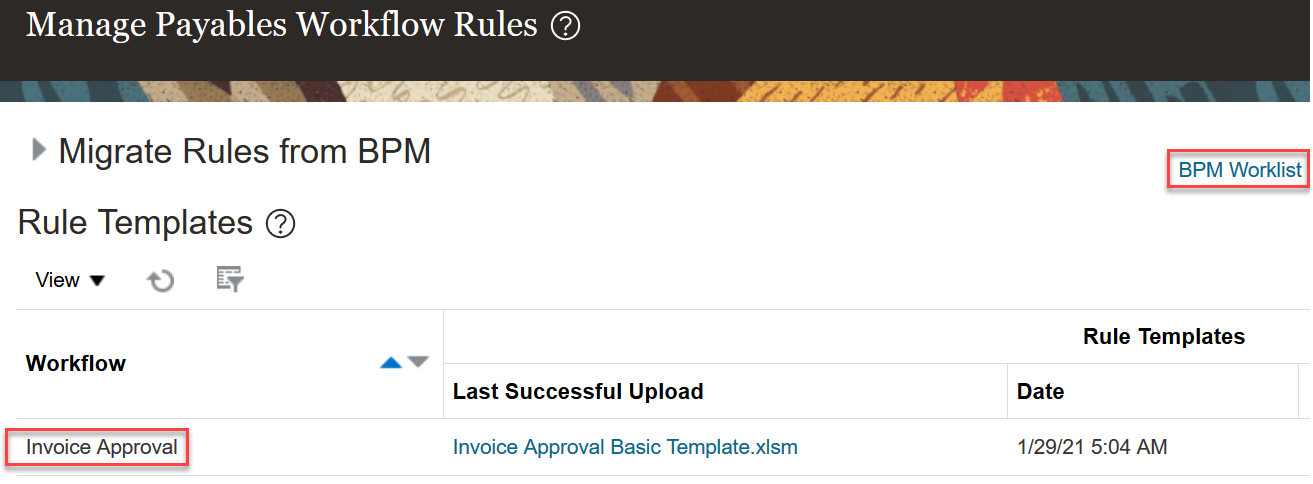

Manage Payables Workflow Rules

Steps to Enable

Make the feature accessible by assigning or updating privileges and/or job roles. Details are provided in the Role section below.

Role Information

You need the following privilege to access the Approval Rules Page in Workflow Transaction console:

- PER_MANAGE_APPROVAL_RULES_PRIV

You need the following privilege to access the Configure Rules Page in Workflow Transaction Console:

- PER_CONFIGURE_APPROVAL_RULES_PRIV

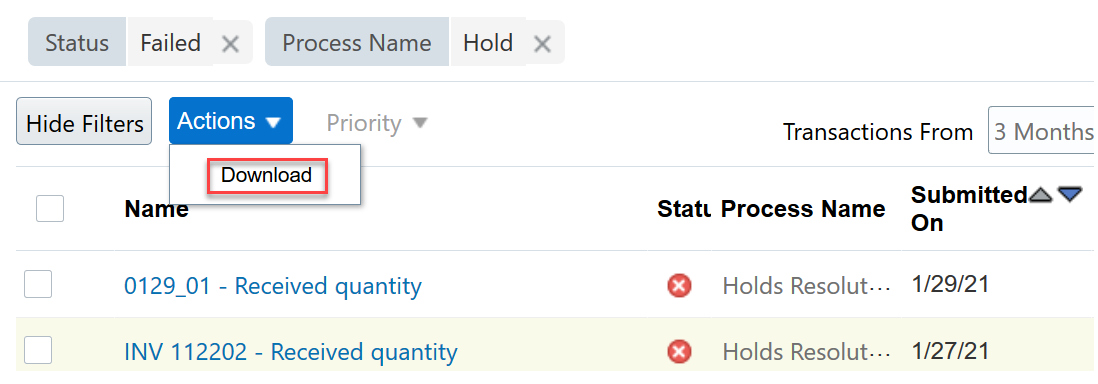

Using a single dashboard, administrators can proactively monitor workflow tasks and resolve exceptions for the Invoice Hold Resolution workflow. This feature was first delivered in update 19D for the Invoice, Expense, and Journal workflows. In update 21B, the Workflow Transaction Console is enhanced to display the workflow tasks related to the Invoice Hold Resolution workflow.

The Workflow Transaction Console lets you monitor workflow tasks, resolve exceptions, and search using your own criteria.

Use the Workflow Transaction Console to:

-

View the latest status of all the tasks in the system

-

Review the issue description and resolution for failed tasks.

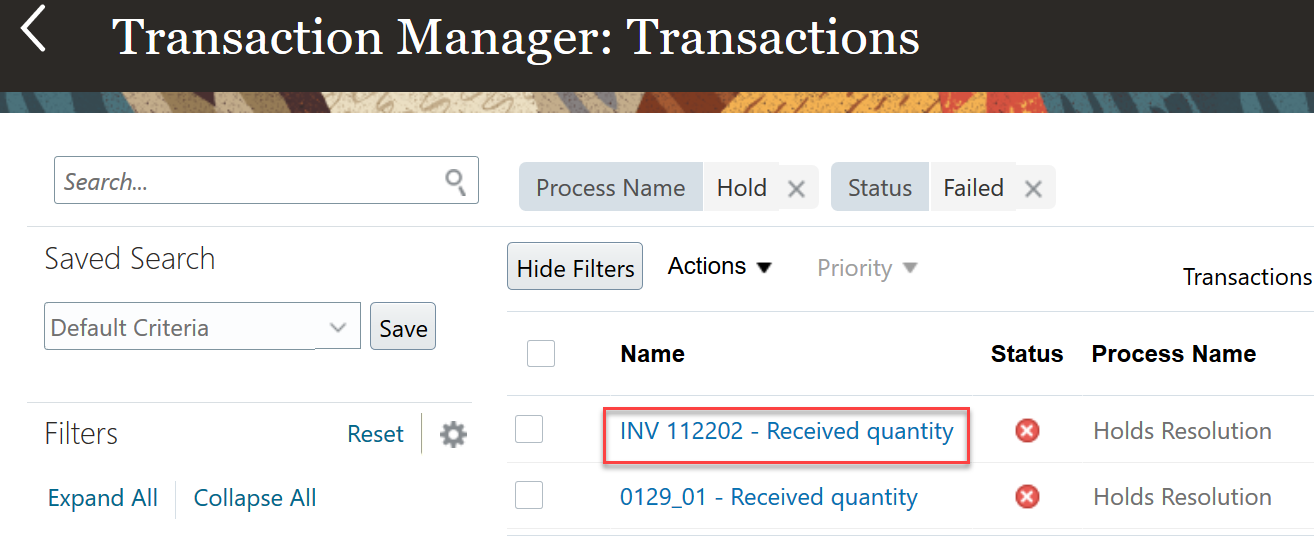

Select a Failed Task

View Issue Description and Resolution

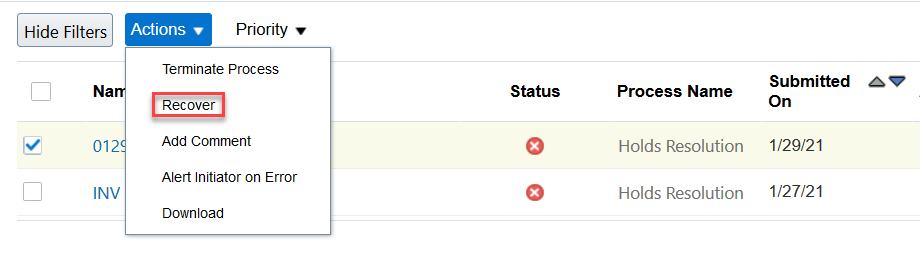

- Take appropriate actions based on the issue description and resolution. For example, you can recover a failed task after correcting the rule

Recover a Failed Task After Correcting the Rule

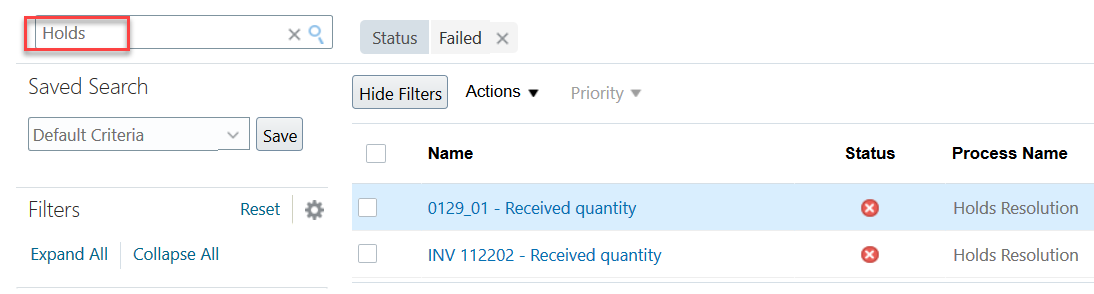

- Search based on the user-defined criteria.

Search Transactions

- Download the search results to a spreadsheet in the CSV format.

Download Search Results

Steps to Enable

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Financials

Tips And Considerations

To display only financial-related tasks in the Workflow Transaction Console, enable the transaction security feature by performing the following steps:

- Go to Navigator > Setup and Maintenance > Manage Enterprise HCM Information.

- Click Edit > Correct.

- In the Transaction Console Information section, select Enable Transaction Security.

Role Information

- Financial Application Administrator

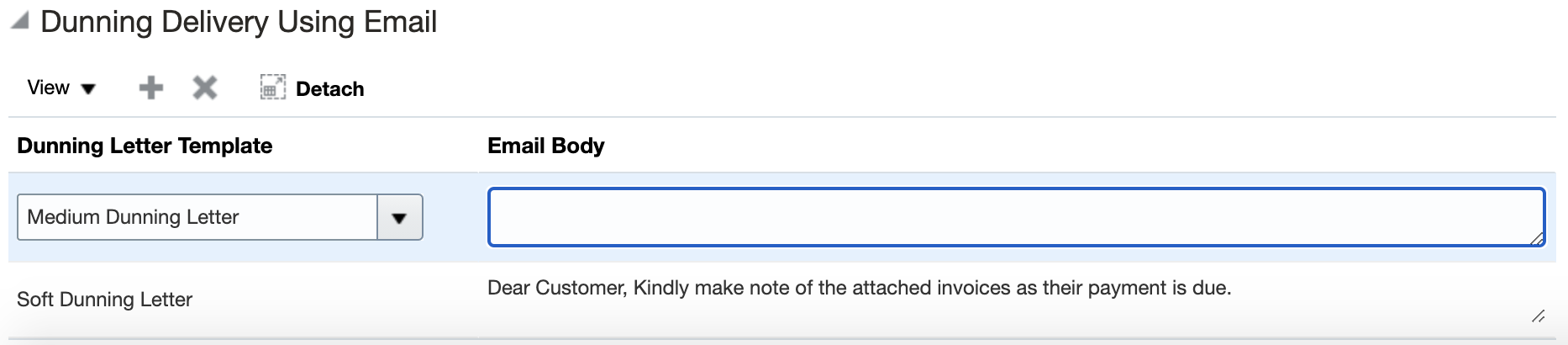

Enhanced Message Content for Dunning Letters Delivered Using Email

Send dunning letters using email with enhanced rich text content in the body of the message. Users can choose different fonts, modify font size and style, and insert logos and hyperlinks. The enhanced content improves the user experience for customers who receive dunning letters as an email attachment.

Use the Dunning Delivery Using Email section of the Manage Collections Preferences page to configure the email body content. The email body can be configured for each of the Dunning Letter Templates which are already available in the product.

Dunning Delivery Using Email

Provides users with various tools for improving the content of an email message, including emphasis, promotional material, access to additional information, and an overall professional look and feel.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

- The character limit for the Email Body field is 4000 which includes values of the dynamic tokens if used.

- If you do not define email body content for a particular Dunning Letter Template, then the email body content uses predefined messages.

