- Revision History

- Overview

- Optional Uptake of New Features (Opt In)

- Feature Summary

- Collaboration Messaging Framework

- Financials Common

- Accounting and Control

-

- Budgetary Control

- General Ledger

- Intercompany

- Joint Venture Management

-

- Attachments for Joint Venture Definitions and Partner Contributions

- Joint Venture Account Sets

- Joint Venture Invoices for Paid Expenses

- Original Ownership Definition Start and End Date Display for Rebill Distributions

- Overhead Methods with Direct Bill Partner Option

- Percentage of Cost Joint Venture Overhead Method Based Upon General Ledger and Subledger Transactions

- Receivable Code Combination Default for Joint Venture Receivables Invoices

-

- Payables and Expenses

- Receivables and Cash

- Asset and Lease Management

- Region and Country-Specific Features

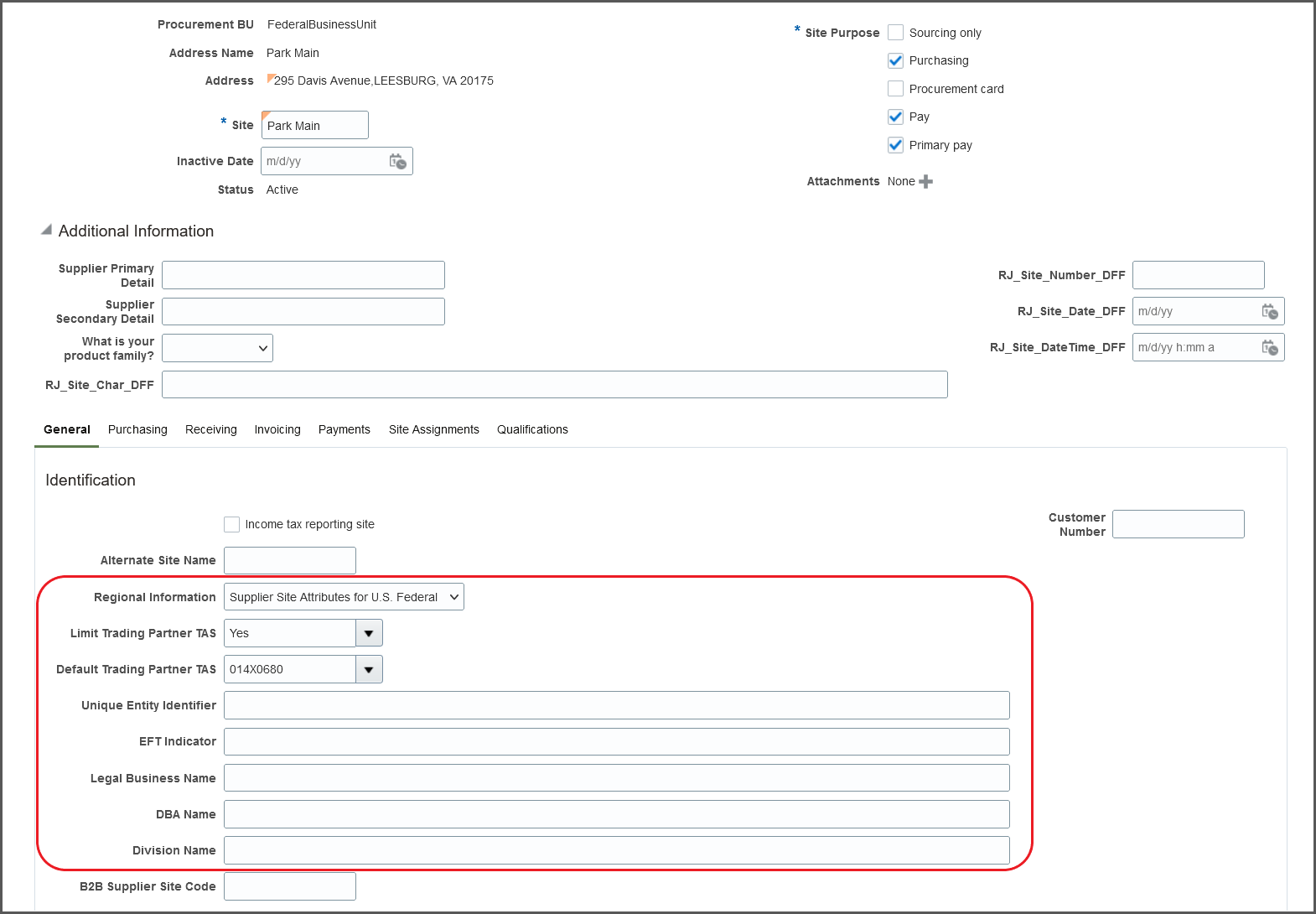

- U.S. Federal Financials

- Financials-Pre 21D

This document will continue to evolve as existing sections change and new information is added. All updates appear in the following table:

| Date | Module | Feature | Notes |

|---|---|---|---|

| 28 OCT 2022 | Collections | Start and End Time Display of Collections Strategies and Strategy Tasks | Updated document. Revised feature information. |

| 14 MAR 2022 | Expenses | Access to Digest Notification for Expense Delegates | Updated document. Revised feature information. |

| 01 MAR 2022 | U.S. Federal Financials | U.S. Federal SPS Summary Schedules | Updated document. Added Steps to Enable. |

| 25 JAN 2022 | Financials Common | Service Excellence Continuing Investments | Updated document. Revised feature information. |

| 13 JAN 2022 | Oracle Digital Assistant | Oracle Enterprise Performance Management Financial Consolidation and Close Skill in Digital Assistant for Fusion Applications | Updated document. Delivered feature in update 22A. |

| 10 DEC 2021 | Created initial document. |

HAVE AN IDEA?

HAVE AN IDEA?

We’re here and we’re listening. If you have a suggestion on how to make our cloud services even better then go ahead and tell us. There are several ways to submit your ideas, for example, through the Ideas Lab on Oracle Customer Connect. Wherever you see this icon after the feature name it means we delivered one of your ideas.

GIVE US FEEDBACK

We welcome your comments and suggestions to improve the content. Please send us your feedback at oracle_fusion_applications_help_ww_grp@oracle.com.

DISCLAIMER

The information contained in this document may include statements about Oracle’s product development plans. Many factors can materially affect Oracle’s product development plans and the nature and timing of future product releases. Accordingly, this Information is provided to you solely for information only, is not a commitment to deliver any material, code, or functionality, and should not be relied upon in making purchasing decisions. The development, release, and timing of any features or functionality described remains at the sole discretion of Oracle.

This information may not be incorporated into any contractual agreement with Oracle or its subsidiaries or affiliates. Oracle specifically disclaims any liability with respect to this information. Refer to the Legal Notices and Terms of Use for further information.

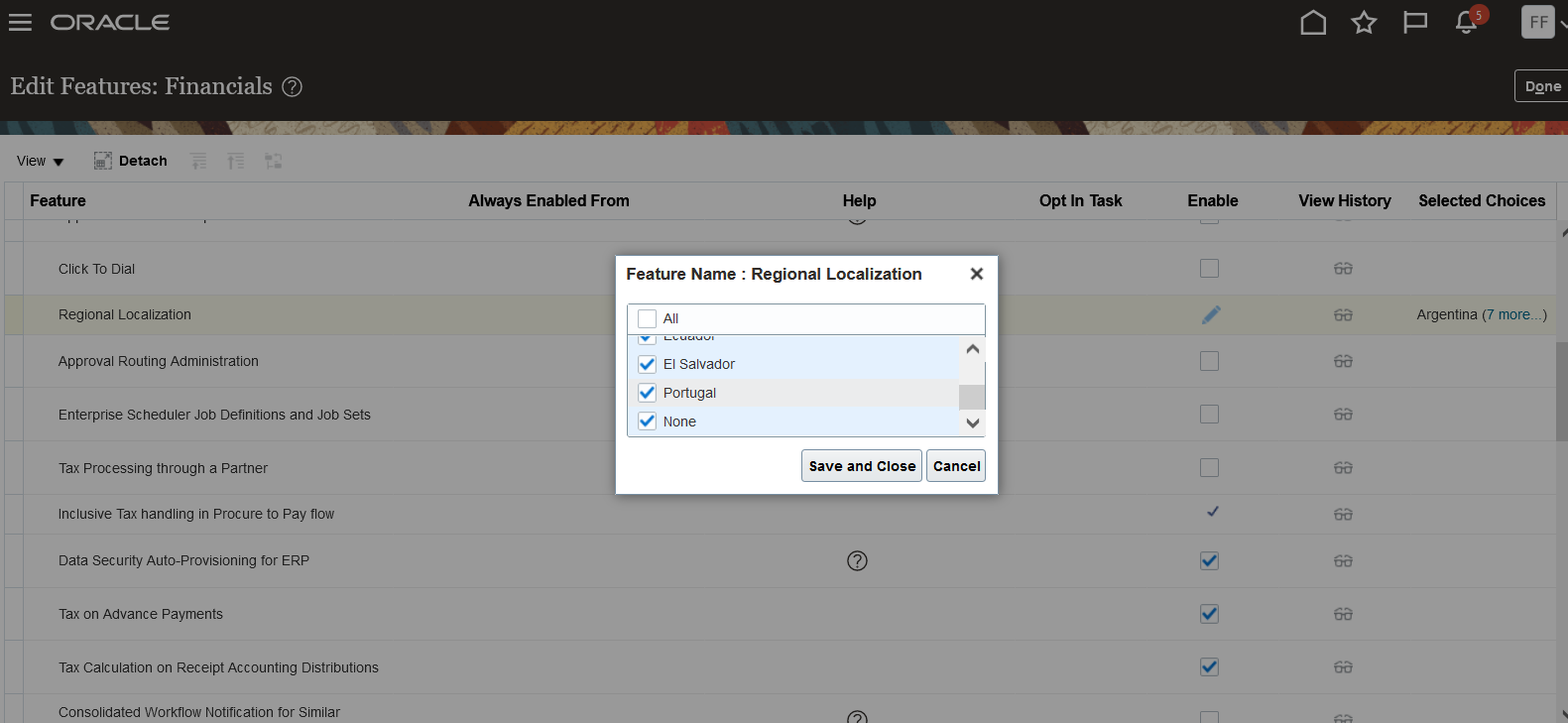

Optional Uptake of New Features (Opt In)

Oracle Cloud Applications delivers new updates every quarter. This means every three months you'll receive new functionality to help you efficiently and effectively manage your business. Some features are delivered Enabled meaning they are immediately available to end users. Other features are delivered Disabled meaning you have to take action to make available. Features delivered Disabled can be activated for end users by stepping through the following instructions using the following privileges:

- Review Applications Offering (ASM_REVIEW_APPLICATIONS_OFFERINGS_PRIV)

- Configure Oracle Fusion Applications Offering (ASM_CONFIGURE_OFFERING_PRIV)

Here’s how you opt in to new features:

- Click Navigator > My Enterprise > New Features.

- On the Features Overview page, select your offering to review new features specific to it. Or, you can leave the default selection All Enabled Offerings to review new features for all offerings.

- On the New Features tab, review the new features and check the opt-in status of the feature in the Enabled column. If a feature has already been enabled, you will see a check mark. Otherwise, you will see an icon to enable the feature.

- Click the icon in the Enabled column and complete the steps to enable the feature.

In some cases, you might want to opt in to a feature that's not listed in the New Features work area. Here's how to opt in:

- Click Navigator > My Enterprise > Offerings.

- On the Offerings page, select your offering, and then click Opt In Features.

- On the Opt In page, click the Edit Features (pencil) icon for the offering, or for the functional area that includes your feature.

- On the Edit Features page, complete the steps to enable the feature.

For more information and detailed instructions on opting in to new features for your offering, see Offering Configuration.

Opt In Expiration

Occasionally, features delivered Disabled via Opt In may be enabled automatically in a future update. This is known as an Opt In Expiration. If your cloud service has any Opt In Expirations you will see a related tab in this document. Click on that tab to see when the feature was originally delivered Disabled, and when the Opt In will expire, potentially automatically enabling the feature. You can also click here to see features with Opt In Expirations across all Oracle Cloud Applications.

Column Definitions:

Report = New or modified, Oracle-delivered, ready to run reports.

UI or Process-Based: Small Scale = These UI or process-based features are typically comprised of minor field, validation, or program changes. Therefore, the potential impact to users is minimal.

UI or Process-Based: Larger Scale* = These UI or process-based features have more complex designs. Therefore, the potential impact to users is higher.

Features Delivered Disabled = Action is needed BEFORE these features can be used by END USERS. These features are delivered disabled and you choose if and when to enable them. For example, a) new or expanded BI subject areas need to first be incorporated into reports, b) Integration is required to utilize new web services, or c) features must be assigned to user roles before they can be accessed.

Collaboration Messaging Framework

Collaboration Messaging Framework

Receive Order Forecasts from Customers

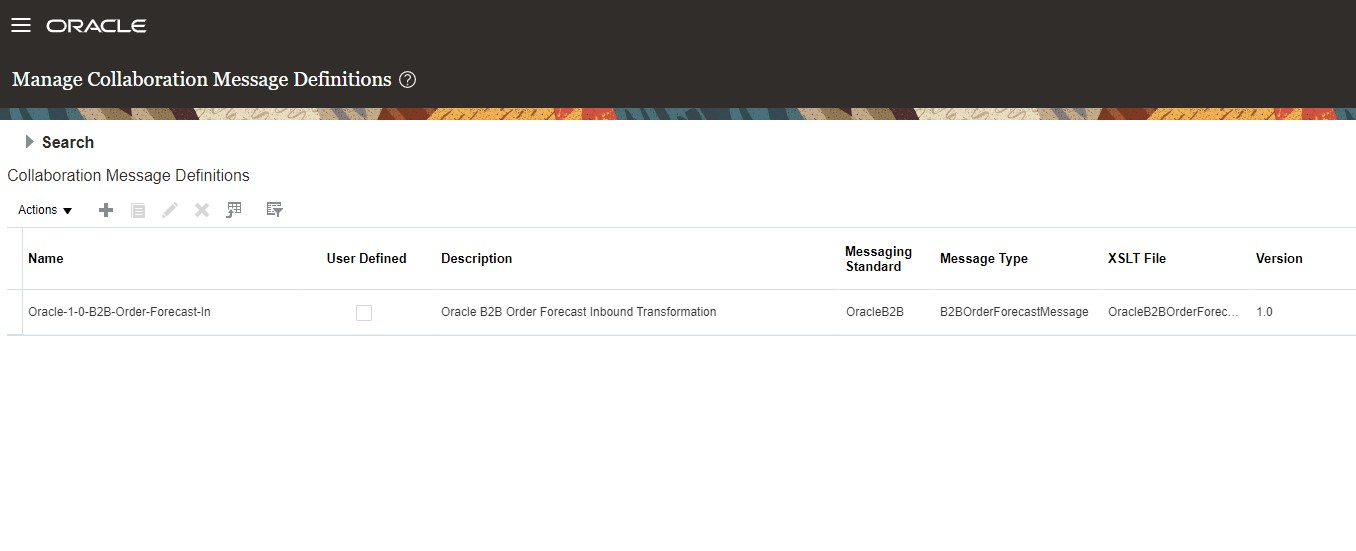

Use the new predefined message definition Oracle-1-0-B2B-Order-Forecast-In to receive an order forecast message from your customers and use it for your organization’s demand planning.

Enable the Customer Collaboration business process to allow the Order Forecast – Inbound document to be exchanged. Then associate it with a customer in the Manage Customer Collaboration Configuration task.

Set up this message definition as an inbound collaboration message for a trading partner and then associate the trading partner and Order Forecast- Inbound document with a customer using the Manage Customer Collaboration Configuration task.

After the message is received and transformed, a compressed file is placed in Oracle WebCenter Content and processed by the Collaboration Customer Demand Uploads resource.

Oracle-1-0-B2B-Order-Forecast-In Message Definition

Increase the accuracy of your organization's demand plan by allowing customers to share their order forecast data using a B2B XML message.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

- Configuring and Managing B2B Messaging for Oracle Applications Cloud guide available on the Oracle Help Center.

Role And Privileges

You have a couple of options for giving people access to this feature, depending on whether you're assigning them predefined job roles or your own configured job roles.

- Users who are assigned any of these predefined job roles can access this feature:

- B2B Administrator (ORA_CMK_B2B_ADMINISTRATOR)

- Supply Chain Application Administrator (ORA_RCS_SUPPLY_CHAIN_APPLICATION_ADMINISTRATOR_JOB)

- Users who are assigned a configured job role that contains this privilege can access this feature:

- Manage Customer Demand as Customer User (VCS_MANAGE_CUSTOMER_DEMAND_CUSTOMER_PRIV)

Service Excellence Continuing Investments

Our ongoing investment in service excellence has a focus on overall usability, resiliency, performance, and security.

This work is based on monitoring performance trends, reviewing common use patterns, analyzing service requests, and participating in many discussions with customers.

In this update, our ongoing investment in service excellence includes improvements in the following areas:

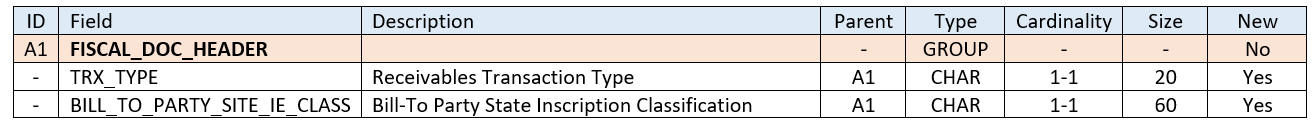

- Resiliency and diagnostic improvements to the collection documents process for Brazil, including:

- standardization of FBDI column descriptions to align with UI labels

- diagnostic enhancements for FBDI import processes

- improved troubleshooting and resolution of errors through improved error messages

- Resiliency and diagnostic improvements to the fiscal document generation process for Brazil, including:

- automatic resolution of certain error statuses

- inclusion of the Receivables transaction type in the fiscal document extract for partners

- improved customer experience

-

Payables invoice attachments added through IPM are available to approvers in workflow notifications by default.

-

Manually created withholding invoices are routed for approvals.

Steps to Enable

You don't need to do anything to enable this feature.