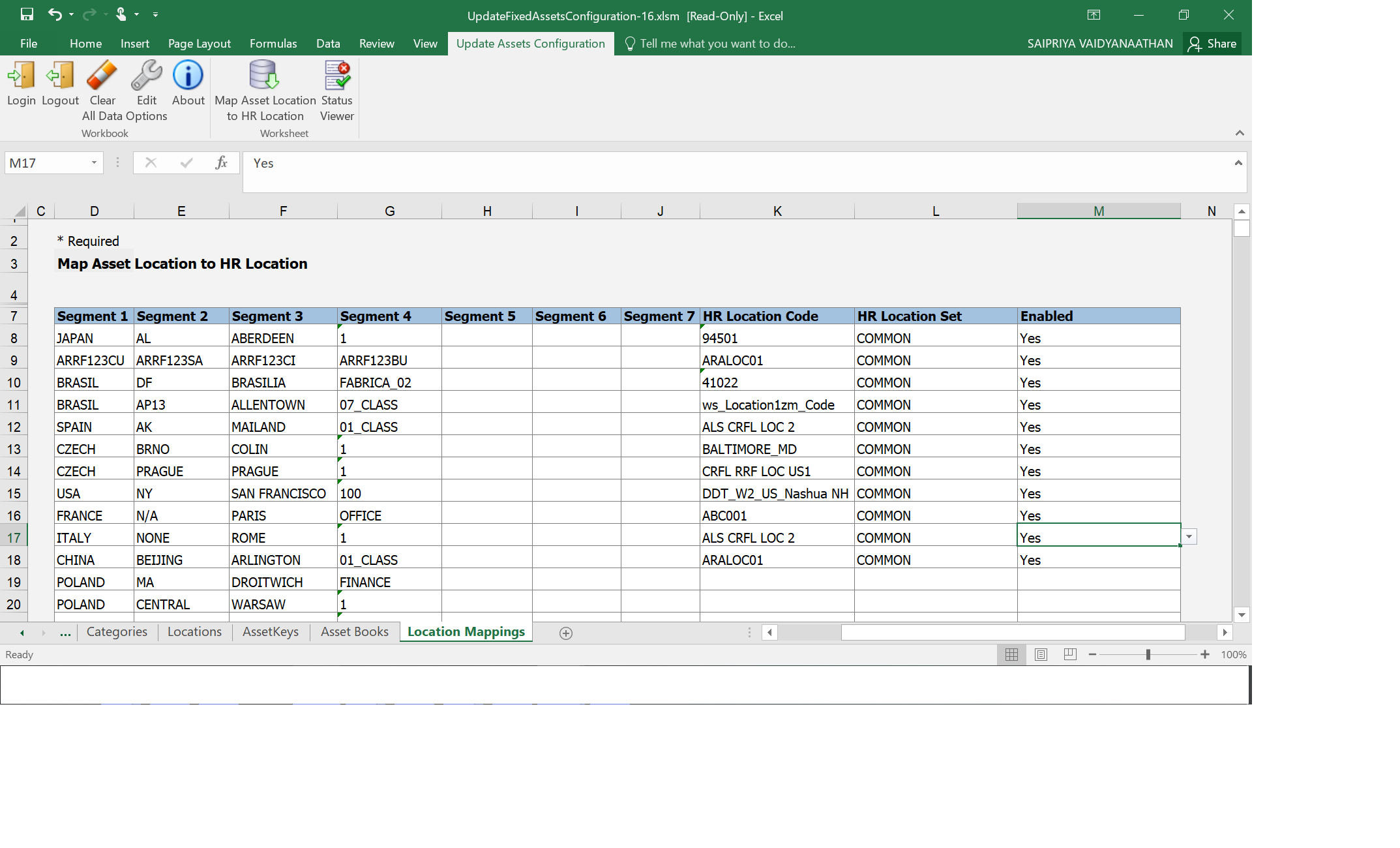

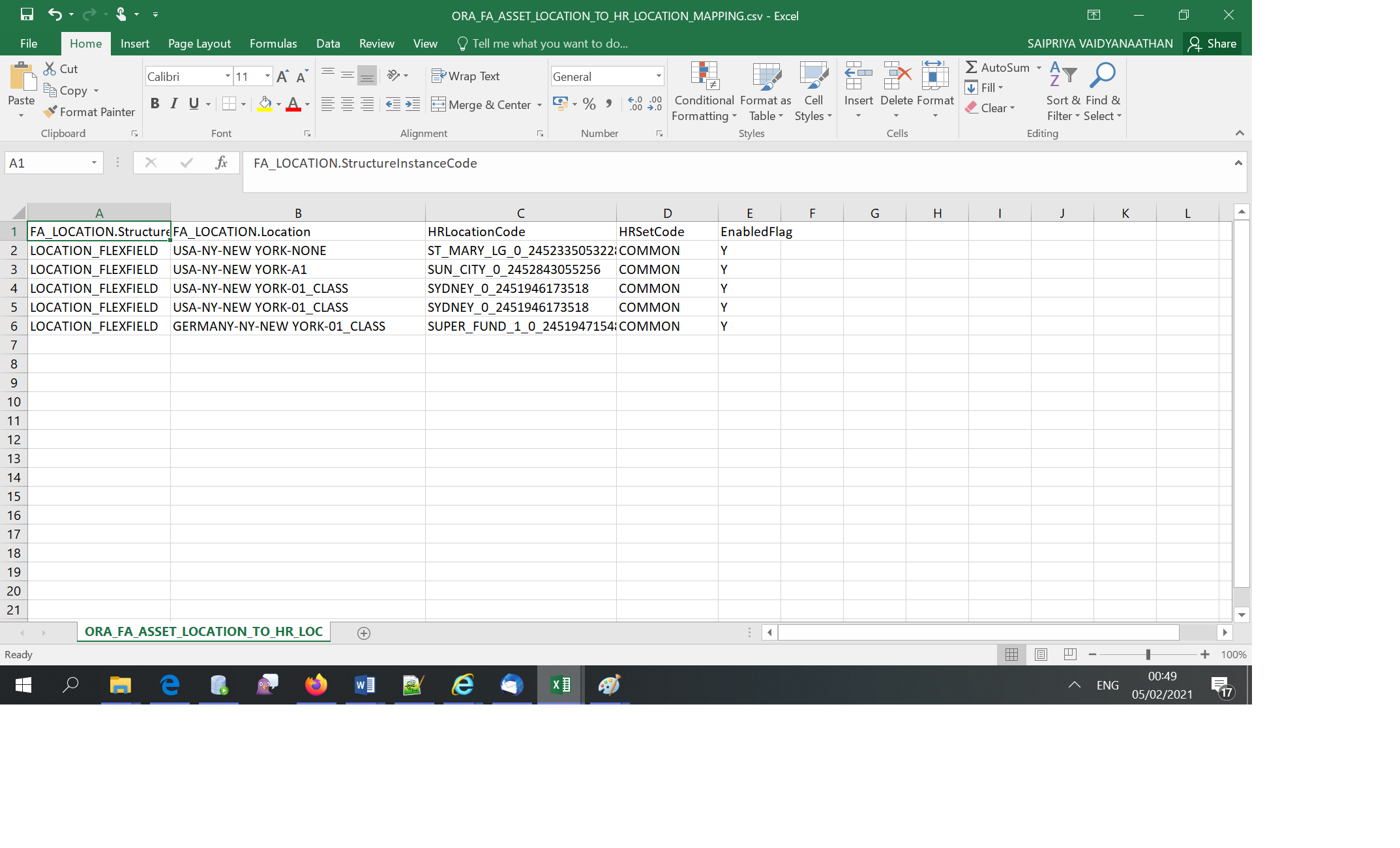

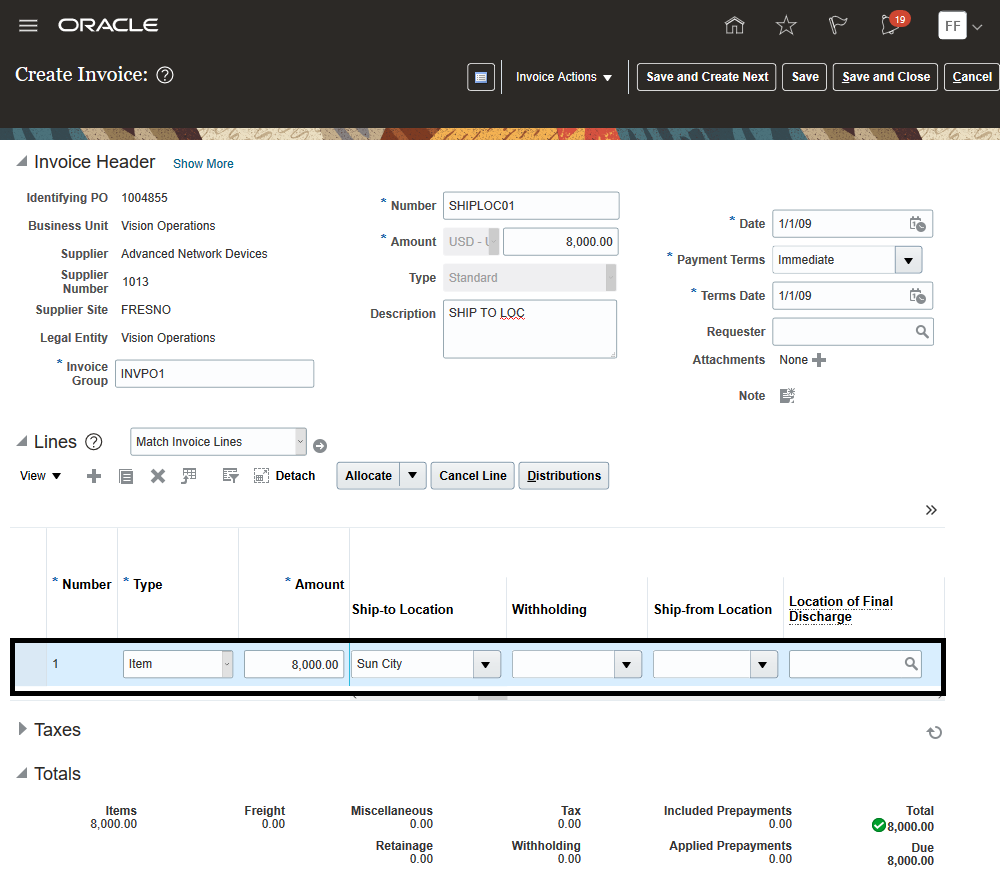

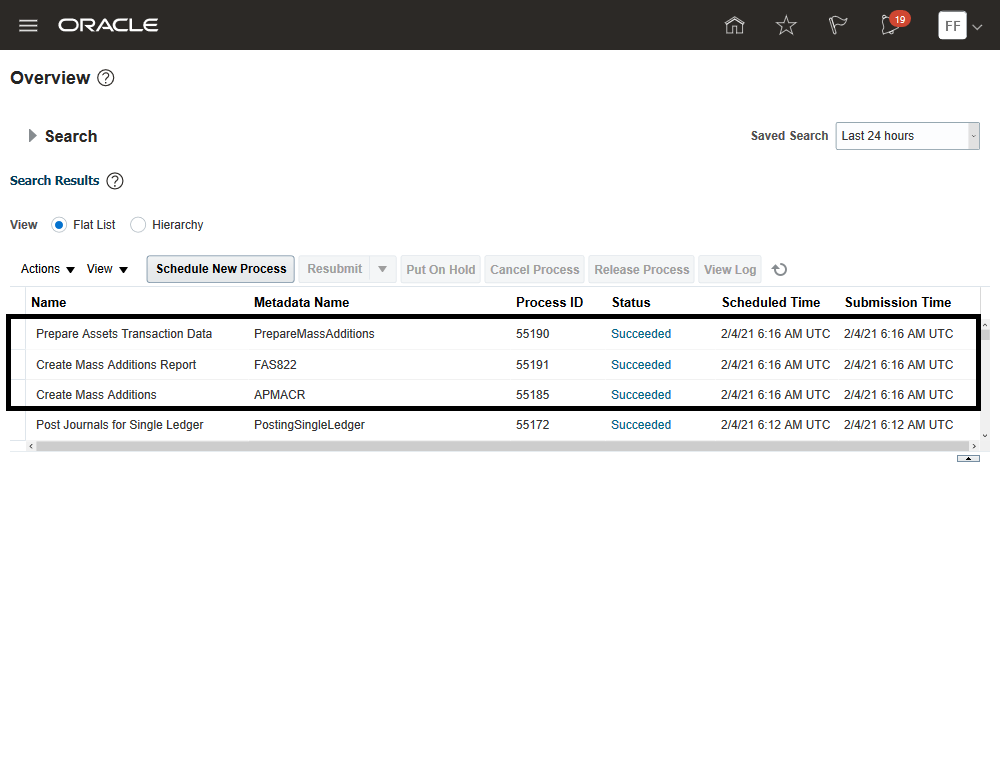

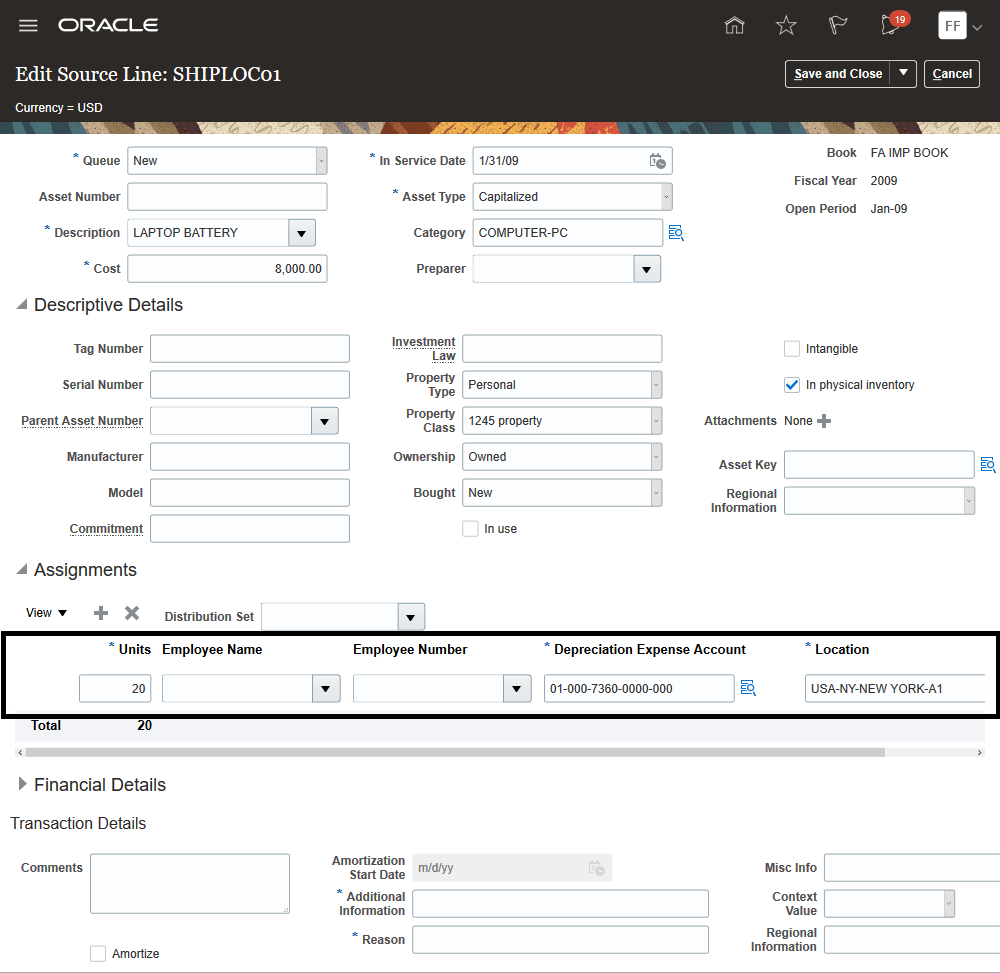

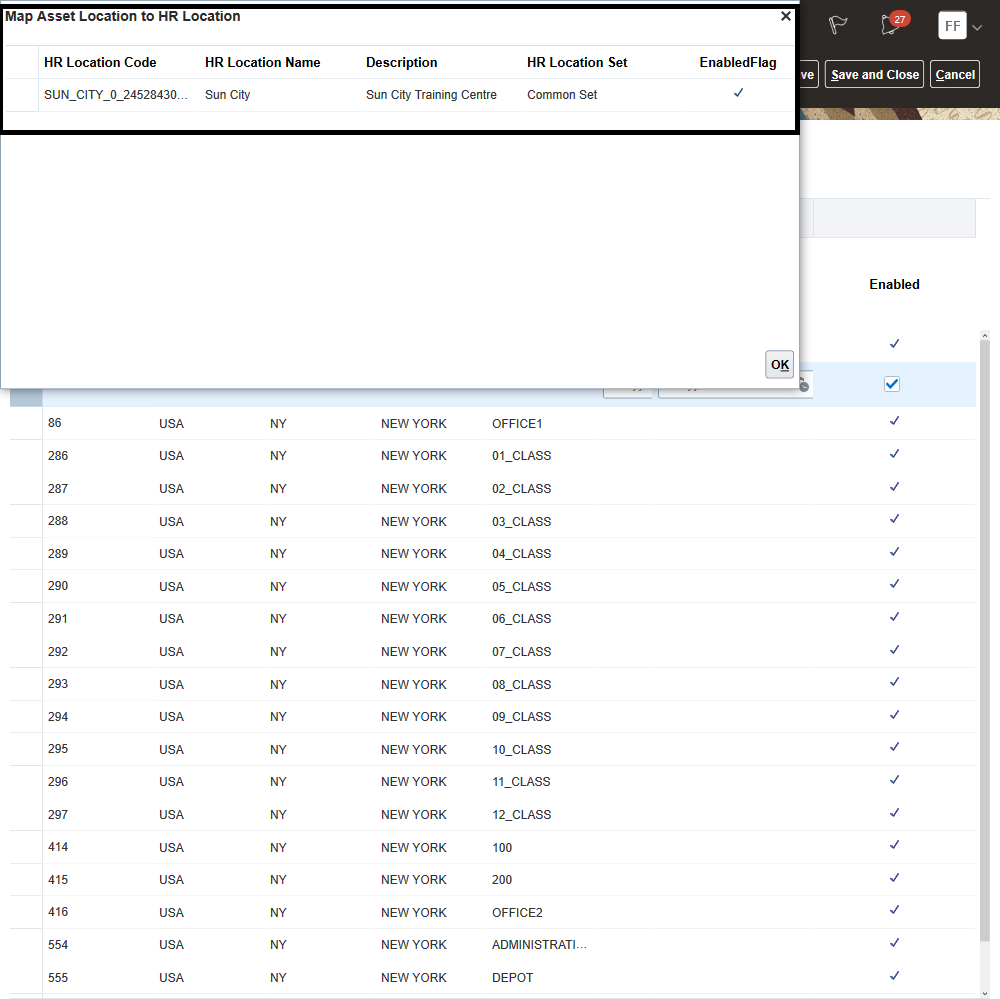

Derivation of Asset Location from Payables Invoice Ship-To Location

Use the Create Mass Additions process to transfer ship-to location information from Payables invoices to Assets. Assets automatically assigns an asset location to each Payables invoice line based on the HR location to asset location mapping, eliminating the need to enter an asset location manually.

Use the mapping table to map the Assets location and the HR location. You can view mapped locations in the Manage Assets Locations page.

You can now automatically populate the asset location for each invoice line by defining a mapping between the asset location and ship-to location setup in HR Locations. When you run the Create Mass Additions process, the Prepare Assets Transaction Data automated process populates the asset location that is mapped to the ship-to location of the invoice line. The mapped locations can be viewed from the Manage Assets Locations page.

You can create a mapping between the asset location and HR location using:

- Location Mapping worksheet in the Update Fixed Assets Configuration Sheet.