Oracle Enterprise Performance Management Financial Consolidation and Close Skill in Digital Assistant for Fusion Applications

You can now use the Oracle Enterprise Performance Management Financial Consolidation and Close skill from within Fusion to do these tasks:

- View and update consolidation data.

- Start consolidation jobs directly within the digital assistant.

- View task summary and status.

The integrated Financial Consolidation and Close skill can be used in Oracle Web channel or Microsoft Teams.

NOTE: The Financial Consolidation and Close skill is supported only when the EPM instance is deployed on an Oracle Cloud Infrastructure second-generation (Gen 2) cloud environment.

You can now quickly view the EPM close status along with pending tasks and consolidate data directly within the digital assistant configured for Fusion Applications. This enables faster coordination among teams managing the Financial Consolidation and Close process, without needing to access the EPM business processes directly.

Steps to Enable

- Configure authentication parameters for Financial Consolidation and Close Skill in the Oracle Digital Assistant instance.

- Extend your configured digital assistant and the Financial Consolidation and Close skill.

- Configure the entities and train the extended skill to reflect your data.

- Replace the default skill with the extended skill and train the digital assistant.

- Integrate the digital assistant with Oracle Web channel or Microsoft Teams.

Key Resources

Role And Privileges

- To set the Financial Consolidation and Close skill in the digital assistant platform, you need a role that provides administrator access to the platform.

- To use the Financial Consolidation and Close skill in your digital assistant, you need a role that provides access to Oracle Enterprise Performance Management Financial Consolidation and Close.

Collections Strategy Change Using a REST API

Change collections strategies assigned to customers using the Collections Strategies REST API.

Use the Collections Strategies REST API to replace the existing strategy assigned to a customer with a new strategy:

- Use POST operation to update the attribute "Change Strategy" to the value 'Y' using the Collections Strategy REST API. When Change Strategy value 'Y' is passed then the value of "Allow Strategy Change" is ignored in the exiting strategy group setup and replace with new strategy .

You can view details about these services in the REST API for Oracle Financials Cloud guide.

Business Benefits include:

- Change the existing strategy for a customer at any time, according to you business requirements.

Steps to Enable

Review the REST service definition in the REST API guides, available from the Oracle Help Center > your apps service area of interest > REST API. If you're new to Oracle's REST services you may want to begin with the Quick Start section.

Key Resources

- For an overview of REST APIs and the technical details, see the REST API for Oracle Financials Cloud guide in the Oracle Help Center.

Customer Dispute Submission for Transaction Header Sections Using a REST API

Submit customer disputes for any part of a transaction using the Receivables Dispute REST API. Specify the sections of the transaction to dispute: total percentage; lines subtotal; freight; tax. Add related comments about the dispute. The REST API also initiates the delivery of dispute confirmation to the customer after the credit memo approval workflow is approved.

You can use this service to register disputes in Receivables Cloud from external sources, and initiate the approval workflow to track them.

Steps to Enable

Review the REST service definition in the REST API guides, available from the Oracle Help Center > your apps service area of interest > REST API. If you're new to Oracle's REST services you may want to begin with the Quick Start section.

Tips And Considerations

This service also supports creation of disputes on one or more transaction lines against the quantity and/or line amount, which was delivered as part of the 21D update.

Key Resources

- For an overview of REST APIs and the technical details, see the REST API for Oracle Financials Cloud guide in the Oracle Help Center.

Enhancements to Receivables Transaction Interface Lines REST API

Review and update interface line attributes using the Receivables Transaction Interface Lines REST API.

You can review and update the following interface line attributes:

- Line Type

- Authorization Number

- Interface Line Status

You can audit any updates to interface lines that are made using the Receivables Transaction Interface Lines REST API. In the Manage Audit Policies page, enable the Interface Line Audit option to capture audit data.

You can view details about these services in the REST API for Oracle Financials Cloud guide."

Business Benefits include:

- Update AutoInvoice Interface data before importing invoices and other transactions.

- Create an audit trail to find the data mismatches between upstream and downstream products.

Steps to Enable

Review the REST service definition in the REST API guides, available from the Oracle Help Center > your apps service area of interest > REST API. If you're new to Oracle's REST services you may want to begin with the Quick Start section.

Key Resources

- For an overview of REST APIs and the technical details, see the REST API for Oracle Financials Cloud guide in the Oracle Help Center.

Role And Privileges

- You must create a new privilege access to use this feature:

- Create a new privilege for the Interface service

- Add the privilege to the user

Name: Manage Receivables AutoInvoice Interface Line via Rest Service

Code: AR_MANAGE_AUTOINVOICE_INTERFACE_LINE_REST_PRIV

Description: Retrieve and Update Auto Invoice Interface Lines via Rest Service.

Unpaid Reason Code Update Using a REST API

Update the unpaid reason code on collections delinquencies using the Collections Delinquencies REST API.

You can perform these activities using the Collections Delinquencies REST API:

- Get details of collections delinquencies

- Update the Unpaid Reason Code on collections delinquencies

- Create a collections delinquency record for an invoice to capture the unpaid reason code of the invoice.

By using the Collections Delinquencies REST API, you can update the unpaid reason code in bulk resulting in time and resource savings.

Steps to Enable

Review the REST service definition in the REST API guides, available from the Oracle Help Center > your apps service area of interest > REST API. If you're new to Oracle's REST services you may want to begin with the Quick Start section.

Key Resources

- For an overview of REST APIs and the technical details, see the REST API for Oracle Financials Cloud guide in the Oracle Help Center.

Simplified Workflow Rules Configuration

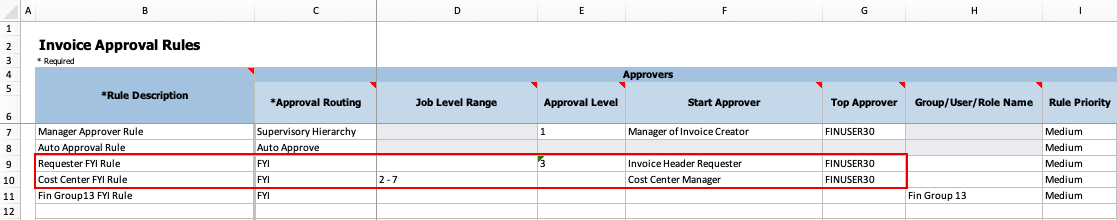

Use the Simplified Workflow Rules Configuration feature to create workflow rules using spreadsheets for Payables Invoice Approval and General Ledger Journal Approval workflows. This feature was introduced in update 18C. In update 22A, you can define rules to send FYI notifications to members of a Supervisory or Job Level hierarchy.

Use the FYI option in the Approval Routing column to define rules to send information-only notifications that do not require user action to approvers. Administrators can use this option to define rules to send FYI notifications to members of a Supervisory Hierarchy or Job Level Hierarchy.

FYI Rules in Simplified Workflow Rules Configuration Template

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

- Select the 'FYI' option in Approval Routing to configure rules to send information-only notifications to any of the following:

- Supervisory Hierarchy

- Job Level Hierarchy

- Approval Group

- User

- Role

- Enter details in the Approvers section as below:

Rout To Required Information in Approvers Section Supervisory Hierarchy Approval Level, Start Approver & Top Approver Job Level Hierarchy Job Level Range, Start Approver & Top Approver Approval Group Group/ User/ Role Name User Group/ User/ Role Name Role Group/ User/ Role Name

Key Resources

- For an overview of the Simplified Workflow Rules Configuration feature, refer to the Manage Workflow Rules Using a Spreadsheet topic on the Oracle Help Center.

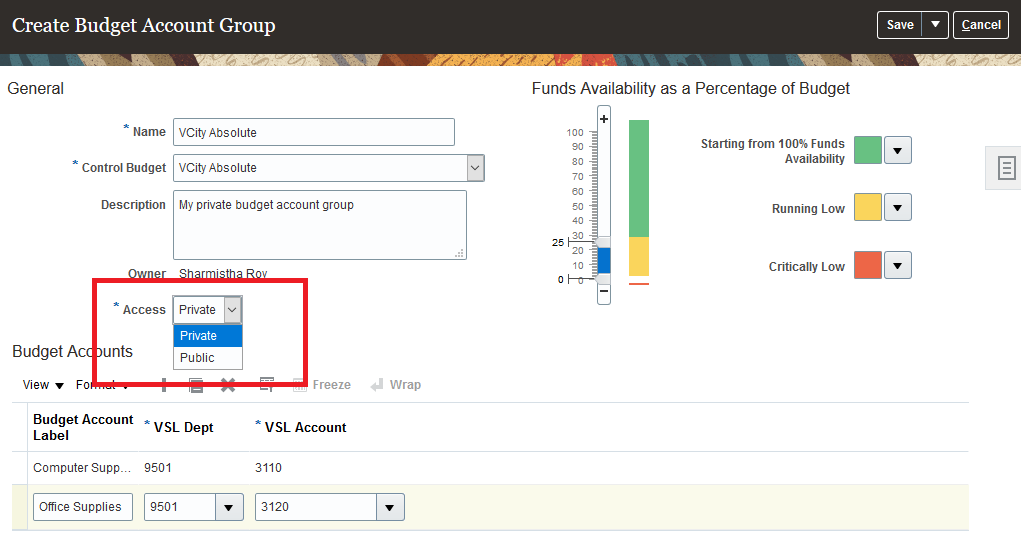

Ability to Create Private Budget Account Groups

Use the Budget Account Group page to create budget account groups to view budget accounts and balances that cannot be viewed by others.

Create a budget account group that you can use and share with your organization. Use private budget account groups for the budget accounts that you want to monitor. Use public budget account groups for budget accounts that your organization monitors.

Create Budget Account Group

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

- In the Budget Monitor all users can select public budget account groups.

- Upgrade customers:

- All existing budget account groups created in a prior release are public.

- The creator of a budget account group is the only user that can update its definition.

- The following two settings have moved from the Edit Budget Account Group page to the Manage Budget Accounts Groups page:

-

- Default in My Budget Monitor

- Display on My Infolet

Key Resources

- Budgetary Control Infolets in Oracle Financials Cloud Infolet and Work Area Guide

- Inquiry and Reporting in Using Financials for the Public Sector

Role And Privileges

- Budget managers can create or edit budget account groups for control budgets they have access to.

Budget Balances Synchronization from Budget Transfers in Both Budgetary Control and General Ledger

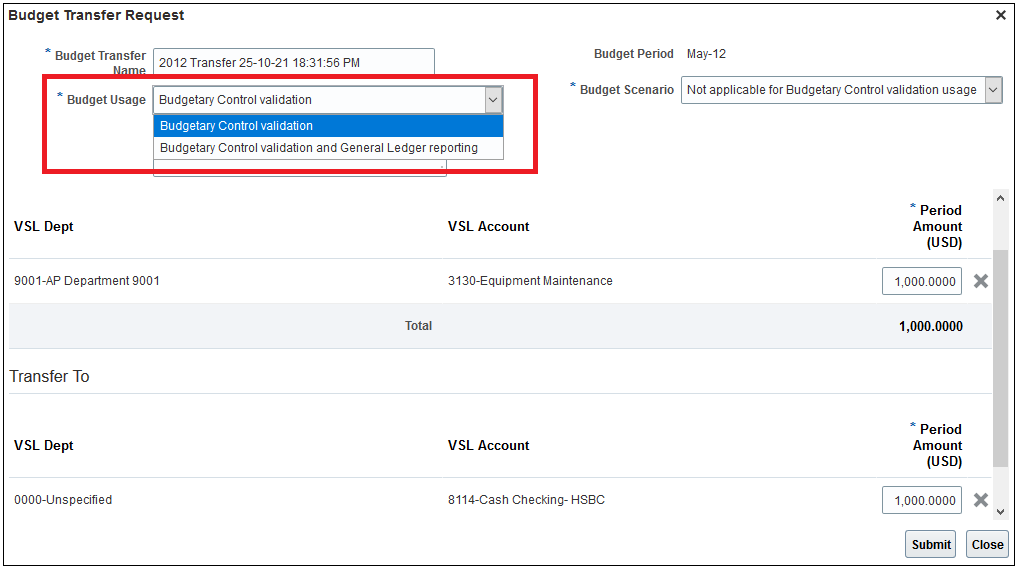

Enter budget transfers in the Review Budgetary Control Balances page and synchronize budget balances for both Budgetary Control validation and General Ledger query and reporting.

You can transfer budget and then simultaneously update the budget balances in both Budgetary Control and General Ledger. You can also continue to transfer budget in Budgetary Control and General Ledger separately.

Use the Budget Usage field in the Budget Transfer Request page to control the impact of budget data.

Budget Transfer Request

Steps to Enable

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Financials No Longer Optional From: Update 22C

Tips And Considerations

-

These are the opt-in defaults for your installation type:

Installation Type Opt In New customer Enabled Upgrade customer Disabled -

How to use this feature with Budget Transfer.

Select the Budgetary Control validation and General Ledger reporting budget usage parameter:

- To load budget simultaneously in Budgetary Control and General Ledger

- To specify a scenario member from the General Ledger Balances cube in which the budget is stored. Use the Define Budget Scenarios setup task to create and review existing scenarios. Submit the Create Scenario Dimension Members process to update General Ledger Balances cube with the new created scenario member.

Select the Budgetary Control Validation budget usage parameter:

- To load budget into Budgetary Control balances only.

- Other budget entry methods that synchronize budget balances to General Ledger available in prior releases:

- File-Based Data Import - no opt in. Use one of the processes below:

- Import Budget to Budgetary Control and General Ledger

- Import Budget Amounts (load budget amounts to Budgetary Control only)

- Validate and Upload Budgets (load budget amounts to General Ledger only)

- Enter Budgets in Spreadsheet – opt in to 21D feature, Budget Creation and Synchronization Using Spreadsheet for Both Budgetary Control and General Ledger. Use the budget usage parameter to select:

- Budgetary Control validation and General Ledger reporting

- Budgetary Control Validation

- Budget Revisions from Enterprise Performance Management are imported to both Budgetary Control and General Ledger.

- File-Based Data Import - no opt in. Use one of the processes below:

Key Resources

- Budget Transfers in Using Financials for the Public Sector.

Role And Privileges

- Budget Manager role is needed to access the Review Budgetary Control Balances page.

Budget Monitor Display of Accounts with Budget or Consumption Balances Only

Budget accounts without budget or consumption balances are not displayed as you drill down in the Budget Monitor.

Focus is on the budget accounts with budget balances or consumption balances. Budget accounts without budget and consumption balances aren’t displayed when drilling down on budget accounts in the Budget Monitor.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

Use Smart View if you want to see all budget accounts including those without budget or consumption balances.

Key Resources

- Inquiry and Reporting in Using Financials for the Public Sector

Role And Privileges

- Budget managers with control budget data access can access and drill down on balances in the Budget Monitor.

Review Budgetary Control Balances Page Personalization

Use personalizations to add or remove fields from the Review Budgetary Control Balances page default display.

Customize your view or your organization’s view of the Review Budgetary Control Balances page to create the user experience you prefer. Customizations are retained across sessions which enable you and your organization to focus on the data which matters.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

You can now customize columns in the Budget Balances region in Review Budgetary Control Balances page using the Page Composer tool.

Key Resources

- Overview of Using Page Composer in Configuring and Extending Applications

Role And Privileges

- Budget Manager role is needed to access Review Budgetary Control Balances page.

Chart of Accounts Mapping Segment Rules Using File-Based Data Import

Create and update chart of accounts mapping segment rules using a file-based data import template. This facilitates the creation and maintenance of a large number of segment mapping rules between primary and secondary ledger charts of accounts and other chart of accounts mapping requirements.

You can download the template from either the File-Based Data Import (FBDI) for Financials guide or the application.

To access the template from the FBDI guide:

- In the Oracle Help Center (http://docs.oracle.com), open the File-Based Data Import (FBDI) for Financials guide.

- In the table of contents, click General Ledger.

- Click Chart of Accounts Mapping Rules Import.

- In the File Links section, click the link to the Excel template.

To access the template from the application:

- In the Setup and Maintenance work area, go to the Manage Chart of Accounts Mappings task, Offering: Financials, Functional Area: Financial Reporting Structures, Task: Manage Chart of Accounts Mappings.

- On the Manage Chart of Accounts Mappings page, Actions menu, click Download Rules.

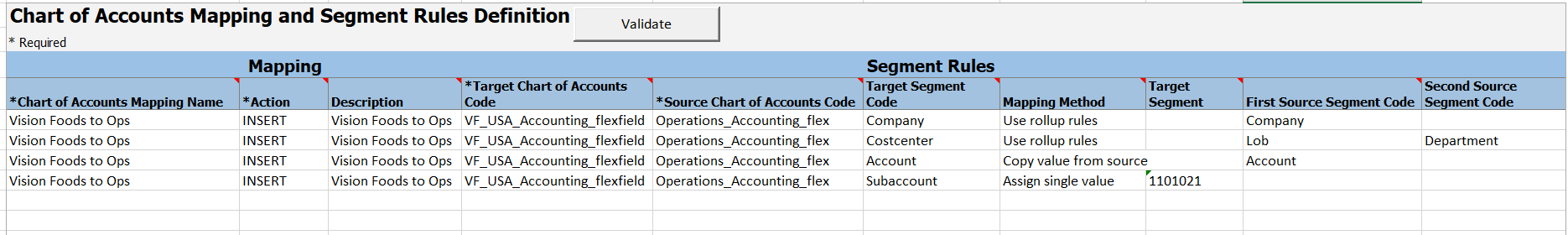

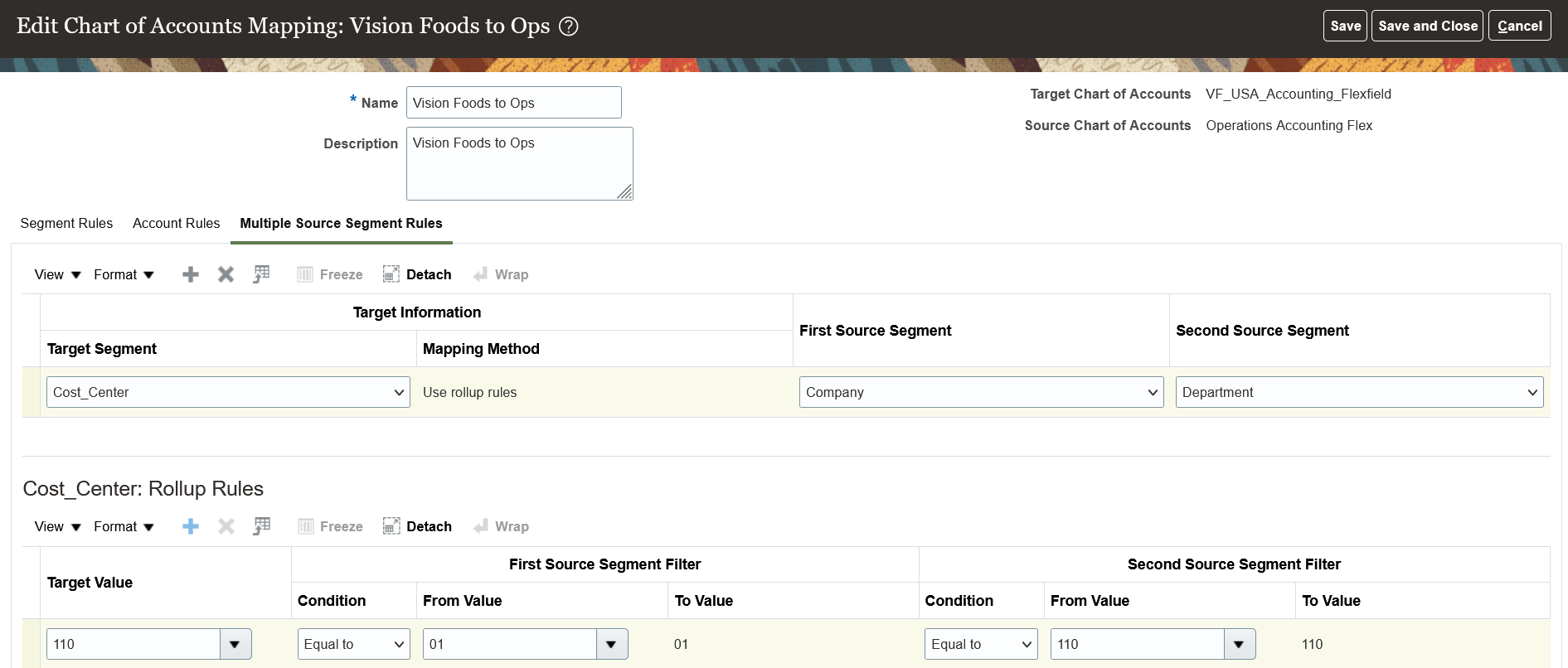

This example shows the chart of account mappings and segment rules for the Vision Foods to Ops mapping.

Chart of Account Mappings and Segment Rules

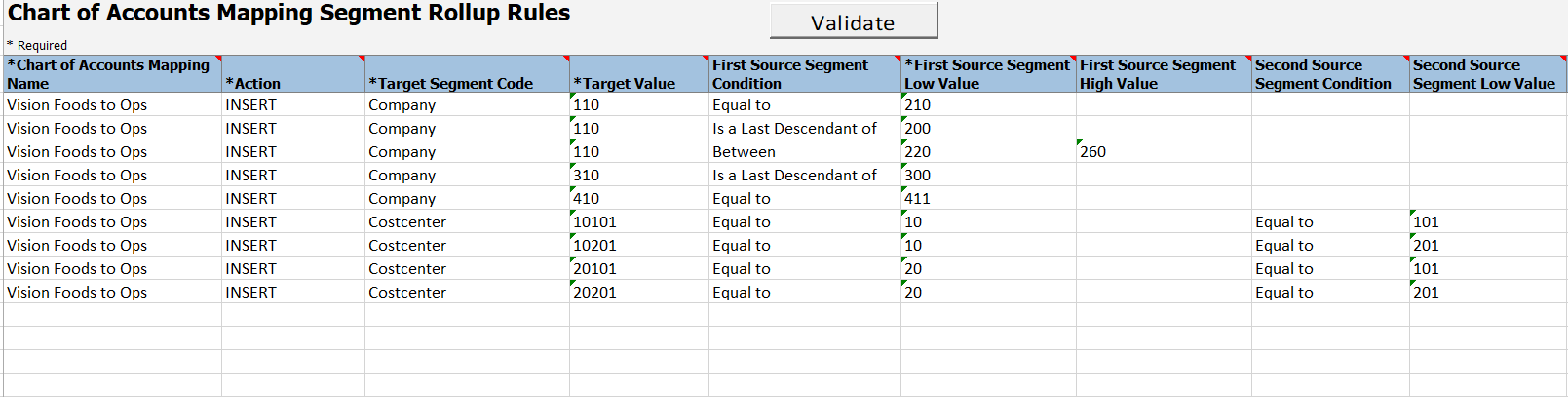

If the segment rules between target and source segments are defined with the 'Use rollup rules' mapping method, then you can now manage the rollup rule values using a file-based data import template. The following figure shows an example of the template with rollup rule values.

The improved user experience centralizes all related elements of managing chart of accounts mapping segment rules and provides efficient tools for creating and editing large volumes of rollup rules. The user interface (UI) provides the streamlined experience with an integrated actions menu for on-demand file upload, file download, and import process submission.

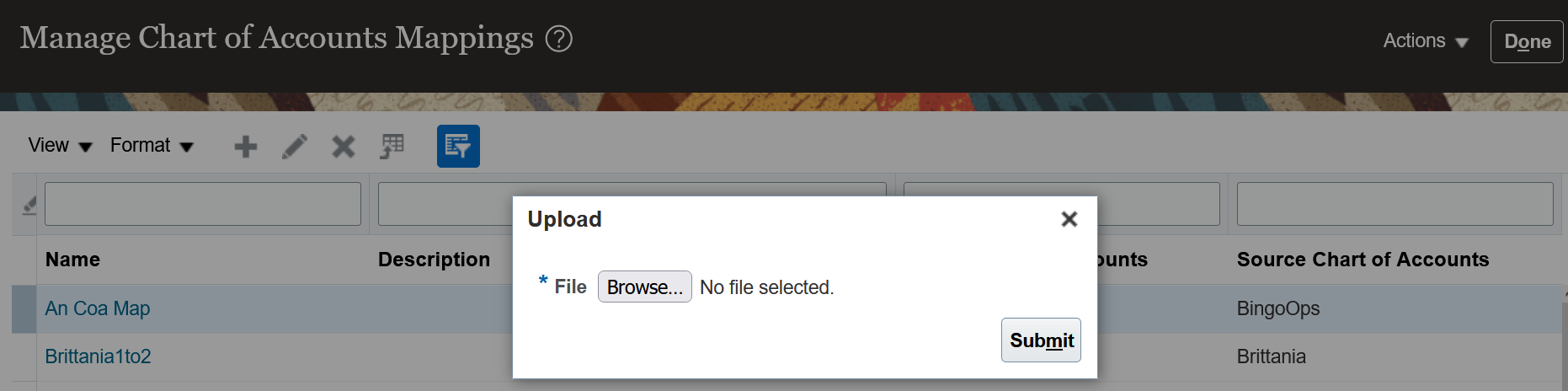

- Navigate to the Manage Chart of Accounts Mappings page and select Actions -> Upload Rules to upload the chart of accounts mapping segment rules from the prepared spreadsheet file to the interface tables.

- Navigate to the Manage Chart of Accounts Mappings page and select Actions -> Download Unprocessed Rules to view the chart of accounts mapping segment rules in the interface table, which are not yet processed in the application.

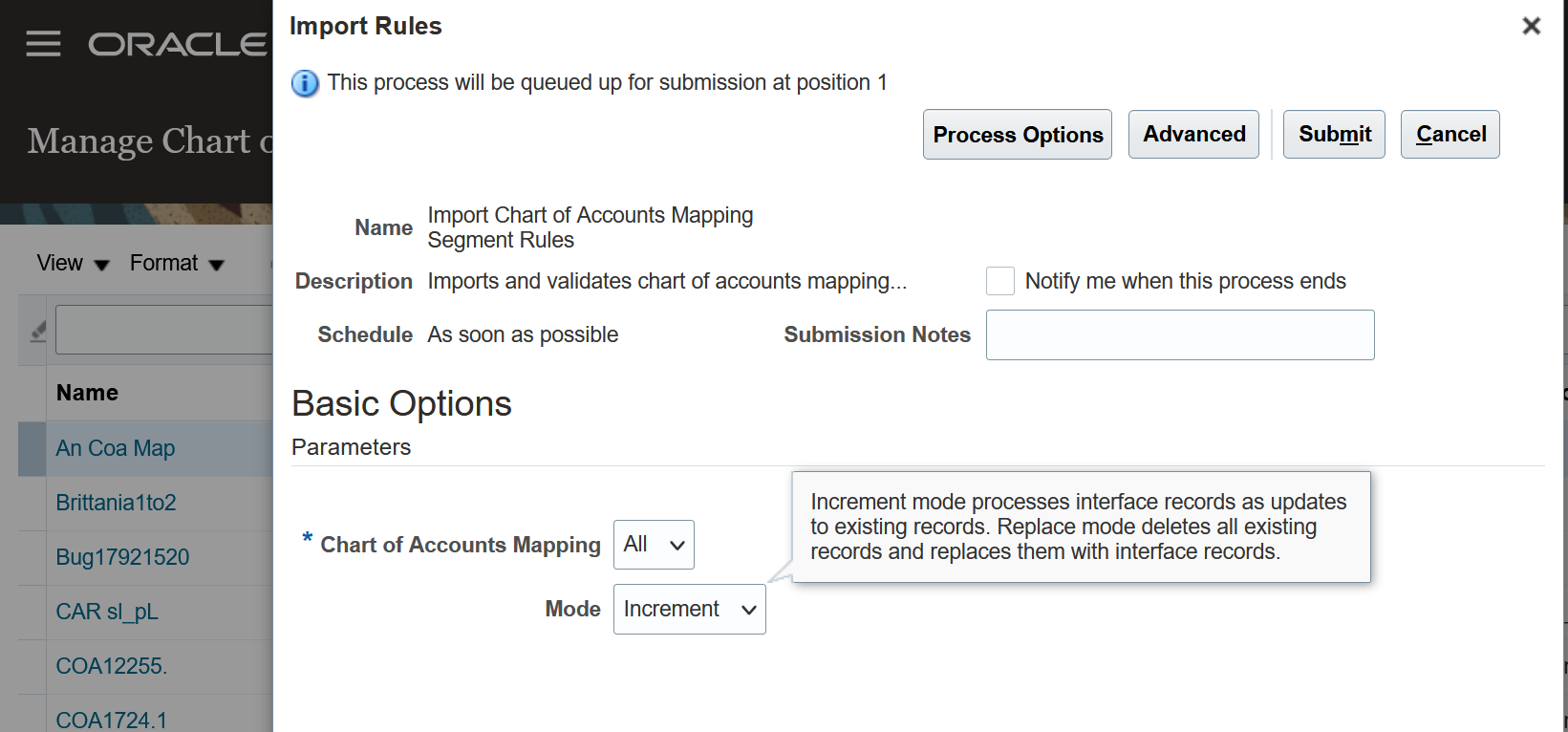

- Navigate to the Manage Chart of Accounts Mapping page and select Actions -> Import Rules. Select the chart of accounts mapping name and the Increment or Replace mode to import the mapping segment rules from the interface tables into the application. Select Increment mode when you are uploading delta or incremental mapping segment rules. Select Replace mode only when you are completely replacing the existing chart of account mapping rules with all new mapping segment rules. This mode supports integrations that send a complete replacement file.

- Download the chart of account mapping segment rules from the application in the FBDI file format by selecting Actions -> Download Rules. This action will open the Chart of Accounts Mappings dialog box. Select the chart of accounts mapping name you want to download.

- You can now use the 'Use rollup rules' mapping method to map a target segment to two source segments using the template and the UI as well. Only the Equals to operator is currently supported for the rollup rule values defined between a target segment and its two source segments.

Business Benefit

- Upload records in bulk to create, update, and delete segment rules for a chart of accounts mapping.

- Support external integration using REST services to bring chart of accounts mapping segment rules into General Ledger.

- Streamline the user experience with an integrated Actions menu for on-demand file upload, file download, and process submission.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

- You can update or delete existing chart of accounts mapping segment rules by downloading the rules from the page. This will open the file in the FBDI format, where you can view all the rules and select the update or delete action to update them.

- Replace mode enables you to replace the segment rules in the application from external data source systems. Use the Replace mode carefully. If the file you’re loading contains a subset of chart of accounts mapping segment rules, all of the other existing chart of accounts mapping segment rules in the application will be deleted. The Replace mode:·

- Inserts the new chart of accounts mapping segment rules from the file.

- Updates the existing chart of accounts mapping segment rules with the changes from the file.

- Deletes all other existing chart of accounts mapping segment rules from the application that aren’t included in the file.

- The import process follows an all-or-nothing approach while importing chart of accounts mapping segment rules. If there are any validation errors for one or more chart of accounts mapping segment rules, then the process will not import any segment rules for the chart of accounts mapping. You can review the output file for the errors, correct the records, and reload the file to process all the chart of accounts mapping segment rules in the file. If there are no validation errors, then the process will import all the chart of accounts mapping segment rules.

- You can map a target segment to a single source segment and two source segments at the same time. The rollup rule for the two source segments must be defined in the Multiple Source Segment Rules tab on the Create or Edit Chart of Accounts Mapping page.

Key Resources

- For more information, refer to the following guides in the Oracle Help Center:

- Implementing Enterprise Structures and General Ledger

- File-Based Data Import (FBDI) for Financials

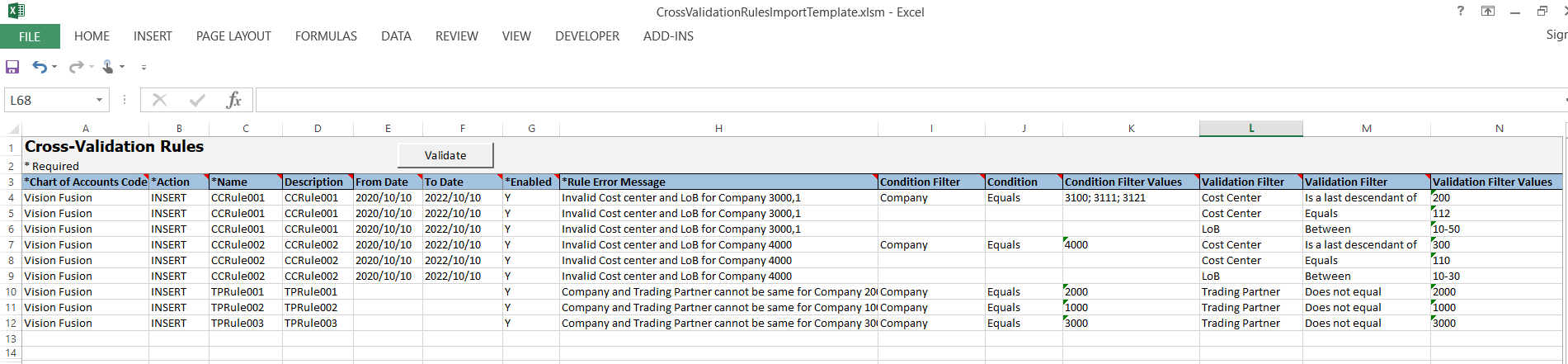

Cross-Validation Rules Creation and Maintenance Using File-Based Data Import

Manage cross-validation rules for your chart of accounts using file-based data import (FBDI). FBDI is an efficient way to manage cross-validation rules from external sources.You can download the template from either the File-Based Data Import (FBDI) for Financials guide or the application.

To access the template from the FBDI guide:

- In the Oracle Help Center (http://docs.oracle.com), open the File-Based Data Import (FBDI) for Financials Cloud guide.

- In the table of contents, click General Ledger.

- Click Cross-Validation Rules Import.

- In the File Links section, click the link to the Excel template.

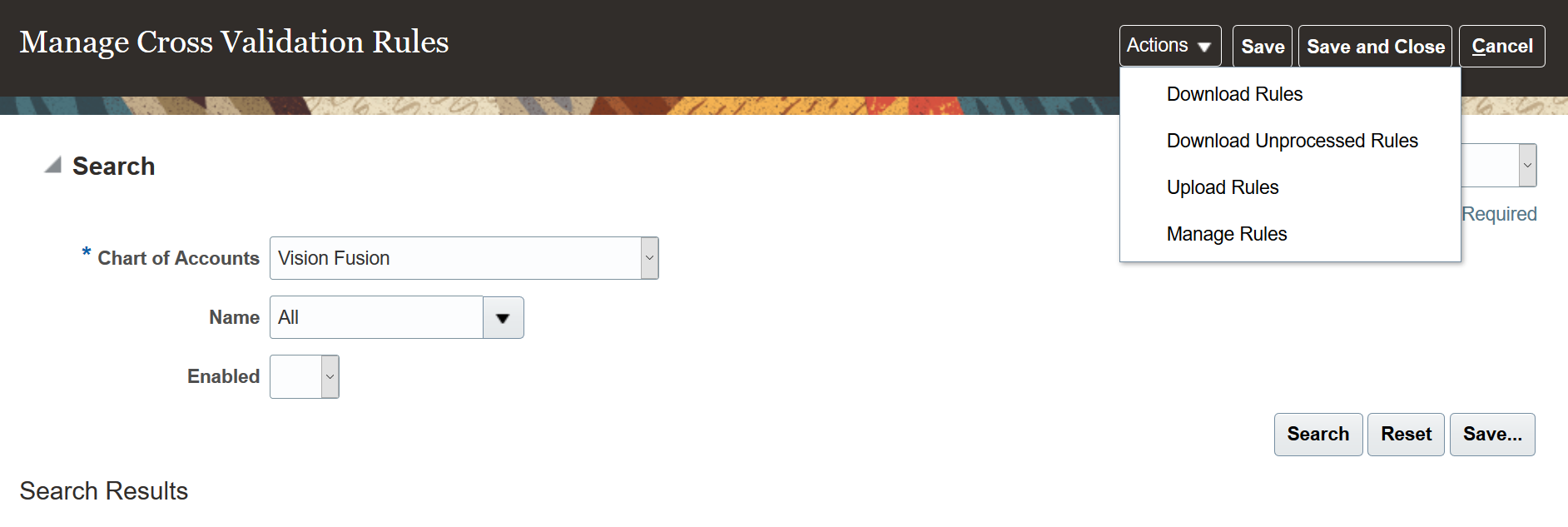

To access the template from the application:

- In the Setup and Maintenance work area, go to the Manage Cross-Validation Rules task, Offering: Financials, Functional Area: Financial Reporting Structures, Task: Manage Cross-Validation Rules.