- Manage Asset Location in Export and Import Process.

The Update fixed Assets Configuration Sheet downloads all the assets location including the location for which mapping already exists. To create the mapping between the assets location and HR location, select the HR Location Code from the list of values against the Assets locations.Upload the generated csv files.The upload fixed assets configuration process creates the mapping. Enter the HR Location Code to create mapping through Export Import csv file.The assets location and mapping of asset location to HR location can be done simultaneously by entering the assets locations in the Location sheet and the Mapping in the Location Mapping sheet.

The asset location and HR location must both exist and be active before you can complete the mapping. You can create the assets location and map the asset location to the HR location at the same time. You can disable the existing mapping at any time. You can view the mapped locations from the Manage Assets Location Page.and download them in Updated Fixed Assets Configuration spreadsheet and Export and Import csv file.

- Create a mapping between the asset location and HR location using the Update Fixed Assets Configuration spreadsheet and the Export and Import csv file.

- Create Invoices with Ship to Location

- Create Mass Additions and Prepare assets transaction data.

- Auto populate Assets location in Edit Asset Page

- View Mapped Asset Location to HR Location.

You can now automatically assign an asset location to each invoice line transferred from Payables. This eliminates the need to enter asset locations manually.

Steps to Enable

- In Setup and Maintenance, navigate to the task Manage Fixed Assets Lookups.

- Search for the lookup type FA_MASS_ADD_PREPARE_RULES.

- Enable the option for the Default lookup code.

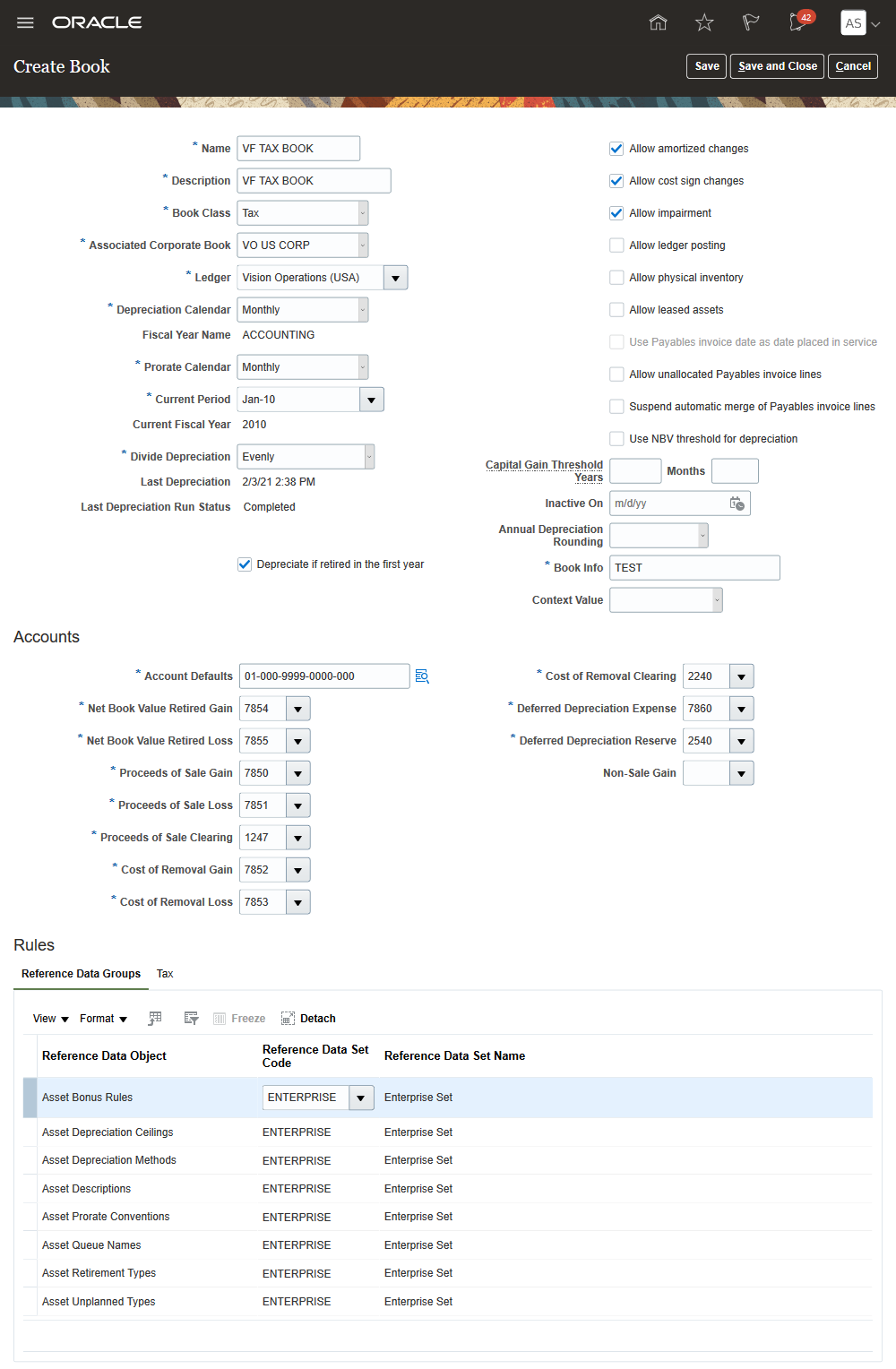

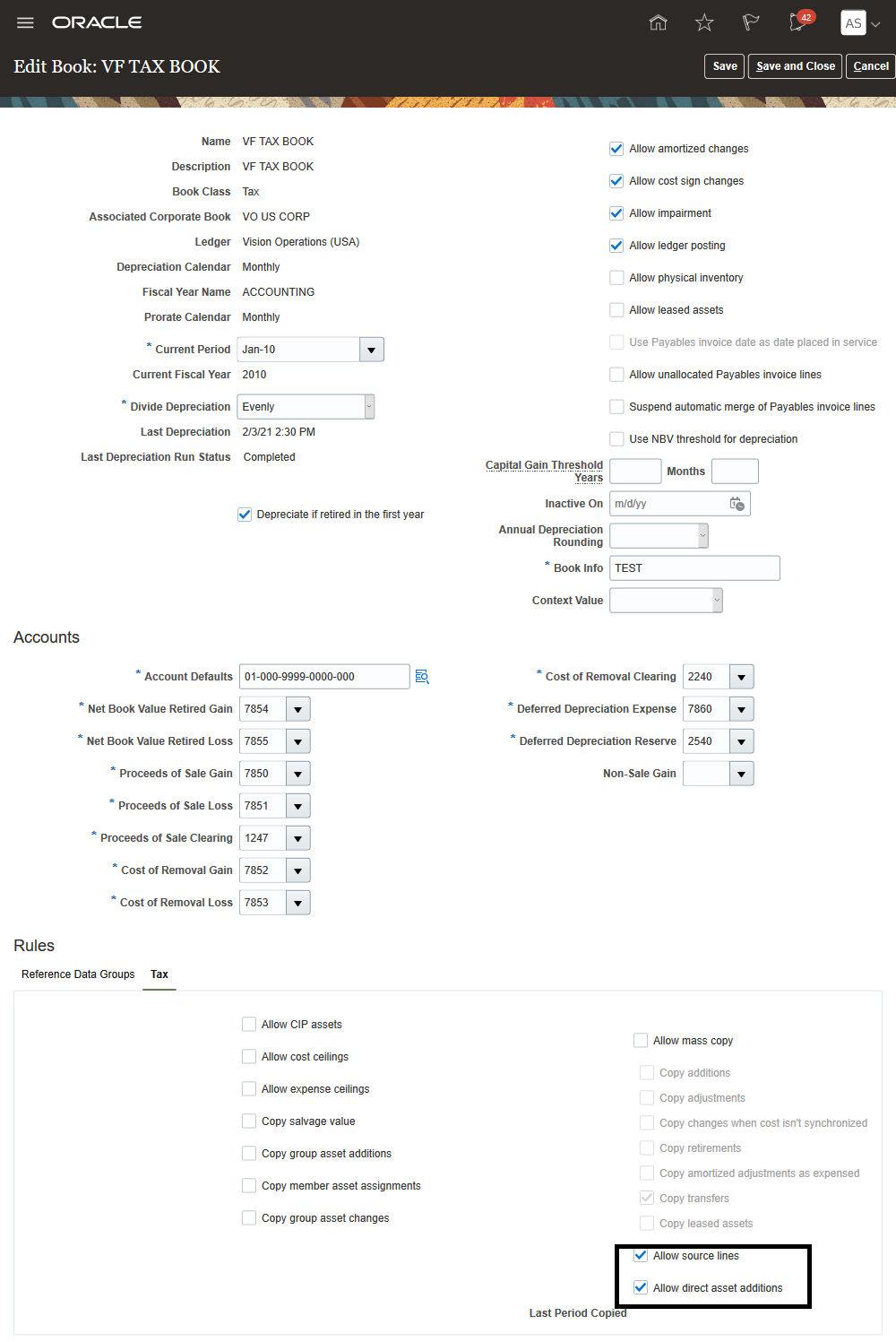

Directly Add Assets in Tax Books

Add assets directly to a tax book using either the Add Asset page or the Add Assets spreadsheet.

You can easily add assets to a tax book. These assets can be depreciated in tax books only.

Steps to Enable

- To add assets to a tax book using the Add Asset page or the Asset Additions spreadsheet,complete these steps: Set up tax books for the corporate books ledger, and a secondary ledger with the same currency as the primary ledger. Enable the "Allow direct asset additions" option.

-

To add assets to a tax book with source line information, enable the "Allow source lines" option in the Edit Book page. Enable this option before adding assets to the tax book. If you do not enable this option before adding assets to the tax book: Assets will be added without source line information. Merge and Add to Asset transactions are not allowed on this book, because these are source line transactions.

- Create a tax book for the corporate book ledger, and a secondary ledger with the same currency as the primary ledger.

- Enable the "Allow direct asset additions" and "Allow source lines" option.

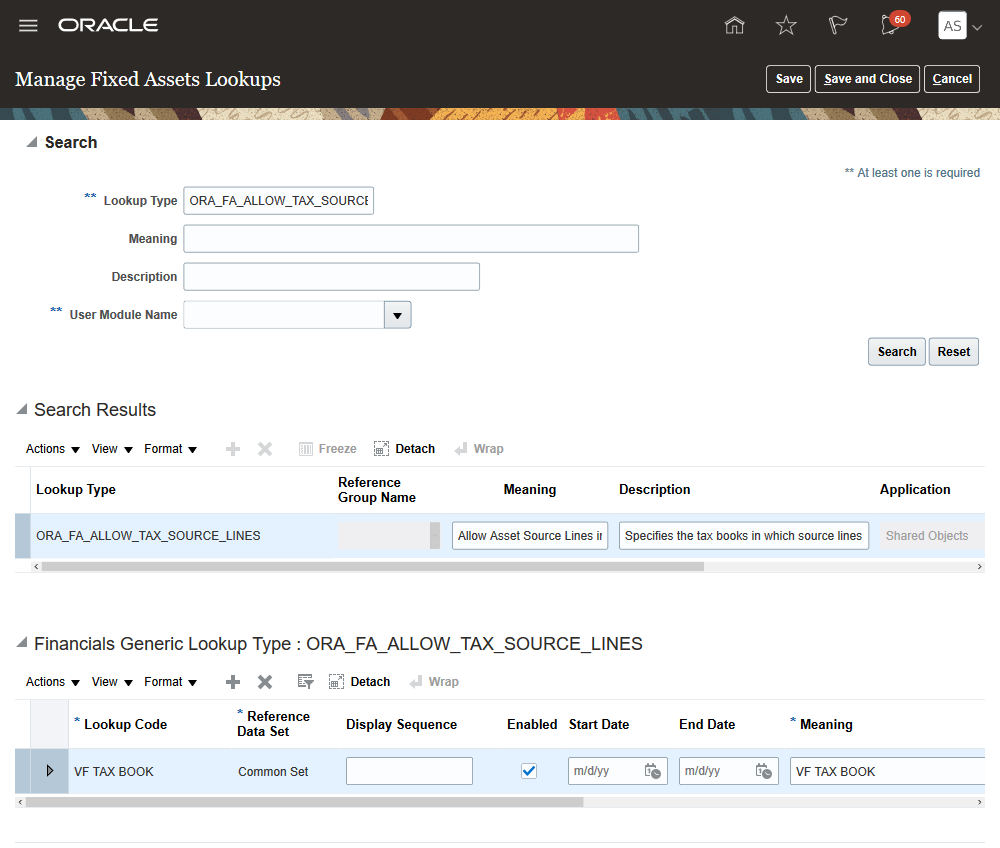

- In Setup and Maintenance, search and go to the task ‘Manage Fixed Assets Lookups’.

- Search for the lookup types- ‘ORA_FA_ALLOW_TAX_SOURCE_LINES’ and ‘ORA_FA_ALLOW_TAX_DIRECT_ADD’.

- Enter your asset book name as the lookup code.

- In the Edit Book page, enable the following options.

- Allow source lines.

- Allow direct asset additions.

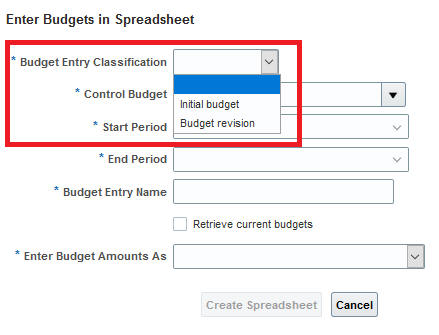

Budget Entry Classification for Initial or Adjustment Budget Balance Using Spreadsheet

Select the budget entry type to impact either initial or adjustment budget balances. Specify the budget entry type when you use file-based data import or spreadsheet to load budgets. You can make budget revisions to the initial budget balance when the budget period is open for consumption.

Control the classification of your budget entries as initial budget or budget revision to reflect the intention of the budget entry for reporting and inquiry on budget balances.

Budget Entry Classification

Steps to Enable

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Financials

Tips And Considerations

New Customer Installations:

- This feature defaults with Opt-In enabled.

Upgraded Customer Installations:

- This feature defaults with Opt-In disabled.

- When this feature is disabled, the budget entry classification is determined by period status. When the budget period status is Open, the budget balance is classified as an adjustment. When the budget period status is Available for budgeting, the budget balance is classified as initial. When this feature is enabled, you select the budget entry classification of the budget balance regardless of the period status.

- We recommend implementing this feature in your next fiscal year budget preparation cycle to ensure all budget entries are categorized consistently. However, don’t enable the feature on the Opt In page until you’re ready to load the budget entries for the new fiscal year budget.

- Classification of budget entries by budget period will be removed in a future release.

- If you have scheduled either the Import Budget Amounts or Import Budget for Budgetary Control and General Ledger process, or you have created custom ERP integration to invoke any of these processes, you must update them to reflect the new and changed parameters introduced by this feature.

- The Import Budget Amounts process Import mode parameter has been renamed to Budget Amounts Entered As and has these new values.

Previous Parameter Name New Parameter Name Fail This parameter is no longer available and the logic has been merged with "New budget or replacement of current budget." Overwrite New budget or replacement of current budget Increment Addition to or subtraction from current budget

Key Resources

- Import Budget Data from a Flat File for Budgetary Control in Using Financials for the Public Sector

- Budgetary Control Budget Import in File-Based Data Import for Financials

Role Information

Budget Manager role is needed to submit these processes:

- Enter Budgets in Spreadsheet

- Import Budget Amounts

- Import Budget for Budgetary Control and General Ledger

Initial Budget Adjustments for Carry Forward Processes

Update the initial budget balance using the Carry Forward Purchase Order Budgetary Control Balances process and the Carry Forward Funds Available process. Budget entries for the carry forward of funds available and purchase orders updates the initial budget balance regardless of budget period status.