- On the Manage Cross-Validation Rules page, search for your chart of accounts.

- In the Actions menu, click Download Rules.

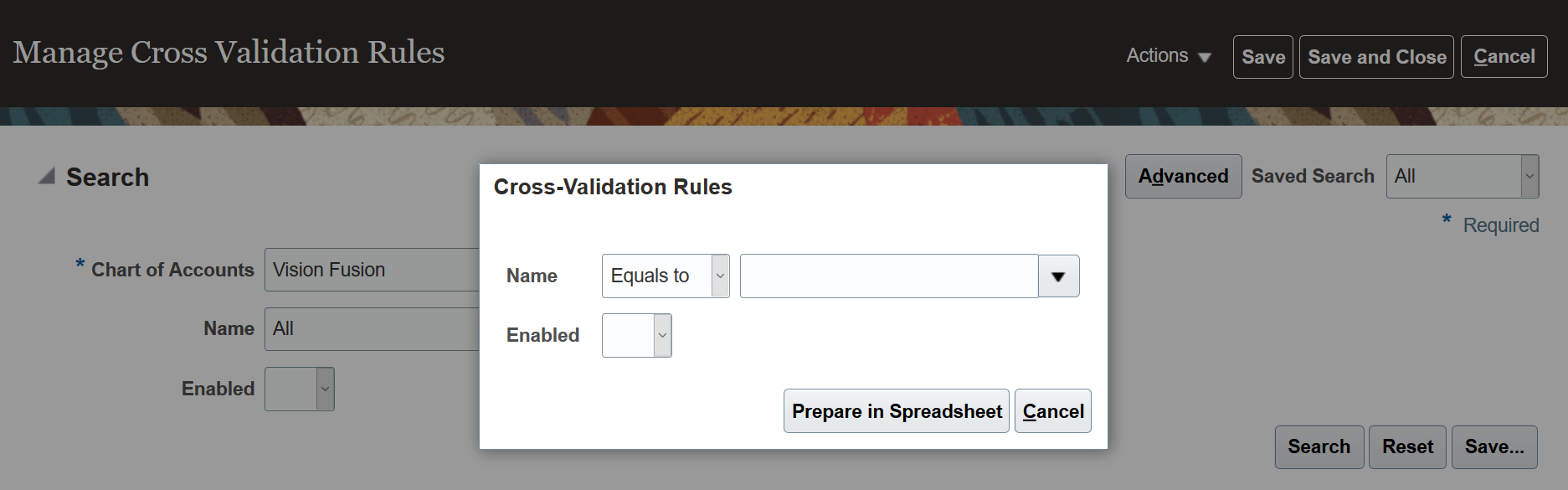

This example shows the cross-validation rules for the Vision Fusion chart of accounts.

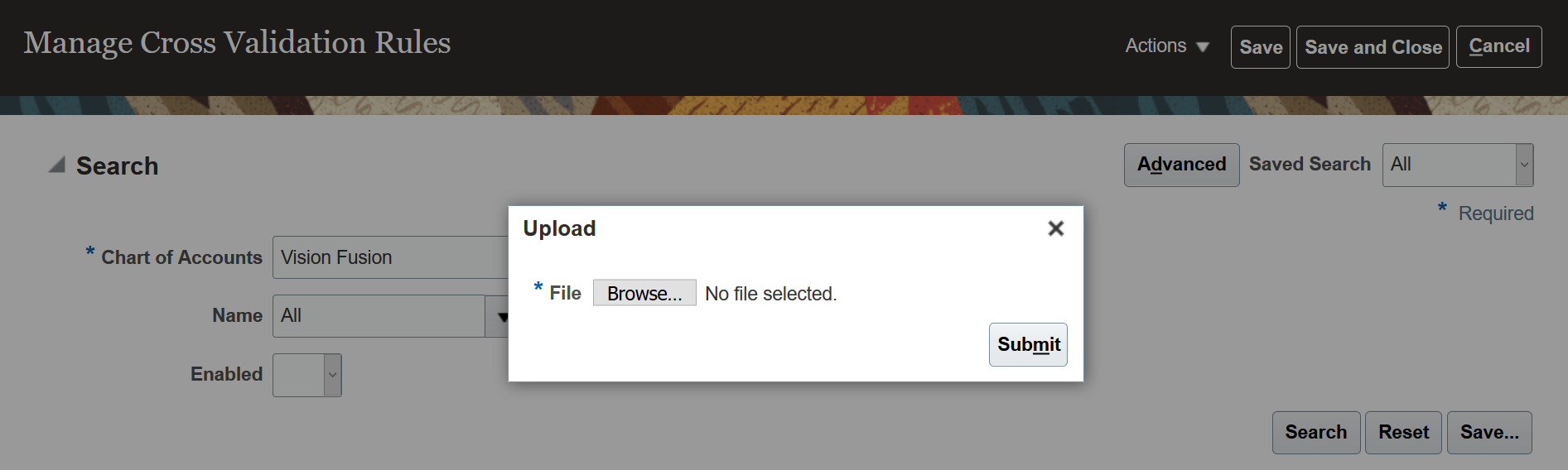

The improved user experience centralizes all related elements of managing cross-validation rules for your chart of accounts and provides efficient tools for creating and editing large volumes of cross-validation rules. The user interface provides a streamlined experience with an integrated actions menu for on-demand file upload, file download, and import process submission.

Manage Cross Validation Rules

- Navigate to the Manage Cross Validation Rules page and select Actions -> Upload Rules to upload the cross-validation rules from the prepared spreadsheet file to the interface tables.

- Navigate to the Manage Cross Validation Rules page and select Actions > Download Unprocessed Rules to view the cross-validation rules in the interface table that are still to be processed.

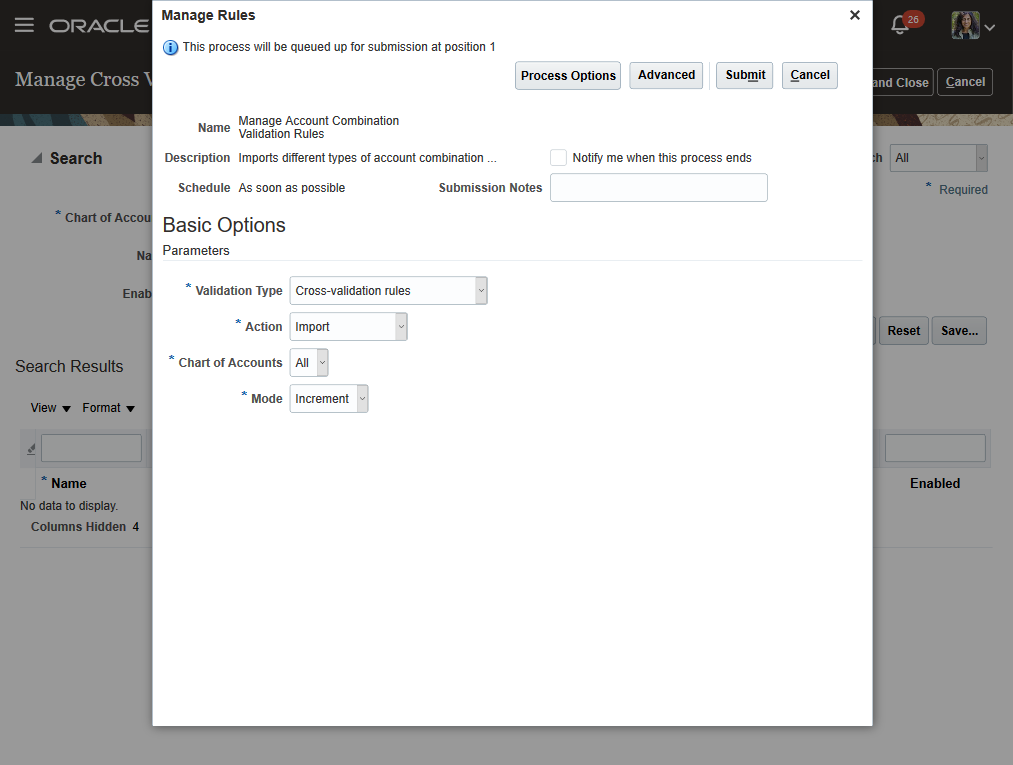

- Navigate to the Manage Cross Validation Rules page and select Actions -> Manage Rules. Select the Validation type of Cross-validation rules and the Import action to import the rules from the interface table into the application in either Increment mode or Replace mode. Select Increment mode when you are uploading delta or incremental cross-validation rules. Select Replace mode only when you are completely replacing the existing cross-validation rules with all new cross-validation rules. This mode supports integrations that send a complete replacement file.

- Download the cross-validation rules from the application to FBDI file format by selecting Actions > Download Rules. This action opens the Cross-Validation rules window. Enter in the Name field the cross-validation rules you want to download. Use the Starts with, Ends with, and Contains operators to select a range of cross-validation rules. Leave the Name field blank to download all the rules for a given chart of accounts.

Download Rules

Business Benefits

- Upload records in bulk to create, update, and delete cross-validation rules.

- Support external integration using REST services to bring cross-validation rules into General Ledger.

- Streamline the user experience with an integrated Actions menu in the UI for on-demand file upload, file download, and process submission.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

- You can update or delete the existing cross-validation rules by downloading the rules from the UI. This will open the file in the FBDI format, where you can view all the rules and select the update or delete action to update the rules.

- Replace mode enables you to replace the rules in the application from external data source systems.

- Use the Replace mode carefully. If the file you’re loading contains a subset of cross-validation rules, all of the other existing cross-validation rules in the application will be deleted. The Replace mode:·

- Inserts the new cross-validation rules from the file.

- Updates the existing cross-validation rules with the changes from the file.

- Deletes all other existing cross-validation rules from the application that aren’t included in the file.

- You can submit the Manage Cross-Validation Rule Violations process by navigating to Actions -> Manage Rules and selecting the Review Violations action.

- The import process follows an all-or-nothing approach while importing cross-validation rules for a chart of accounts. If there are any validation errors for one or more cross-validation rules, then the process will not import any rules for the chart of accounts. You can review the output file for the errors, correct the records, and reload the file to process all the cross-validation rules in the file. If there are no validation errors, then the process will import all the cross-validation rules for the chart of accounts.

Key Resources

- For more information, refer to the following guides in the Oracle Help Center:

- Implementing Enterprise Structures and General Ledger

- File-Based Data Import (FBDI) for Financials

Role And Privileges

You need one of these roles to manage cross-validation rules import:

- Application Implementation Consultant

- Financial Application Administrator

Historical Rates Entry Using File-Based Data Import

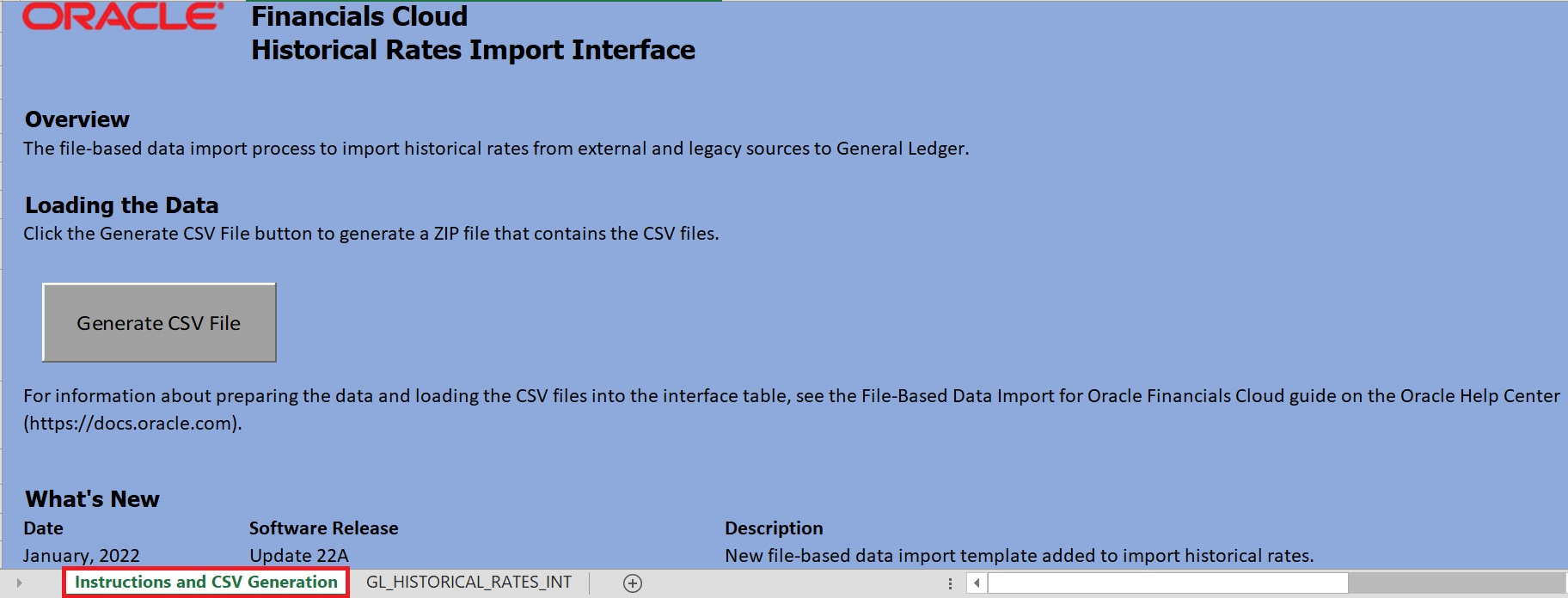

You can now create, update or delete historical rates for multiple ledgers at once using a standard File Based Data Import template. Use the Historical Rates Import file-based data (FBDI) template to import historical rates from external and legacy sources to General Ledger. This method is particularly useful while entering or updating large volumes of historical rates.

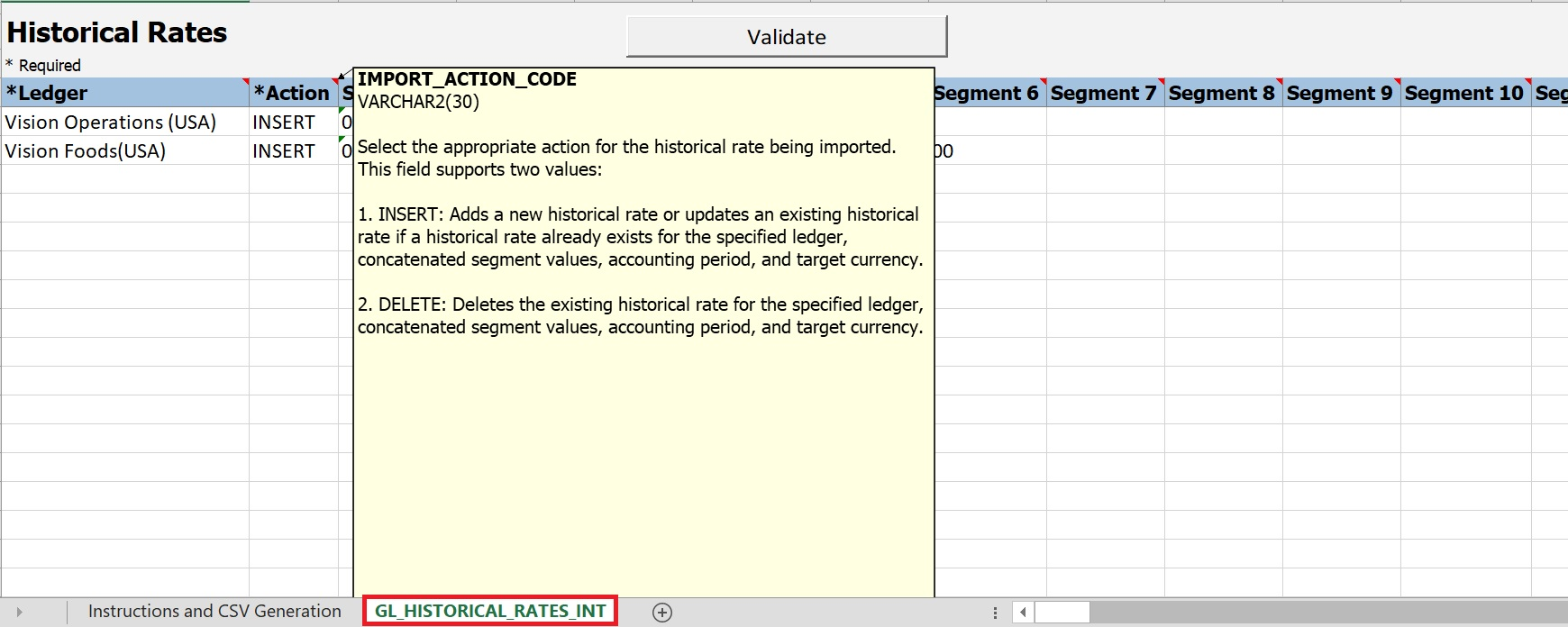

Download the Historical Rates Import FBDI template from the General Ledger section of the File-Based Data Import (FBDI) for Financials Implementation Guide in Oracle Help Center. Refer to the Instructions and CSV Generation tab for an overview of the template and use the GL_HISTORICAL_RATES_INT tab to enter the historical rates information. Help text is provided for each column with detailed instructions.

Import Historical Rates - Instructions tab

Import Historical Rates - GL_HISTORICAL_RATES_INT tab

The steps to import historical rates follow standard file based data import procedures -

- Enter the historical rates information in the GL_HISTORICAL_RATES_INT tab of the Historical Rates Import FBDI template. Validate the data entered to review any errors and correct them.