Carried forward budget are reported separately from budget revisions entered in the new budget year. Carried forward budget updates the initial budget balance, whereas budget changes made during the new year will update the adjusted budget balance.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

When carrying forward funds available balance to the next year, the funds available balance will be classified as initial budget in the new budget year regardless of the budget period status being Available for budgeting or Open.

When you carry forward the purchase order to the next year and you choose to leave the funds available unchanged in the current year, the current year budget is still classified as adjustment.

To carry forward the purchase order obligation to the next budget year, you must continue to open the budget period in the new budget year.

To understand the impact of the feature on the Carry Forward Purchase Order Budgetary Control Balances process, consider the following example. You want to carry forward a purchase order’s obligation and budget balance from 2020 to 2021 while leaving the funds available unchanged in 2020.

The control budget period status must be OPEN for:

- 2020

- 2021

The Carry Forward Purchase Order Budgetary Control Balances process is run with these parameter values.

- Finally Close Through Budget Date = 2020

- Reopen Open Budget Date = 2021.

These are the budgetary control balance results.

- 2020 (no change to the functionality)

- Obligation is reduced

- Reduction of the budget in 2020 is classified as adjusted budget.

- 2021

- Obligation is reserved (There are no changes to the feature)

- Carry forward of the budget to 2021 is classified as initial budget. (This is the change to the feature)

- The results are shown in the table below.

Obligation Budget 2020 2021 2020 2021 Initial Budget Adjusted Budget Initial Budget Adjusted Budget Final Close PO in 2020 Reduction of Obligation Reopen PO in 2021 Reservation of Obligation Budget Impact Reduce Budget in 2020 Reduction of Budget Move Budget to 2021 Carry Forward of Budget (changed)

Key Resources

- Managing Budgetary Control Carry Forward support note 2705986.1

Role Information

Budget Manager role is needed to run the Carry Forward Purchase Order Budgetary Control Balances process.

View Funds Reservation Errors When Final Close or Reopen Fails for a Purchase Order

Drill down to the funds reservation results from error messages. These error messages are displayed when final close or reopen fails for a purchase order because of issues in releasing or reserving funds. You can contact the budget manager listed on the results for assistance in resolving the issues.

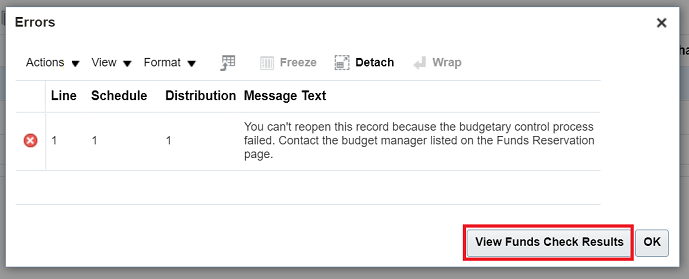

These screen captures illustrate the feature:

Reopen Purchase Order Error Message Dialog Box

Purchase Order Funds Reservation Results

Steps to Enable

You don't need to do anything to enable this feature.

Role Information

You have a couple of options for giving people access to set up and use this feature, depending on whether you're assigning them predefined job roles or your own configured job roles.

- Users who are assigned this predefined job role are automatically able to access this feature:

- Buyer (ORA_PO_BUYER_JOB)

- Users who are assigned configured job roles that contain these privileges are able to access this feature:

- Create Purchase Order (PO_CREATE_PURCHASE_ORDER_PRIV)

- Change Purchase Order (PO_CHANGE_PURCHASE_ORDER_PRIV)

Wildcard Support for Bank Statement Processing Using UCM Protocol

Retrieve multiple bank statements using the Universal Content Management Reader Protocol with a wildcard. Enter a wildcard in the file name to retrieve and download multiple files at once instead of doing it for each file.

The capability to retrieve files using a wildcard reduces the manual effort of downloading files individually. You can retrieve multiple bank statements (that match the wildcard pattern) at once, instead of individually retrieving each file. Prior to this update, only the SFTP protocol was supported for loading bank statement files. Support for Universal Content Management Reader (UCM) protocol improves your integration capability with banks using this protocol.

Steps to Enable

You don't need to do anything to enable this feature.

Cancellation of Payment Requests for Cash Advances

Automatically update an employee's cash advance status when a payment request for a cash advance is canceled. Employees see the correct status, thereby reducing inquiries to the accounts payable department.

The new status in the Cash Advances work area allows employees to easily track the changes to their cash advance statuses, thereby improving employee experience.

When an auditor is notified that an approved cash advance is no longer required due to a trip or event cancellation or due to incorrect entries, the auditor can request the payables supervisor to cancel the cash advance. The cancellation of a cash advance takes place in Oracle Payables. Only invoiced or validated payment requests are eligible for cancellation. When a cash advance is canceled, a cancellation event is raised and the Expenses application sets the status of the cash advance to Invoice Canceled. No further actions can be performed on a cancelled cash advance.

Steps to Enable

You don't need to do anything to enable this feature.

Role Information

To cancel payment requests, you need the Payables Supervisor role.

Cancellation of Payment Requests for Expense Reports

When a payment request for an expense report is canceled, update the expense report status, delete both pay expense reports created to pay corporate card issuers, and reverse cash advance applications. This allows auditors to reprocess the expense report to Payables when needed to pay the employee and card issuer according to the correct schedule.

The ability to cancel payment requests for expense reports allows companies to prevent incorrect reports from reimbursement processing and communicate real time status to employees. Employees see the new status in the cards in the Expenses work area, thereby reducing inquiries to the accounts payable department.

Only payment requests with the status Invoiced or Validated can be canceled. When a payment request is canceled, the associated expense report status is changed to Invoice Canceled and the suffix “+1” is added to the expense report number. The references to the original payment request are removed. The Expenses work area reflects the status change and the new expense report number. Employees cannot take any action on an expense report in the Invoice Canceled status. In the Audit Expense Report page, an auditor can update a canceled expense report and process it again for expense reimbursement or return a canceled expense report to the employee. The employee can rework a returned report and resubmit it again.

A payables supervisor can cancel the following types of payment requests for expense reports.

- Expense reports containing cash expenses

When reprocessed for reimbursement, a new payment request to an employee is created.

- Expense reports containing individual pay corporate card transactions

When reprocessed for reimbursement, a new payment request to an employee is created.

- Expense report containing both pay corporate card transactions

When a payables supervisor initiates the cancel action, the application prevents the supervisor from further action if the expense report is a both pay report and one of the payment request is already in payment process. When both payment requests are in invoiced or in validated statuses, the application alerts the supervisor that both of these payment requests will be cancelled. When the expense report is reprocessed for reimbursement, the application creates two new payment requests, one for the employee and the second for the card issuer.

- Expense report containing company pay card transactions

When a payment request for the card issuer is canceled, the invoice number is removed from the card transactions and these transactions are available for reprocessing. When a payment request for the employee is canceled, the expense report status is changed to Invoice Canceled.

Steps to Enable

You don't need to do anything to enable this feature.

Role Information

To cancel payment requests, you need the Payables Supervisor role.