- The FBDI spreadsheet converts the data to a zip file for the File Import process. You can click the Generate CSV File button on the Instructions and CSV Generation tab to create a CSV file in .zip file format.

- You then load the zip file to the historical rates interface table. The final step is to run the Import Historical Rates process which validates the historical rates data uploaded in the interface table and imports them into General Ledger module. Review the output file for details on records processed, deleted or rejected due to errors.

- If the Import Historical Rates process ends in error, you can review the GlHistoricalRatesInterfaceErrors.csv file for information on the records that couldn’t be imported along with the error details.

Business benefits include :

- Streamline business processes by populating historical rates information from external and legacy sources.

- Better performance while uploading large volumes of historical rates.

- Maintain historical rates for multiple ledgers at once using the Historical Rates Import file-based data (FBDI) template.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

- When a historical rate exists for a specific account combination and accounting period, using the same account combination and accounting period again to insert a historical rate results in replacement of the existing historical rate.

- Import historical rates for multiple ledgers at once by selecting the 'All' value in the Ledger parameter of the Import Historical Rates process. You must have access to all the ledgers for which you want to upload historical rates.

- When there are error records in the Import Historical Rates process, you can re-use the GlHistoricalRatesInterfaceErrors.csv file to correct the errors and upload the records again. To do this, review and correct the errors and then delete the Errors columns in the CSV file. Zip the file and use it to upload the historical rates.

- The Import Historical Rates process is auditable i.e. all update and delete operations are audited. You must enable audit for the Historical Rates business object when audit is enabled for Oracle Fusion Applications.

Key Resources

- How Historical Rates Import Data Is Processed topic on Oracle Help Center.

- File-Based Data Import (FBDI) for Financials Implementation Guide.

Credit Memo for Negative Intercompany Transactions

Create credit memos in Receivables and Payables for negative Intercompany transactions using ADF Desktop Integrator (ADFdi), File-Based Data Import (FBDI), Intercompany import processes and Transaction Account Definition (TAD) to enter details into the Intercompany ERP module.

This feature is an enhancement to the existing Credit Memo for Negative Intercompany Transactions feature in 21C. You may like to refer to 21C What's New: Credit Memo for Negative Intercompany Transactions which was delivered in 21C.

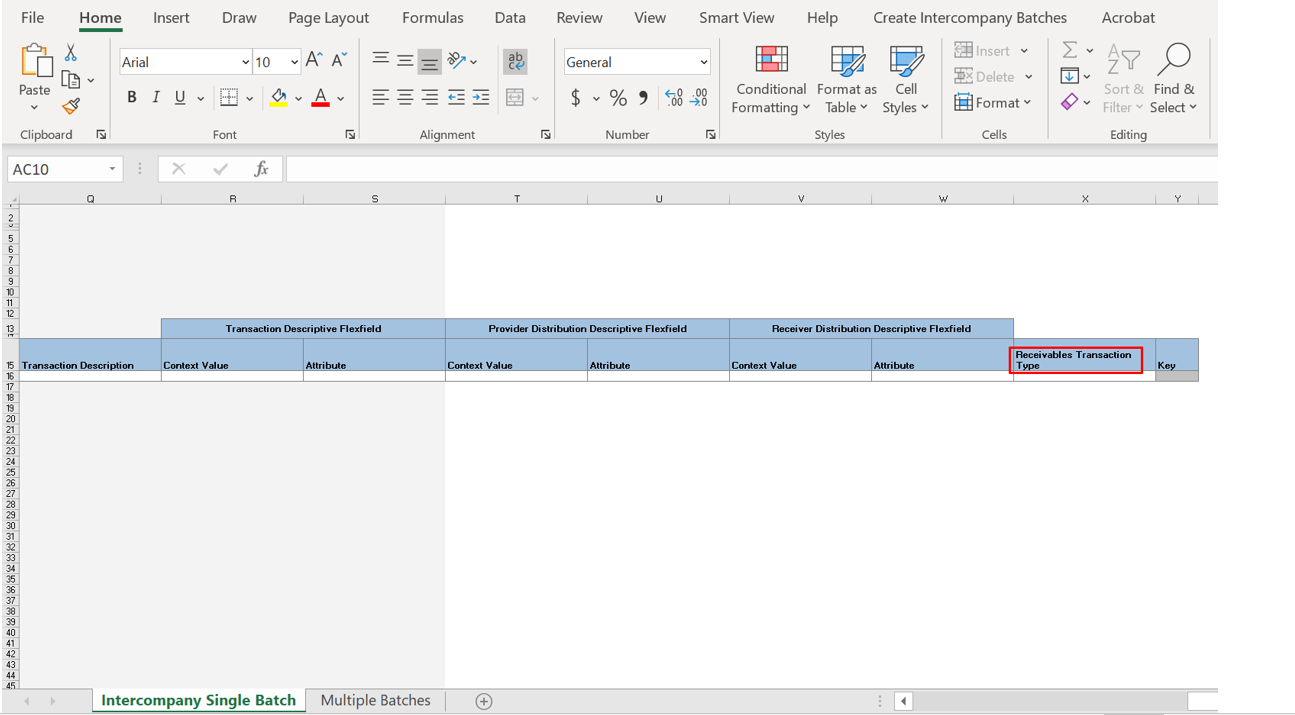

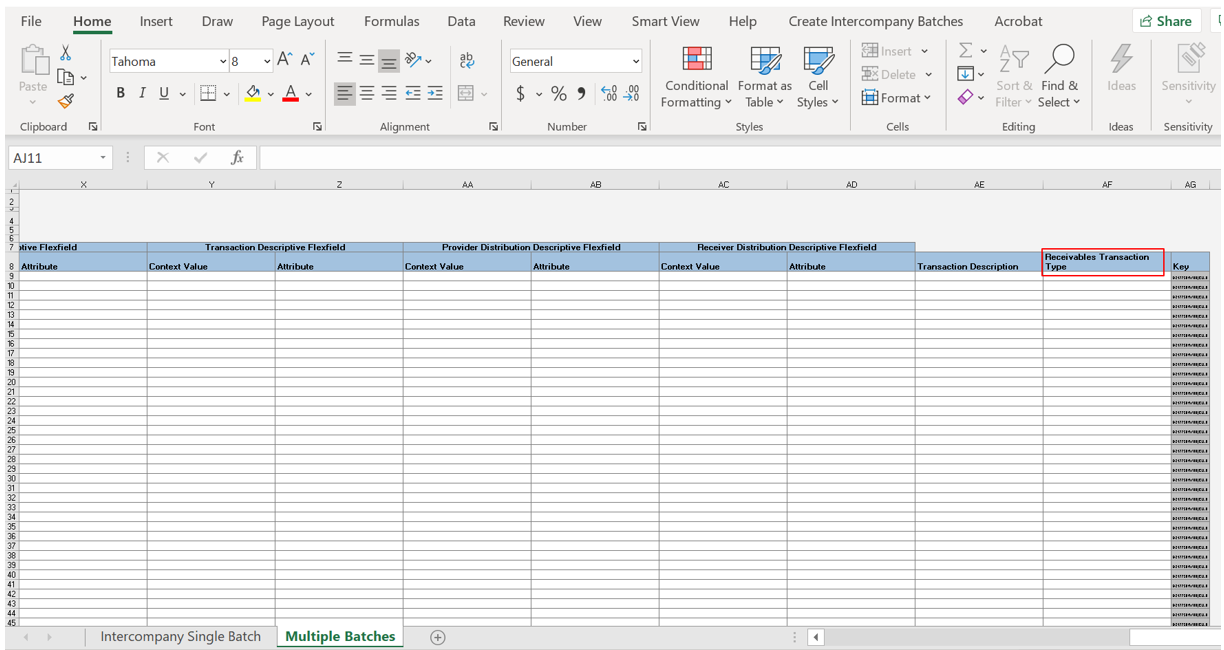

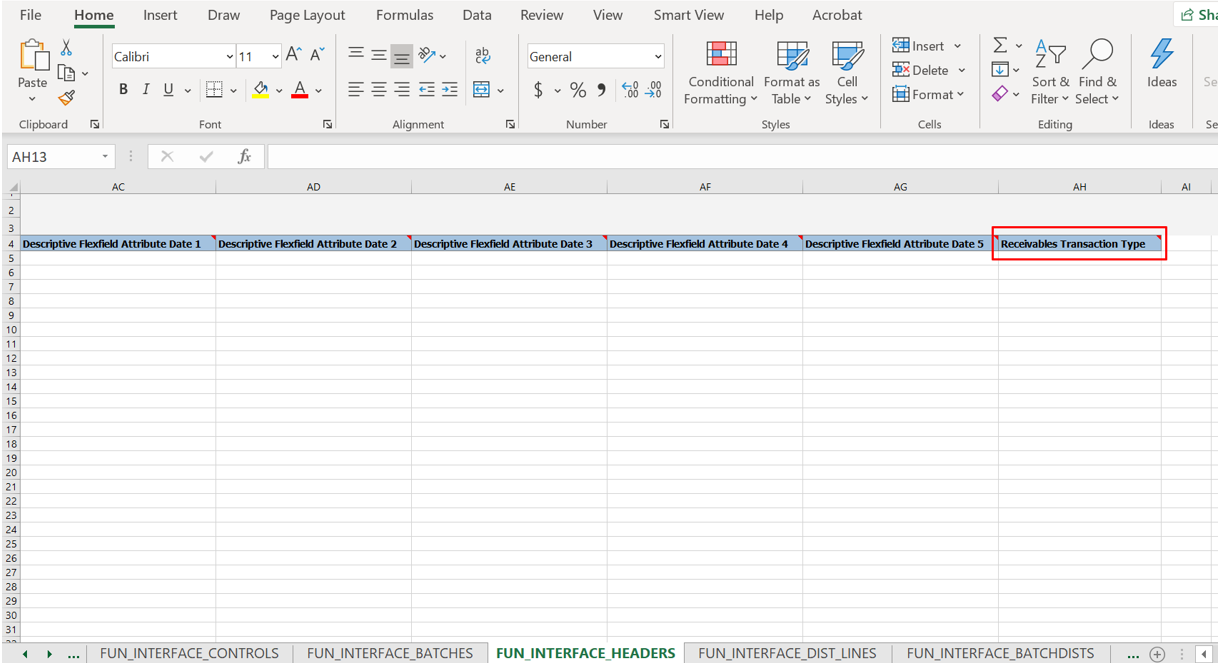

In this release you will be able to efficiently generate Receivables and Payables credit memo documents from high volume of intercompany transactions created using ADF Desktop Integrator (ADFdi) single batch sheet, ADFdi multiple batches, File-Based Data Import (FBDI), Intercompany import and CSV Import/Export files as illustrated here.

- In ADFdi single batch sheet

- In ADFdi multiple batches sheet

- In FBDI sheet

- For Intercompany Import, a non mandatory field ArInvCmTrxTypeName is added where a valid Receivables transaction type applicable for invoice or credit memo can be provided.

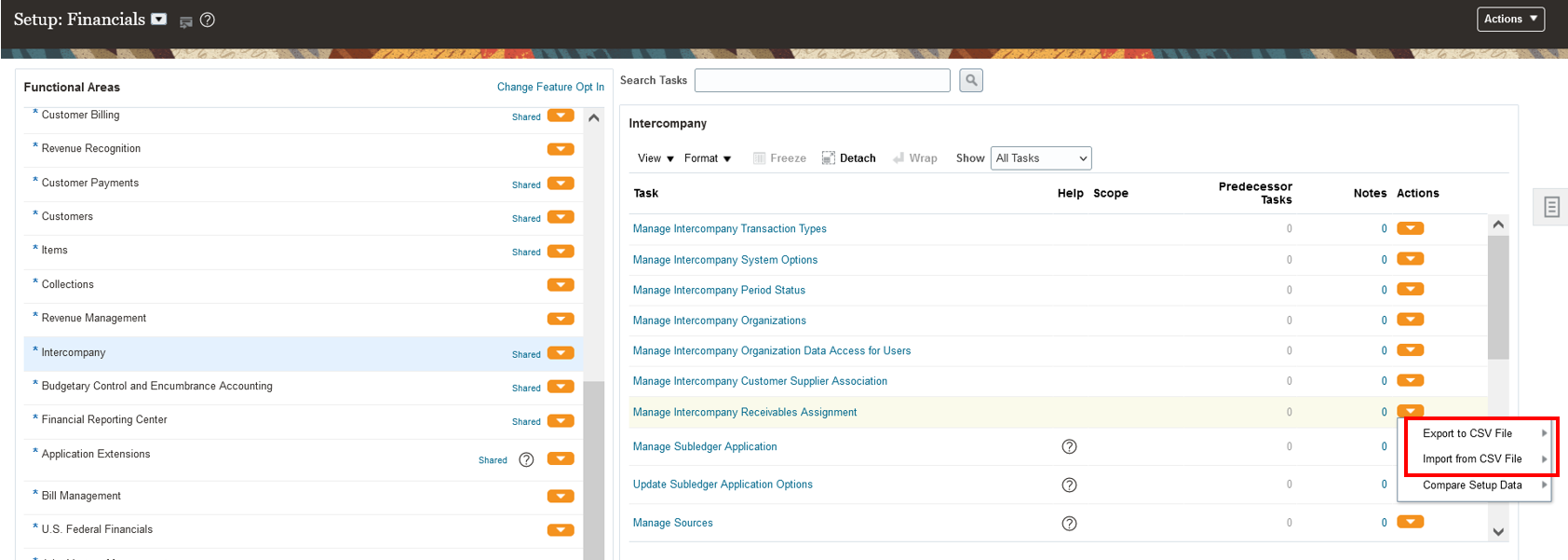

- Under Setup and Maintenance > Financial > Intercompany > All Tasks > Manage Intercompany Receivables Assignment > Actions, you can import or export the CSV file for viewing/inserting Receivables transaction type through export/import CSV file process respectively. This prevents you from having to enter the setup details manually on Manage Intercompany Receivables Assignment.

Example of Setting Up TAD Using Receivables Transaction Type for Creation of Credit Memo or Invoice for Intercompany can be accessed here.

Business benefits include:

- Generate Receivables and Payables credit memo documents from a high-volume of Intercompany transactions created using the available bulk entry mechanisms.

- Assign a default Receivables transaction type to generate an invoice or credit memo for the specified transaction account definition (TAD).

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

- For ADFdi single batch sheet, the selection of Receivables transaction type can be made per the setup provided under the Manage Intercompany Receivables Assignment. However, if the value selected for Receivables transaction type is not specified in the setup and submitted for processing of transaction, then the application will automatically pick up the value as defined in the setup.

- For ADFdi multiple batches sheet, FBDI sheet and Intercompany import transaction, if the value selected for Receivables transaction type is not specified in the setup, then the batch transaction will show an error which users can clear out by resubmitting it from the Edit Intercompany Batch page. The selection of Receivables transaction type will be automated from the setup once a batch is resubmitted from the UI.

- These conditions apply to the Receivables transaction type in order to successfully run the Intercompany Import process for ADFdi multiple batches sheet, the FBDI sheet, or Intercompany import transactions:

- Transaction type is active.

- Transaction type is invoice or credit memo.

- Creation sign of the transaction type is set to Any.

- Transaction type comes from either the set assigned to the BU or the common set.

- If the Receivables transaction type value is kept blank then system will pick up the value as per the Receivables assignment mapping created on Manage Intercompany Receivables Assignment setup. If there is no Receivables assignment mapping then value will be defaulted from Manage Intercompany System Options.

- During CSV import, if Receivables transaction type value entered is invalid then Negative Receivables transaction type field is skipped and import process continues to execute for other data.

- You can override the default Receivables transaction type before submitting the transaction for processing.

- If you don't have a Receivables transaction type specified either on your negative transaction or in the setup, Oracle Cloud Receivables will create a negative invoice.

- You can also select different Receivables transaction types for transactions that will be created as invoices in Oracle Cloud Receivables.

Key Resources

-

Example of Setting Up TAD Using Receivables Transaction Type for Creation of Credit Memo or Invoice for Intercompany can be accessed here.

-

Example to Setting Up Transaction Account Definition for Intercompany without use of Credit Memo for Negative Intercompany Transaction feature.

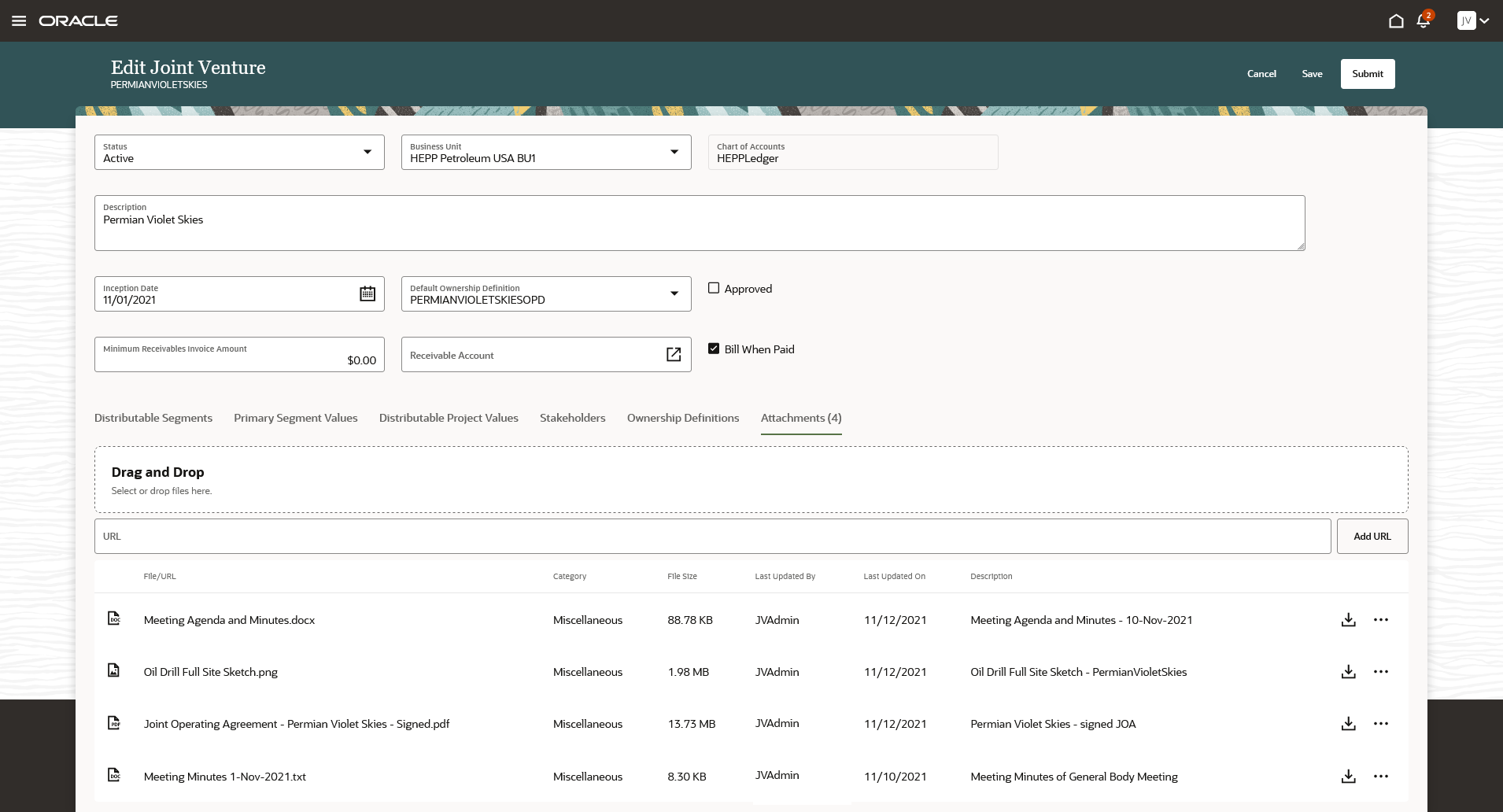

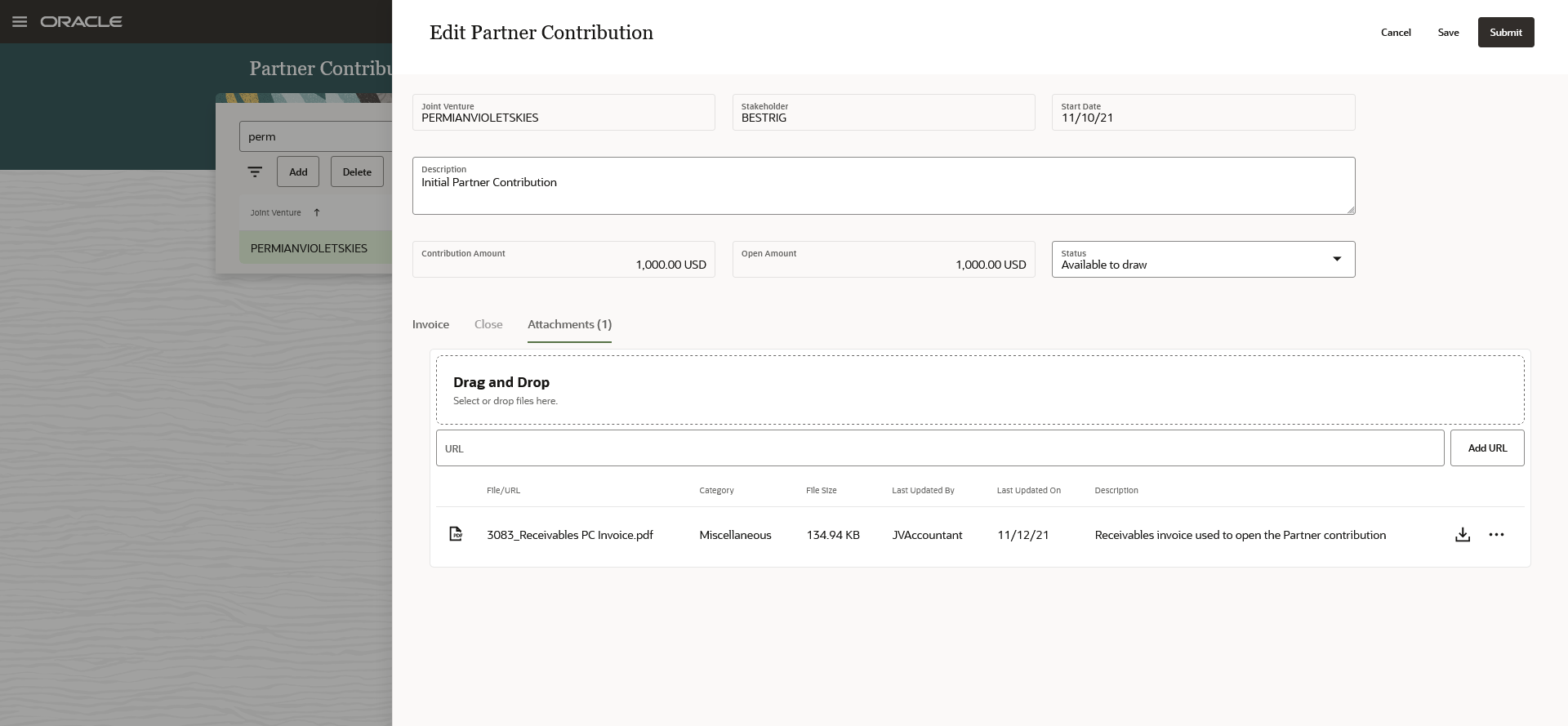

Attachments for Joint Venture Definitions and Partner Contributions

Add and retrieve attachments at various levels within Joint Venture Definitions and Partner Contributions.

Add attachments of different types, including those related to joint operating agreements, operational documents, specific joint venture stakeholders, ownership definitions, merger and acquisition activities, scope changes, and changes in partner responsibilities. Attachments can be documents, such as signed contracts, emails, statements, blueprints, spreadsheets, and permits.

The business benefits include:

- Reduced time in finding pertinent documents related to a joint venture.

- Conformance to the joint operating agreement with easy access to related supporting documents.

- Built-in security to access attachments.

Watch a Demo.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

- For more information, refer to

- Implementing Joint Venture Management guide and

- Using Joint Venture Management guide.

Role And Privileges

- Joint Venture Application Administrator

- Joint Venture Accountant

- Joint Venture Accounting Manager

Joint Venture Account Sets provides an easy and flexible method for specifying the accounts to be used when identifying transactions for Joint Venture Management processes. Joint Venture Administrators can quickly define filter criteria to support single accounts, ranges of accounts, and the exclusion of accounts.

Joint Venture Account Sets are available in overhead methods and reduce errors associated with specifying each account separately for a method.

The business benefits include:

- Provides an efficient way to define the accounts to be used in Joint Venture Management processes.

- Reduces errors associated with specifying accounts separately.

- Reduces the maintenance of accounts in Joint Venture Management, because dynamically created accounts within a range are automatically included when the Joint Venture Account Set is used in a process.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

Review your joint operating agreement (JOA) for specific account information and cross reference it with the accounts available in your financial system prior to creation of the Account Set.

Key Resources

- For more information, refer to

- Implementing Joint Venture Management guide and

- Using Joint Venture Management guide.

Role And Privileges

- Joint Venture Application Administrator

- Joint Venture Accountant

Joint Venture Invoices for Paid Expenses

Choose to invoice joint venture partners only for paid expenses. Managing partners can use this option to conform to joint operating agreements with the requirement to bill partners only for paid expenses. This option is only available for expenses brought into Joint Venture Management from Oracle Cloud Payables.

The business benefits include:

- Minimize month-end processing and reduce potential errors caused by manual entry using automated processes.

- Conformance to the joint operating agreement by processing only paid expenses.

Watch a Demo.

Steps to Enable

To enable the Bill When Paid feature, turn on the Bill When Paid option in the joint venture definition.

Tips And Considerations

- Make sure that you process all unprocessed joint venture transactions and distributions to a completed status before turning on/off the bill when paid feature.

- If you create a manual subledger journal with journal source set as Payables, and this transaction is brought into Joint Venture Management for joint ventures that have the Bill When Paid feature enabled, the joint venture transaction is set to the status Awaiting Payment. In this case, the subledger journal transaction is not associated with a Payables invoice and Joint Venture Management cannot recognize when payment is completed for the subledger journal. The joint venture transaction remains in Awaiting Payment status until you manually update the status to Available to Process to make it available to downstream processes.

Key Resources

- For more information, refer to

- Implementing Joint Venture Management guide and

- Using Joint Venture Management guide.

Role And Privileges

- Joint Venture Application Administrator

- Joint Venture Accountant

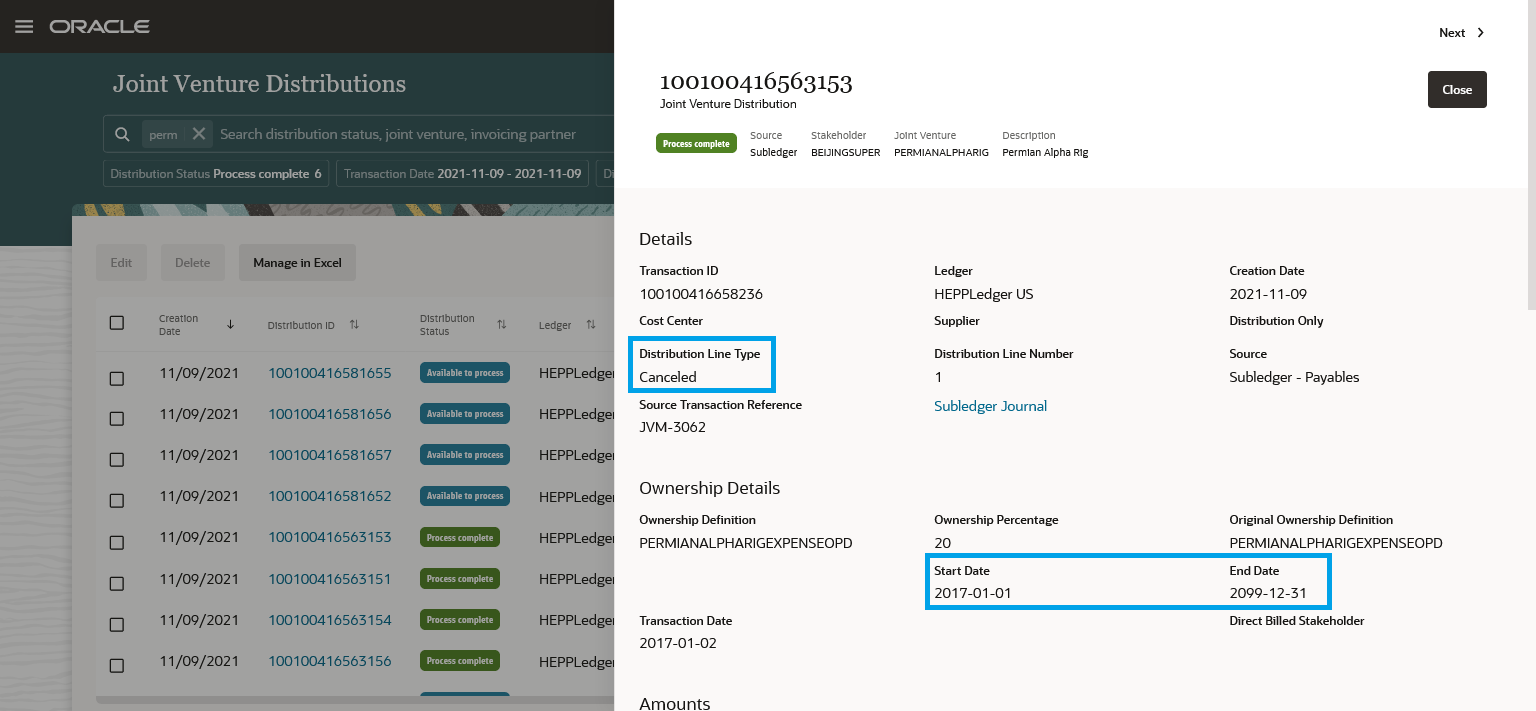

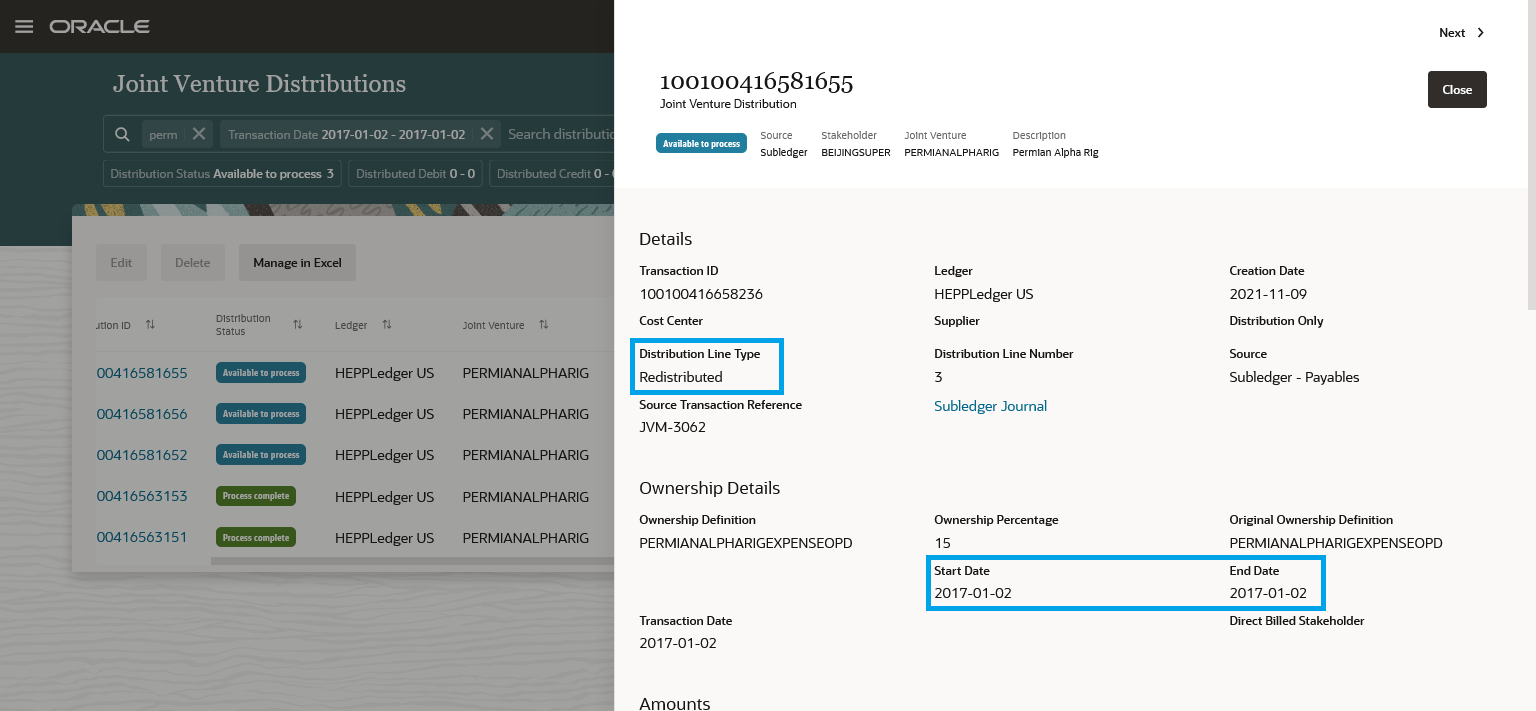

Original Ownership Definition Start and End Date Display for Rebill Distributions

Display the original start and end dates for the ownership definition that was used for a distribution. Auditors can use this information to determine the ownership definition used for a transaction that was rebilled based upon a change to the ownership definition.

Business Benefit:

Enables proper auditing of the ownership definition used on the joint venture transactions that have been through the rebilling process, thus ensuring conformance to the joint operating agreement.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

Ownership dates on joint venture distributions processed prior to implementation of release 22A will be blank.

Key Resources

- For more information, refer to

- Using Joint Venture Management guide.

Role And Privileges

- Joint Venture Accountant

Overhead Methods with Direct Bill Partner Option

Specify a direct billed stakeholder for an overhead method as an alternative to the ownership definition. Instead of splitting and distributing overhead charges to the joint venture partners, the direct billed stakeholder will be responsible for the overhead charges. Additionally, Joint Venture Accountants can apply a direct bill stakeholder by exception to overhead transactions.

The business benefits include:

- Gain efficiency by reducing the number of steps required to set up an overhead method.

- Increase maintainability by not requiring an ownership definition to be set up with a 100% share defined for a single partner.

Steps to Enable

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Financials

Opt in to Joint Venture Overhead in Joint Venture Management.

Functional Area: Joint Venture Management

Task: Manage Joint Venture Overhead Methods

- In the overhead method, select the direct billed stakeholder for the billing of the overhead charge.

Tips And Considerations

Joint venture transactions created by an overhead method can now have the Direct Billed Stakeholder overridden through the Joint Venture Transactions work area.

Key Resources

- For more information, refer to

- Implementing Joint Venture Management guide and

- Using Joint Venture Management guide.

Role And Privileges

- Joint Venture Application Administrator

- Joint Venture Accountant

Percentage of Cost Joint Venture Overhead Method Based Upon General Ledger and Subledger Transactions

Provide an additional overhead calculation based upon a percentage of selected financial transactions. Calculate overhead based upon selected transactions from the General Ledger and Subledger Accounting recorded for a specific period, the beginning of the year through a specific period, or the inception of the joint venture through a specific period.

The business benefits include:

- Conform to the joint operating agreement by ensuring accurate calculation and distribution of overhead and management fees associated with the operation of the joint venture.

- Minimize month-end processing and reduce potential errors caused by manual entry through the use of automated processes.

Steps to Enable

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Financials

Opt in to Joint Venture Overhead in Joint Venture Management.

Functional Area: Joint Venture Management

Task: Manage Joint Venture Overhead Methods

- Create the overhead method with the following values for the attributes:

Type - Percentage of cost

Basis Source - General ledger and subledger transactions

Tips And Considerations

- In an overhead method, you must specify the partner account before the method can be activated. This partner account is used while creating the Receivables invoice to recoup the overhead costs from partners. Before you define the partner account on the overhead method, ensure that the GL Code Combination for the partner account has been defined using Manage Account Combinations.