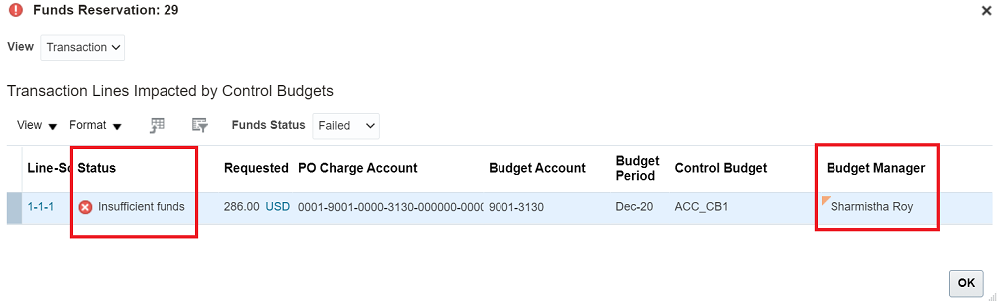

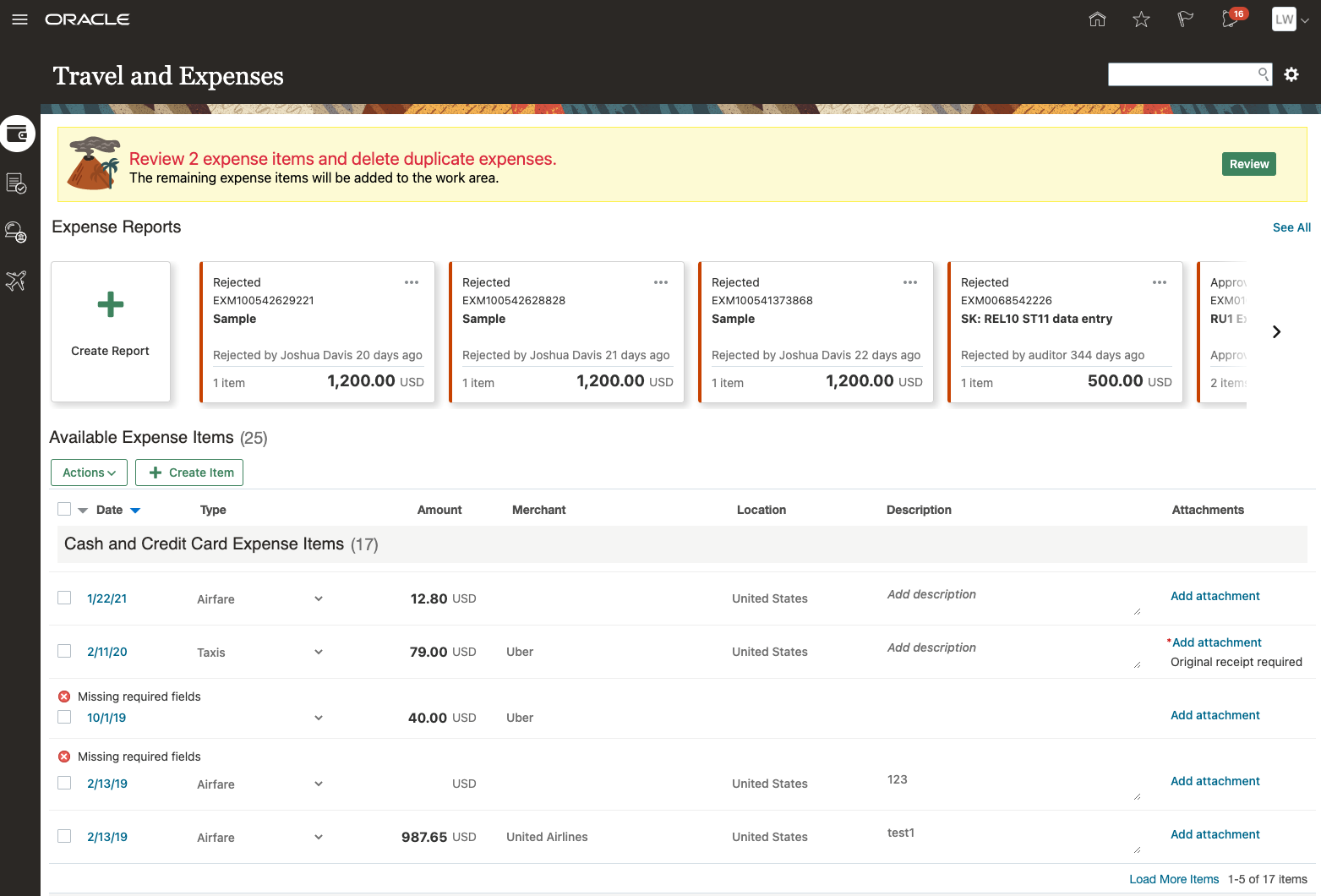

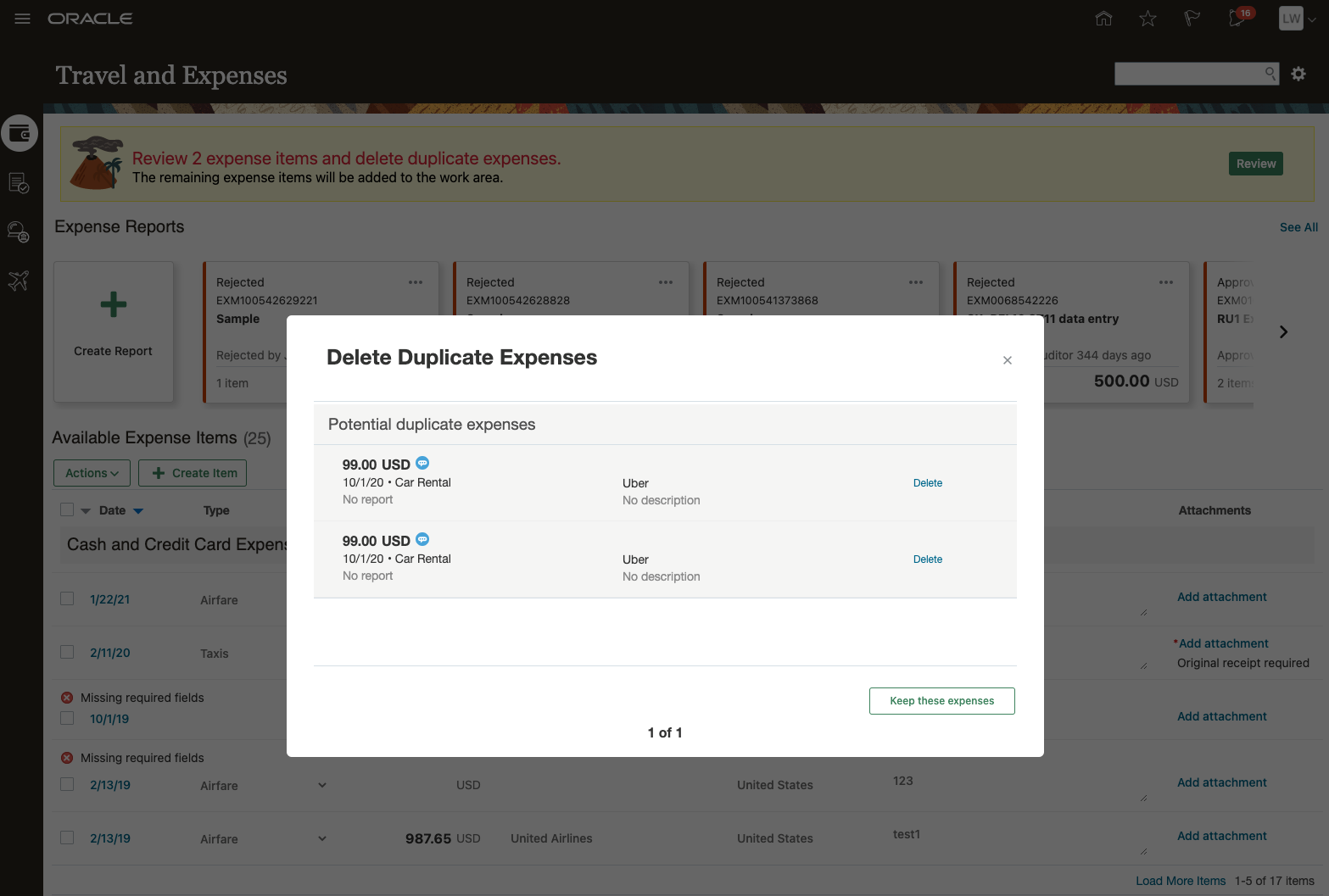

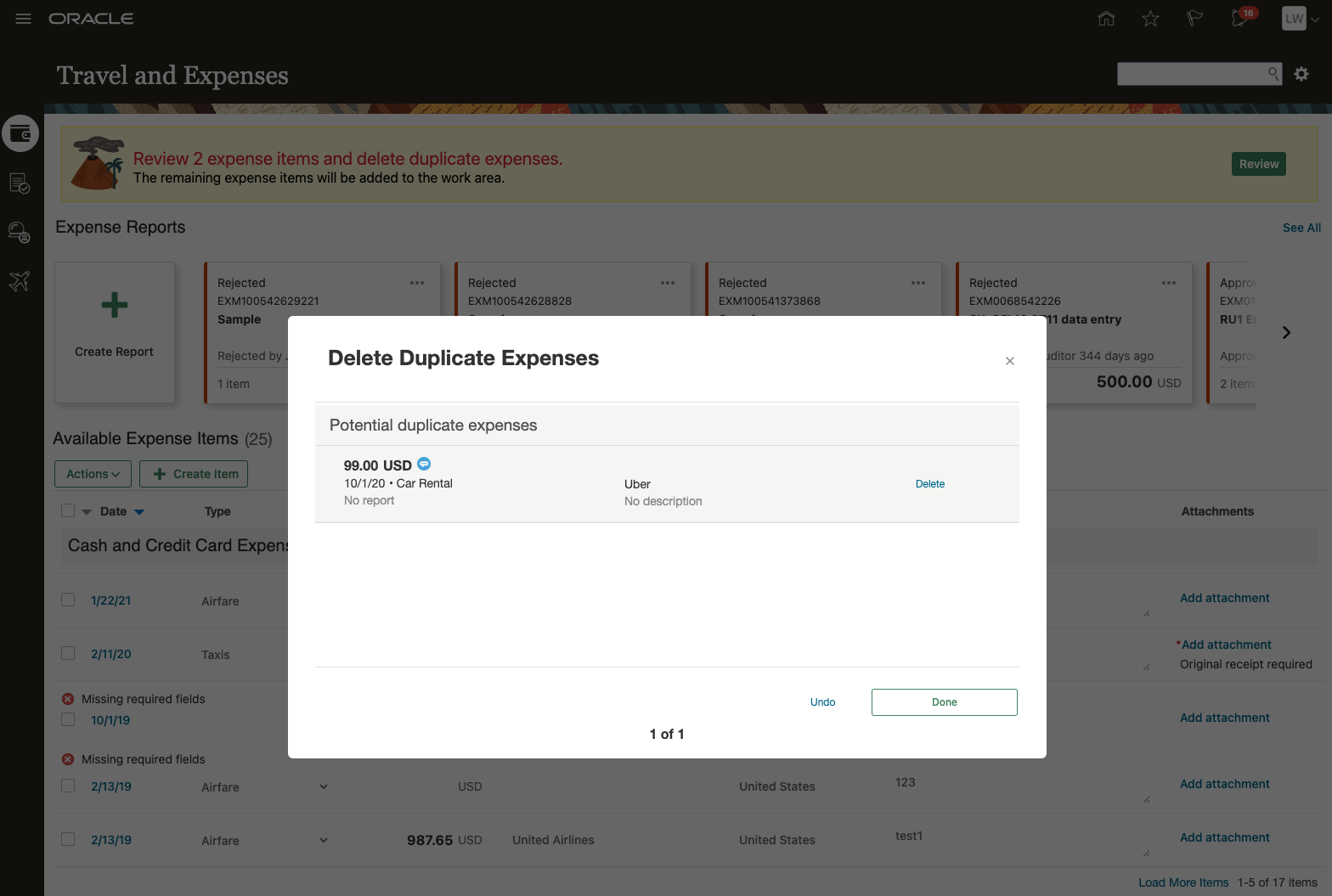

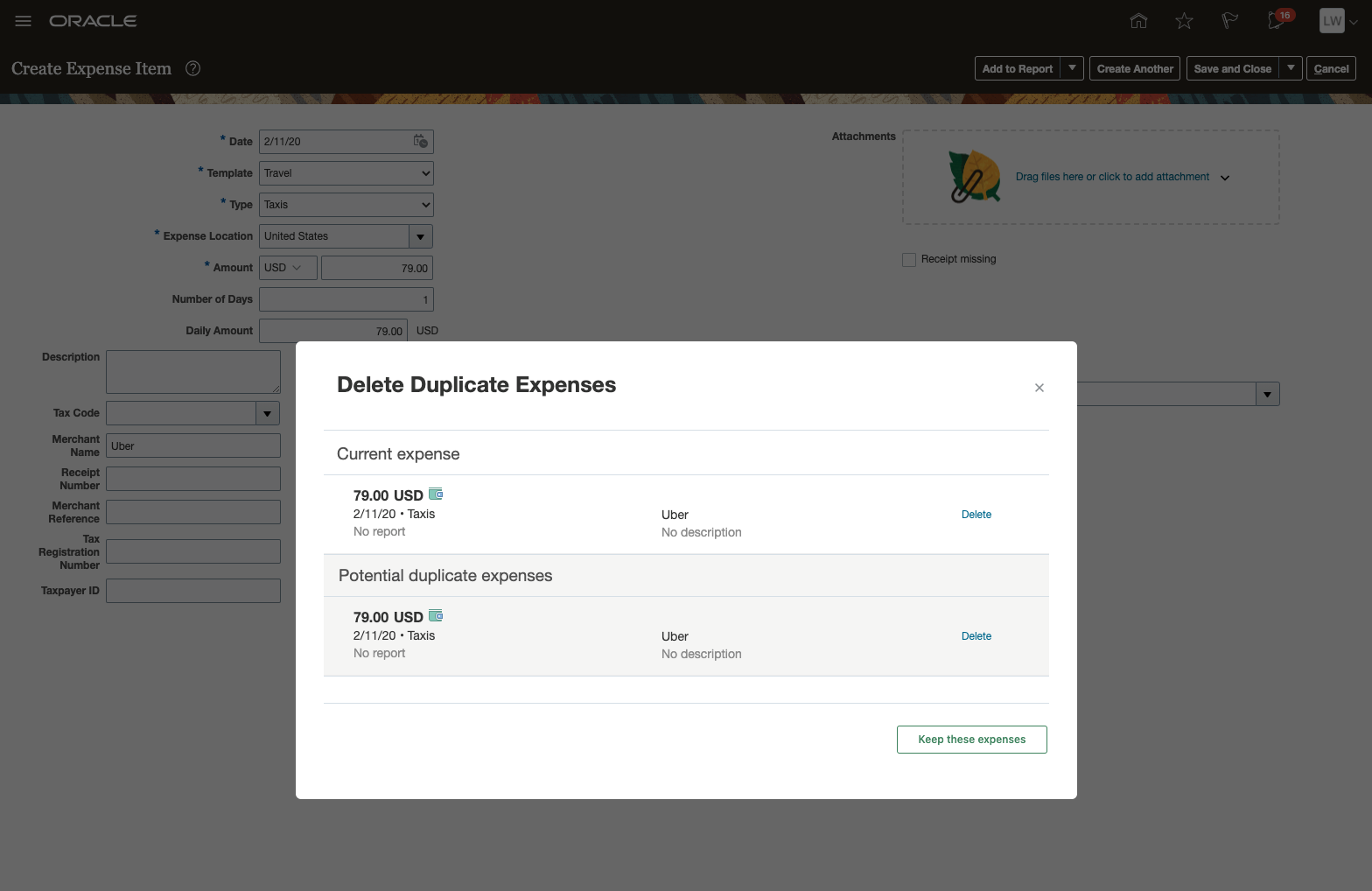

Detection of Duplicate Expenses

Identify duplicate expenses using a scoring model and alert employees when duplicates are found. Employees can review the duplicate expenses in the Expenses work area and take actions, such as deleting the duplicate or merging the duplicate expense with the original expense.

When are two expenses considered duplicates?

- Based on the expense fields such as amount, date, currency, expense type, merchant, etc., the duplicate detection algorithm determines if two expenses are considered duplicates and notifies the user. Duplicate detection also takes into account the values on a receipt to identify duplicate expenses created with the same receipt. The notification appears in two ways:

- When the user is creating an expense and fills out all the details and tries to save it; the duplicate detection algorithm runs and it immediately shows the user a warning pop-up that the expense being created is marked as a "duplicate" to an existing expense and allows the user to take the necessary action to either 1) delete the current expense or 2) continue creating the expense, in the case it is not actually a duplicate.

- When a user creates two duplicate expenses from sources other than the web such as email forwarding or Digital Assistant, they are marked as duplicates on the web UI and users are notified in the form of a banner at the top of the work area.

What happens when a duplicate is inside a report?

- When a duplicate expense is inside a report, it is marked with an error to resolve the potential duplicates and the user is not allowed to submit the report until the error is resolved. The error makes sure double payment is avoided for duplicate expenses.

What happens when a duplicate is detected in an already submitted reports?

- Duplicates are detected for all expenses created by the user within a six month period. This means that expenses that are not yet submitted can be marked as duplicates of already submitted expenses. Note: the employee is only allowed to delete or take action on the expenses that are not yet submitted.

Duplicates are detected and shown in the banner (as show below).

Open the banner to review the expense items currently marked as duplicate. The employee can delete duplicate items or merge one or more item with the original expenses.

After the user deletes the duplicates, they can click Done to finish.

The remaining items get added to the work area and with the Just Added tag.

If an expense was already created and the user tries to create a duplicate, the item is marked when the user clicks Save and Close.

Business benefits include:

- Saves time and money by reducing potential expense process errors associated with duplicate expenses going undetected during the expense report process.

- Delivers a better user experience by offering users the ability to process expense reports based on their personal or organizational preferences, i.e. using SMS or Web channels to process expenses.

- Increases compliance with an organization's expense reporting policies and processes.

Steps to Enable

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Financials No Longer Optional From: Update 21D

U.S. Federal Financials is a configurable and flexible solution that enables U.S. Federal agencies to meet Federal financial management system requirements. It supplements Financials and Procurement functionality by providing U.S. Federal specific functionality. The initial release of U.S. Federal Financials will include the features described below. Additional functionality to fully meet mandatory Federal financial management requirements will be provided in upcoming releases.

U.S. Federal Payment Attributes

Capture voided payment numbers on the payment transactions to support the reclassification of payments.

The Manage Payment page contains a Voided Payment field to use to reference a reclassified payment.

Use the voided payment field for selecting a payment when:

- The referenced payment document is voided.

- The new and voided payments have the same supplier and supplier site.

- The new payment amount equals the original voided payment amount.

- The new and voided payments have the same Agency Location Code (ALC) on their internal bank accounts.

- The new and voided payments have the same general ledger period.

- The voided payment document isn't referenced on any other payment.

U.S. Federal Payment Attributes

Watch a Demo

The value in the Voided Payment field provides a link between a payment and the payment it's reclassifying. This is a prerequisite requirement for the CTA interface feature which is functionality to be provided in a future release.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

- Watch U. S. Federal Payment Attributes Readiness Training

- For more information on the Voided Payment attribute, refer to the Using U.S. Federal Financials guide.

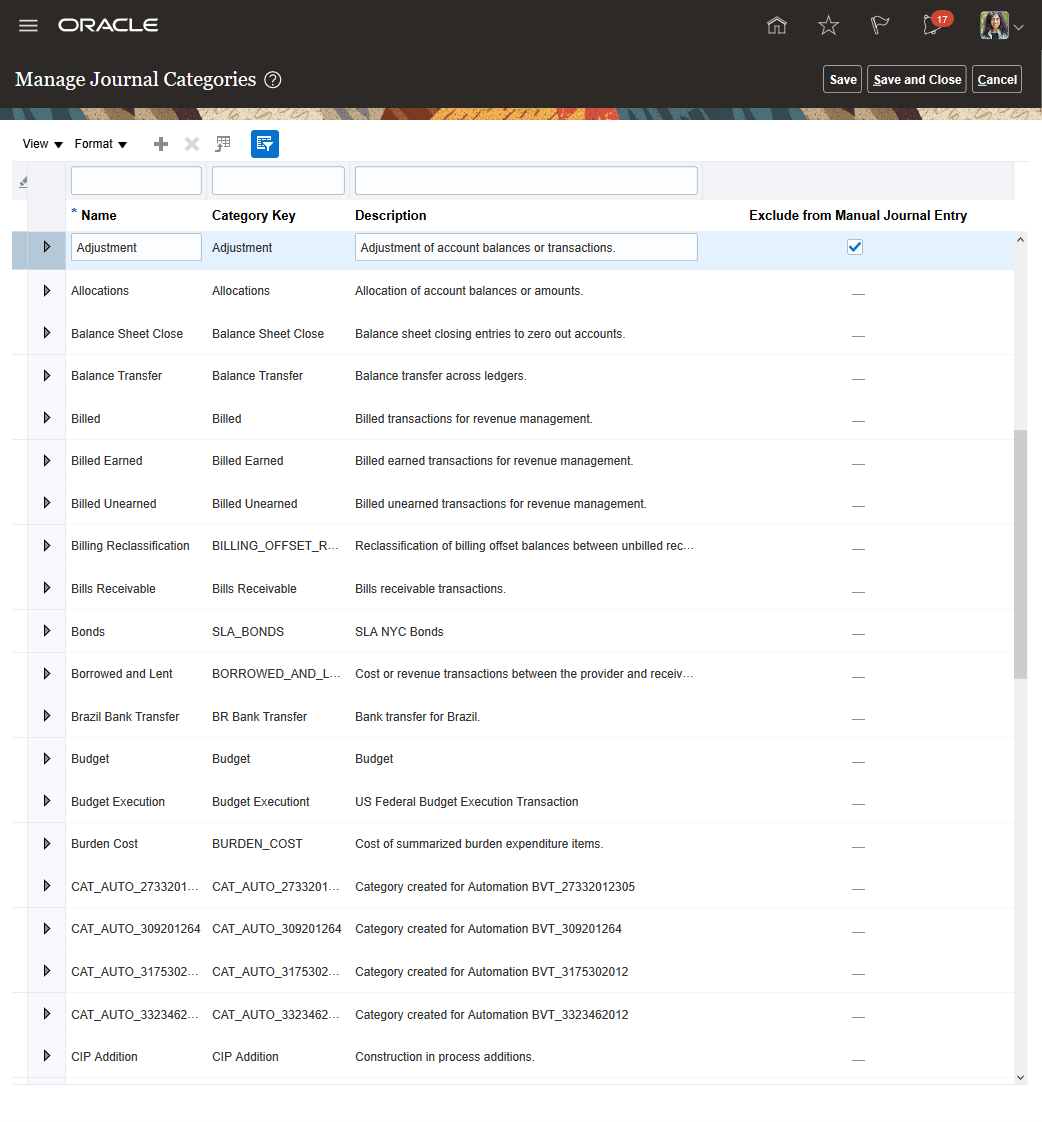

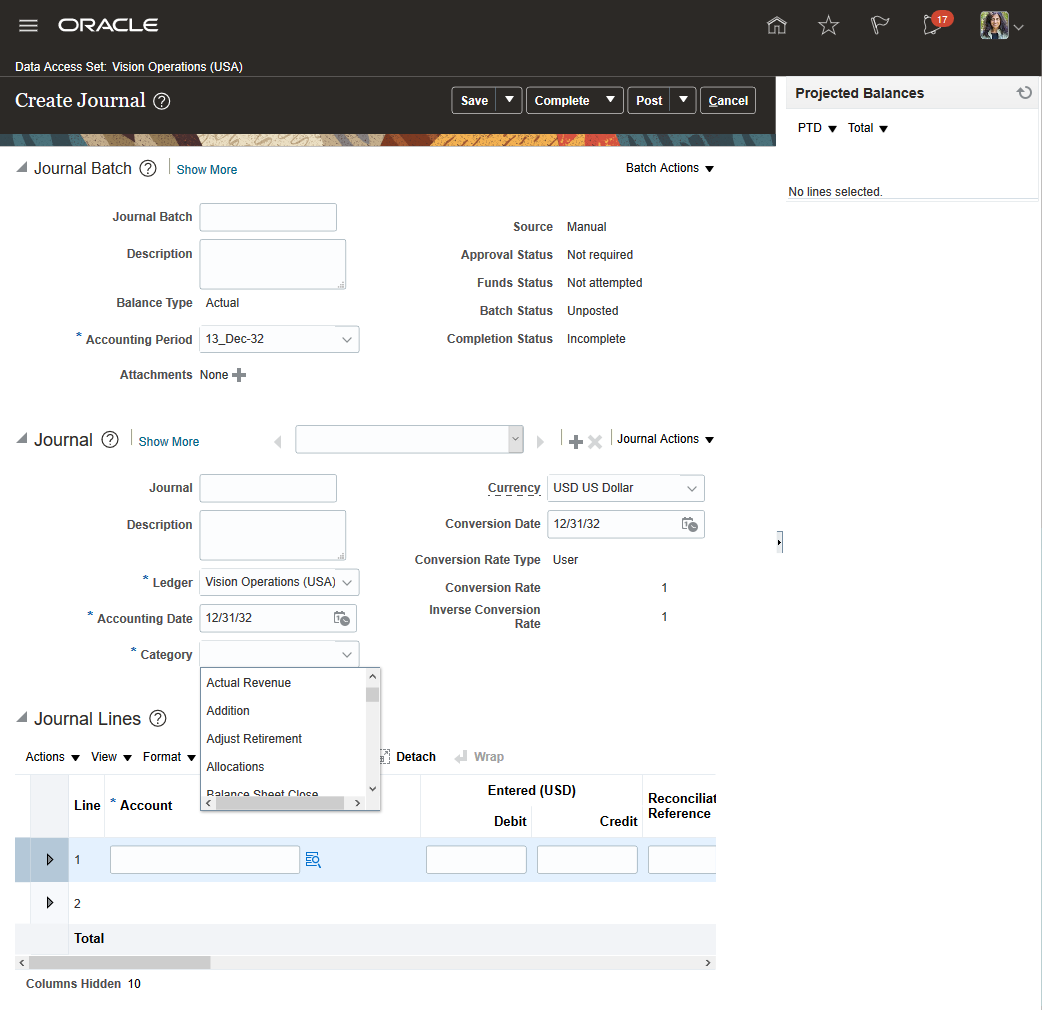

Journal Categories Excluded During Manual Journal Entry

Optionally restrict the list of journal categories available for manual journal entry.

Use the Exclude from Manual Journal Entry field on the Manage Journal Categories page to indicate a journal category should not be available to users when creating manual journal entries.

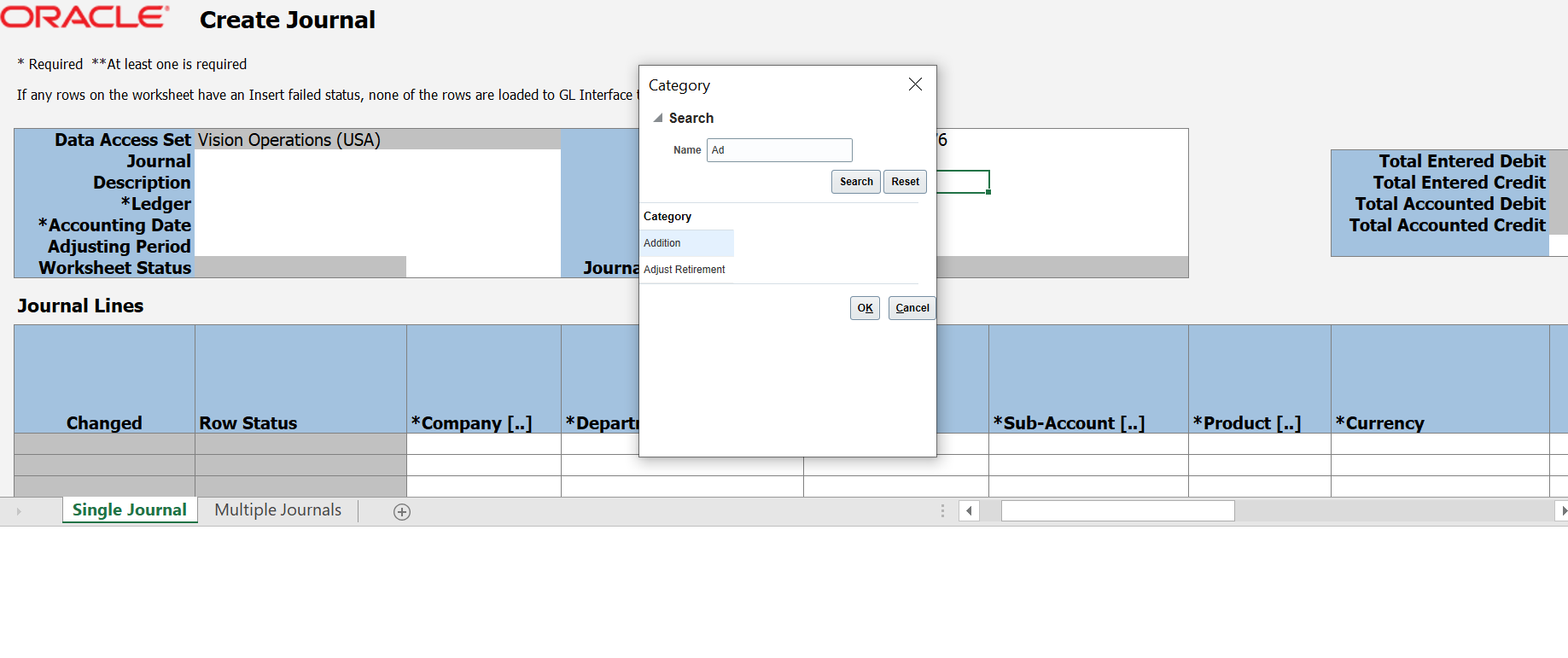

Exclude from Manual Journal Entry in the Manage Journal Categories Page

The setting restricts the list of journal categories users can choose from when entering journals manually or creating journals using the spreadsheet interface.

Create Manual Journal Page

Create Manual Journal Using Spreadsheet

The journal Categories that are excluded in the Journal Category definition page will still be available for journal entry from transactions imported from Oracle subledgers or from third-party source systems. Also, journals using those journal categories can be viewed from the Manage Journals page.

This feature lets you simplify manual journal entry by hiding journal categories that are not relevant for your business and hence easing the usability of Create Journal page.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

By default, all journal categories are available for manual journal entry unless you choose to exclude some in the Manage Journal Categories Page.

You may need to sign out and sign back in to see the setup change take effect.

Search Section on Manage Journals Page Remains Expanded After Search

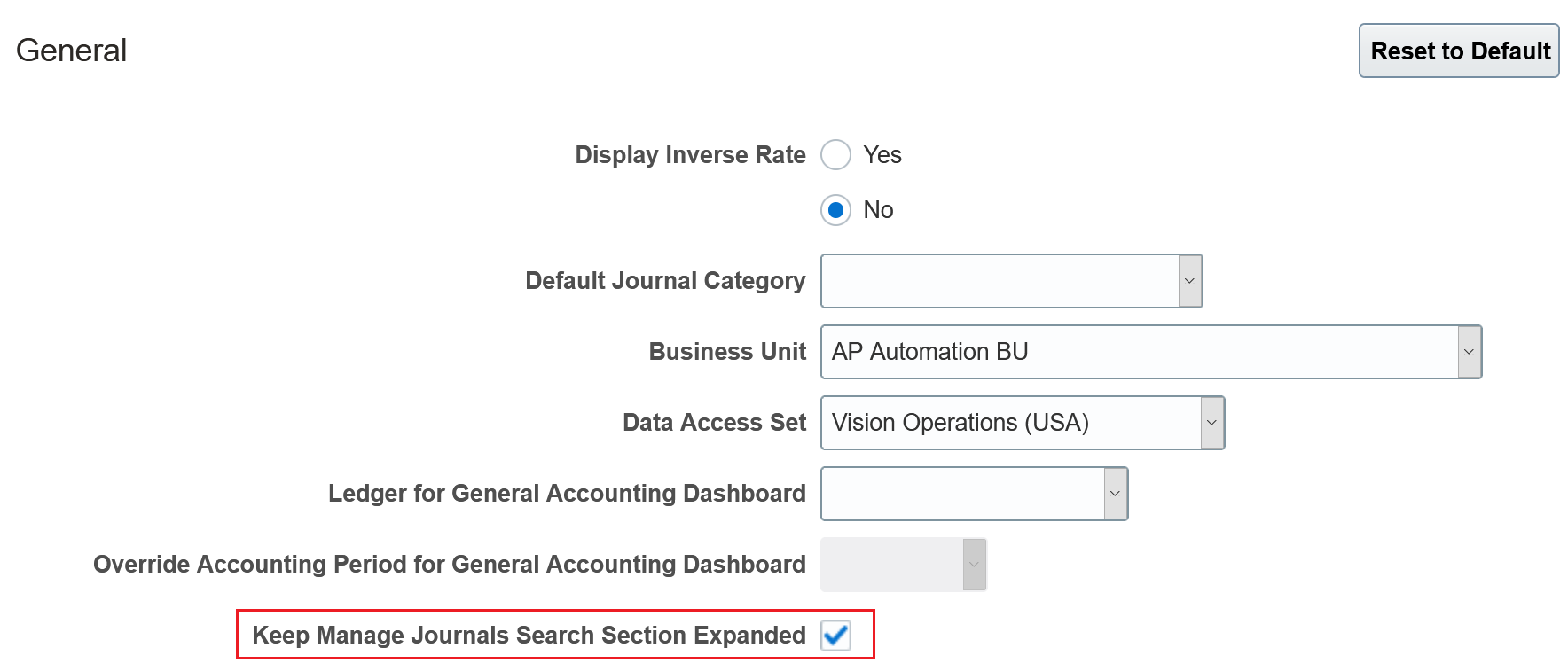

Optionally configure the Manage Journals page to leave the Search section expanded by default after search results are displayed.

Manage Journals Search Page Expanded

Enabling this preference helps reduce clicks between multiple searches on the Manage Journals page.

Steps to Enable

- On the Settings and Actions menu, click Set Preferences.

- On the Preferences page, click General Ledger Preferences.

- In the General section, select the Keep Manage Journals Search Section Expanded check box.

- Save the change.

Enable Keep Manage Journals Search Section Expanded Preference

Distributable Costs by Project Attributes

Currently, Joint Venture Management identifies transactions to be distributed to joint venture partners based on distributable chart of account segment values.

This enhancement provides the option for customers to additionally specify project attributes—Project, Task, and Expenditure Type—to identify distributable transactions for a joint venture.

Watch a Demo

This provides increased flexibility to designate cost transactions as eligible to be distributed to joint venture stakeholders based on project-related attributes.

Distributable chart of account segment values provide the first level of designation for determining joint venture transactions from subledger accounting and general ledger. Project-level attributes provide the ability to refine these further and eliminate transactions that shouldn’t be brought into Joint Venture Management.

Steps to Enable

Opt-in to the following features to use this capability:

- Project Costing and Capital Projects features in Project Financial Management

- Project Capitalization and Progress Management feature in Joint Venture Management

To use project attributes for identifying distributable transactions for a joint venture, the joint venture accountant must complete the following setup:

- Access the Joint Venture Definition for the joint venture.

- Navigate to Distributable Project Values tab and enter the Project, Task and Expenditure Type that are eligible for joint venture processing.

Tips And Considerations

If Project Capitalization and Progress Management is enabled, corresponding configuration is completed in Joint Venture Management, and distributable project values are set up, any subsequent and new joint venture transactions with projects information will be eligible to be designated as distributable based on the Distributable Costs by Projects Attributes feature in addition to Chart of Account segment values.

Preexisting transactions created by Joint Venture Management prior to distributable project values being set up will be designated as distributable based exclusively on distributable Chart of Account segment values.

Key Resources

- Watch Distributable Costs by Project Attributes Readiness Training

- Watch Task and Expenditure Type Overrides on Project Costing Adjustments Readiness Training

- Watch Joint Venture and Project Management Enhanced Data (update 21A) Readiness Training

- Watch Project Capitalization and Progress Management (update 20D) Readiness Training

- For more information, refer to the Implementing Joint Venture Management guide

Role Information

- Joint Venture Accountant

Task and Expenditure Type Overrides on Project Costing Adjustments

The existing Joint Venture Management and Project Costing integration enables customers to automatically adjust Project Costing to facilitate accurate project capitalization and gross to net reporting, budgeting and forecasting. With this integration, distributed costs sent to partners to recoup joint venture costs are also sent to Project Costing in accounted mode as cost adjustments. This integration enables customers to reconcile costs in Project Costing with General Ledger and gives the ability to budget and forecast by net costs.

The feature—Task and Expenditure Type Overrides on Project Costing Adjustments—will provide you with the option to tailor project attributes in cost adjustments sent to Project Costing from Joint Venture Management.

With the ability to override the task number and expenditure type in cost adjustments, customers can now budget and forecast by gross costs.

Note that the ability to budget and forecast by gross costs is in addition to the existing capability to budget and forecast by net costs.

Steps to Enable

To specify the project attributes that should be used as override on the project costing adjustments, the joint venture application administrator must complete the following setup:

- Access Joint Venture System Options.

- Enter the Task Number and Expenditure Type under the Project Overrides section.

Tips And Considerations

If Project Capitalization and Progress Management is enabled, corresponding configuration is completed in Joint Venture Management, and either task or expenditure type override is set up, any subsequent and new joint venture distributions will be eligible for task or expenditure type override.

Preexisting distributions created by Joint Venture Management prior to task or expenditure type overrides being set up will not be eligible for these overrides.

Key Resources

- Watch Task and Expenditure Type Overrides on Project Costing Adjustments Readiness Training

- Watch Distributable Costs by Project Attributes Readiness Training

- Watch Joint Venture and Project Management Enhanced Data (update 21A) Readiness Training

- Watch Project Capitalization and Progress Management (update 20D) Readiness Training

- For more information, refer to the Implementing Joint Venture Management guide

Role Information

- Joint Venture Application Administrator

Transaction Date Determination from GL Lines

Currently, Joint Venture Management has the following options to determine the transaction date (also known as the service date or activity date in different industries) for transactions brought into Joint Venture Management for distribution to stakeholders:

- Transaction date is defaulted from the accounting date for transactions that originate in subledger accounting.

- Transaction date is defaulted from the effective date for transactions that originate in general ledger.

- Configure the system to specify a reference date from the original subledger to use as the transaction date.

- Configure the system to specify a date attribute from the general ledger header to use as the transaction date.

To split transactions for distribution among joint venture partners, Joint Venture Management uses the transaction date to determine which date effective ownership definition is used to calculate the split.

With this enhancement, it is now possible to select a field that represents the transaction date from one of the general ledger line attributes.

Watch a Demo

Business benefits include:

- The list of fields that can be used to determine the transaction date are no longer restricted to date fields only since some systems and technologies may only have the ability to write a date to a string field.

- Provides companies with a stricter conformance to the joint operating agreement when the transaction date at the general ledger line level is different from the transaction date at the general ledger header.

- Minimize the time for month-end joint venture processing with automatic determination of joint venture transaction date based on additional source fields.

- Conform to the Joint Operating Agreement by ensuring that the actual activity date is used to resolve the ownership definition percentages for the joint venture partners including those transactions where the transaction date at the general ledger line level is different from the general ledger header level.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

- Watch Transaction Date Determination from GL Lines Readiness Training

- Watch Transaction Date Determination from Subledger Accounting Supporting References and GL Transactions (update 20C) Readiness Training

- For more information, refer to the Implementing Joint Venture Management guide

Role Information

- Joint Venture Application Administrator

Usability and Navigation Improvements for Joint Venture Invoicing

Improve the usability of Joint Venture applications and increase productivity by reducing the number of clicks, minimizing scrolling, and simplifying navigation.

Enhancements include:

- Incorporation of new application designs from the Oracle User Experience team in the Joint Venture Invoices work area, such as using smart filters and drawer panels for detail review.

- Ability to copy ownership definitions.

- Joint Audit Data Exchange (JADE) reporting.