- Use Joint Venture Account Sets to identify the accounts to be included from the General Ledger and Subledger Accounting based upon the joint operating agreement terms for the overhead calculation.

- To enable Year to Period calculations, make sure that the inception date for the joint venture is specified in the Joint Venture Definition.

Key Resources

- For more information, refer to

- Implementing Joint Venture Management guide and

- Using Joint Venture Management guide.

Role And Privileges

- Joint Venture Application Administrator

- Joint Venture Accountant

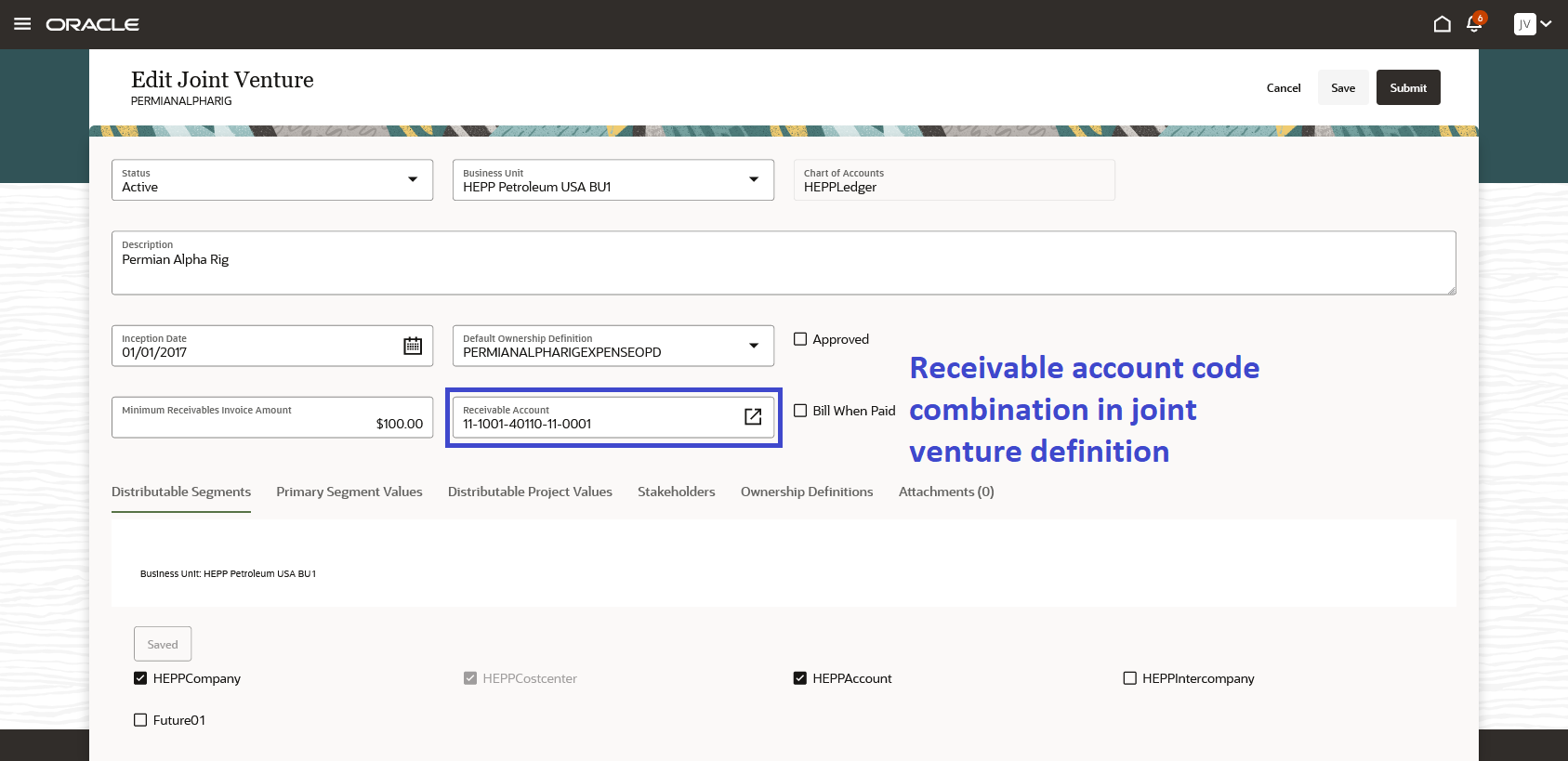

Receivable Code Combination Default for Joint Venture Receivables Invoices

Define a default code combination to use as the receivable account for Receivables invoices created in Joint Venture Management to recoup costs from joint venture partners. The Joint Venture name is available as a source in Subledger Accounting. You can configure Subledger Accounting account mapping to derive accounting using the Joint Venture name.

Business benefits:

- The ability to set up the receivable code combination in the joint venture definition facilitates accurate accounting for joint venture receivables invoices and reduces the complexity of subledger accounting rule setup.

- Having the joint venture name exposed as a source in subledger accounting enables additional flexibility to configure the receivable code combination using subledger accounting rules.

Steps to Enable

Functional Area: Joint Venture Management

Task: Manage Joint Venture Definitions

- Enter the receivable code combination in the joint venture definition.

Key Resources

- For more information, refer to

- Implementing Joint Venture Management guide and

- Using Joint Venture Management guide.

Role And Privileges

- Joint Venture Application Administrator

- Joint Venture Accountant

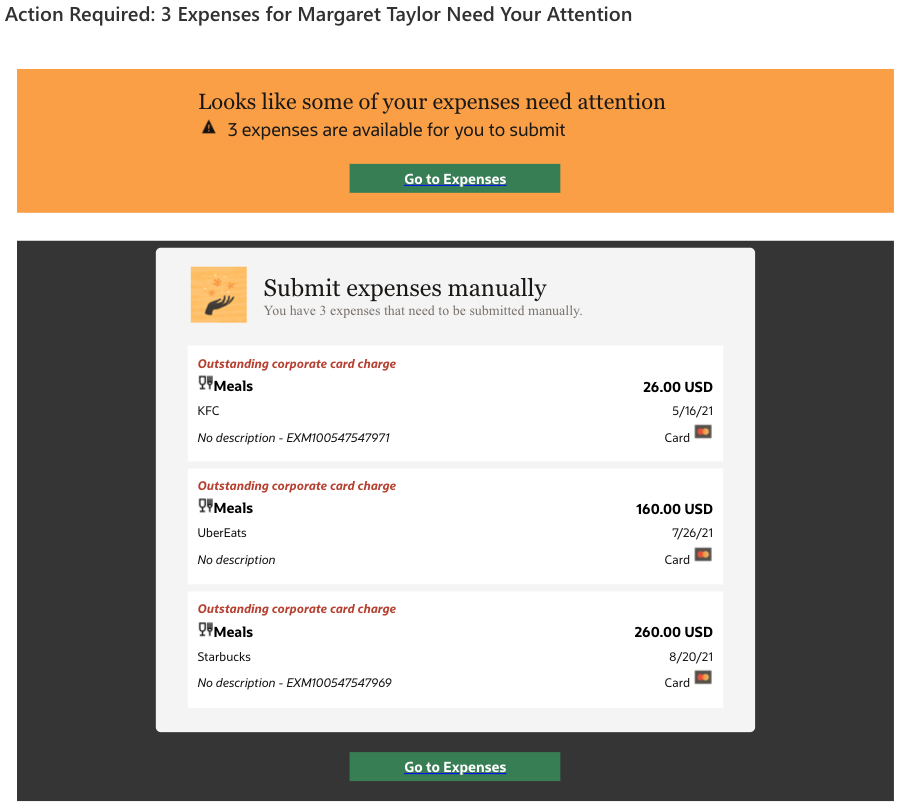

Access to Digest Notification for Expense Delegates

Send expense digest notifications to delegates to allow them to fix expense items requiring expense owner attention.

Expense delegates receive a digest notification for each employee they are a delegate for. The outstanding corporate card charges shown in the digest notification now include corporate card expenses in expense reports that are in Saved, Withdrawn, Rejected, or Returned statuses. The digest notification also shows the expense report number for these charges. Previously, outstanding corporate card charges included only expenses that were not in any reports.

The digest notification enhancements allow expense delegates to quickly identify and fix expense items for the expense owners and give employees a more accurate overview of their outstanding corporate card charges.

Digest Notification

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

To set up digest notifications, refer to the documentation link under Key Resources.

Key Resources

Role And Privileges

You don't need a new role or privilege access to use this feature.

Display of Fields by Expense Type in Oracle Expenses Mobile Application

Simplify expense entry in the Expenses mobile application by only enabling the applicable fields for each expense type. The Description, Merchant, Expense Location, and Number of Days fields are exposed based on the field behavior defined for expense type and the template.

Previously, the mobile application displayed these fields based on profile options, expense category field setup, and policies. With this update, the field behavior defined for the expense type and the expense template takes precedence. Using the fields configuration at the expense type and expense template level, expense managers can set these fields to required, optional, or hidden.

The field behavior in the Expenses mobile application now matches the Expenses web application. This helps reduce delays in expense report submission due to inconsistent behavior in the two applications.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

The tax-related field setup under Oracle Tax is not reflected in the Merchant and Location fields in the Expenses mobile application.

Key Resources

- Refer to the Options for Controlling the Behavior of Expense Fields topic in the Oracle Financials Cloud Implementing Expenses guide to learn how to set up these fields.

Role And Privileges

You don't need a new role or privilege access to use this feature.

Receipt Attachment After Expense Report Approval

Allow employees to attach receipts and supporting documents to an approved expense report, even after expenses are paid. This helps employees comply with government regulations about providing adequate proof of employee expenses.

Receipt attachment after expense report approval provides these business benefits.

- Provides additional information to approved employee expense reports for post-accounting audits.

- Improves the organization of related expenses data.

- Reduces expense management manual updates.

- Enhances audit compliance.

Steps to Enable

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Financials No Longer Optional From: Update 22C

Role And Privileges

To set up receipt rules, you need one of these roles:

- Expense Manager

- Application Implementation Consultant

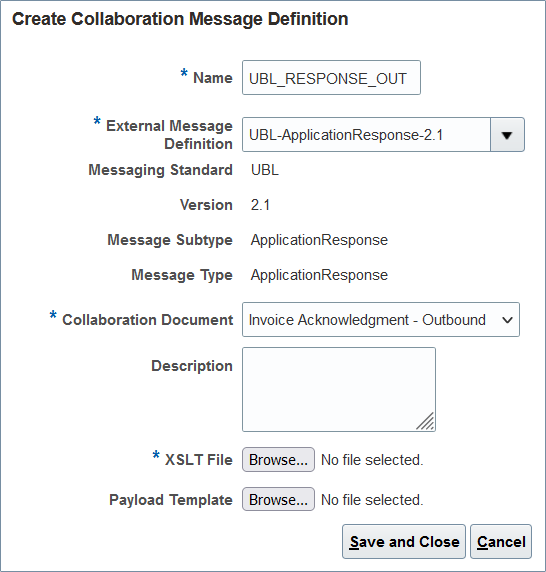

Automatic Notifications to Suppliers for Rejected Electronic Invoices in Industry Standard XML

Inform suppliers about rejected electronic invoices by sending back electronic responses using industry-standard XML. Suppliers who have the capability to process electronic responses can view the rejection reason in their system and take corrective action, resulting in a touchless process.

Until now, suppliers were notified about rejected electronic invoices by email. You can now inform the supplier about rejected invoices electronically using industry-standard XML that can be processed automatically in supplier system. This lets suppliers correct rejected invoices and send them back without the need for manual status queries and actions. The rejected invoice details are sent as a UBL 2.1 Invoice Response Message. You can also send response messages in other industry standard formats by configuring the required message format.

Since electronic response messages can be processed automatically, supplier can view the invoice errors directly in their system and take corrective action. This results in a touchless process for invoice correction, providing greater efficiency and faster processing.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

Perform the following steps to configure the rejection message as a UBL 2.1 Invoice Response Message:

- Navigate to Collaboration Messaging work area.

- Go to the task Manage Collaboration Message Definitions.

- Click on the Create button. Upload the XSLT file provided below.

- Save and Close

- In the service provider setup, go to Outbound Collaboration Messages and add the message definition created above.

- Navigate to the supplier setup. In the B2B Communication section, add the message "Invoice Outbound - Acknowledgement"

Sample XSLT for UBL 2.1 Response Message is provided below. You can save it as an XSL file.

<?xml version="1.0" encoding="UTF-8"?><?oracle-xsl-mapper <!-- SPECIFICATION OF MAP SOURCES AND TARGETS, DO NOT MODIFY. --> <mapSources> <source type="XSD"> <schema location="oramds:/apps/oracle/apps/scm/cmk/xsd/document/AcknowledgeInvoiceOutbound.xsd"/> <rootElement name="processOutboundCollaboration" namespace="http://xmlns.oracle.com/apps/scm/cmk"/> </source> </mapSources> <mapTargets> <target type="XSD"> <schema location="oramds:/apps/oracle/apps/scm/cmk/xsd/message/ApplicationResponse-UBL2.1-Outbound-CollaborationMessage.xsd"/> <rootElement name="processOutboundCollaborationMessage" namespace="http://xmlns.oracle.com/apps/scm/cmk"/> </target> </mapTargets> <substitutions> <sourceSubst substPath="/cmk:processOutboundCollaboration/cmk:OutboundCollaboration" substType="cmk:ApplicationResponseUBL2.1OutboundType"/> </substitutions> <!-- GENERATED BY ORACLE XSL MAPPER 11.1.1.7.0(build 130301.0647.0008) AT [WED JUN 15 18:22:15 EDT 2016]. -->?><xsl:stylesheet version="2.0" xmlns:ns11="http://xmlns.oracle.com/apps/scm/receiving/supplierTransactions/createASN/RcvCreateASNB2BConnectorComposite/schema" xmlns:aia="http://www.oracle.com/XSL/Transform/java/oracle.apps.aia.core.xpath.AIAFunctions" xmlns:bpws="http://schemas.xmlsoap.org/ws/2003/03/business-process/" xmlns:xp20="http://www.oracle.com/XSL/Transform/java/oracle.tip.pc.services.functions.Xpath20" xmlns:bpel="http://docs.oasis-open.org/wsbpel/2.0/process/executable" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" xmlns:ns3="http://xmlns.oracle.com/soa/b2b/OAG/7.2.1/PROCESS_INVOICE_002/OAG_DEF/" xmlns:bpm="http://xmlns.oracle.com/bpmn20/extensions" xmlns:ns12="http://xmlns.oracle.com/apps/scm/receiving/receiptsInterface/receiptConfirmation/receiptConfirmationService/" xmlns:oa="http://www.openapplications.org/oagis/10" xmlns:ns2="http://xmlns.oracle.com/apps/scm/receiving/receiptsInterface/transactions/processorServiceV2/" xmlns:ora="http://schemas.oracle.com/xpath/extension" xmlns:socket="http://www.oracle.com/XSL/Transform/java/oracle.tip.adapter.socket.ProtocolTranslator" xmlns:ns9="http://xmlns.oracle.com/adf/svc/errors/" xmlns:ns1="http://xmlns.oracle.com/apps/scm/receiving/receiptsInterface/transactions/processorServiceV2/types/" xmlns:tns="http://xmlns.oracle.com/apps/financials/payables/invoices/quickInvoices/invoiceInterfaceService/" xmlns:mhdr="http://www.oracle.com/XSL/Transform/java/oracle.tip.mediator.service.common.functions.MediatorExtnFunction" xmlns:oraext="http://www.oracle.com/XSL/Transform/java/oracle.tip.pc.services.functions.ExtFunc" xmlns:dvm="http://www.oracle.com/XSL/Transform/java/oracle.tip.dvm.LookupValue" xmlns:ns7="http://xmlns.oracle.com/adf/svc/types/" xmlns:hwf="http://xmlns.oracle.com/bpel/workflow/xpath" xmlns:ns10="commonj.sdo/java" xmlns:med="http://schemas.oracle.com/mediator/xpath" xmlns:xsl="http://www.w3.org/1999/XSL/Transform" xmlns:ids="http://xmlns.oracle.com/bpel/services/IdentityService/xpath" xmlns:xdk="http://schemas.oracle.com/bpel/extension/xpath/function/xdk" xmlns:xref="http://www.oracle.com/XSL/Transform/java/oracle.tip.xref.xpath.XRefXPathFunctions" xmlns:cmk="http://xmlns.oracle.com/apps/scm/cmk" xmlns:ns5="commonj.sdo" xmlns:xsd="http://www.w3.org/2001/XMLSchema" xmlns:types="http://xmlns.oracle.com/apps/financials/payables/invoices/quickInvoices/invoiceInterfaceService/types/" xmlns:bpmn="http://schemas.oracle.com/bpm/xpath" xmlns:ldap="http://schemas.oracle.com/xpath/extension/ldap" xmlns:ubl="urn:oasis:names:specification:ubl:schema:xsd:ApplicationResponse-2" xmlns:cbc="urn:oasis:names:specification:ubl:schema:xsd:CommonBasicComponents-2" xmlns:cac="urn:oasis:names:specification:ubl:schema:xsd:CommonAggregateComponents-2" xmlns:udt="urn:un:unece:uncefact:data:specification:UnqualifiedDataTypesSchemaModule:2" xmlns:qdt="urn:oasis:names:specification:ubl:schema:xsd:QualifiedDatatypes-2" xmlns:ext="urn:oasis:names:specification:ubl:schema:xsd:CommonExtensionComponents-2" exclude-result-prefixes="xsl ns11 ns3 oa xsd ns12 ns2 ns9 ns1 ns7 ns10 ns5 aia bpws xp20 bpel bpm ora socket mhdr oraext dvm hwf med ids xdk xref bpmn ldap"> <xsl:variable name="prod" select="true()"/> <xsl:variable name="dvm" select="$prod"/> <xsl:variable name="responseListID" select="'UNCL4343OpSubset'"/> <xsl:variable name="documentTypeCodeListID" select="'UNCL1001'"/> <xsl:variable name="statusReasCodeListID" select="'OPStatusReason'"/> <xsl:variable name="AppPartnerCode" select="/cmk:processOutboundCollaboration/cmk:OutboundCollaboration/cmk:ProcessingConfiguration/cmk:ProcActionCode"/> <xsl:variable name="SupplierNumber" select="/cmk:processOutboundCollaboration/cmk:OutboundCollaboration/cmk:ProcessingConfiguration/cmk:PartnerKey4"/> <xsl:variable name="SupplierName" select="/cmk:processOutboundCollaboration/cmk:OutboundCollaboration/cmk:ProcessingConfiguration/cmk:PartnerKey3"/>

<xsl:variable name="otherStatusReasonCodeList"> <value> <code>CAN MATCH TO ONLY 1 LINE</code> <desc>Can match to only one line</desc> </value> <value> <code>DUPLICATE INVOICE NUMBER</code> <desc>Duplicate invoice number</desc> </value> <value> <code>DUPLICATE LINE NUMBER</code> <desc>Duplicate Line Number</desc> </value> <value> <code>INCONSISTENT CURR</code> <desc>Inconsistent currency information</desc> </value> <value> <code>INVALID INVOICE AMOUNT</code> <desc>Invalid invoice amount</desc> </value> <value> <code>INVALID PRICE/QUANTITY/AMOUNT</code> <desc>Inconsistent price, quantity, and amount</desc> </value> </xsl:variable> <xsl:variable name="refStatusReasonCodeList"> <value> <code>INCONSISTENT PO LINE INFO</code> <desc>Inconsistent PO line information</desc> </value> <value> <code>INCONSISTENT PO SUPPLIER</code> <desc>Inconsistent PO supplier information</desc> </value> <value> <code>INVALID ITEM</code> <desc>Invalid Item</desc> </value> <value> <code>INVALID PO INFO</code> <desc>Invalid PO information</desc> </value> <value> <code>INVALID PO NUM</code> <desc>Invalid PO number</desc> </value> <value> <code>INVALID PO RELEASE INFO</code> <desc>Invalid PO release information</desc> </value> <value> <code>INVALID PO RELEASE NUM</code> <desc>Invalid PO release number</desc> </value> <value> <code>INVALID PO SHIPMENT NUM</code> <desc>Invalid PO schedule number</desc> </value> <value> <code>NO PO LINE NUM</code> <desc>No PO line number</desc> </value> <value> <code>RELEASE MISSING</code> <desc>No blanket PO release information</desc> </value> <value> <code>MISSING PO NUM</code> <desc>Missing PO Number</desc> </value> <value> <code>INVALID PO LINE NUM</code> <desc>Invalid PO line number</desc> </value> <value> <code>NO PO SHIPMENT NUM</code> <desc>No PO schedule number</desc> </value> </xsl:variable> <xsl:variable name="qtyStatusReasonCodeList"> <value> <code>NEGATIVE QUANTITY BILLED</code> <desc>Billed quantity is below zero</desc> </value> <value> <code>INVALID QUANTITY</code> <desc>Invalid quantity</desc> </value> </xsl:variable> <!-- /cmk:processOutboundCollaboration/cmk:OutboundCollaboration/types:getSupplierRejectionsResponse --> <xsl:template match="/"> <cmk:processOutboundCollaborationMessage> <cmk:OutboundCollaborationMessage> <xsl:attribute name="xsi:type"><xsl:text disable-output-escaping="no">cmk:ApplicationResponseUBL2.1OutboundType</xsl:text></xsl:attribute> <cmk:EmailContent> <cmk:Body> <cmk:EmailBodyHeader> </cmk:EmailBodyHeader> <xsl:for-each select="//types:result"> <xsl:sort select="./tns:Invoicenum"/> <xsl:sort select="./tns:Invoicenumber"/> <cmk:EmailBodyTableHeader> <cmk:ColumnName ColumnNumber="1"> <cmk:ColumnValue> <!-- 20210318 - bug: 32452823 change mapping from ProcessingConfig to mapping from the object <xsl:value-of select="$SupplierNumber"/> --> <xsl:value-of select="tns:Vendornumber"/> </cmk:ColumnValue> </cmk:ColumnName> <cmk:ColumnName ColumnNumber="2"> <cmk:ColumnValue> <!-- 20210318 - bug: 32452823 change mapping from ProcessingConfig to mapping from the object <xsl:value-of select="$SupplierName"/> --> <xsl:value-of select="tns:VendorName"/> </cmk:ColumnValue> </cmk:ColumnName> <cmk:ColumnName ColumnNumber="3"> <cmk:ColumnValue> <xsl:choose> <xsl:when test="tns:Invoicenum"> <xsl:value-of select="tns:Invoicenum"/> </xsl:when> <xsl:when test="tns:Invoicenumber"> <xsl:value-of select="tns:Invoicenumber"/> </xsl:when> </xsl:choose> </cmk:ColumnValue> </cmk:ColumnName> <cmk:ColumnName ColumnNumber="4"> <cmk:ColumnValue> <xsl:value-of select="tns:InvoiceDate"/> </cmk:ColumnValue> </cmk:ColumnName> <cmk:ColumnName ColumnNumber="5"> <cmk:ColumnValue> <xsl:value-of select="tns:InvoiceCurrencyCode"/> </cmk:ColumnValue> </cmk:ColumnName> <cmk:ColumnName ColumnNumber="6"> <cmk:ColumnValue> <xsl:value-of select="tns:InvoiceAmount"/> </cmk:ColumnValue> </cmk:ColumnName> <cmk:ColumnName ColumnNumber="7"> <cmk:ColumnValue> <xsl:value-of select="tns:Linenumber"/> </cmk:ColumnValue> </cmk:ColumnName> <cmk:ColumnName ColumnNumber="8"> <cmk:ColumnValue> <xsl:value-of select="tns:DisplayedField"/> </cmk:ColumnValue> </cmk:ColumnName> <cmk:ColumnName ColumnNumber="9"> <cmk:ColumnValue> <xsl:value-of select="tns:Description"/> </cmk:ColumnValue> </cmk:ColumnName> </cmk:EmailBodyTableHeader> </xsl:for-each> </cmk:Body> </cmk:EmailContent>

<xsl:call-template name="getInvoice"/>

</cmk:OutboundCollaborationMessage> </cmk:processOutboundCollaborationMessage> </xsl:template> <xsl:template name="getInvoice">

<ubl:ApplicationResponse> <cbc:CustomizationID> <xsl:text>urn:fdc:peppol.eu:poacc:trns:invoice_response:3</xsl:text> </cbc:CustomizationID> <cbc:ProfileID> <xsl:text>urn:fdc:peppol.eu:poacc:bis:invoice_response:3</xsl:text> </cbc:ProfileID> <cbc:ID> <xsl:value-of select="/cmk:processOutboundCollaboration/cmk:OutboundCollaboration/cmk:MessageID"/> </cbc:ID> <cbc:IssueDate> <xsl:if test="$prod"> <xsl:value-of select="xp20:current-date()"/> </xsl:if> </cbc:IssueDate> <cac:SenderParty> <cbc:EndpointID> <xsl:attribute name="schemeID"> <xsl:text>VAT</xsl:text> </xsl:attribute> <xsl:value-of select="/cmk:processOutboundCollaboration/cmk:OutboundCollaboration/cmk:ProcessingConfiguration/cmk:GlobalSenderId"/> </cbc:EndpointID> </cac:SenderParty> <cac:ReceiverParty> <cbc:EndpointID> <xsl:attribute name="schemeID"> <xsl:text>VAT</xsl:text> </xsl:attribute> <xsl:value-of select="/cmk:processOutboundCollaboration/cmk:OutboundCollaboration/cmk:ProcessingConfiguration/cmk:ExtPartnerId"/> </cbc:EndpointID> <cac:PartyLegalEntity> <cbc:RegistrationName> <xsl:value-of select="//types:result[1]/tns:VendorName"/> </cbc:RegistrationName> </cac:PartyLegalEntity> </cac:ReceiverParty> <xsl:variable name="sortedCopy"> <xsl:for-each select="//types:result"> <xsl:sort select="tns:Invoicenum"/> <xsl:sort select="tns:Invoicenumber"/> <xsl:sort select="tns:Linenumber"/> <xsl:copy-of select="current()"/> </xsl:for-each> </xsl:variable> <xsl:for-each select="$sortedCopy/types:result"> <xsl:variable name="num"> <xsl:choose> <xsl:when test="tns:Invoicenum"> <xsl:value-of select="tns:Invoicenum"/> </xsl:when> <xsl:when test="tns:Invoicenumber"> <xsl:value-of select="tns:Invoicenumber"/> </xsl:when> </xsl:choose> </xsl:variable> <xsl:variable name="prevnum"> <xsl:choose> <xsl:when test="position() = 1"> <xsl:value-of select="''"/> </xsl:when> <xsl:when test="preceding-sibling::types:result[1]/tns:Invoicenum"> <xsl:value-of select="preceding-sibling::types:result[1]/tns:Invoicenum"/> </xsl:when> <xsl:when test="preceding-sibling::types:result[1]/tns:Invoicenumber"> <xsl:value-of select="preceding-sibling::types:result[1]/tns:Invoicenumber"/> </xsl:when> </xsl:choose> </xsl:variable> <xsl:if test="string($num) != string($prevnum)"> <cac:DocumentResponse> <cac:Response> <cbc:ResponseCode> <xsl:attribute name="listID"> <xsl:value-of select="$responseListID"/> </xsl:attribute> <xsl:text>RE</xsl:text> </cbc:ResponseCode> <cbc:EffectiveDate> <xsl:if test="$prod"> <xsl:value-of select="xp20:current-date()"/> </xsl:if> </cbc:EffectiveDate> <xsl:call-template name="getStatus"> <xsl:with-param name="num" select="$num"/> <xsl:with-param name="sortedCopy" select="$sortedCopy"/> </xsl:call-template> </cac:Response> <cac:DocumentReference> <cbc:ID> <xsl:choose> <xsl:when test="tns:Invoicenum"> <xsl:value-of select="tns:Invoicenum"/> </xsl:when> <xsl:when test="tns:Invoicenumber"> <xsl:value-of select="tns:Invoicenumber"/> </xsl:when> </xsl:choose> </cbc:ID> <cbc:DocumentTypeCode> <xsl:attribute name="listID"> <xsl:value-of select="$documentTypeCodeListID"/> </xsl:attribute> <xsl:text>380</xsl:text> <!-- 380 - Invoice --> </cbc:DocumentTypeCode> </cac:DocumentReference> </cac:DocumentResponse> </xsl:if> </xsl:for-each> </ubl:ApplicationResponse>

</xsl:template> <xsl:template name="getStatus"> <xsl:param name="num"/> <xsl:param name="sortedCopy"/> <xsl:for-each select="$sortedCopy/types:result[tns:Invoicenum = $num or tns:Invoicenumber = $num]"> <xsl:variable name="rejectionCode" select="tns:DisplayedField"/> <cac:Status> <xsl:choose> <xsl:when test="$otherStatusReasonCodeList/value[desc = $rejectionCode]"> <cbc:StatusReasonCode> <xsl:attribute name="listID"> <xsl:value-of select="$statusReasCodeListID"/> </xsl:attribute> <xsl:value-of select="'OTH'"/> </cbc:StatusReasonCode> </xsl:when> <xsl:when test="$refStatusReasonCodeList/value[desc = $rejectionCode]"> <cbc:StatusReasonCode> <xsl:attribute name="listID"> <xsl:value-of select="$statusReasCodeListID"/> </xsl:attribute> <xsl:value-of select="'REF'"/> </cbc:StatusReasonCode> </xsl:when> <xsl:when test="$qtyStatusReasonCodeList/value[desc = $rejectionCode]"> <cbc:StatusReasonCode> <xsl:attribute name="listID"> <xsl:value-of select="$statusReasCodeListID"/> </xsl:attribute> <xsl:value-of select="'QTY'"/> </cbc:StatusReasonCode> </xsl:when> </xsl:choose> <xsl:variable name="conditions"> <xsl:call-template name="getNameValue"> <xsl:with-param name="name" select="tns:TokenName1"/> <xsl:with-param name="value" select="tns:TokenValue1"/> </xsl:call-template> <xsl:call-template name="getNameValue"> <xsl:with-param name="name" select="tns:TokenName2"/> <xsl:with-param name="value" select="tns:TokenValue2"/> </xsl:call-template> <xsl:call-template name="getNameValue"> <xsl:with-param name="name" select="tns:TokenName3"/> <xsl:with-param name="value" select="tns:TokenValue3"/> </xsl:call-template> <xsl:call-template name="getNameValue"> <xsl:with-param name="name" select="tns:TokenName4"/> <xsl:with-param name="value" select="tns:TokenValue4"/> </xsl:call-template> <xsl:call-template name="getNameValue"> <xsl:with-param name="name" select="tns:TokenName5"/> <xsl:with-param name="value" select="tns:TokenValue5"/> </xsl:call-template> <xsl:call-template name="getNameValue"> <xsl:with-param name="name" select="tns:TokenName6"/> <xsl:with-param name="value" select="tns:TokenValue6"/> </xsl:call-template> <xsl:call-template name="getNameValue"> <xsl:with-param name="name" select="tns:TokenName7"/> <xsl:with-param name="value" select="tns:TokenValue7"/> </xsl:call-template> <xsl:call-template name="getNameValue"> <xsl:with-param name="name" select="tns:TokenName8"/> <xsl:with-param name="value" select="tns:TokenValue8"/> </xsl:call-template> <xsl:call-template name="getNameValue"> <xsl:with-param name="name" select="tns:TokenName9"/> <xsl:with-param name="value" select="tns:TokenValue9"/> </xsl:call-template> <xsl:call-template name="getNameValue"> <xsl:with-param name="name" select="tns:TokenName10"/> <xsl:with-param name="value" select="tns:TokenValue10"/> </xsl:call-template> </xsl:variable> <cbc:StatusReason> <xsl:choose> <xsl:when test="tns:Description != ''"> <xsl:value-of select="concat(tns:Description,$conditions)"/> </xsl:when> <xsl:otherwise> <xsl:value-of select="concat($rejectionCode,$conditions)"/> </xsl:otherwise> </xsl:choose> </cbc:StatusReason> </cac:Status> </xsl:for-each> </xsl:template> <xsl:template name="getNameValue"> <xsl:param name="name"/> <xsl:param name="value"/> <xsl:if test="$name != '' or $value != ''"> <xsl:value-of select="' :'"/> <xsl:if test="$name != ''"> <xsl:value-of select="'-'"/> <xsl:value-of select="$name"/> </xsl:if> <xsl:if test="$value != ''"> <xsl:value-of select="' -'"/> <xsl:value-of select="$value"/> </xsl:if> </xsl:if> </xsl:template> </xsl:stylesheet>

Configurable Payables Workflow Notifications

The Configurable Payables Workflow Notifications feature was introduced in update 17D, with additional capabilities added in update 19D. In update 22A, there are changes in the privileges required for a user to drill down to the invoice from the email and in-app notifications for the following Payables workflows:

- Invoice Approval

- Invoice Account Coding

- Hold Resolution

From update 22A, users can drill down from the in-app and email notifications for these workflows and view the invoice if they have the View Payables Invoice privilege.

Additionally, only those users who have the View Payables Invoice privilege will be able to see the Transaction Details link on the email notification and the View Invoice button on the in-app notifications.

Users with the View Payables Invoices privilege can now drill down to the invoice and view the details during approval. Users who don't have this privilege can't see the Transaction Details link (email notifications) and View Invoice button (in-app notifications). This helps avoid situations where users try to drill down to the invoices unsuccessfully since they don't have the required privilege.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

Use the Security Console to assign the 'View Payables Invoice' privilege to users who need to drill down to the invoices during the approval process.

Key Resources

- For an overview of the Configurable Workflow Notifications feature, see the Configuring Payables Workflow Notifications topic on the Oracle Help Center.

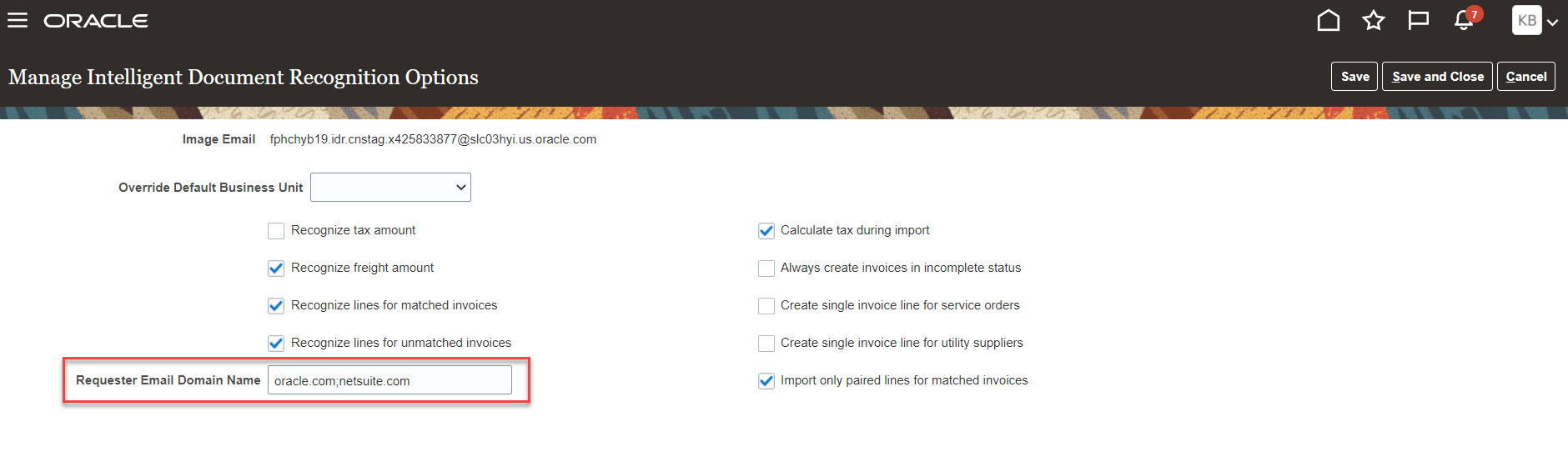

Invoice Requester Recognized from Invoice Document

Recognize and extract the invoice requester from the invoice document. This eliminates the need to manually enter the requester details.