Watch a Demo

Business benefits include:

- Improvements to the Joint Venture Invoices work area provide a streamlined and intuitive user experience for review of Receivables invoices sent to partners, and management of disputes and errors related to joint venture transactions and distributions.

- Improve the productivity of the joint venture accountant on a day-to-day basis by significantly reducing the time required to perform updates with the ability to copy joint venture ownership definitions easily.

- Generate detailed audit reports of joint venture expenditures for review by external auditors to verify compliance with the joint operating agreement (JOA).

Steps to Enable

To enable the use of smart filters in the Joint Venture Invoices work area, an administrator must complete the following setup tasks:

- Enable Oracle Search Extension Framework in the profile options.

- Run initial ingest process to build the indices (invoices and distributions) in the Oracle Search Cloud Service (OSCS) database and populate existing invoices and distributions data to the database.

All other enhancements are delivered enabled and do not require any action to be taken to use them.

Watch a Setup Demo

Tips And Considerations

- The Joint Venture Invoices work area requires Oracle Search Extension Framework, which is delivered with your SaaS subscription.

- Running the initial ingest process is typically a one-time task for each predefined index for your product. The Joint Venture Invoices work area requires two indices to load the data, one for invoices and the other for distributions. Therefore, you will need to run the process twice, once for each index.

Key Resources

- Watch Usability and Navigation Improvements for Joint Venture Invoicing Readiness Training

- For more information, refer to the Implementing Joint Venture Management guide

Role Information

- Joint Venture Accountant

- Application Implementation Consultant

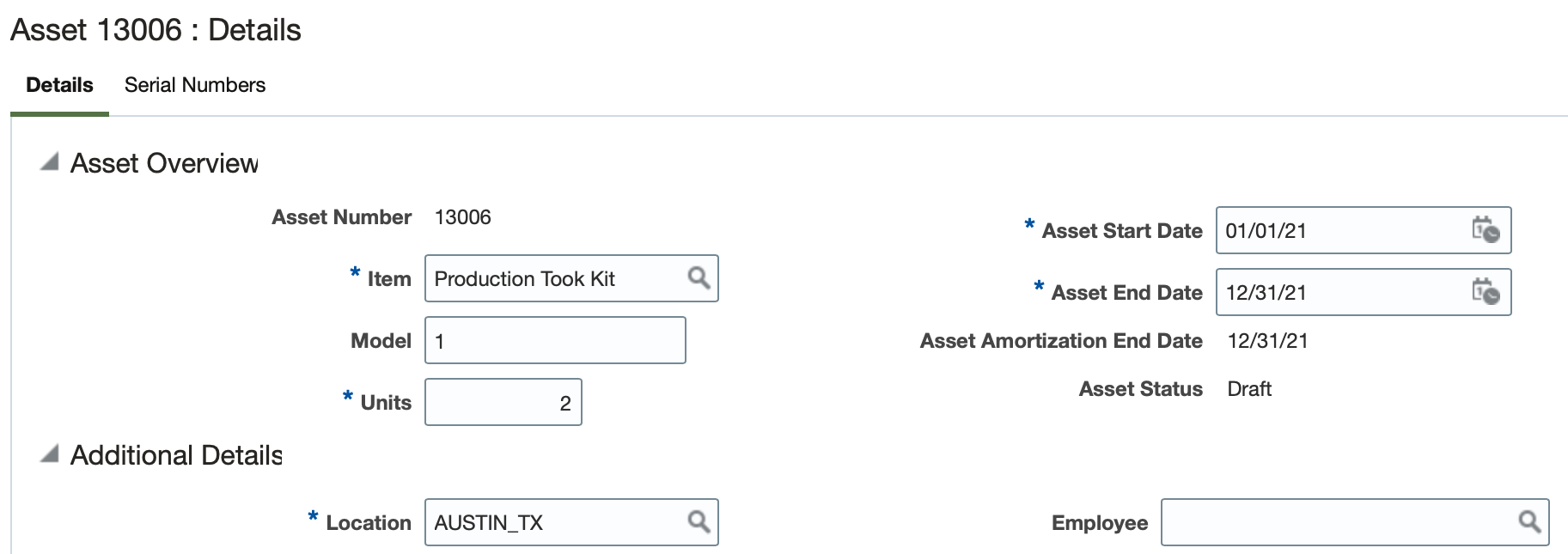

The asset start and end date are key attributes of the lease. When the asset life is less than the lease term, the Right-of-Use amortization for the equipment is through the asset life rather than the lease term. This amortization calculation is necessary because all assets on the lease may not have the same useful life, and the options on the lease may not pertain to all assets. Lease administrators can update asset end dates and associate options to assets.

Asset Start and End Date Available on Asset Overview

Business benefits include:

- Reduce lease administration effort by supporting multiple assets with different useful lives on the same lease.

- Maximize the benefits of each asset with options at the asset level.

Steps to Enable

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Financials

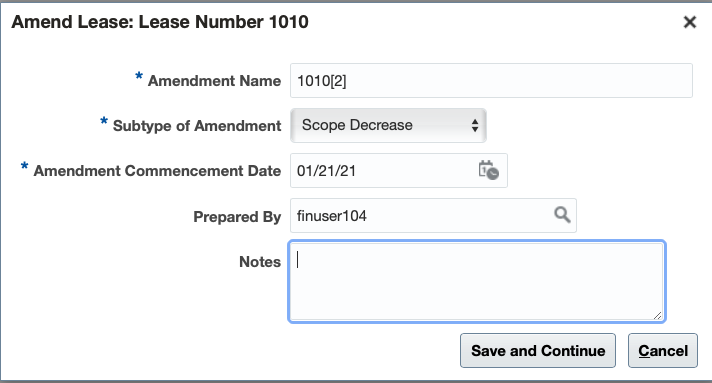

Lease Amendments for Scope Decreases

Perform amendments on a lease to modify payment amounts and shorten lease terms. Amendments include creating a new version of the lease, adjusting the accounting balances for the lease, and maintaining an audit of the changes.

Amendment for Scope Decrease

Business benefits include:

- Reduce time and effort to perform a contract amendment.

- Improve controls with a complete audit history of lease amendments.

- Better transparency with access to prior version of the lease.

- Automate accounting for adjustment to Right-of-Use and Liability balances.

Steps to Enable

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Financials

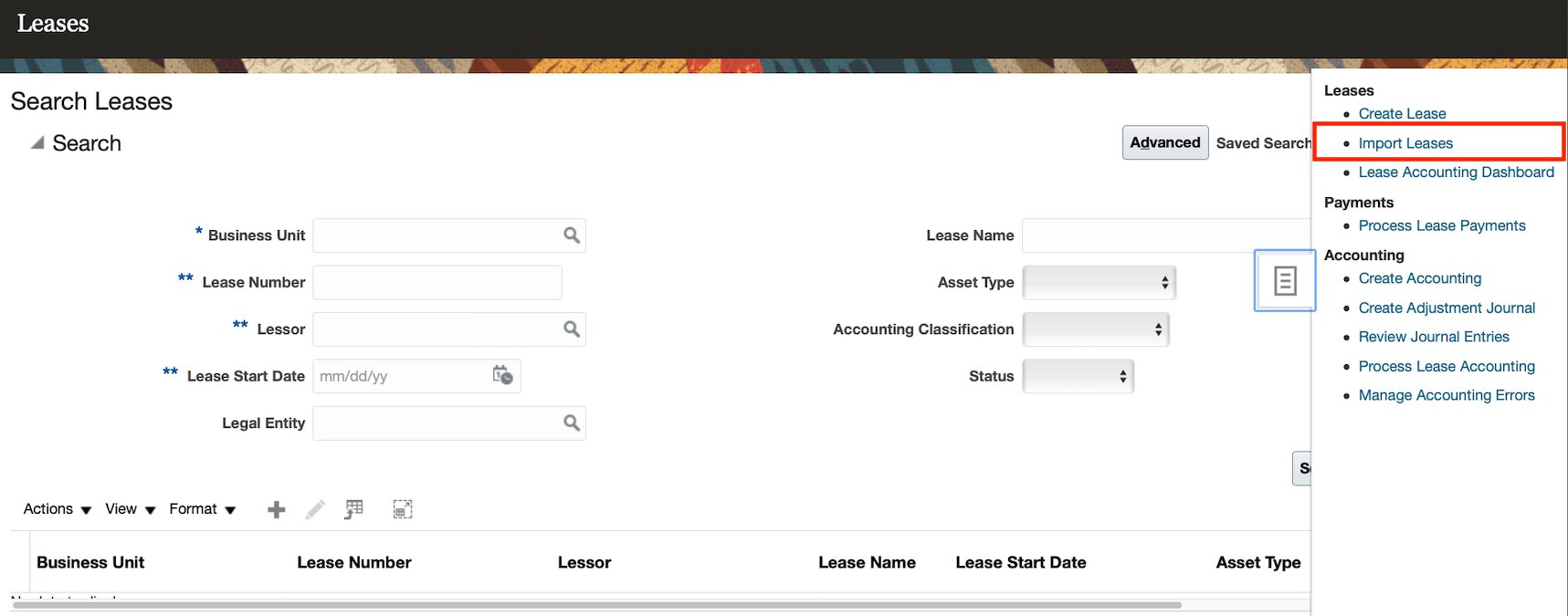

Lease Contract Import and Conversion

Use the Lease Import utility to simplify both lease conversions and new lease creation. The Lease Import utility removes or reduces the need for manual intervention during the lease creation process. Import a batch of leases directly into the desired status: Draft, Validated, Complete, or Booked. Additional attributes for converted leases support the calculation and amortization of Liability and Right-of-Use balances mid-life.

Import Lease Option

Business benefits include:

- Reduce data entry effort with a lease import.

- Streamline business processes by populating Lease Accounting import from origination systems.

- Reduce ROI and implementation time with functionality to migrate existing portfolios.

Steps to Enable

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Financials

Tips And Considerations

The steps to import agreements follow standard import procedures.

- Create leases in an FBDI spreadsheet template. This method is useful when there is a large volume of leases to create. Help text exists for each column to explain what to enter, what is required, and the field type.

- The FBDI spreadsheet converts the data to a zip file for the File Import process. You then load the file to the lease interface table. The final step is to run the Import Lease process. The Import Lease process imports the leases from the interface table to the Lease Accounting module. Leases are visible in the Lease Accounting module after this process completes.

- The Lease Dashboard includes exceptions or errors.

Key Resources

- To access the Lease Accounting FBDI template, please refer to My Oracle Support.

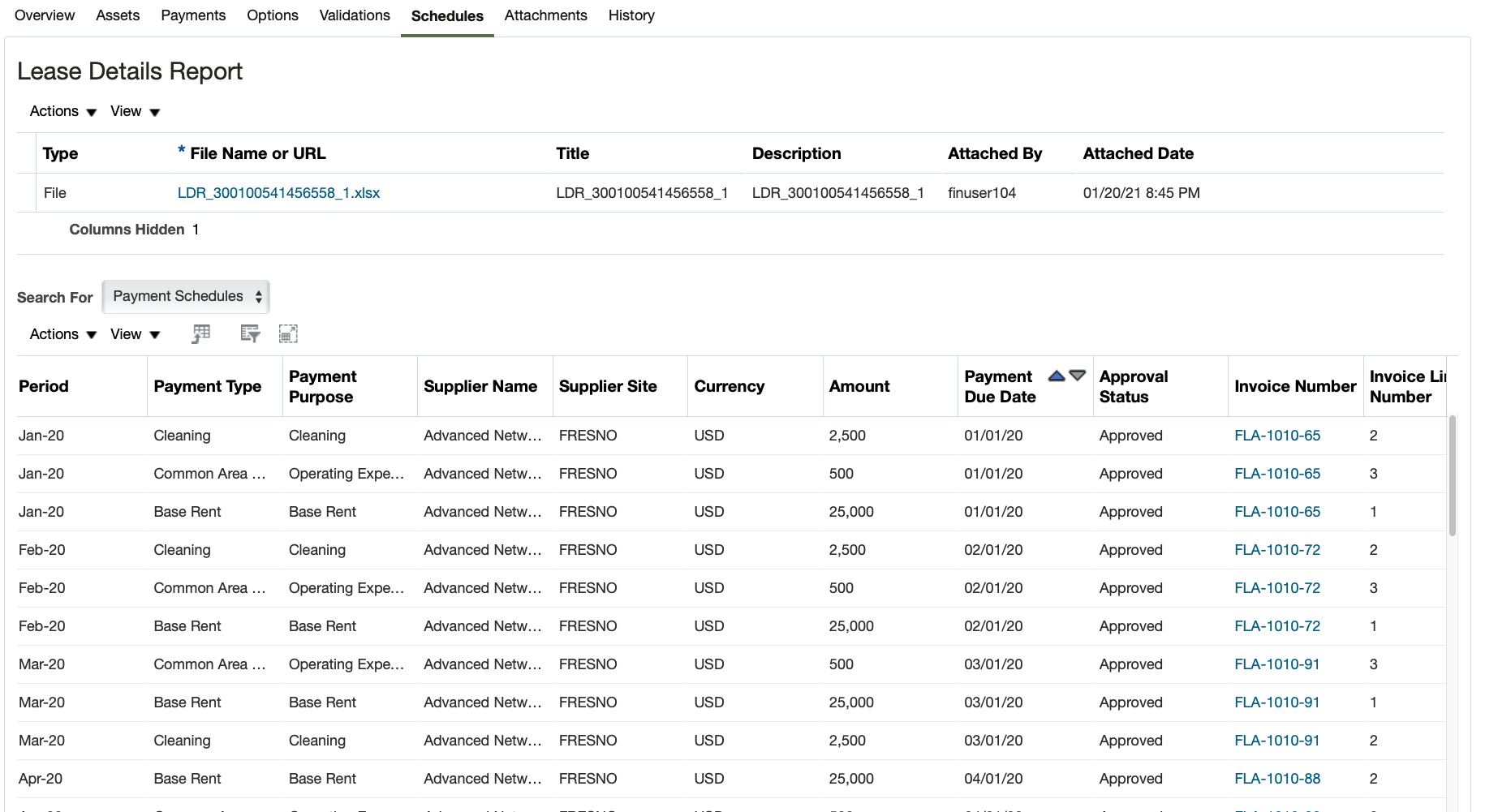

Create lease invoices automatically in Payables for payment processing. Lessees can pay their lessors and other parties associated with their leases each period for rent, service, insurance, common area maintenance charges, or other amounts included in the leases.

Payment Schedule with Payables Invoice Number Reference

Business benefits include:

- Increase control of payments to lessors by authorizing and paying only approved amounts from the lease.

- Reduce effort to pay lessors through automated integration with the Oracle Payables module.

- Improve transparency with Payables invoices initiated from Lease Accounting visible on the lease.

Steps to Enable

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Financials

Tips And Considerations

Customers can choose to opt out of Lease Payment Processing for a particular business unit by setting the system option Payables Integration to No for that business unit. This option suppresses any processing of payments to Payables from Lease Accounting for that specific Business Unit.

The Process Lease Payment process provides the ability to:

- Limit transfer of payments to one lease only, payments within a specific range of dates, a particular supplier and supplier site, payment type, and payment purpose.

- Launch Payables Invoice Import as part of the lease process.

- Put payments on hold and subsequently release the hold.

The invoice number is available on the Schedule tab for a lease after the payment interface to Payables.

Any exceptions that need action are available on the Lease Accounting dashboard.

Configurable Payables Workflow Notifications

Configurable Payables Workflow notifications use Oracle Business Intelligence templates to generate the email and in-app notifications. You can modify the notifications to display information based on your business requirements and policies. Choose from a comprehensive list of attributes to modify the notifications in accordance with your requirements. You can change both layout and content - add images, change colors and styling, add or remove attributes or modify text.

In update 21B, the following additional attributes are available in the Invoice Approval Data Model.

- Invoice Header Descriptive Flexfield

- Invoice Header Global Descriptive Flexfield

- Invoice Line Global Descriptive Flexfield

- Invoice Distribution Global Descriptive Flexfield

Use these attributes when modifying the Invoice Approval, Hold Resolution and Invoice Account Coding workflow notifications in accordance with your business requirements.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

- The descriptive flexfield and global descriptive flexfield attributes are available as raw attributes. For example, the invoice line global descriptive flexfield attributes are available as 'INVL_GLOBAL_ATTRIBUTE1', 'INVL_GLOBAL_ATTRIBUTE2' and so on. When modifying the notification report to use these attributes, remember to use the appropriate labels.

- The templates used to generate workflow notifications are located in the Reports and Analytics work area under the Shared Folders > Financials > Workflow Notifications folders in the Oracle Business Intelligence catalog.

-

A single template is used to generate both the email and in-app notifications for a particular workflow. Any modifications that you make to the predefined template, will be reflected in both email and in-app notifications for the workflow.

-

For additional tips and considerations, click here.

Key Resources

- Configuring Payables Workflow Notifications topic on the Oracle Help Center.

Role Information

Financial Application Administrator is required to modify the workflow notifications.

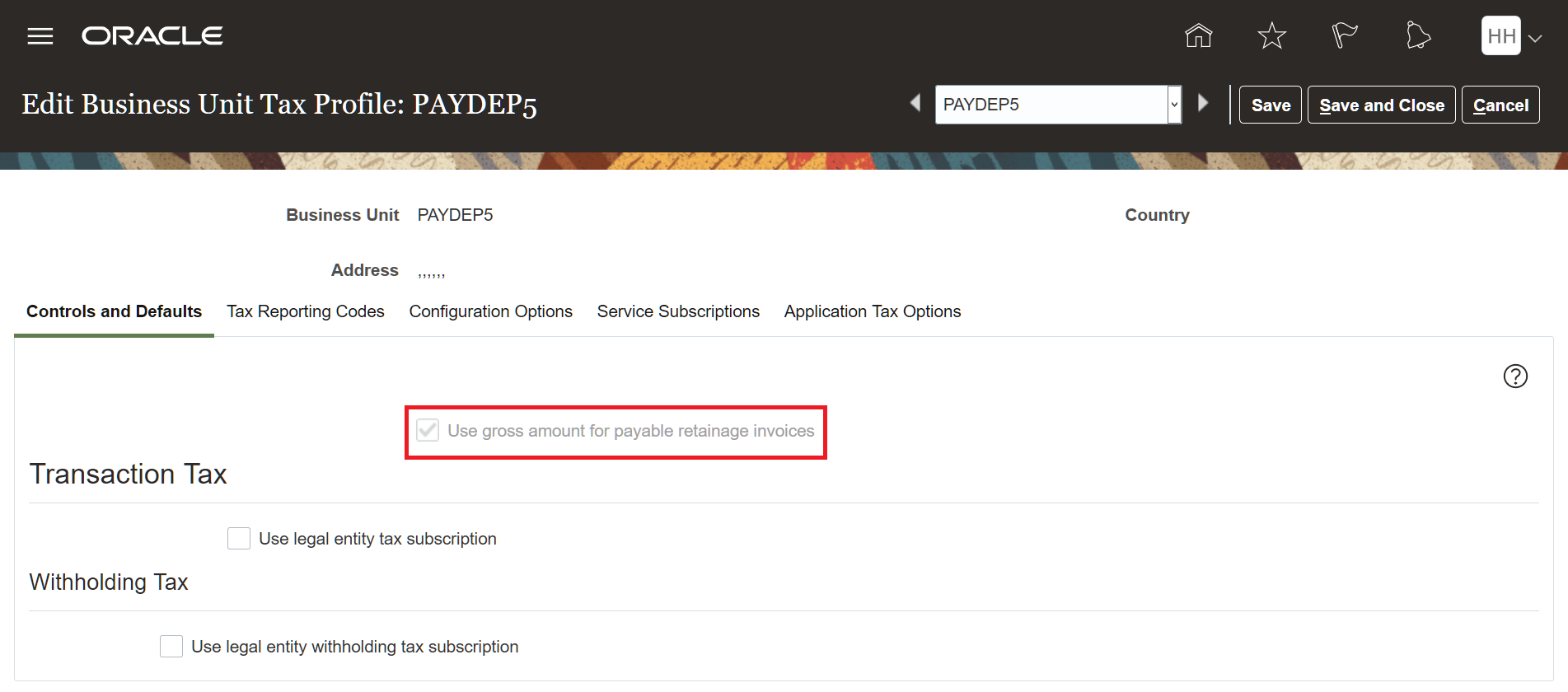

Creation and Management of Supplier Invoices with Retainage Payment Terms

In addition to calculating taxes on the net line amount (after deducting retainage) of Payables invoices, you can also calculate taxes on the gross amount. The gross amount is the amount of the line without deducting the retainage.

The Retainage feature was introduced in update 21A. In update 21A, the taxes were calculated on the net line amount, i.e., the line amount after deducting the retainage amount.

In update 21B, you can calculate taxes on the gross line amount for Payables invoices with retainage.

RETAINAGE RELEASE INVOICES

Since the taxes are calculated on the full (i.e., gross) amount on Payables standard invoices, there would be no taxes calculated on Payables retainage release invoices.

Additional details for the main feature in 21A are available here.

This feature enables companies to calculate the transaction taxes and the invoice time withholding on the full invoice amount on Payables standard Invoices, without calculating transaction taxes and invoice time withholding Payables retainage release invoices.

Steps to Enable

- Create the Lookup Type and Lookup Code:

Task – Manage Standard Lookups

Lookup Type – ZX_OPTIN_OPTIONS

Meaning – ZX_OPTIN_OPTIONS

Description – ZX_OPTIN_OPTIONS

Module – Tax

Lookup Configuration Level – User

REST Access Secured – Secure

Under this Lookup Type, create the Lookup Code with the following details:

Lookup Code – ZX_21B_OI_GROSS_RET

Display Sequence – 1

Enabled – Checked (Yes)

Start Date – <start date of the choice>

Meaning – ZX_21B_OI_GROSS_RET

Description – ZX_21B_OI_GROSS_RET

Lookup Code Setup

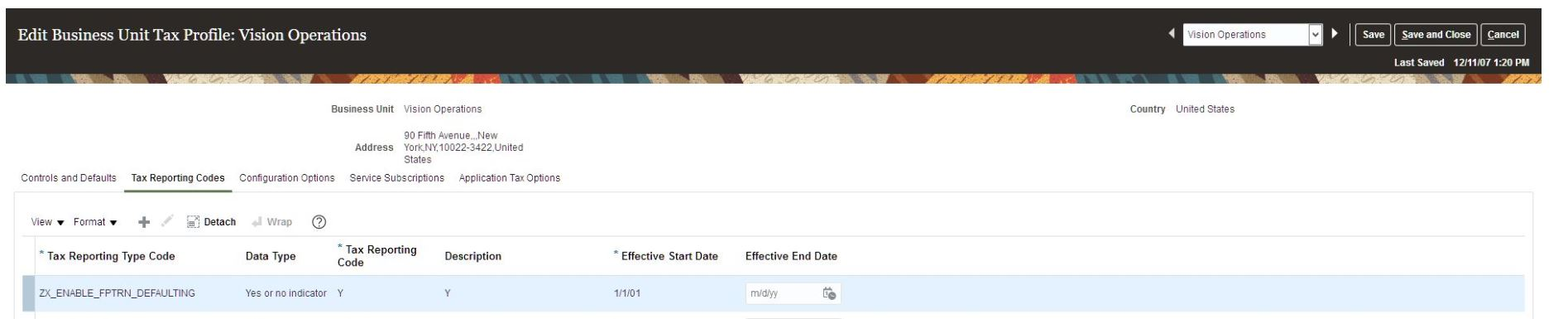

- Enable the 'Use gross amount for payable retainage invoices' option at the Party Tax Profile of the Business Unit or Legal Entity

Task – Manage Party Tax Profile

BU PTP Setup

NOTE: This setup is irreversible. Once this option is checked, it can’t be reverted back.

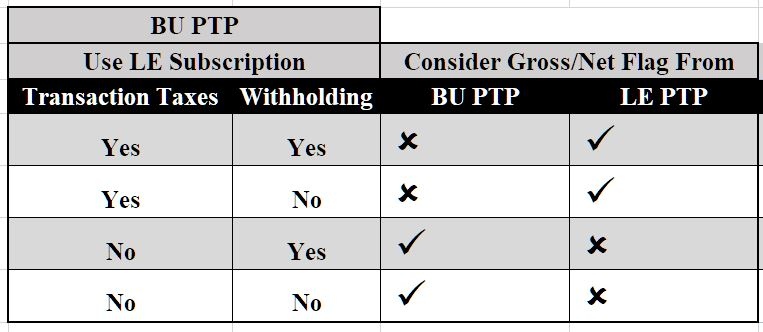

Tips And Considerations

-

The Tax Engine uses the setting for 'Use gross amount for payable retainage invoices' at the LE or BU, depending on whether the 'Use legal entity subscription' is checked or not for the BU for Transaction Taxes. The 'Use legal entity subscription' setting for Withholding is ignored. This is described in the table below.

BU or LE Level Flag to Be Considered

-

If the 'Use gross amount for payable retainage invoices' is enabled, then the transaction taxes and the invoice time withholding will be calculated on the gross amount. If this flag is not enabled, then the transaction taxes and the invoice time withholding will be calculated on the net amount.

-

Payment time withholding is always calculated on the payment amount for both Payables standard invoices and Payables retainage release invoices. (The 'Use gross amount for payable retainage invoices' is ignored for Payment time withholding)

-

Retainage with the Net amount option is supported for the Partner enabled tax calculation. Retainage with the Gross amount option is currently not supported for the Partner enabled tax calculation.

Data Security for Collaboration Documents

Secure access to business-to-business (B2B) messages in Collaboration Messaging Framework work area based on the user's job role. The documents Credit Note and Invoice Rejection can be viewed only by users having job roles Accounts Payable Manager, Accounts Payable Supervisor and Accounts Payable Invoice Supervisor.

- Secures B2B messages based on the user's job roles. For example, Supplier Invoices, Credit Notes and Invoice Rejection can be viewed only by Payables users.

- Improves usability since documents unrelated to user's job roles are not visible.

- Eliminates errors due to users from one process flow accidentally taking action on documents related to other business flows.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

If you want to set up a single user for access to all B2B messages, you can assign the role B2B Administrator (ORA_CMK_B2B_ADMINISTRATOR_ABSTRACT) to the user.

Role Information

- Accounts Payable Supervisor

- Accounts Payable Manager

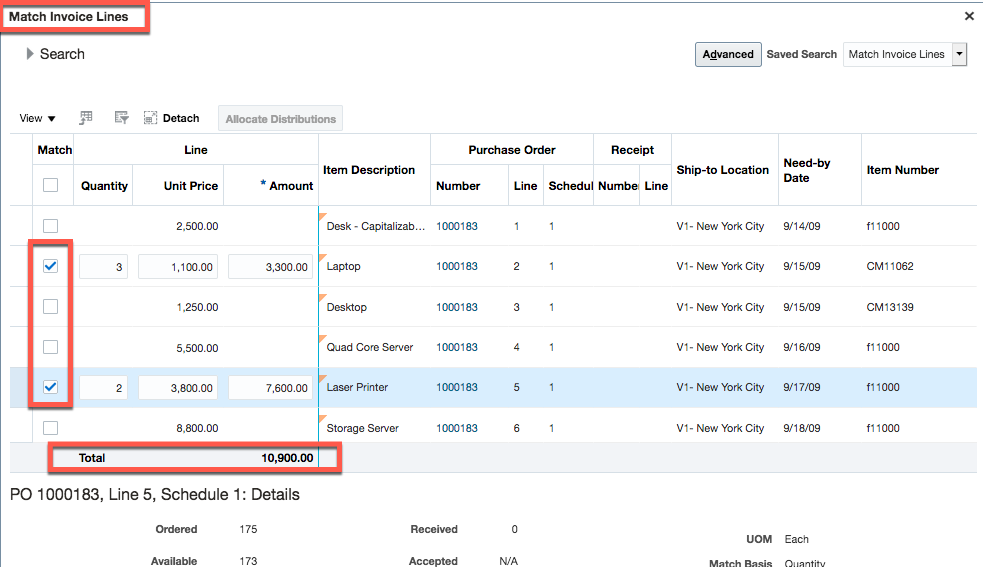

Display of Cumulative Total Amount for Selected Lines in the Match Invoice Lines Page

View the cumulative total amount of the selected purchase order schedules in the Match Invoice Lines page.

Amount Total for Selected Lines

While matching invoice lines with purchase orders that have a large number of shipments, Accounts Payables Specialists can use cumulative total to verify the value of the lines selected for matching with the physical invoice and reduce data entry errors.

Steps to Enable

You don't need to do anything to enable this feature.

Supplier Invoice Import with Requester Email Address

Specify the requester email address instead of the requester name when creating supplier invoices using the Import Payables Invoices process. This improves the process of identifying the correct requester details, because multiple users can have the same requester name.

This feature is supported for invoices created through FBDI and ADFDI. It is supported even in the correction spreadsheet to allow corrections for rejected invoices.

Because every user has a unique email address, the Import Payables Invoices process can more accurately identify the invoice requester using the email address instead of the first and last name. This reduces the number of invoice rejections due to the inability to find a unique invoice requester.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

Requester details are assigned to the invoice header and invoice lines from the following columns in the Payables invoice interface table: Requester ID, Employee Number, Email address, First Name and Last Name. The application searches for requester information in the table columns using this hierarchy:

- Requester ID

- Requester Employee Number

- Requester Email Address

- Requester First Name and Requester Last Name

The application assigns the first column with requester information to the invoice header. For example, the application first looks for requester information in the Requester ID column. If no data is found, the application then looks in the Requester Employee Number column. If this column contains requester information, the application assigns this information to the invoice. The application performs the same search to assign requester information to each invoice line. If invoice line does not contains requester information, the requester information on the invoice header is assigned to the invoice lines.

Note: If the information in the table column that is assigned to the invoice or an invoice line turns out to be invalid, the invoice is rejected without a further search for requester information from other columns.

Role Information

Users with access to create Payables invoices will be to use this feature. Following seeded roles provide access users to create Payables invoices.

- Accounts Payable Supervisor

- Accounts Payable Specialist

Creation of All Payment Files in One Payment Batch Without User Intervention

Create and complete all the payment files in an electronic payment batch automatically when it is submitted with a payment document and results in multiple payment files. Payment supervisors can seamlessly process multiple electronic payment files in a payment batch without submitting the format payment files job for each payment file manually.

Prior to update 21B, a payment batch submission only created the first payment file automatically. It was necessary to generate the remaining files manually by submitting the format payment files job for each file. Now, when multiple payment files are generated as a result of submitting an electronic payment batch with payment document, all payment files will be generated automatically, without any user intervention.

Steps to Enable

You don't need to do anything to enable this feature.

Channel Revenue Management Integration with Receivables for Claim Creation and Settlement for Receipts Created Using Spreadsheet or SOAP Services

Initiate claims in Channel Revenue Management for receipts created using spreadsheet and SOAP services, when Receivables customers make invoice-related and non-invoice related underpayments and overpayments. Accelerate claim processing to quickly settle underpayments and overpayments, including processing all settlement-related financial transactions. Receipts created using a spreadsheet and receipt applications performed using the Apply Receipts Using AutoMatch Process can now create claims in Channel Revenue Management for invoice-related underpayments and non-invoice related overpayments.

ENHANCEMENTS TO THE RECEIPTS CREATED USING SPREADSHEETS OR CREATE RECEIPT PAGE AND APPLICATION PROCESSED USING APPLY RECEIPTS USING AUTOMATCH PROCESS

The feature provides the following functionality for creation of invoice-related and non-invoice related underpayments and overpayments: