- Revision History

- Overview

- Optional Uptake of New Features (Opt In)

- Feature Summary

- Collaboration Messaging Framework

- Financials Common

- Accounting and Control

-

- Budgetary Control

- General Ledger

- Joint Venture Management

-

- Classification of Operated and Non-Operated Joint Ventures

- Joint Venture Distributions in Entered Currency

- Joint Venture Management Overhead Method - Percentage of Cost with Sliding Scale Option

- Joint Venture Ownership Definition and Direct Billed Stakeholder Assignment Rules

- Joint Venture Partner Contribution Requests

- Partner Contributions for Internal Stakeholders

- Statistical Journal Entry Creation for Joint Venture Operational Measures

- Transaction Date Default Configuration

-

- Subledger Accounting

- Asset and Lease Management

- Payables and Expenses

-

- Expenses

- Payables

-

- Adaptive Learning Data Sharing Between Environments for Intelligent Document Recognition

- Adaptive Learning for Invoice Lines Using Intelligent Document Recognition

- Adaptive Learning for Routing Attributes Using Intelligent Document Recognition

- Legal Entity Recognition from Invoice Document

- Receipt-Matched Invoices for Catch Weight Items

- Recognition of Specific Internal Suppliers for Invoices Created Using Intelligent Document Recognition

- Recognition of Supporting Document Separators for Invoices Using Intelligent Document Recognition

-

- Payments

- Receivables and Cash

- Region and Country-Specific Features

- U.S. Federal Financials

- IMPORTANT Actions and Considerations

This document will continue to evolve as existing sections change and new information is added. All updates appear in the following table:

| Date | Product | Feature | Notes |

|---|---|---|---|

| 23 JUN 2022 | Regional Shared Features | Single Step Submission of Select Transactions for Tax Reporting and Tax Allocation Processes | Updated document. Revised feature information. |

| 23 JUN 2022 | Regional Shared Features | First Party Tax Registration Number Enforcement on Payables and Receivables Transactions | Updated document. Revised feature information. |

| 17 JUN 2022 | Payments | Updated document. Delivered new feature in update 22B. | |

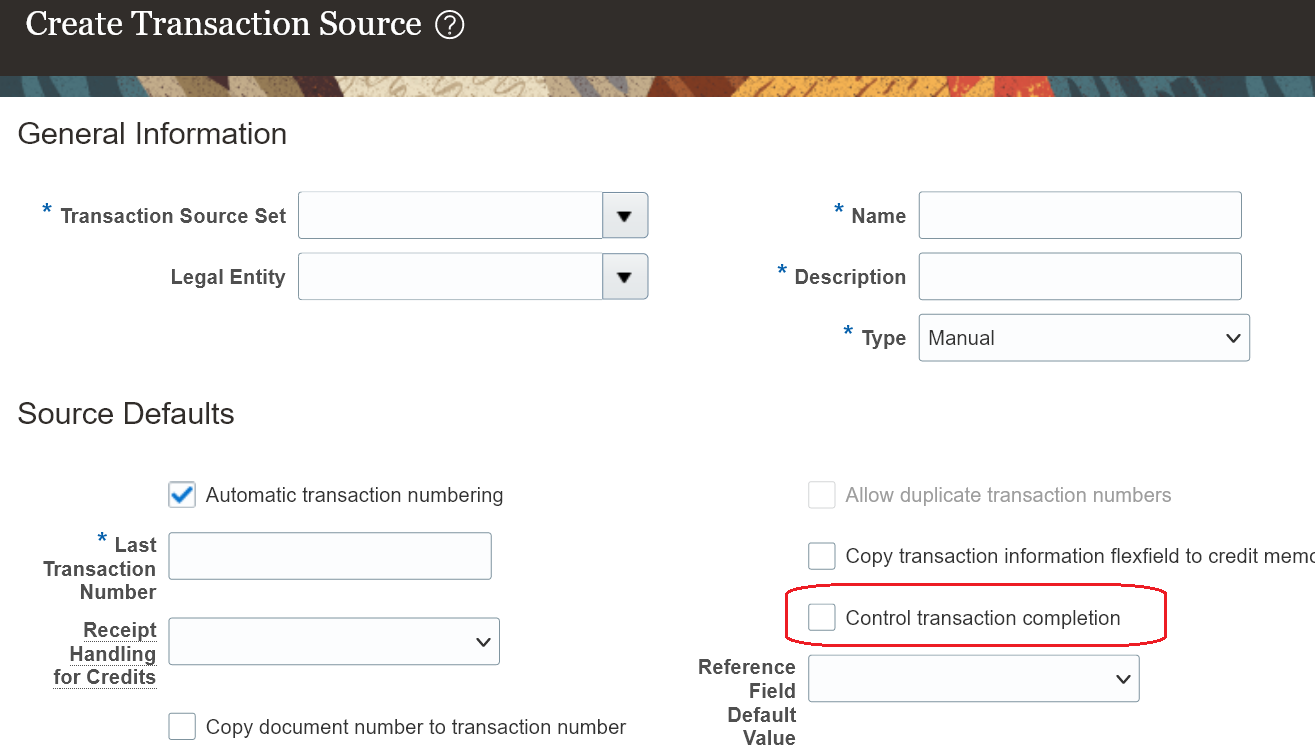

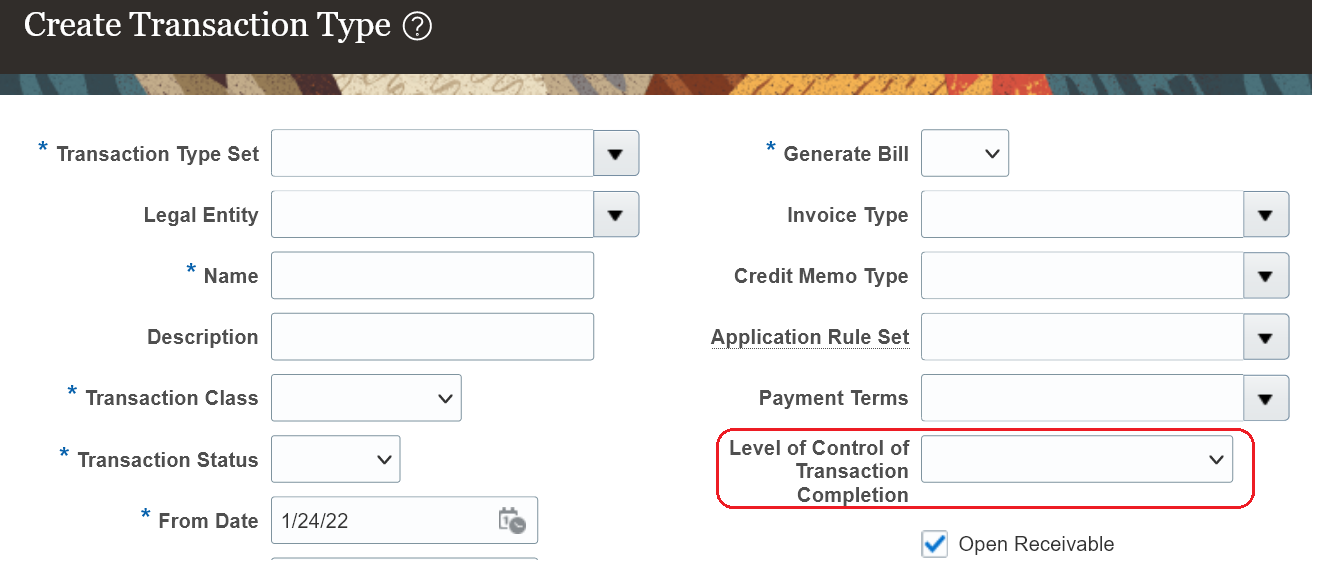

| 17 JUN 2022 | Receivables | Management of Negative Invoice Line Amounts and Transaction Completion |

Updated document. Revised feature information. |

| 27 MAY 2022 | U.S. Federal Financials | U.S. Federal Treasury Payment Schedules | Updated document. Revised steps to enable. |

| 27 MAY 2022 | Common Financials | Service Excellence Continuing Investments | Updated document. Revised feature information. |

| 27 MAY 2022 | IMPORTANT Actions and Considerations | Deprecation of Payment Infotile | Updated document. Added information about upcoming feature deprecation. |

| 29 APR 2022 | Budgetary Control | OTBI Drilldown to Review Budgetary Control Transactions | Updated document. Added additional Key Resources. |

| 29 APR 2022 | Common Financials | Workflow Transaction Console | Updated document. Added upcoming opt in change. |

| 27 APR 2022 | Collaboration Messaging Framework | Retrieve Large Purchase Order Payloads for B2B Messaging | Updated document. Added a feature that was backported to update 22B in the May monthly maintenance pack. |

| 18 MAR 2022 | Common Financials | Simplified Workflow Rules Configuration | Updated document. Delivered new feature in update 22B. |

| 04 MAR 2022 | Created initial document. |

IMPORTANT NOTE: If you are being updated directly from 21D to 22B you should review the content of both 22A and 22B sections to ensure you see all the changes included in the update.

HAVE AN IDEA?

HAVE AN IDEA?

We’re here and we’re listening. If you have a suggestion on how to make our cloud services even better then go ahead and tell us. There are several ways to submit your ideas, for example, through the Ideas Lab on Oracle Customer Connect. Wherever you see this icon after the feature name it means we delivered one of your ideas.

GIVE US FEEDBACK

We welcome your comments and suggestions to improve the content. Please send us your feedback at oracle_fusion_applications_help_ww_grp@oracle.com.

DISCLAIMER

The information contained in this document may include statements about Oracle’s product development plans. Many factors can materially affect Oracle’s product development plans and the nature and timing of future product releases. Accordingly, this Information is provided to you solely for information only, is not a commitment to deliver any material, code, or functionality, and should not be relied upon in making purchasing decisions. The development, release, and timing of any features or functionality described remains at the sole discretion of Oracle.

This information may not be incorporated into any contractual agreement with Oracle or its subsidiaries or affiliates. Oracle specifically disclaims any liability with respect to this information. Refer to the Legal Notices and Terms of Use for further information.

Optional Uptake of New Features (Opt In)

Oracle Cloud Applications delivers new updates every quarter. This means every three months you'll receive new functionality to help you efficiently and effectively manage your business. Some features are delivered Enabled meaning they are immediately available to end users. Other features are delivered Disabled meaning you have to take action to make available. Features delivered Disabled can be activated for end users by stepping through the following instructions using the following privileges:

- Review Applications Offering (ASM_REVIEW_APPLICATIONS_OFFERINGS_PRIV)

- Configure Oracle Fusion Applications Offering (ASM_CONFIGURE_OFFERING_PRIV)

Here’s how you opt in to new features:

- Click Navigator > My Enterprise > New Features.

- On the Features Overview page, select your offering to review new features specific to it. Or, you can leave the default selection All Enabled Offerings to review new features for all offerings.

- On the New Features tab, review the new features and check the opt-in status of the feature in the Enabled column. If a feature has already been enabled, you will see a check mark. Otherwise, you will see an icon to enable the feature.

- Click the icon in the Enabled column and complete the steps to enable the feature.

In some cases, you might want to opt in to a feature that's not listed in the New Features work area. Here's how to opt in:

- Click Navigator > My Enterprise > Offerings.

- On the Offerings page, select your offering, and then click Opt In Features.

- On the Opt In page, click the Edit Features (pencil) icon for the offering, or for the functional area that includes your feature.

- On the Edit Features page, complete the steps to enable the feature.

For more information and detailed instructions on opting in to new features for your offering, see Offering Configuration.

Opt In Expiration

Occasionally, features delivered Disabled via Opt In may be enabled automatically in a future update. This is known as an Opt In Expiration. If your cloud service has any Opt In Expirations you will see a related tab in this document. Click on that tab to see when the feature was originally delivered Disabled, and when the Opt In will expire, potentially automatically enabling the feature. You can also click here to see features with Opt In Expirations across all Oracle Cloud Applications.

Column Definitions:

Report = New or modified, Oracle-delivered, ready to run reports.

UI or Process-Based: Small Scale = These UI or process-based features are typically comprised of minor field, validation, or program changes. Therefore, the potential impact to users is minimal.

UI or Process-Based: Larger Scale* = These UI or process-based features have more complex designs. Therefore, the potential impact to users is higher.

Features Delivered Disabled = Action is needed BEFORE these features can be used by END USERS. These features are delivered disabled and you choose if and when to enable them. For example, a) new or expanded BI subject areas need to first be incorporated into reports, b) Integration is required to utilize new web services, or c) features must be assigned to user roles before they can be accessed.

Collaboration Messaging Framework

Retrieve Large Purchase Order Payloads for B2B Messaging

Configure Oracle Collaboration Messaging Framework to process large purchase orders (typically more than 2,000-lines) when you initiate B2B communication. The payload for a large purchase order is retrieved in small parts from Oracle Purchasing and then combined and delivered as one purchase order, resulting in improved performance. This feature is available in the May monthly maintenance pack for update 22B.

After you enable the feature, enter a value in the Large PO Processing section of the Manage Collaboration Messaging Configuration page in the Large PO Minimum Line Count field to specify the minimum number of lines in a large PO. Then enter a value in the PO Lines Retrieved in a Single Query field to specify the number of lines to retrieve from Oracle Purchasing in each part (1000 lines by default). The values you set in the Large PO Delivery Duration (30 minutes by default) and Large PO Delivery Attempt Interval (3 minutes by default) fields indicate how long and how often to attempt delivery of the PO.

Large Purchase Order Processing in Manage Collaboration Messaging Configuration

Steps to Enable

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Order Management

Tips And Considerations

A purchase order with more than 2,000 lines is considered a large purchase order, but you can determine the minimum line count for your large purchase orders based on your specific business needs.

Key Resources

- Oracle Supply Chain Management Cloud: Configuring and Managing B2B Messaging guide available on the Oracle Help Center.

Role Information

You have a couple of options for giving people access to this feature, depending on whether you're assigning them predefined job roles or your own configured job roles.

- Users who are assigned this predefined job role can access this feature:

- B2B Administrator (ORA_CMK_B2B_ADMINISTRATOR_ABSTRACT)

- Users who are assigned configured job roles that contain this privilege are able to access this feature:

- Manage Collaboration Messaging Configuration (CMK_MANAGE_COLLAB_MESG_CONFIG_PRIV)

Service Excellence Continuing Investments

Our ongoing investment in service excellence has a focus on overall usability, resiliency, performance, and security. This work is based on monitoring performance trends, reviewing common use patterns, analyzing service requests, and participating in many discussions with customers.

In this update, our ongoing investment in service excellence includes improvements in the following areas:

Usability

-

Convert the quantity-based tax on invoices to the invoice currency, when the invoice currency is different from the tax currency. This enables users to compute, charge, and report more accurate tax amounts on both Payables and Receivables invoices.

-

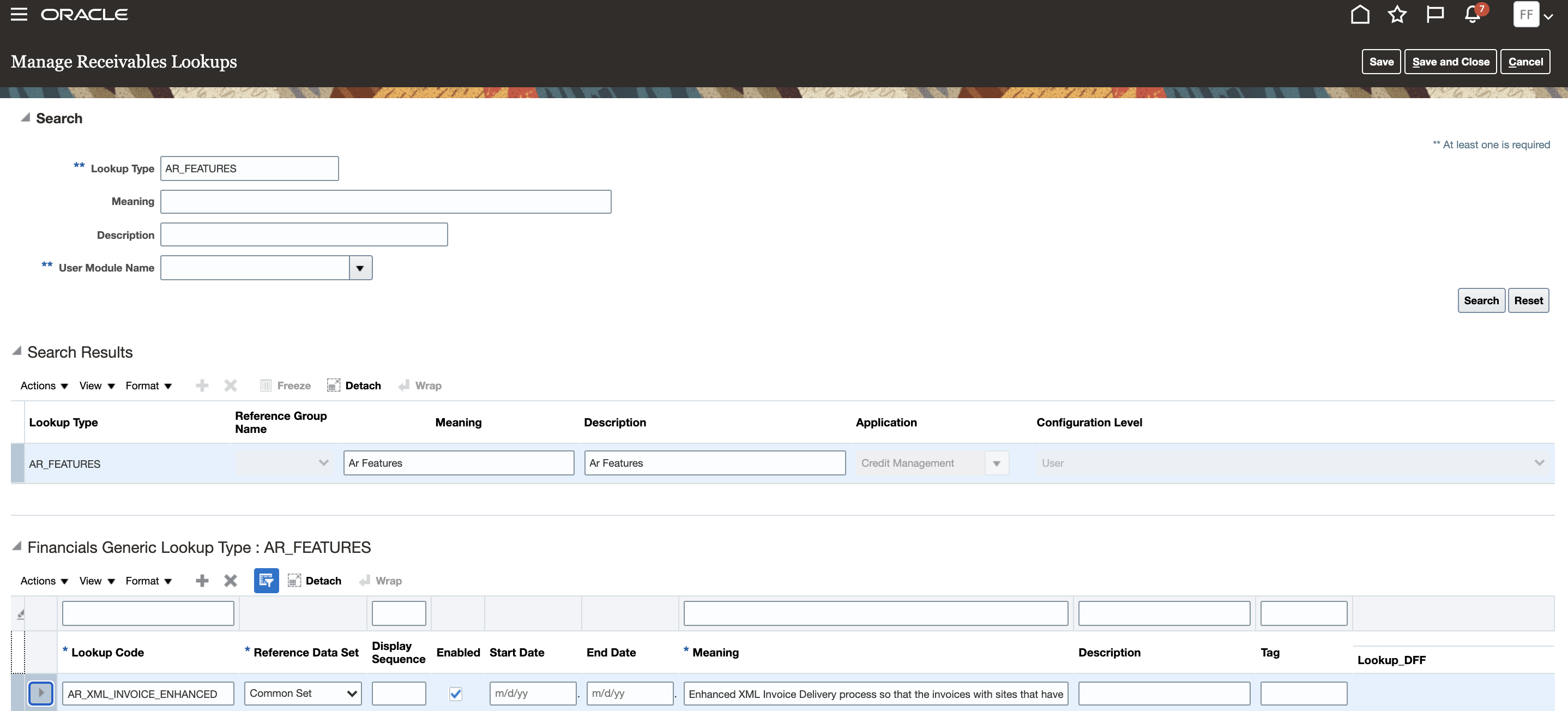

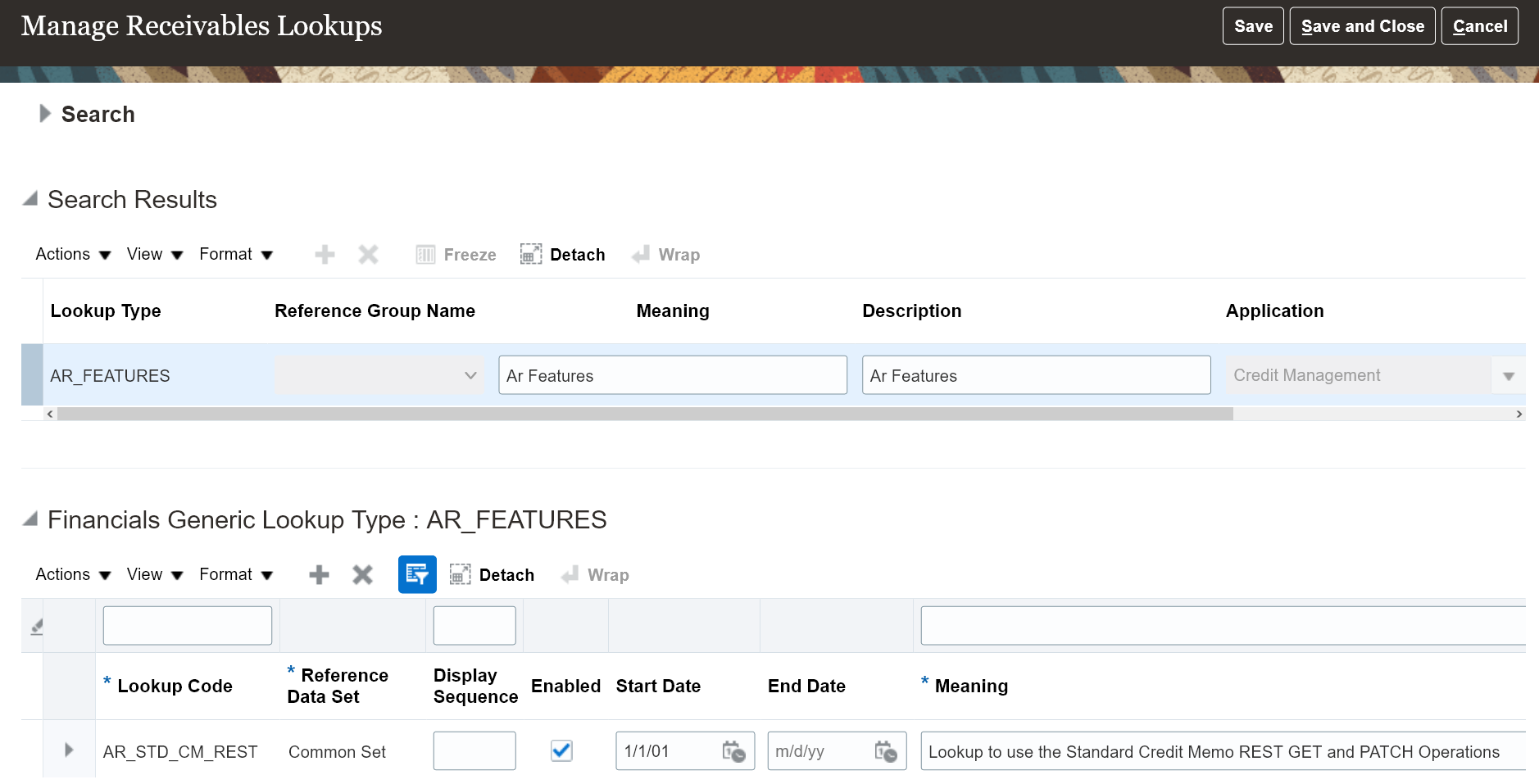

Identification of credit analyst using email address in the Customer Import Upload FBDI. Previously, the Credit Analyst field of the Customer Import Upload FBDI only supported the import of credit analyst names. Enable this functionality by adding a new lookup code CR_ANALYST_EMAIL_CUST_PROFILE under the lookup type AR_FEATURES.

-

Intercompany workflow transactions are rejected on expiration and notified to the relevant stakeholders.

-

Splitting of customer statements by site for PRINT delivery method. Enable this functionality by adding a new lookup code AR_PRINT_STATEMENT_BURSTING under the lookup type AR_FEATURES.

Resiliency

-

Import Segment Values and Hierarchies process ends gracefully on cancellation.

-

Improved readability of log files when high volumes of journals are imported.

- Resiliency and diagnostic improvements to the fiscal document generation process for Brazil. Improvements include

- Simplification to Fiscal Document processing to allow multiple ESS processes to run on a single request.

- Better visibility for standalone fiscal documents.

- Corrections in handling CST (Tax Situation Code) for vendor flows.

- Resiliency and diagnostic improvements to the collection documents process for Brazil. Improvements include

- The anticipated withholding tax amount is displayed when the installment amount is updated.

- Improved performance of the Receivables Bank Return process.

Performance

- Performance improvements to the tax engine for account-based tax rules.

- Performance improvement in invoice validation through improved invocation of tax calculation.

- The Import Segment Values and Hierarchies process contains performance improvements when importing descriptive flexfield information.

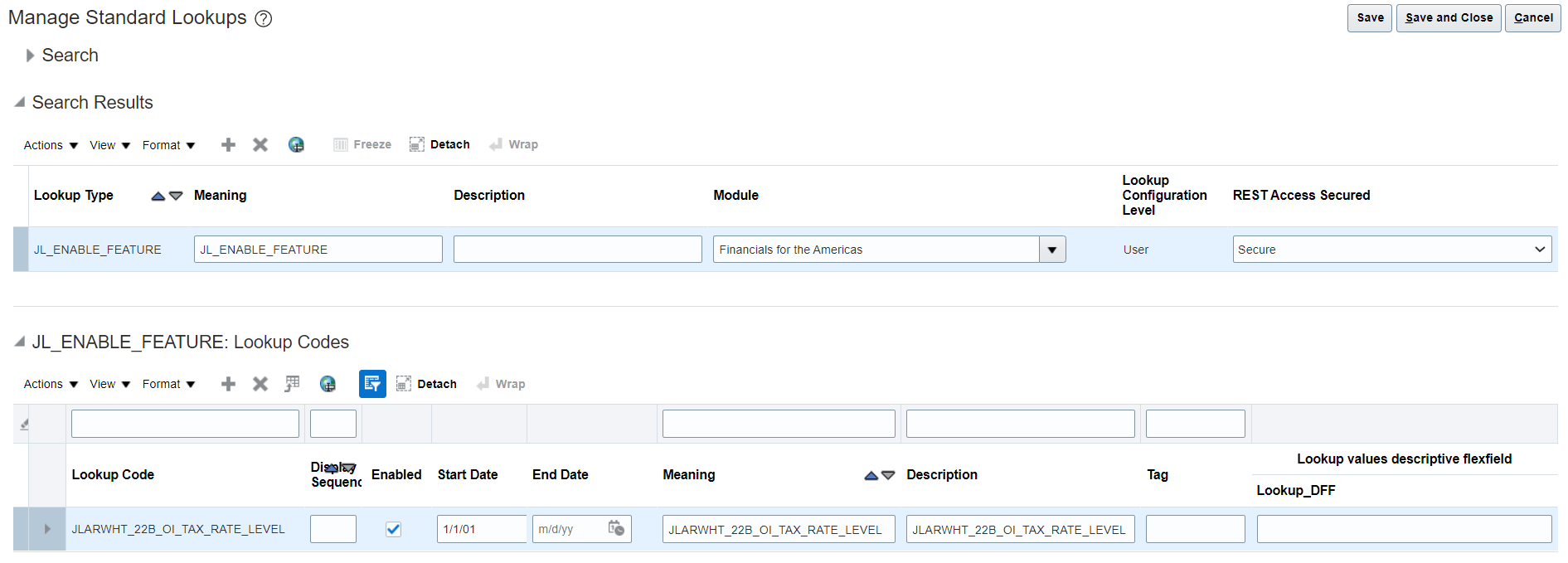

- Support for purging of Collection Scoring History. Customers with high volume can purge the collection scoring history for optimal performance. Enable this functionality by adding a new lookup code IEX_SCORE_HISTORIES_UPSERT under the lookup type IEX_FEATURES. Optionally, stop storing data point histories by adding a new lookup code DISABLE_STORING_DATA_POINTS under lookup type IEX_FEATURES.

Steps to Enable

You don't need to do anything to enable this feature.

Simplified Workflow Rules Configuration

Use the Simplified Workflow Rules Configuration feature to create workflow rules using spreadsheets for Payables Invoice Approval and General Ledger Journal Approval workflows. Download the templates using the Manage Workflow Rules in Spreadsheet task to create and manage workflow rules according to your approval policies.

This feature was introduced in update 18C. In addition to the existing features, the 22B update also lets you do the following:

- Create rules using advanced configurations (rule conditions using sum, aggregate, count, and others).

- Specify the type and date of currency conversion rates for rules that evaluate transaction amounts in a different currency.

The advanced options allows you to configure approval rules to meet the complex approval requirements, such as routing approval notification to the approver based on the sum of all distribution lines amount for a particular cost center entered on distribution lines.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

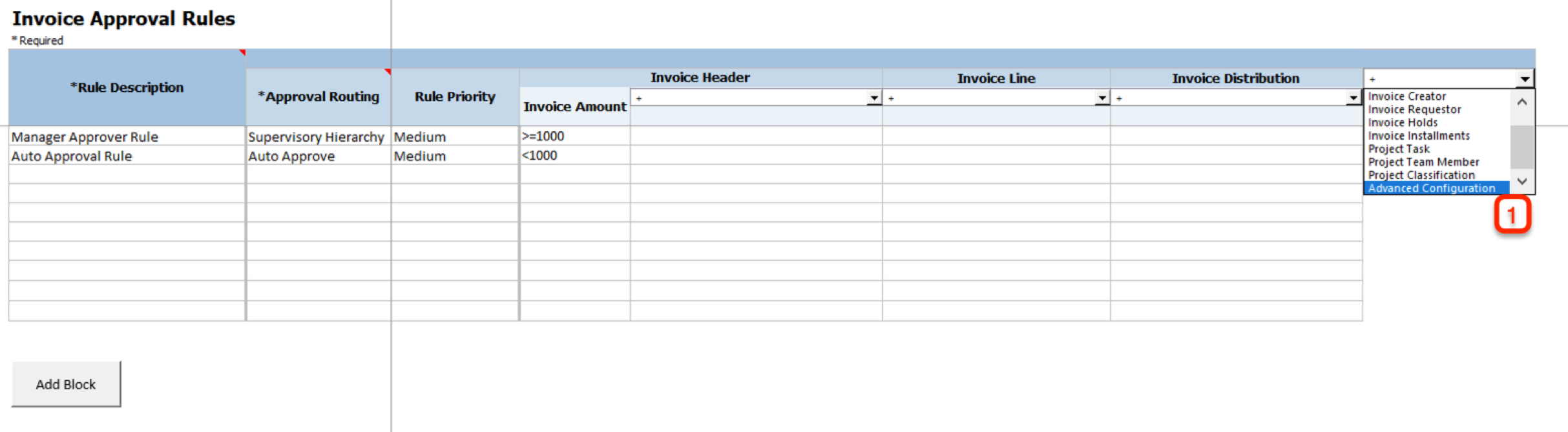

Follow these steps to use advanced configuration:

- Select the newly introduced 'Advanced Configuration' in attribute categories.

- Select one of the options from the list within advanced configuration.

- Enter the values using dialog box by clicking on the respective cells.

Select Advanced Configuration and Then Select an Option

You can select from the following options to configure advanced rules:

| Advanced Configuration Option |

Description |

| Count |

Returns the total number of data items such as Invoice Lines, Invoice Distributions etc. |

| Sum |

Returns the total of all the values of the selected attribute. |

| Maximum |

Returns the largest value in a set of values of the selected attribute. |

| Minimum |

Returns the smallest number in a set of values of the selected attribute. |

| Average |

Returns the average of all the values of the selected attribute. |

| Transform to Uppercase |

Converts the text in the attribute to upper case. |

| Transform to Lowercase |

Converts the text in the attribute to lower case. |

| Trim White Spaces |

Removes white spaces and rearranges the text in the attribute. |

Example using SUM:

For cost center 110, Approver A is authorized to approve when the total for cost center is less than or equal to $1000 and Approver B is authorized to approve when the total for cost center is above $1000.

Enter Values for SUM

Using No Case Where:

In specific cases, you can use the 'no case where' pattern with COUNT option by setting the value as '0' or '= 0'. This lets you check that a selected data item doesn’t have a count of 0. For example, you can validate that none of the Distributions contain Cost Center as 520 or no Lines cross an amount limit.

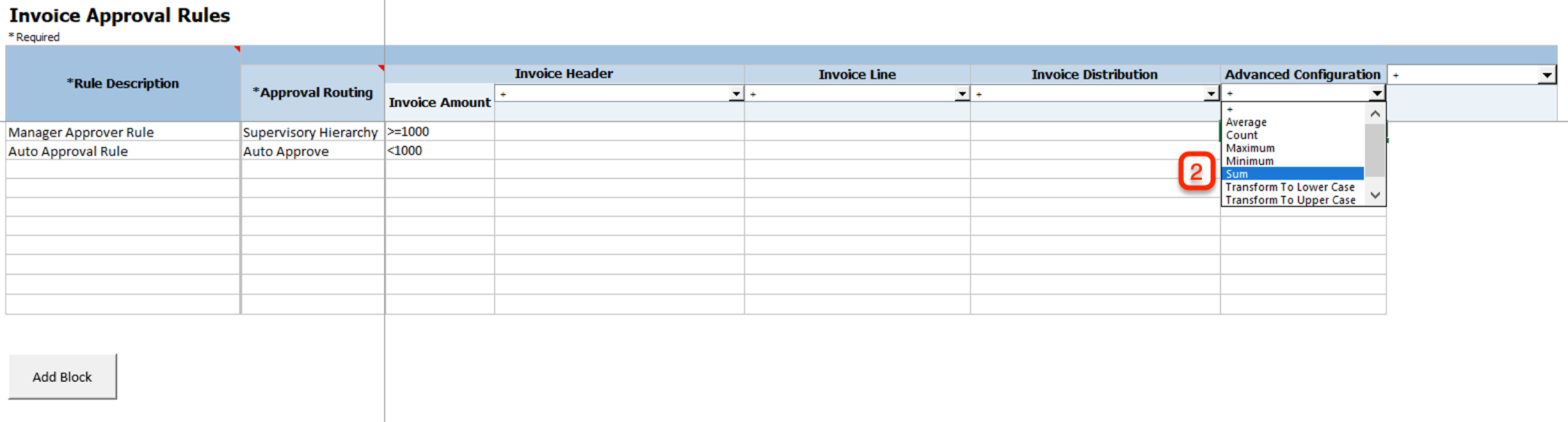

Additional rule evaluation currency conversion options:

When defining rule evaluation currencies, you can now also provide these values for accurate calculation of currency conversion rate:

- Conversion Date

- Conversion Rate Type

The business requirement in the following example is to configure approval rules based on the invoice amount limit in functional currency always which is ‘GBP’. Invoice amount has to be converted into GBP using the invoice creation date as currency conversion date and currency conversion type "Spot".

Enter Date & Rate Type Values in Rules with Currency Conversion Evaluation

Key Resources

- For an overview of the Simplified Workflow Rules Configuration feature, refer to the Manage Workflow Rules Using a Spreadsheet topic on the Oracle Help Center.

Role Information

- To use simplified workflow rules configuration, you need this role:

- Financial Application Administrator

Use the Workflow Transaction Console to proactively monitor all workflow tasks and resolve the exceptions for these workflows:

- Invoice Approval

- Expense Approval

- Journal Approval

- Invoice Hold Resolution

This feature was introduced in update 19D, with Invoice Hold Resolution workflow added in update 21B. In update 22C, this feature will be enabled by default for all customers.

When this feature is enabled, users will continue to see the following statuses on the transactions, even when the approval process fails for the transaction.

| Workflow Name | Workflow Transaction Status |

|---|---|

| Invoice Approval | Initiated |

| Expense Approval | Pending manager approval or Pending individual approval |

| Journal Approval | In process |

If you have not enabled this feature, the following statuses are displayed for the transactions where the approval process failed.

| Workflow Name | Workflow Transaction Status |

|---|---|

| Invoice Approval | Rejected |

| Expense Approval | Required |

| Journal Approval | Saved |

In case of the Hold Resolution Workflow, there are no changes to the workflow status of the transaction irrespective of whether this feature is enabled or not.

If you had already enabled this feature and then decided to opt out, this feature will not be re-enabled for you in update 22C.

For all failed workflow transactions, the workflow administrator or workflow submitter of the transaction receives an email notification for the error. Workflow administrators must review all failed transactions and the failure causes on the Workflow Transaction Console page and take appropriate action.

You can find additional details for this feature in the 19D release notes and help center documentation.

Steps to Enable

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Financials

This feature has been enabled by default for new customers from update 19D onwards.

From 22C update, this feature will be enabled by default for upgraded customers as well.

You still have the option to opt out of using this feature. However, we strongly recommend that you plan for the uptake of this feature. If you wish to opt out of using the feature, follow these steps:

-

Click the Navigator, and then click New Features (under the My Enterprise heading).

-

On the Features Overview page, go to the Available Features tab.

-

Select the Workflow Transaction Console feature and click on the Enabled icon.

-

On the Edit Features page, deselect the Enable option for the feature or feature choices as required and then click Done.

Tips And Considerations

To display only financial-related tasks in the Workflow Transaction Console, enable the transaction security feature by using these steps:

-

Go to Navigator > Setup and Maintenance > Manage Enterprise HCM Information.

-

Click Edit > Correct.

-

In the Transaction Console Information section, select Enable Transaction Security.

Role Information

- Financial Application Administrator

Different Tax Exception and Tax Exemption Source Taxes

Apply tax exception and tax exemption derived from different source taxes to a related tax of the same regime. This helps reduce the setup and ongoing maintenance of the tax setup, and improve run-time performance during tax calculation.

Customers in the US (and countries like Brazil, Argentina, Colombia) with nexus in multiple states/provinces and needing to use Product Fiscal Classification to determine the tax rate that applies can define Tax Exceptions by Product Fiscal Classifications as an alternative to tax rate determination rules that are based on Product Fiscal Classification codes. This avoids maintaining too many tax rules/conditions for changes in tax rates and new states. For example, even if the customers leverage Tax Exceptions by Product Fiscal Classifications, the sheer number of required jurisdictions puts a burden on configuration, maintainability, and performance. In almost all cases, each category treatment is different only by state, not by each county, city, and so on. Hence, it is required for users to specify the exceptions for the state level. The Tax engine should pick up the exception for the lower-level jurisdictions from the state level tax.

Using this feature, you can derive the Tax Exception rate for lower-level jurisdictions by using the Tax Exception Source Tax specified at the Tax level. For example, users can specify the Tax Exception Source Tax as State for the county tax. If this is done, the Tax engine will use the exception derived for the state tax for the current transaction line and apply it for the tax line for the county tax. You can also define Tax exception based on both Product category and Inventory Linked Product Fiscal Classification, only once for each of the higher jurisdiction level taxes, and it will be applicable for all lower jurisdiction level taxes.

Countries like the US have tens of thousands of jurisdictions, and the tax rates, whether exempt/zero-rated or others, can vary from state to state for each product fiscal classification code. This feature will ensure that the tax rates can be applied to transactions with a minimum configuration, which will avoid performance issues and maintenance overhead.

If there is any change to the Tax rate or the inclusion of new states, this feature helps users to implement the minimum changes necessary to the Tax exception setups. Users no longer need to create new Tax Rules or change the conditions, reducing overall maintenance.

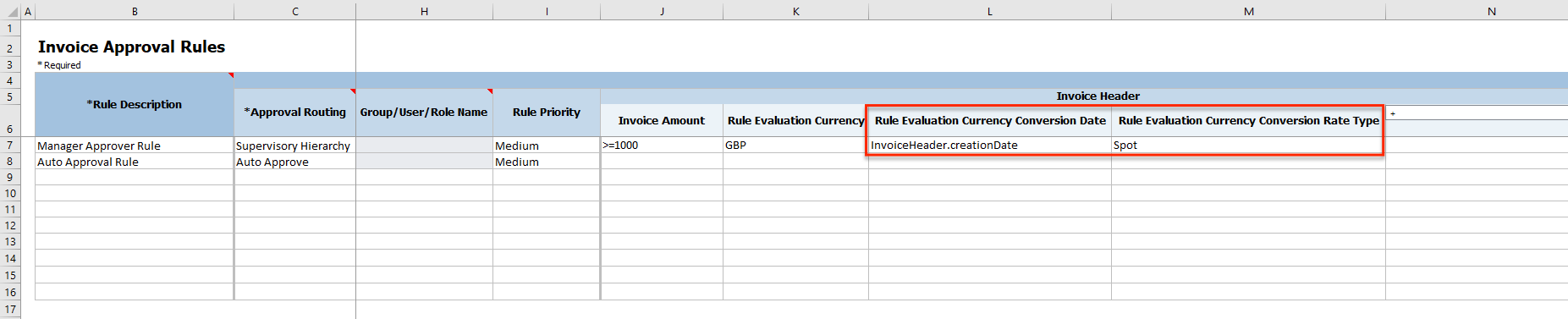

Steps to Enable

To use this feature, assign the source tax to a lower level tax using the following steps:

- Navigator -> Setup and Maintenance Task - Manage Taxes.

- Search the Tax and go to Control and Defaults.

- Check "Use tax exceptions from an existing tax".

- Provide Source Tax in "Tax Exceptions Source" field

- Save and Close.

NOTE: You can only find these fields on the Create/Edit Tax page. These fields are not available when you create tax using other methods such as rapid setup spreadsheets and setup services.

- Navigator -> Setup and Maintenance Task - Manage Tax Exceptions.

- Create a tax exception for the source tax based on Product Fiscal Classification.

Tips And Considerations

- To apply the tax exception to lower tax from source tax, we also need to have both taxes applicable to the transaction. This will ensure that the correct tax exception against the source tax and jurisdiction is picked up while calculating lower level tax amount.

- The compounding precedence of source tax should be lower than the compounding precedence of lower tax.

- If an exception is defined at a lower level, it will take precedence. If not found engine will search for source tax exception.

- If no source tax is applicable during tax calculation, the engine will consider it as no exception from source tax.

- If the exception type from source tax is ‘Special Rate’, it is not applied to the lower level tax.

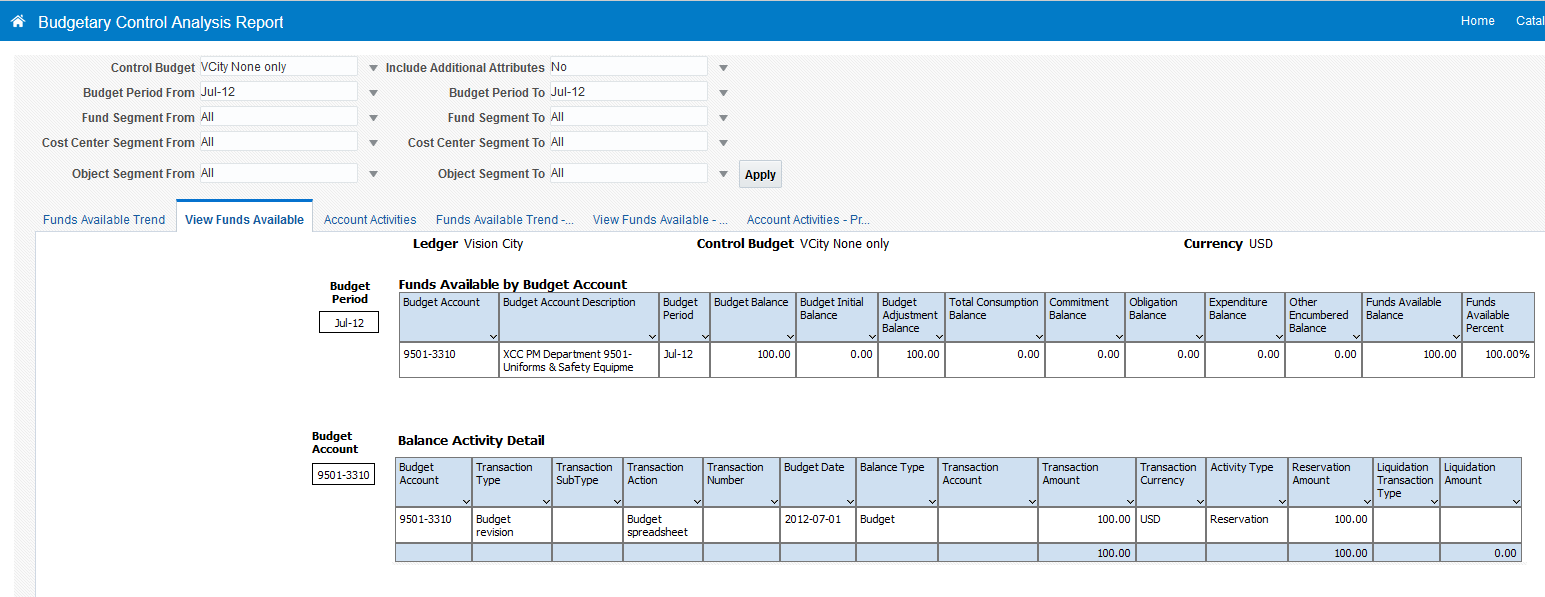

Budgetary Control Analysis Report Enhancements

Use the Budgetary Control Analysis Report to display budget transactions that update budget balances for control budgets with a control level of None as budget balance activities.

The Budget Entry Classification for Initial or Adjustment Budget Balance using Spreadsheet and Budget Transfer feature opt in impacts the records shown in the Balance Activity Detail region. Enable this feature to display both initial and adjustment budget balance activities in the Balance Activity Detail region.

Budgetary Control Analysis Report

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

For custom reports using the Budgetary Control Analysis Data Model, there is a change in the control level code field values for control budgets with a control level of None at the header.

The control level code will display:

- NONE for budget balance activity records created prior to 22B

- TRACK for budget balance activity records created starting in 22B

NOTE: The shipped Budgetary Control Analysis Report doesn’t show the control level field.

Key Resources

- Budget Balance Classifications in Using Financials for the Public Sector

Carry Forward Open Purchase Orders for Budgetary Controlled Sponsored Projects

Use the Carry Forward Open Purchase Orders process to move purchase orders associated with budgetary controlled sponsored projects from one budget year to another. The process automatically updates the budget date to the corresponding budget year for these purchase orders.

Budget year-end processing now supports sponsored and non-sponsored project.

The Carry Forward Open Purchase Order process will automatically move these purchase orders to the new budget year. Run the process in the Draft mode to review which purchase orders will be automatically carried forward and then choose to let the system process them. You can also manually update the purchase orders that need additional attention.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

- There is no impact on burden amounts as the expenditure item date isn’t changed. The Carry Forward Open Purchase Orders process updates only the purchase order budget date. To update expenditure item date also, review and manually update the purchase order.

- Project control budget changes are centralized in Project Portfolio Management. Budget adjustments created automatically for chart of account-based control budgets are not created automatically for project control budgets.

- If a budget adjustment is required for a project, use the following report information to update the budget balance for the project control budget by creating and baselining a new project budget version in Project Portfolio Management:·

- Not Attempted Budget Entries Details layout of the Carry Forward Purchase Order

Key Resources

- Managing Budgetary Control Carry Forward support note 2705986.1

- This feature originated from the Idea Labs on Oracle Customer Connect: PO Obligation Carry Forward Job does not carry forward PO's with Project Data

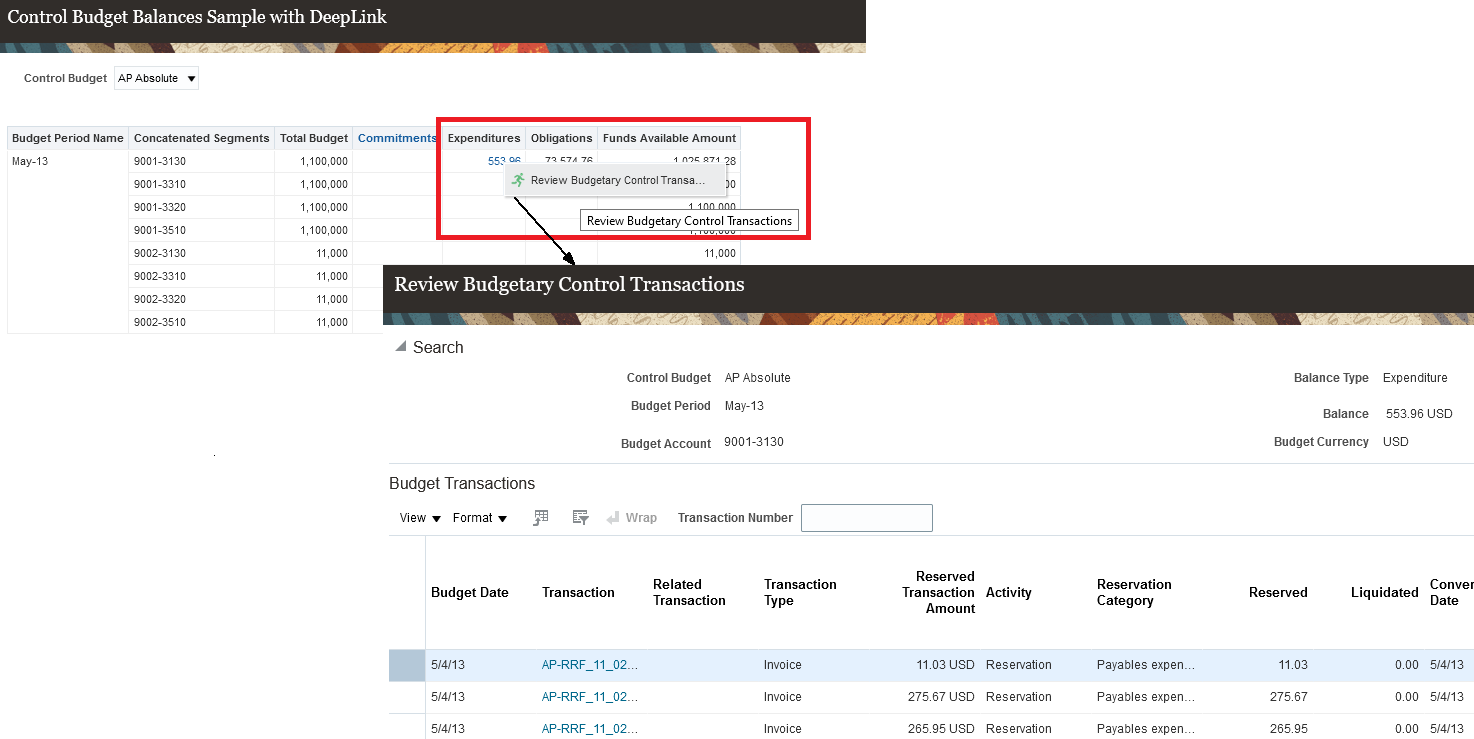

OTBI Drilldown to Review Budgetary Control Transactions

Drill down from Oracle Transactional Business Intelligence (OTBI) to the Review Budgetary Control Transactions page. Add an action link on a column, such as control budget account, to enable the drilldown using a deep link. A deep link is a URL to open a page without navigating through the application menu structure. Budget managers can easily navigate back and forth from the analysis to the application to review details.

Provide budget managers with direct access to the details of the underlying transactions that make up the budgetary control balance.

Drill Down from OTBI Report to Review Budgetary Control Transactions

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

-

A sample report called Control Budget Balances Sample with Deep Link is available for download on Customer Connect.

Key Resources

-

Budgetary Control Balances OTBI with Deep Link Sample Report in Oracle Customer Connect

-

Balances Real Time Subject Area of Budgetary Control in Using Financials for the Public Sector

- For more information on other deep links available for Financials see this document:

- How to Drill down to Fusion Financial Applications Transactions from OTBI ERP Reports. Support document 2603149.1

-

This feature originated from the Idea Labs on Oracle Customer Connect: Need deep link into Review Budgetary Control Transactions

Role Information

- Budget manager role is needed to access the Review Budgetary Control Transaction page.

General Ledger Account Details Report Data Model Changes

The data model for the General Ledger Account Details report is enhanced to include additional columns. The new additional columns provide more information about the periodic journal activity for each general ledger account to reconcile beginning and ending account balances.

NOTE: This data model change does not impact the existing report layout. The new additional columns are only viewable in the CSV output and not in the other report delivery output formats (PDF, Excel, HTML).

Here are the new GL balance-related columns that were added to the data model:

| Column |

Description |

| EFFECTIVE_PERIOD_NUM |

Denormalized period number (PERIOD_YEAR*10000 + PERIOD_NUM). |

| ACCOUNT_VALUE | Account segment value. |

| COST_CENTER_VALUE |

Cost center segment value. |

| INTERCOMPANY_SEGMENT_VALUE |

Intercompany segment value. |

| LEGAL_ENTITY_ID |

Legal entity identifier. |

| LEGAL_ENTITY_NAME |

Legal entity name. |

| LE_ADDRESS_LINE_1 |

Legal entity address line 1. |

| LE_ADDRESS_LINE_2 |

Legal entity address line 2. |

| LE_ADDRESS_LINE_3 |

Legal entity address line 3. |

| LE_CITY |

Legal entity city name. |

| LE_POSTAL_CODE |

Legal entity postal code. |

| LE_REGISTRATION_NUMBER |

Legal entity registration number. |

| LE_ACTIVITY_CODE |

Legal entity activity code. |

| ACCT_DESC |

Journal account description. |

| COST_CENTER_DESC |

Cost center segment description. |

| ACCT_LEVEL10_VALUE |

Not currently used. For future use only. |

| ACCT_LEVEL10_VALUE_DESC |

Not currently used. For future use only. |

| ACCT_LEVEL9_VALUE |

Not currently used. For future use only. |

| ACCT_LEVEL9_VALUE_DESC |

Not currently used. For future use only. |

| ACCT_LEVEL8_VALUE |

Not currently used. For future use only. |

| ACCT_LEVEL8_VALUE_DESC |

Not currently used. For future use only. |

| ACCT_LEVEL7_VALUE |

Not currently used. For future use only. |

| ACCT_LEVEL7_VALUE_DESC |

Not currently used. For future use only. |

| ACCT_LEVEL6_VALUE |

Not currently used. For future use only. |

| ACCT_LEVEL6_VALUE_DESC |

Not currently used. For future use only. |

| ACCT_LEVEL5_VALUE |

Not currently used. For future use only. |

| ACCT_LEVEL5_VALUE_DESC |

Not currently used. For future use only. |

| ACCT_LEVEL4_VALUE |

Not currently used. For future use only. |

| ACCT_LEVEL4_VALUE_DESC |

Not currently used. For future use only. |

| ACCT_LEVEL3_VALUE |

Not currently used. For future use only. |

| ACCT_LEVEL3_VALUE_DESC |

Not currently used. For future use only. |

| ACCT_LEVEL2_VALUE |

Not currently used. For future use only. |

| ACCT_LEVEL2_VALUE_DESC |

Not currently used. For future use only. |

| ACCT_LEVEL1_VALUE |

Not currently used. For future use only. |

| ACCT_LEVEL1_VALUE_DESC |

Not currently used. For future use only. |

Here are the new Journal-related columns that were added to the data model:

Column

Description

JRNL_HEADER_ID

Journal entry header identifier.

JRNL_CURRENCY_CODE

Journal entry currency.

SUB_DOC_SEQ_ID

Subledger document sequence Identifier.

ACCT_VALUE_IN

Journal Account value.

JGZZ_RECON_STATUS

Reconciliation status.

BATCH_PERIOD

Accounting period.

CODE_COMBIINATION_ID

Account combination identifier.

JRNL_EFFECTIVE_DATE

Journal entry default effective date.

CP_START_DATE

Not currently used. For future use only.

CP_END_DATE

Not currently used. For future use only.

CHART_OF_ACCOUNTS_ID

Key flexfield structure instance identifier.

ACCT_LEVEL_PARAM

Not currently used. For future use only.

PAGE_NUM_START_PARAM

Not currently used. For future use only.

The General Ledger Account Details report data model enhancement provides additional GL balance and journal information in the CSV output for better reporting and audit purposes.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

The existing display order of the columns in the CSV output has been changed with the addition of the new columns. If you use the CSV output for any integrations, review the revised columns order display in the output for any potential impact.

Journals Report Data Model Changes

The data model for the Journals report is enhanced to include additional columns. View more information about your batches, journals, and journal lines when you export the report to the CSV format.

NOTE: This data model change does not impact the existing report layout. The new additional columns are only viewable in the CSV output and not in the other report delivery output formats (PDF, Excel, HTML).

Here are the new batch-related columns:

| Column | Description |

|---|---|

| BATCH_ID |

Journal entry batch identifier. |

| BATCH_POSTED_STATUS |

Journal entry batch status. |

| BATCH_DESC |

Journal entry batch description. |

Here are the new journal-related columns:

| Column | Description |

|---|---|

| HEADER_ID |

Journal entry header identifier. |

| PERIOD_NAME |

Accounting period type. |

| JRNL_ACCT_SEQ_NAME |

Journal accounting sequence name. |

| JRNL_ACCT_SEQ_VERSION |

Journal accounting sequence version. |

| JRNL_ACCT_SEQ_NUM |

Journal accounting sequence number. |

| JRNL_DOC_SEQ_NAME |

Journal document sequence name. |

| JRNL_DOC_SEQ_NUM |

Sequential numbering sequence. |

| JRNL_REP_SEQ_NUM |

Journal reporting sequence number. |

| JRNL_REP_SEQ_VERSION |

Journal reporting sequence version. |

| JRNL_REP_SEQ_NAME |

Journal reporting sequence name. |

| JRNL_EFFECTIVE_DATE |

Journal entry default effective date. |

| JRNL_DESC |

User entered description of the journal header. |

Here are the new journal line-related columns:

| Column | Description |

|---|---|

| REFERENCE1 |

Sequential numbering sequence. |

| ACCT_DESC |

Account description. |

| BALANCING_SEGMENT_DESC |

Balancing segment description. |

| NATURAL_ACCOUNT_DESC |

Natural account segment description. |

| COST_CENTER_DESC |

Cost center segment description. |

| MANAGEMENT_SEGMENT_DESC |

Management segment description. |

| INTERCOMPANY_SEGMENT_DESC |

Intercompany segment description. |

| GL_SECONDARY_DESC |

Secondary balancing segment description. |

| ACCT_VALUE |

Account segment value. |

| BALANCING_SEGMENT_VALUE |

Balancing segment value. |

| COST_CENTER_VALUE |

Cost center segment value. |

| MANAGEMENT_SEGMENT_VALUE |

Management segment value. |

| INTERCOMPANY_SEG_VAL |

Intercompany segment value. |

| SECONDARY_TRACK_SEG_VAL |

Secondary balancing segment value. |

| LEGAL_ENTITY_ID |

Legal entity identifier. |

| LEGAL_ENTITY_NAME |

Legal entity name. |

| LE_ADDRESS_LINE_1 |

Legal entity address line 1. |

| LE_ADDRESS_LINE_2 |

Legal entity address line 2. |

| LE_ADDRESS_LINE_3 |

Legal entity address line 3. |

| LE_CITY |

Legal entity city name. |

| LE_POSTAL_CODE |

Legal entity postal code. |

| LE_REGISTRATION_NUMBER |

Legal entity registration number. |

| LE_ACTIVITY_CODE |

Legal entity activity code. |

Here are the new generic columns:

| Column | Description |

|---|---|

| CHART_OF_ACCOUNTS_ID |

Key flexfield structure instance. |

| PERIOD_TO_PARAM |

Not currently used. For future use only. |

| PAGE_NUM_START_PARAM |

Not currently used. For future use only. |

| DOC_SEQ_NAME_PARAM |

Not currently used. For future use only. |

| START_DOC_SEQ_NUM_PARAM |

Not currently used. For future use only. |

| END_DOC_SEQ_NUM_PARAM |

Not currently used. For future use only. |

| ACCT_SEQ_NAME_PARAM |

Not currently used. For future use only. |

| START_ACCT_SEQ_NUM_PARAM |

Not currently used. For future use only. |

| END_ACCT_SEQ_NUM_PARAM |

Not currently used. For future use only. |

| REP_SEQ_NAME_PARAM |

Not currently used. For future use only. |

| START_REP_SEQ_NUM_PARAM |

Not currently used. For future use only. |

| END_REP_SEQ_NUM_PARAM |

Not currently used. For future use only. |

| USER_JRNL_SRC_PARAM |

Not currently used. For future use only. |

| JRNL_CATEGORY_PARAM |

Not currently used. For future use only. |

| FILTER_CONDITIONS_ATT |

Not currently used. For future use only. |

| FILTER_CONDITIONS_OPT |

Not currently used. For future use only. |

| ACTUAL_FLAG |

Balance type (Actual, Budget, or Encumbrance). |

| LEDGER_ID |

Ledger unique identifier. |

| CONFIGURATION_ID |

Not currently used. For future use only. |

| ENVIRONMENT_CODE |

Not currently used. For future use only. |

Business Benefit:

The Journals report data model enhancement provides additional journal batch, header and line information columns in the CSV output for better reporting and audit purposes.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

The existing display order of the columns in the CSV output has been changed with the addition of the new columns. If you use the CSV output for any integrations, review the revised columns order display in the output for any potential impact.

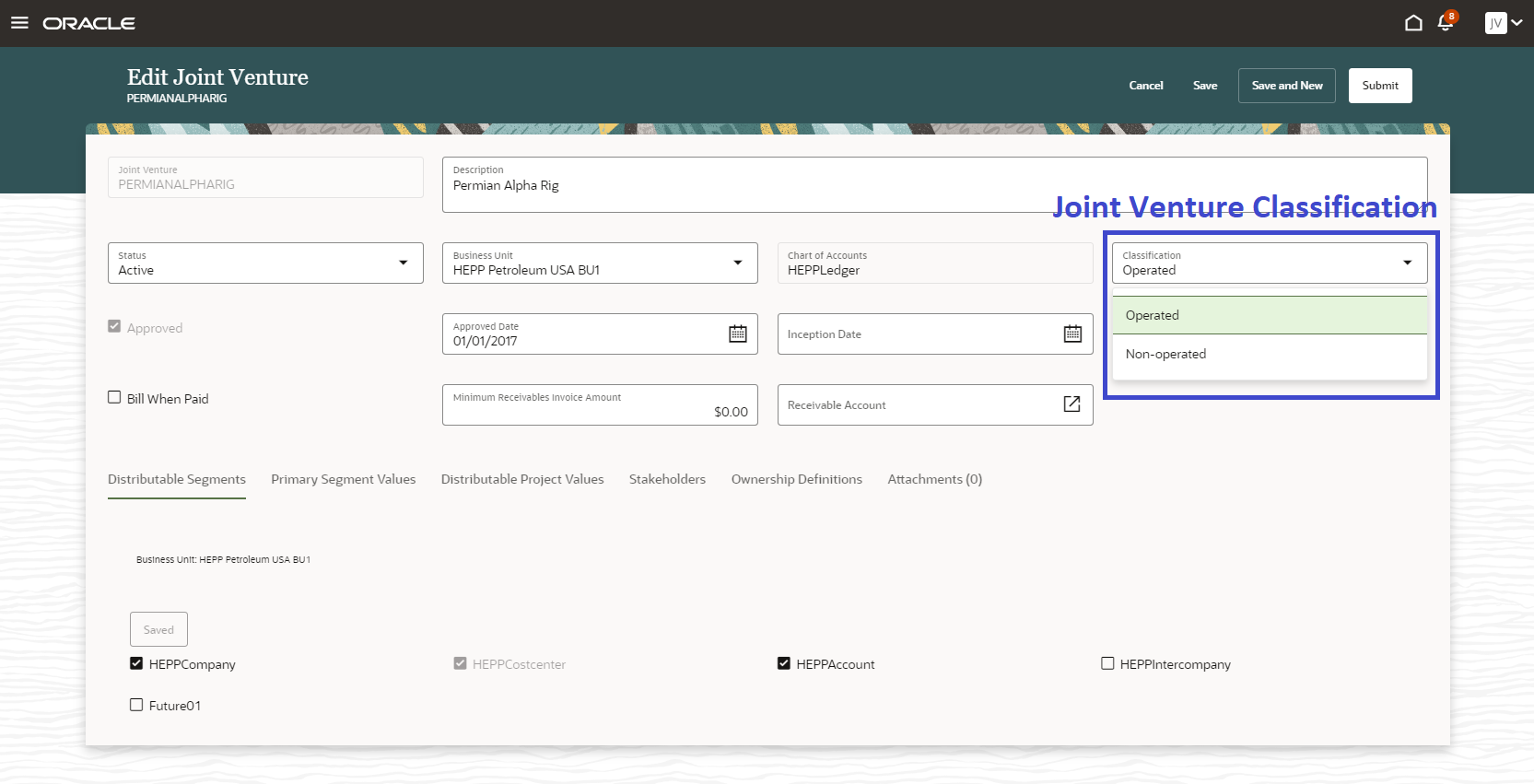

Classification of Operated and Non-Operated Joint Ventures

Identify joint ventures as Operated or Non-Operated ventures. This attribute enables users to identify their role in a joint venture.

Business Benefit:

The new classification is useful for reporting and auditing purposes.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

Ensure the appropriate classification is set up in the Joint Venture Definition for your joint ventures.

Key Resources

- For more information, refer to Implementing Joint Venture Management guide

Role Information

- Joint Venture Application Administrator

- Joint Venture Accountant

Joint Venture Distributions in Entered Currency

Distribute entered amounts on transactions during the joint venture distribution process.

Business benefits include:

- Distribution of both the accounted and entered amounts improves reporting and audit processes.

- Facilitates the creation of invoices or journal entries in the entered currency, saving time and reducing processing errors.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

The Entered Amount is never populated for overhead distributions because overhead is calculated from within Joint Venture Management.

Key Resources

- For more information, refer to Using Joint Venture Management guide.

Role Information

- Joint Venture Accountant

- Joint Venture Accounting Manager

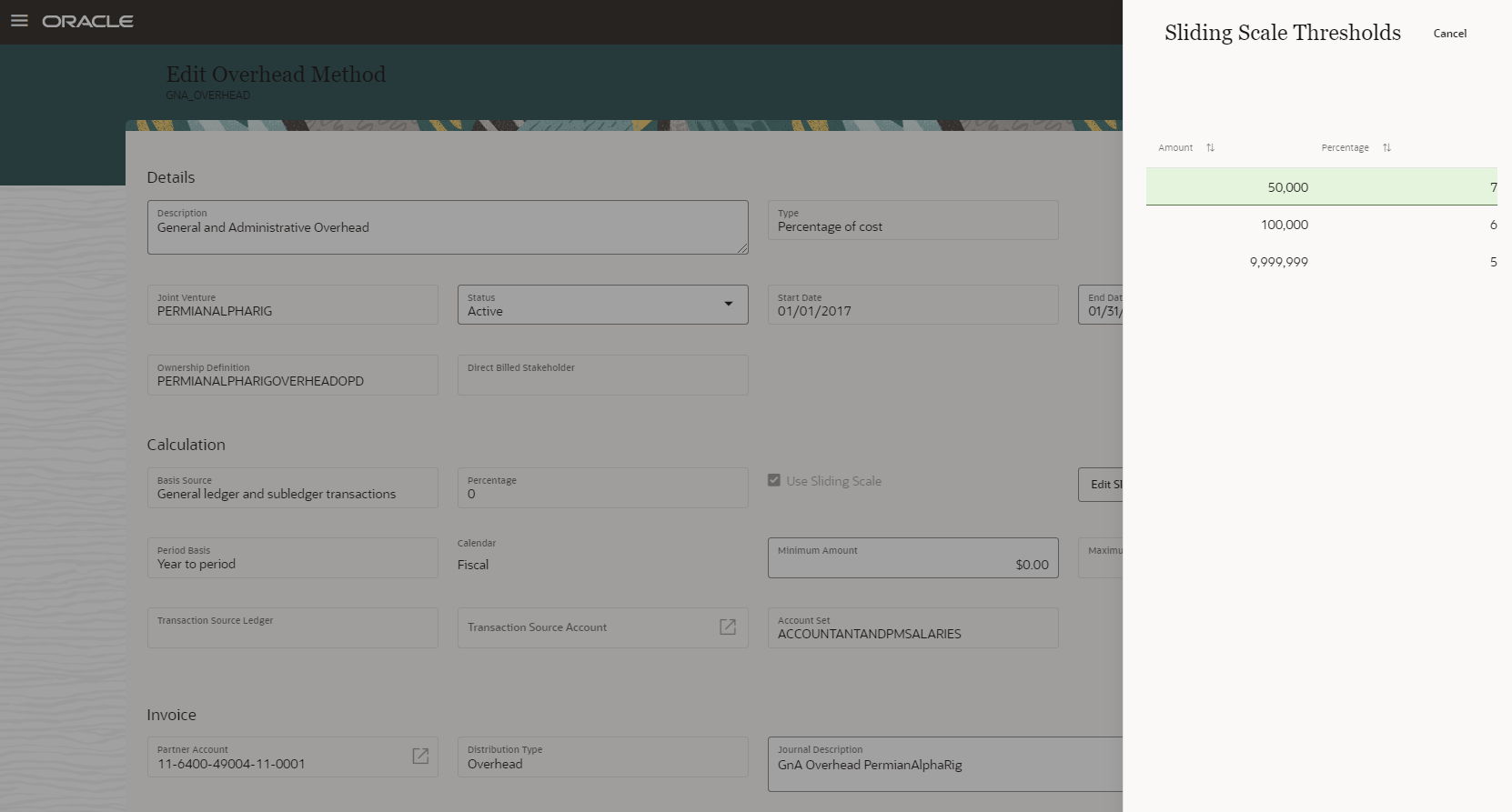

Joint Venture Management Overhead Method - Percentage of Cost with Sliding Scale Option

Calculate overhead costs using a sliding scale based on incurred costs. Use the existing percentage of costs overhead method with a basis source of General Ledger and Subledger transactions and sliding scale option to specify percentages for the overhead calculation.

A sliding scale enables you to calculate overhead by applying different percentages to different portions of the total cost amount that you are basing the overhead calculation on.

Business benefits include:

- Conform to the joint operating agreement by ensuring accurate calculation and distribution of overhead and management fees to be billed to the joint venture partners.

- Minimize month-end processing and reduce potential errors caused by manual entry through the use of automated processes.

Steps to Enable

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Financials

- Opt in to Joint Venture Overhead in Joint Venture Management.

- Access the task Manage Joint Venture Overhead Methods under the functional area Joint Venture Management.

- Create the overhead method with the following values for the attributes:

- Type - Percentage of cost

- Basis Source - General ledger and subledger transactions

- Enable the checkbox for “Use Sliding Scale”.

- Click “Edit Sliding Scale” and then enter the sliding scale thresholds.

Tips And Considerations

- In an overhead method, you must specify the partner account before the method can be activated. This partner account is used while creating the Receivables invoice to recoup the overhead costs from partners. Before you define the partner account on the overhead method, ensure that the GL Code Combination for the partner account has been defined using Manage Account Combinations.

- Use Joint Venture Account Sets to identify the accounts to be included from the General Ledger and Subledger Accounting based upon the joint operating agreement terms for the overhead calculation.

- To enable Inception to Period calculations, make sure that the inception date for the joint venture is specified in the joint venture definition.

Key Resources

-

Watch Joint Venture Overhead Enhancements Readiness Training.

- For more information, refer to

- Implementing Joint Venture Management guide and

- Using Joint Venture Management guide.

Role Information

- Joint Venture Application Administrator

- Joint Venture Accountant

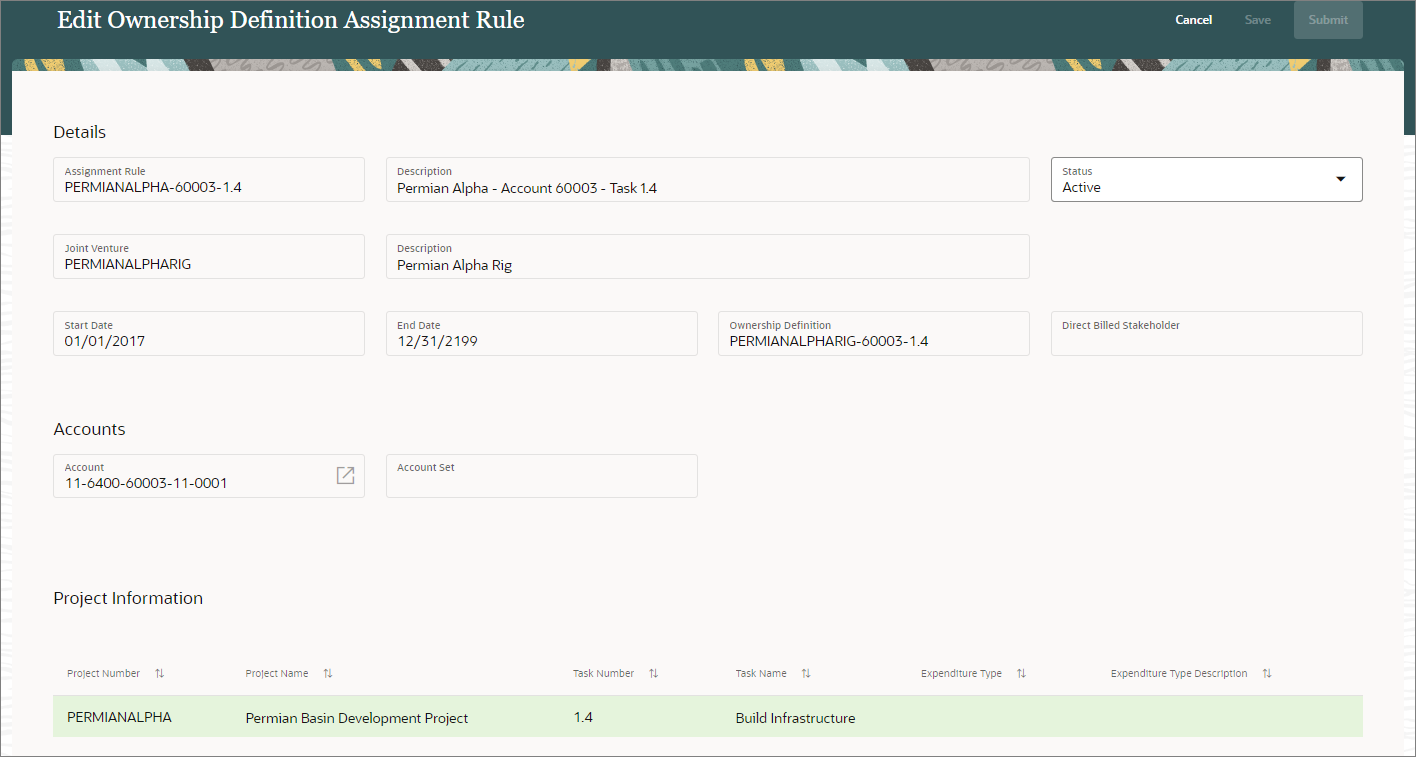

Joint Venture Ownership Definition and Direct Billed Stakeholder Assignment Rules

Assign an ownership definition or a direct-billed stakeholder to joint venture transactions using a configuration based on the transaction's account and project information. Use the configuration to enforce the ownership percentage requirements stated in the joint operating agreement for all accounts that will be distributed to your partners.

Watch a Setup Demo.

Business Benefit:

Automatically conform to the specifications for partner splits for distributed transactions in the joint operating agreement.

Watch a Demo.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

- Carefully plan the assignment rules based upon the joint operating agreement.

- Create Joint Venture Account Sets to identify the accounts for rules that will apply to multiple accounts.

Key Resources

- For more information, refer to

- Implementing Joint Venture Management guide

- Using Joint Venture Management guide.

Role Information

- Joint Venture Application Administrator

- Joint Venture Accountant

Joint Venture Partner Contribution Requests

Create and process joint venture partner contribution requests based on the frequency of processing, requested amount, ownership definition, and direct billed stakeholder. Users can select to not specify a requested amount and instead configure the request to calculate the requested amount during processing based on distributions that are available to process.

Business Benefit:

This solution will save time and reduce errors associated with manual creation of partner contributions.

Watch a Demo.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

- Carefully plan the partner contribution requests frequency and the process schedule for the Joint Venture Partner Contributions ESS job to ensure all partner contributions are created per their frequency.

- Create all joint venture distributions before processing partner contribution requests that calculate the amount based upon open distributions.

Key Resources

- For more information, refer to

- Implementing Joint Venture Management guide

- Using Joint Venture Management guide.

Role Information

- Joint Venture Accountant

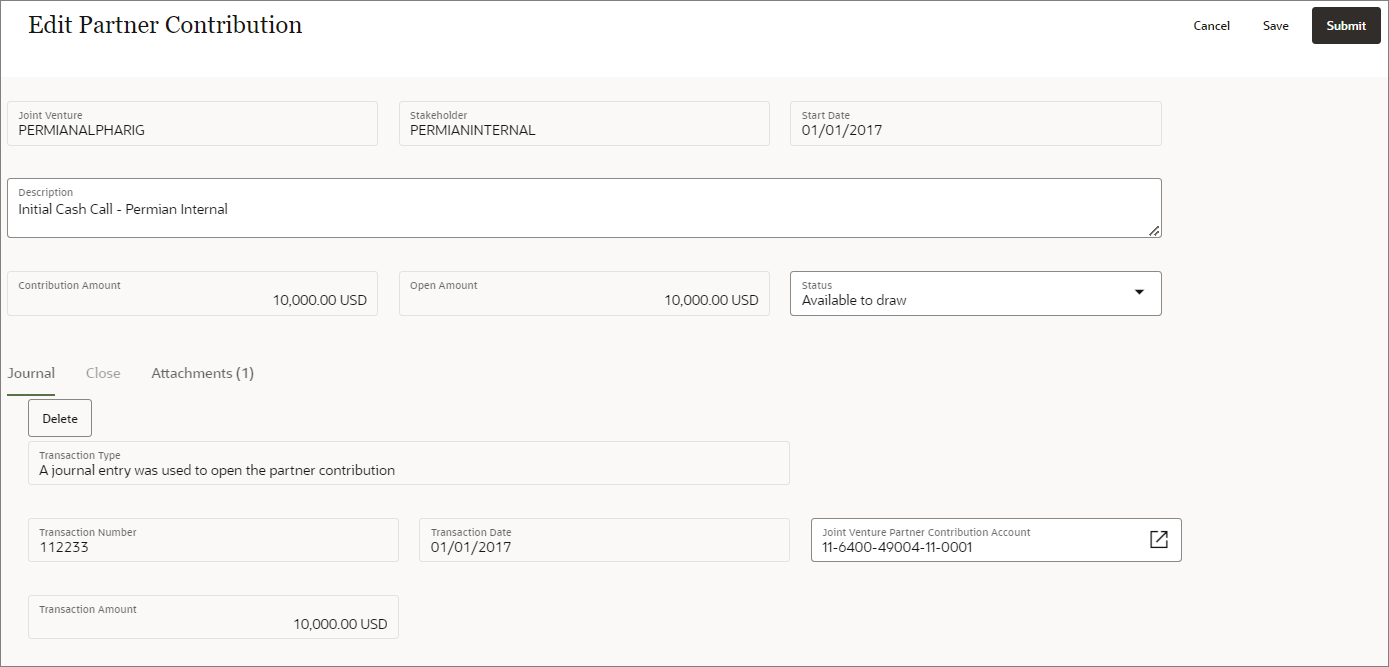

Partner Contributions for Internal Stakeholders

Enable the creation of partner contributions for internal stakeholders and manually add a reference to the journal entries associated with the contribution within Joint Venture Management.

Business Benefit:

Including internal stakeholders in the partner contribution process saves time and reduces human errors associated with manual processes for creating partner contributions.

Watch a Demo.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

- Determine how the partner contribution for the internal partners will be requested.

- Partner contributions can support a reference to an invoice or a journal entry.

Key Resources

-

Watch Partner Contribution Management for Joint Ventures Update 20D Readiness Training

- Watch Joint Venture Subledger for Internal Transfers Update 20D Readiness Training

- For more information, refer to

- Implementing Joint Venture Management guide

- Using Joint Venture Management guide.

Role Information

- Joint Venture Accountant

Statistical Journal Entry Creation for Joint Venture Operational Measures

Record statistics for joint venture operations using Joint Venture Operational Measures. Use statistics, such as units of production, employee hours, and utility usage to support cost allocation during period close. This capability creates statistical journal entries based on operational measures using the Joint Venture subledger.

Business Benefit:

Automatic creation of statistical journal entries based on operational measures improves the overall efficiency of the allocation process.

Watch a Demo.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

- Ensure that you have set up the appropriate Operational Measure Types for the measures that will be used to create statistical journal entries.

- Set up Subledger Accounting to ensure each operational measure type is directed to the appropriate account that will be used in your allocation processes.

Watch a Setup Demo.

Key Resources

- For more information, refer to

- Implementing Joint Venture Management guide

- Using Joint Venture Management guide.

Role Information

- Joint Venture Application Administrator

- Joint Venture Accountant

Transaction Date Default Configuration

Configure Joint Venture Management to either use the default transaction date or set the transaction to error if it is blank. Currently, it uses the accounting date as the transaction date if it cannot determine a date using supporting references for transactions originating from the General Ledger and Subledger Accounting.

With this enhancement, you can determine how Joint Venture Management handles the processing of transactions without a transaction date. You can configure the joint venture system options to:

- Use the effective date for transactions from the general ledger and the accounting date for transactions from subledger accounting.

- Use the system date for the transaction date.

- Leave the transaction date blank, which sets the transaction to an error status in the Joint Venture Transactions work area. This enables you to locate the transactions in error for troubleshooting purposes.

Business Benefit:

This option ensures that the recorded activity date that determines the ownership percentages to distribute transactions to joint venture partners conforms to the joint operating agreement.

Steps to Enable

- Access the task Manage Joint Venture System Options under the functional area Joint Venture Management.

- Select values for the Default GL Transaction Date and the Default SLA Transaction Date based upon your business needs.

Key Resources

- For more information, refer to

- Implementing Joint Venture Management guide

- Using Joint Venture Management guide.

Role Information

- Joint Venture Application Administrator

- Joint Venture Accountant

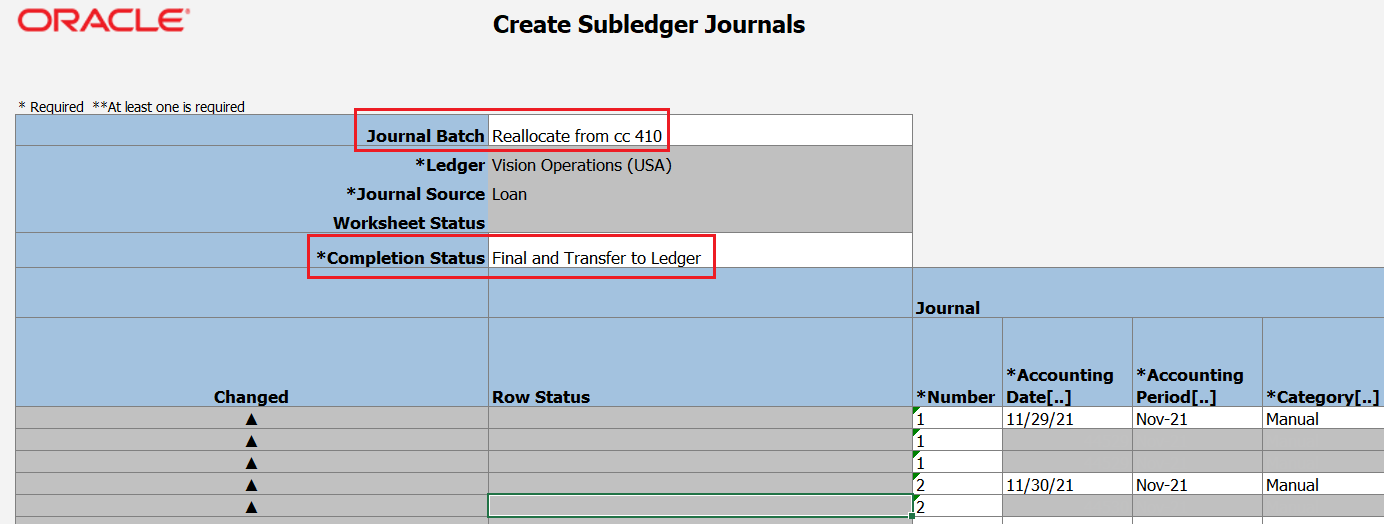

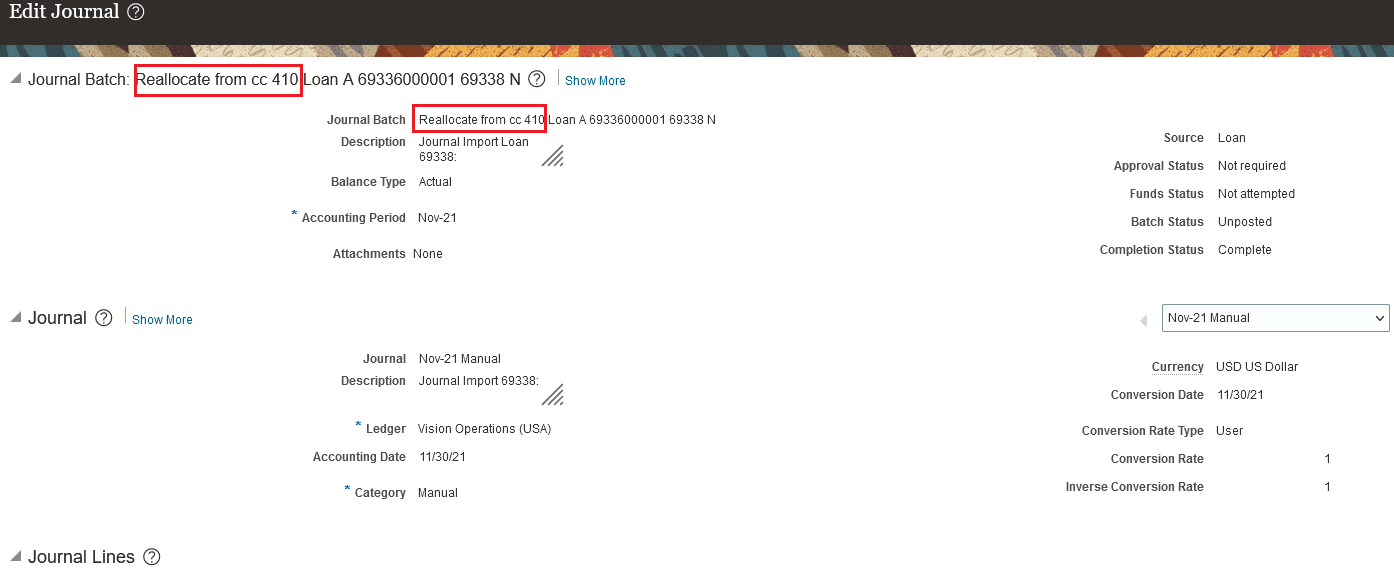

Manual Subledger Journal Transfer to General Ledger by Preparer

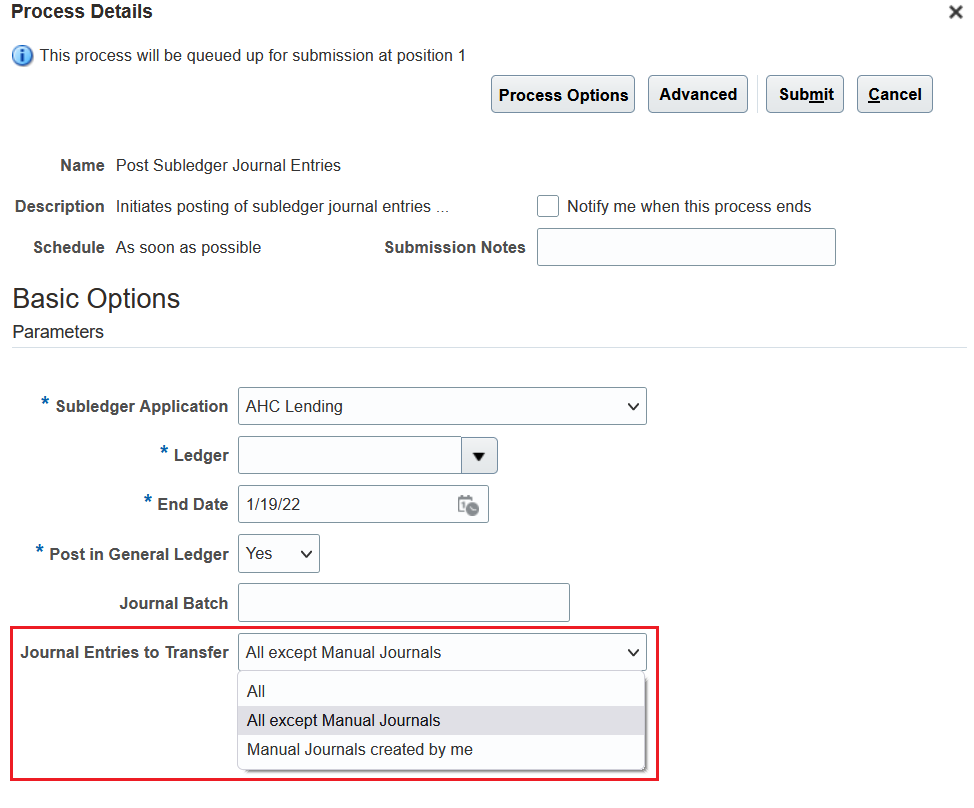

Transfer manual subledger journal entries to the general ledger by preparer while creating subledger journals using a spreadsheet or submitting the Post Subledger Journal Entries process. Manual journal entries created by different users are split into separate general ledger journal batches. This facilitates routing the journal batches to different approvers or reviewers based on the preparer. You can also choose to transfer all subledger journals, or exclude manual journal entries, while submitting the Post Subledger Journal Entries process.

On enabling this feature, the following changes are applied -

- When you create subledger journals using a spreadsheet with Completion Status as ‘Final and Transfer’ or ‘Final and Post’, eligible manual subledger journals created by the same user will be transferred to the general ledger. Manual subledger journals created by other users will not be transferred.

- Use the Journal Batch field to optionally enter text to use as a prefix to the General Ledger journal batch name when creating subledger journals using a spreadsheet.

- An additional parameter, Journal Entries to Transfer, would be displayed in the Post Subledger Journal Entries ESS Parameter submission window for users to select which subledger journal entries should be transferred -

- All - Selecting this option will allow continuing current behavior i.e. submit transfer for all subledger journals.

- All except manual journals - Selecting this option will exclude manual subledger journals from transferring to general ledger.

- Manual journals created by me - Selecting this option will only transfer manual subledger journals created by the current user.

Entering a Journal Batch Prefix in Create Subledger Journals Spreadsheet

General Ledger Journal Batch Created with the Prefix Entered

Selecting Journal Entries to Transfer in the Post Subledger Journal Entries Program

Business benefits include:

- Leverage general ledger journal approval workflow to review and approve subledger journals created for accounting hub subledgers.

- Improved user experience in tracing general ledger journal batches generated for manual subledger journals.

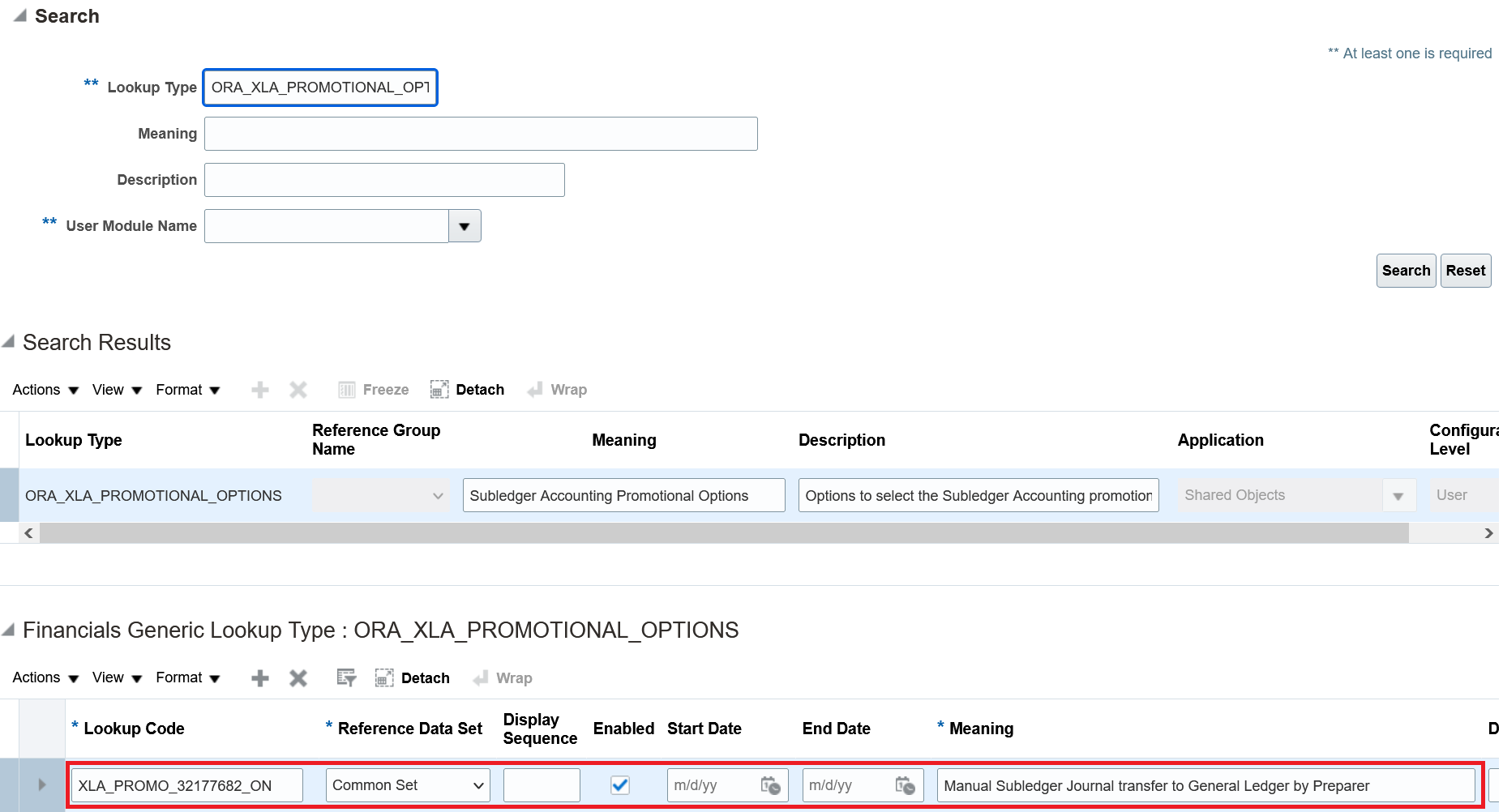

Steps to Enable

- Log in with a user having access to Setup pages. For example, User with Application Implementation Consultant role.

- Navigate to Fusion Setup and Maintenance page.

- Select Offering: Fusion Accounting Hub and Functional Area: Accounting Transformation.

- Click on the Task: Manage Subledger Accounting Lookups.

- Search the Lookup Type: ORA_XLA_PROMOTIONAL_OPTIONS and add a lookup code under it with the following details –

- Lookup Code: XLA_PROMO_32177682_ON

- Reference Data Set: Common Set

- Enabled: <Checked>

- Meaning: Transfer Accounting Hub Manual Journals to GL by Preparer

- Save the changes.

Lookup Code Setup to Enable the Feature

Tips And Considerations

- You can also create manual subledger journal entries using the Create Subledger Journal page and group them into one GL batch by posting them using the Post Subledger Journal Entries process. All manual adjustments entered through UI or spreadsheet will be grouped into one GL batch when a user selects ‘Manual Journals created by me’ in the Journal Entries to Transfer parameter.

- To group all accounting hub transactions which have not been transferred yet into one GL batch, you can account the transactions in Final status and then submit the Post Subledger Journal Entries ESS program with Journal Entries to Transfer set to ‘All except Manual Journals’.

NOTE: This option will not transfer any manual subledger journal entries to GL. It will not select eligible journals by the preparer.

- If a Journal Batch is not specified in the spreadsheet, or you’re using an old template, a system generated batch name will be assigned to the GL journal batch.

NOTE: You can't enter a Journal Batch exceeding 50 characters.

Role Information

No new roles/privileges are required to secure access to this feature.

Asset Operations from ERP Integrations REST Service

Create fixed asset transactions, such as additions, adjustments, retirements, or transfers, as asset REST operations.

Submit a REST payload with the ERP Integrations REST service endpoint using the Post method for any of the following Asset life cycle operations:

- Create assets.

- Adjust financial details or units of your assets.

- Retire assets or reinstate recent retirements.

- Capitalize your construction-in-process (CIP) assets or reverse recent CIP capitalizations.

- Reclassify assets.

- Transfer assets from your cost center, location or employee to others.

- Perform descriptive detail updates.

- Update mass additions or get the details of your mass additions.

- Perform unplanned depreciations.

- Perform source line transfers.

- View asset details such as book information, source line attributes or descriptive details.

- View asset transaction history or retirement history.

- View asset details, such as book information, source line attributes or descriptive details.

Business benefits include:

- Simpler, scalable option to manage your fixed assets from REST clients.

- Integrate asset operations into your own asset cycle management framework.

- Enhance your existing asset life cycle framework to add additional business validations.

Steps to Enable

Review the REST service definition in the REST API guides, available from the Oracle Help Center > your apps service area of interest > REST API. If you're new to Oracle's REST services you may want to begin with the Quick Start section.

This feature is automatically enabled from 22B.

Key Resources

- Refer to the Use Cases section of the REST API for Oracle Financials Cloud Guide for 22B for use cases.

Role Information

- You do not need any new role or privilege access to set up and use this feature.

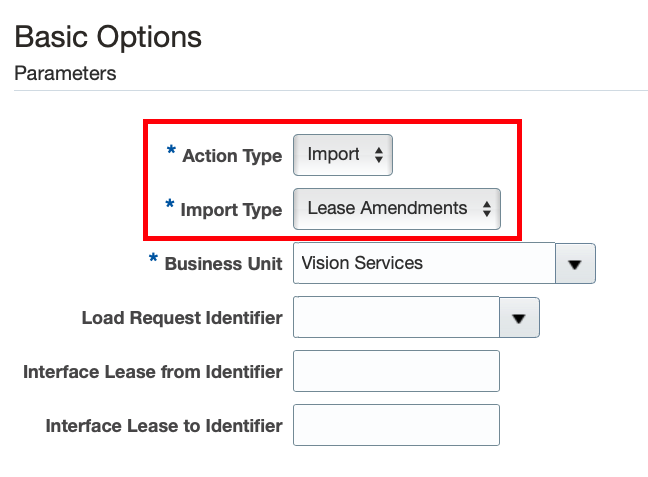

Use the Lease Amendment Import utility to simplify contract changes. The Lease Amendment Import utility removes or reduces the need for manual intervention during the lease amendment process. Amendments include scope increases, scope decreases, non-financial changes, and changes to the borrowing rate. Import a batch of lease amendments directly into the desired status: Draft, Validated, Complete, or Booked.

Lease Amendment Import

Business benefits include:

- Reduce data entry effort with a lease amendment import.

- Streamline business processes by populating Lease Accounting amendment import from originating systems.

Steps to Enable

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Financials

Tips And Considerations

The steps to import amendments follow standard import procedures.

- Create leases in an FBDI spreadsheet template. This method is useful when there is a large volume of lease amendments. Help text exists for each column to explain what to enter, what is required, and the field type.

- The FBDI spreadsheet converts the data to a zip file for the File Import process. You then load the file to the lease interface table. The final step is to run the Import Lease process with the import type of Lease Amendments. The Lease Amendments type imports the lease modifications from the interface table to the Lease Accounting module. Amendments are visible in the Lease Accounting module after this process completes.

- The Lease Dashboard includes exceptions or errors.

Key Resources

- To access the Lease Accounting Amendment FBDI template, please refer to My Oracle Support.

- This feature originated from the Idea Lab:

- https://community.oracle.com/customerconnect/discussion/612430

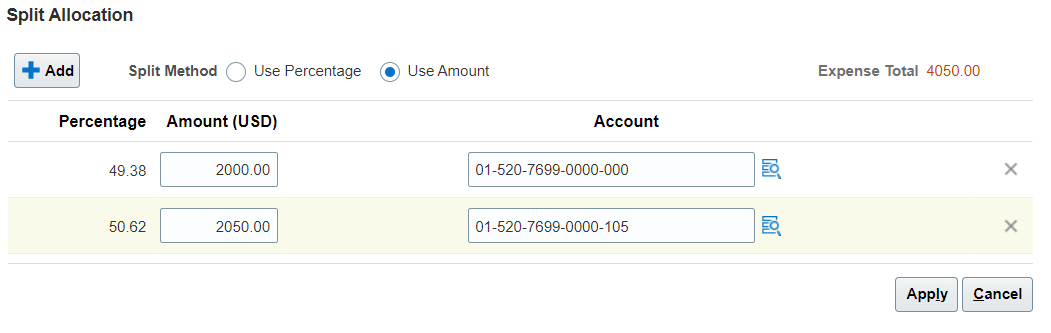

Expense Allocation to Projects and Accounts by Amount At Expense Report Level

Allocate specific amounts to a project or expense account during expense report entry. The application calculates the percentage of allocation to the project or account using the amounts entered.

Use the Split Allocation window to split expense allocations across projects or accounts by amount or percentage.

You can access the Split Allocation window using the Split Allocations button in the expense report. Click the button to enter project or account allocations for the entire report, or select individual lines in the report and click the button to enter allocations for these lines only.

The inclusion of split allocations by amount lets you apply costs directly to a project or account, and optionally apply allocations to specific lines of an expense report. This is useful, for example, when allocating funds to projects or accounts with specific reimbursement maximums.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

- This feature uses the split allocation setting,

- You can only have one set of lines at a time for the line level split.

Key Resources

- Watch Split Allocations in Expense Reports Readiness Training

- This feature originated from the Idea Labs on Oracle Customer Connect: https://community.oracle.com/customerconnect/discussion/557070

Role Information

There is no need for a new role.

Expense Approval Routing Using Accounting Segments

Configure expense approval rules using accounting segments. This enables companies to route expense reports to account owners for approval, thereby providing visibility into expenses charged to their accounts.

An expense can be charged to one or more accounts, thereby creating one or more expense allocations for an expense. The Expense Distribution folder in the FinExmWorkflowExpenseApproval workflow is enhanced to include all account segments and its characteristics for each expense allocation.

You can create expense approval rules or update existing rules to take advantage of these new attributes. These attributes let you route expense report approval notifications to appropriate account owners.

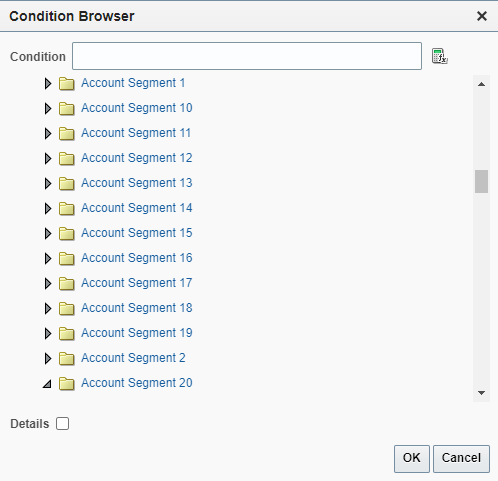

These accounting attributes are added to the Expense Distribution folder for expense approval routing:

- Account Enabled Indicator

- Account End Date

- Account Segment 1 - Account Segment 30

- Account Start Date

- Account Type

- Detailed Budgeting Allowed Indicator

- Detailed Posting Allowed Indicator

- Financial Category

Accounting Segments Added to Expense Distribution Folder

Configuring approval rules by accounting segments provides the account owners better visibility into the expenses that are charged to their accounts, and also helps add another level of approval if needed.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

- This feature originated from the Idea Labs on Oracle Customer Connect: https://community.oracle.com/customerconnect/discussion/609253

Role Information

To configure expense approval rules, you need to have the role of Application Implementation Consultant.

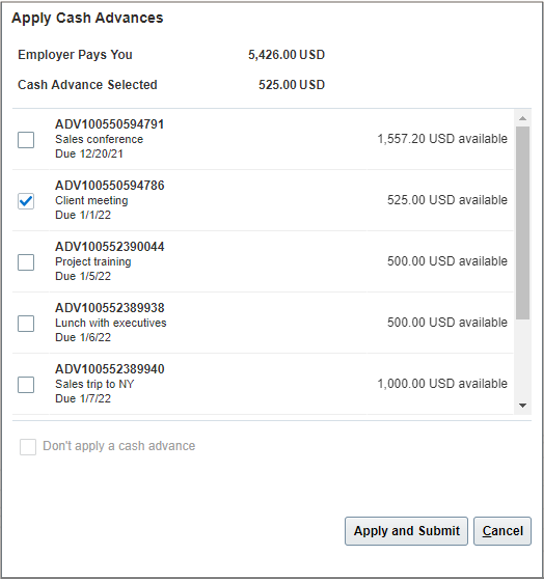

Manual Application of Cash Advances to Expenses

Manually apply cash advances to expenses during expense report submission. Employees can apply the cash advance designated for a specific trip to the corresponding expenses, providing visibility to approvers and auditors.

When submitting expenses, employees can select cash advances that are applicable to the selected expenses and submit the reports. If they choose not to apply a cash advance, they can provide a justification for not applying the available cash advances. The available cash advance amounts and the cash advance statuses get updated after employees apply cash advances and submit reports. Employees can view applied cash advances details in expense reports after submission.

Select Applicable Cash Advances

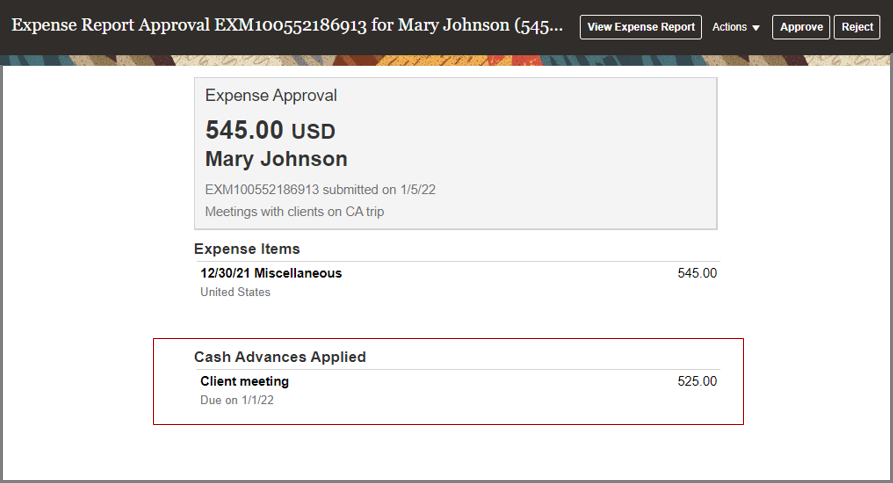

Approvers can review the applied cash advances in approval notifications and take necessary action. If the employee has provided a justification for not applying the available cash advances, then the approver can review it in the notification..

Review Applied Cash Advances

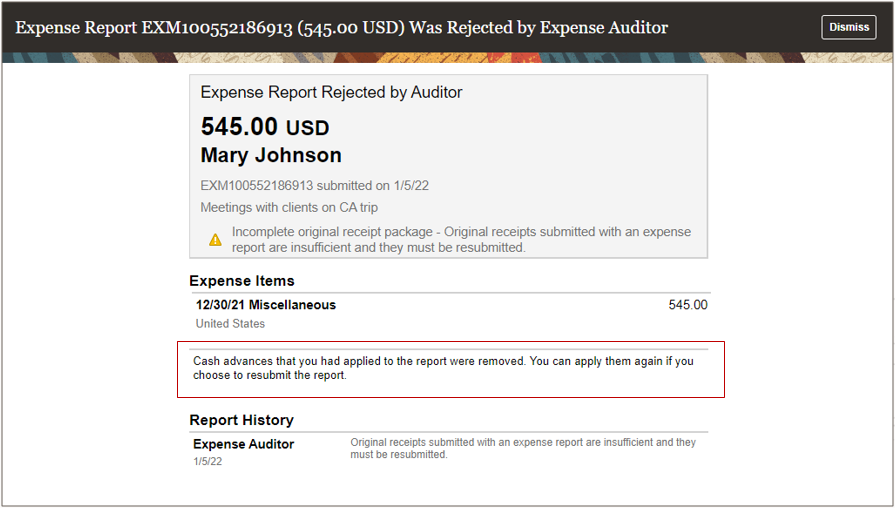

Auditors can view the applied cash advances on the Audit Expense Report page. Auditors cannot make any changes to cash advances that are applied to a report.

If approvers or auditors reject expense reports, then cash advances that are applied to the reports are automatically removed and returned to the employee’s available cash advances. If expense amounts are adjusted during expense report audit and applied cash advances exceed the reimbursement due to employee, then the difference is added back to employee’s available cash advances. The available cash advance amounts and the statuses are updated accordingly on the Cash Advances work area. The adjustment and rejection notifications identify any changes to the applied cash advances.

Cash Advances Removed

Enabling employees to manually apply cash advances provides more flexibility to employees and allows them to apply the cash advance obtained for a specific purpose to corresponding expenses. Additionally, approvers and auditors have better visibility into the outstanding cash advances.

Steps to Enable

To enable manual application of cash advances, perform the following steps:

- Sign in as the Application Implementation Consultant.

- From the Setup and Maintenance work area, navigate to the Manage Cash Advance and Authorization Policies page.

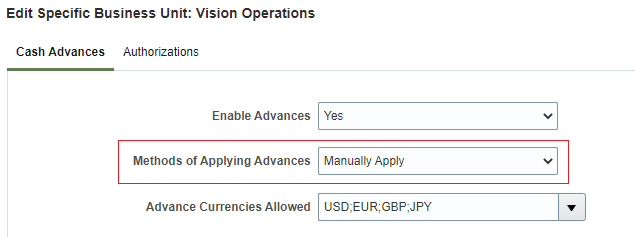

- Under Cash Advances, set Methods of Applying Advances to Manually Apply.

You can enable this at the implementation level on the Manage Cash Advance and Authorization Policies page, which applies to all business units. Alternatively, you can enable this for specific business units on the Create/Edit Business Unit window.

Configure Methods of Applying Advances

Key Resources

- Watch Manual Application of Cash Advances Readiness Training

- This feature originated from the Idea Labs on Oracle Customer Connect: https://community.oracle.com/customerconnect/discussion/557032

Role Information

To enable manual application of cash advances, you need one of these roles:

- Expense Manager

- Application Implementation Consultant

Manual Submission of All Expenses from Digital Assistant

Enable employees to submit all expenses from the digital assistant, including corporate card charges and cash expenses created from the Expenses web application.

Expenses that require more information, contain any errors, or are waiting for corporate card matches are not available for submission.

Employees can submit all the expenses together using Digital Assistant thereby simplifying the expense submission process.

Steps to Enable

You don't need to do anything to enable this feature.

Role Information

You don't need a new role or privilege access to use this feature.

PDF Attachments in Expenses Mobile Application

Enable employees to select PDF documents as attachments to their expenses. Search for and select PDF files that exist on the device.

When creating expenses from the mobile application, employees can browse through their device folders or cloud drives and attach PDF documents to their expenses in addition to image files. Approvers can also view the PDF attachments when approving the expenses from the mobile application.

This enables employees to attach PDF files, such as hotel, car rental, and airfare receipts easily, and to comply with local regulations where employees are required to attach the original PDF receipts from the merchants.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

To use this feature, ensure that you have downloaded the latest Expenses mobile application.

Key Resources

- Watch Expense Attachments in Expenses Mobile Application and Expense Approval Rules Readiness Training

- Refer to this idea in Idea Lab: https://community.oracle.com/customerconnect/discussion/534521

Role Information

You don't need a new role or privilege access to use this feature.

Adaptive Learning Data Sharing Between Environments for Intelligent Document Recognition

Copy the invoice recognition adaptive learning data from one environment to another, while using Intelligent Document Recognition (IDR) to process supplier invoices. You can perform adaptive learning for IDR invoices on the source environment, and copy this training data onto the target environment.

Previously, training for adaptive learning would need to be performed separately for the source and target environments.

Use this feature to perform adaptive learning for IDR on your test environment and reap the benefits of such training directly on your production environment. This eliminates the need to train IDR on the production environment separately and helps you achieve better recognition results faster.

Steps to Enable

To enable this feature you need to log a Service Request (SR).

Prerequisites for using this feature:

- The adaptive learning training data is maintained based on supplier IDs. Ensure that the source and the target environments have the same supplier IDs. You can do this by requesting for a P2T refresh via a Service Request (SR).

- Train IDR on the source environment by testing with invoices for your most frequently used suppliers. Perform corrections using the interactive invoice viewer wherever necessary. This builds the adaptive learning training data on the source environment.

Log a Service Request when you're ready to copy the adaptive learning training data to the target environment. Note that you can specify the date range for which you want to copy the training data. This gives you the flexibility to exclude any prior training data and only copy the most recent set of adaptive learning training data.

Tips And Considerations

When implementing Intelligent Document Recognition to process supplier invoices, we recommend testing with at least 10 sample invoices each, for your most frequently used suppliers. This testing also helps in building adaptive learning training data, that IDR uses to accurately recognize subsequent invoices for such suppliers.

Key Resources

- For additional details, refer to Features, Recommendations, Guidelines, and Tips for Oracle Intelligent Document Recognition for Payables Invoices (Doc ID 2656229.1) on My Oracle Support.

- This feature originated from the Idea Labs on Oracle Customer Connect: bf61e80448

Adaptive Learning for Invoice Lines Using Intelligent Document Recognition

Use the interactive invoice viewer to correct line information for invoices processed using Intelligent Document Recognition (IDR). IDR uses adaptive learning to improve line recognition on subsequent invoices from the same supplier.

This adds adaptive learning capability for invoice lines where it was previously available only for invoice header attributes.

The interactive invoice viewer can be used to make corrections for the following invoice line-level attributes:

- Description

- Quantity

- Unit Price

- UOM (Unit of Measure)

- Amount

Business Benefit:

Adaptive learning lets IDR continuously improve the recognition rate for invoice lines, based on the corrections that you make using the interactive invoice viewer. This helps improve the recognition accuracy for subsequent invoices from the same supplier.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

Correcting the line information helps IDR use adaptive learning to improve the recognition of lines for subsequent invoices from the same supplier in the following scenarios:

- None of the lines are extracted.

- Invoice lines are extracted, but one or more columns within the lines are not extracted. Note that these missing columns should be amongst the supported attributes for adaptive learning (Description, Quantity, Unit Price, Unit of Measure and Amount).

- One of more columns within the extracted lines are incorrectly identified. For example, IDR extracted the amounts from the 'Total without tax' column on the invoice document, whereas the requirement was to extract from the 'Total with Tax' amount.

The adaptive learning capability won't improve line recognition on subsequent invoices in cases where the interactive invoice viewer is used to detect additional lines or delete extra lines recognized by IDR.

Key Resources

- For additional details, refer to Features, Recommendations, Guidelines, and Tips for Oracle Intelligent Document Recognition for Payables Invoices (Doc ID 2656229.1) on My Oracle Support.

Role Information

To use interactive invoice viewer, you need either of these roles:

- Accounts Payable Specialist

- Accounts Payable Supervisor

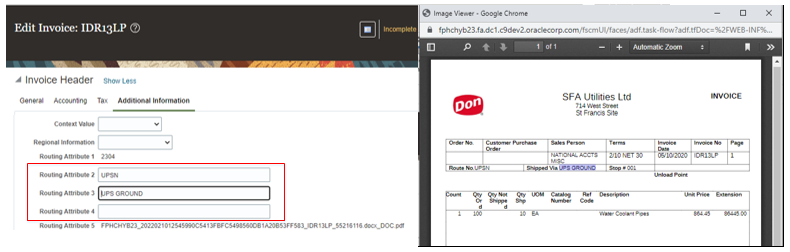

Adaptive Learning for Routing Attributes Using Intelligent Document Recognition

Use the interactive invoice viewer to identify information that you want to recognize for Routing Attribute 2, 3 and 4 on the supplier invoice. Adaptive learning uses this information to recognize the values for these attributes for subsequent invoices for the same supplier.

Business Benefit:

Using this feature, you can recognize attributes from a supplier invoice document that are specific to the supplier and your business. This helps you avoid manually updating the information in these attributes on every invoice.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

- To view the Routing Attributes 2, 3 and 4, click on the Show More link in the Invoice Header section when editing the invoice. The attributes are available in the Additional Information tab.

- Place the cursor on the routing attribute that requires update on the invoice page. Double-click or highlight the relevant text on the invoice document in the interactive image viewer. The selected value on the invoice document will be copied onto the selected routing attribute field in the invoice page. Save your changes.

Routing Attributes on the Additional Information Tab in Invoice Header Section

Key Resources

- For additional details, refer to Features, Recommendations, Guidelines, and Tips for Oracle Intelligent Document Recognition for Payables Invoices (Doc ID 2656229.1) on My Oracle Support.

Role Information

To use interactive invoice viewer, you need either of these roles:

- Accounts Payable Specialist

- Accounts Payable Supervisor

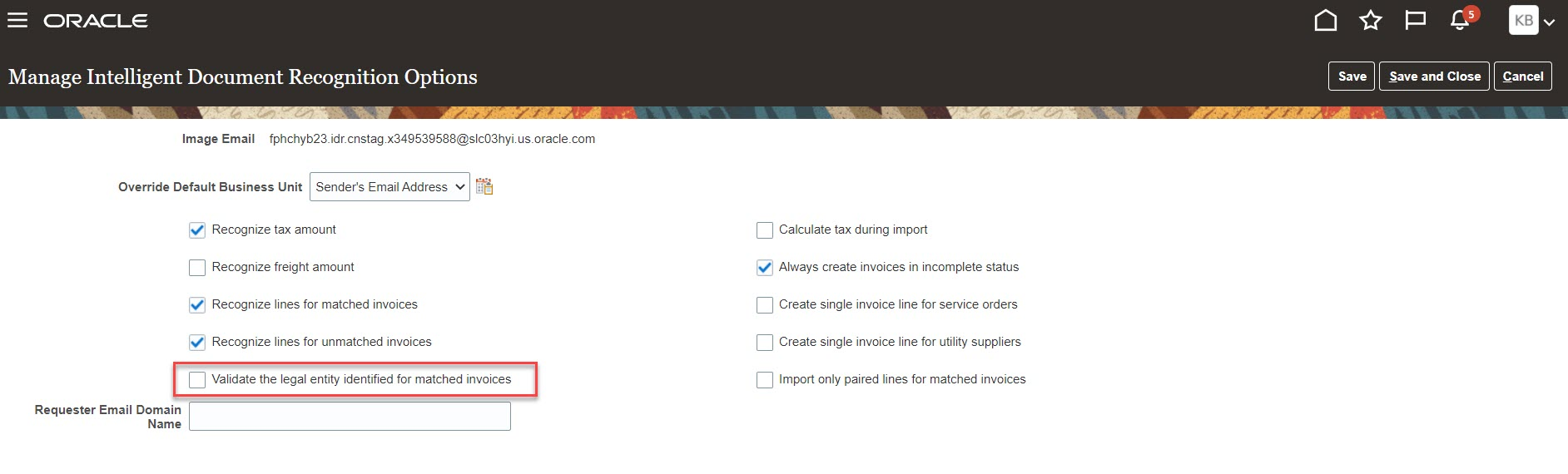

Legal Entity Recognition from Invoice Document

Use Intelligent Document Recognition to recognize the legal entity on the invoice image through key elements such as the bill-to location and the legal entity registration number. This helps in accurate tax calculation without user intervention.

Intelligent Document Recognition (IDR) always attempts to identify and extract all invoice attributes, including the legal entity, supplier name, invoice number, and so on. This feature can’t be disabled. IDR matches the Bill-to location address on the invoice with the legal entity address in the Fusion Legal Entity Configurator. The addresses of both the legal entity as well as the associated legal reporting unit (LRU) are used for this purpose. IDR improves the accuracy further by also considering the registration numbers (EIN, TIN, and so on) of the legal entity or the LRU during the matching process.

For matched invoices, you can opt to verify that the legal entity identified for the invoice matches the legal entity of the purchase order recognized from the invoice. You can enable these options on the Manage Intelligent Document Recognition Options page. If this configuration is enabled and the legal entity on the matched invoice doesn’t match the legal entity of its purchase order, then the purchase order is rejected during the invoice import process and the invoice is imported in incomplete status. In the application, you can see an error on the PO field which you can correct to proceed further.

IDR Options

Deriving the Default Legal Entity Based on Invoice Type

- Unmatched invoices:

- Legal entity is recognized from the invoice document.

- If it’s not recognized for the invoice document, derive the default legal entity using the same logic as used on the Create Invoice page.

- Matched invoices when the option to validate legal entity isn’t enabled in the IDR options:

- Derive the default legal entity from the purchase order.

- Matched invoices when the option to validate legal entity is enabled in the IDR options:

- Legal entity is recognized from the invoice document.

- If it’s not recognized from the invoice document, derive the default legal entity from the purchase order.

Business benefits include:

- Recognition of legal entity by the Intelligent Document Recognition reduces manual efforts.

- Queue the purchase order matched invoices for user review if the legal entity identified for the invoice does not matches the legal entity of the purchase order recognized from the invoice..

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

- Any changes in the addresses of the legal entities or the associated LRUs can take up to 24 hours to synchronize with IDR.

- Any changes on the Manage Intelligent Document Recognition Options page related to legal entity validation are enforced immediately.

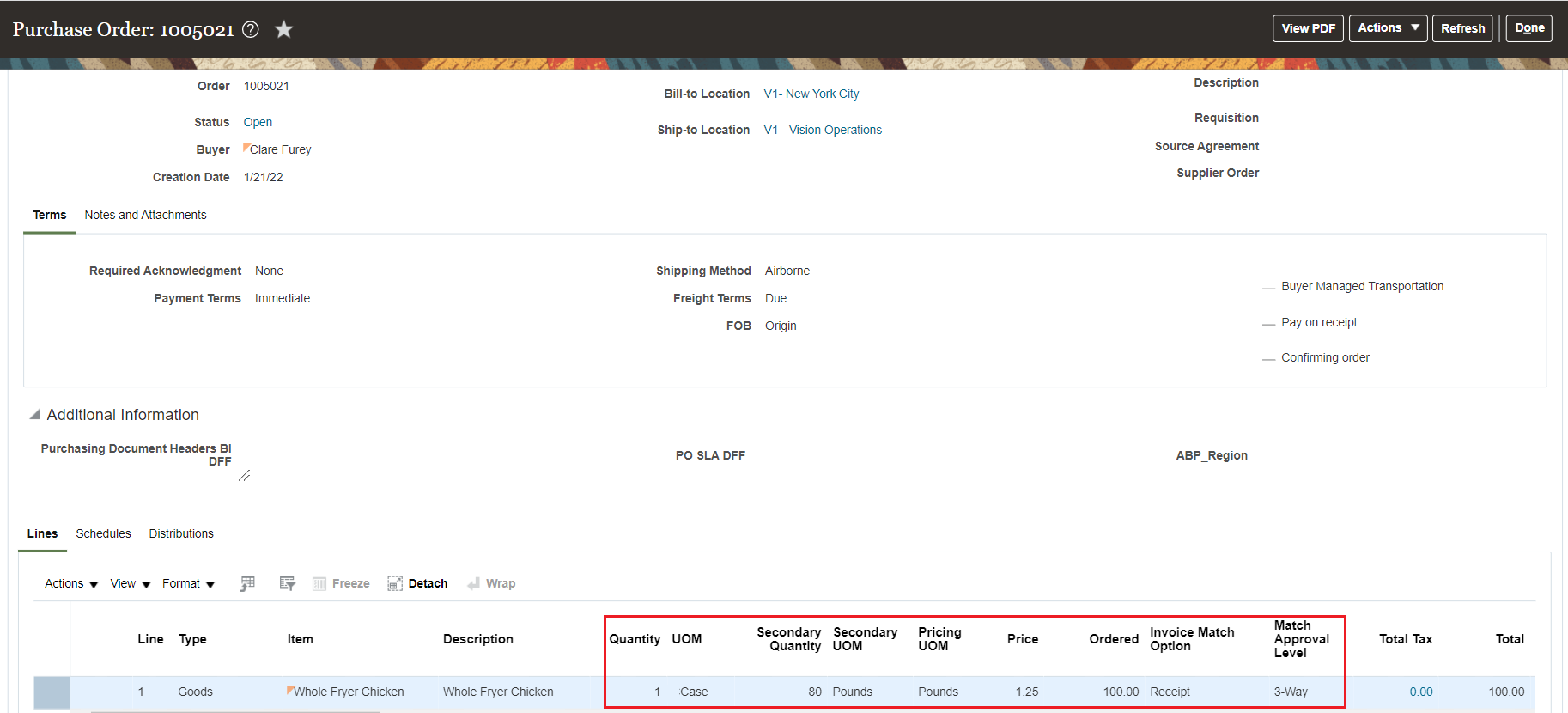

Receipt-Matched Invoices for Catch Weight Items

Create receipt-matched invoices for catch weight items using the pricing unit of measure. The pricing unit of measure is the secondary unit of measure on the receipt. A segment of customers in industries such as food and beverages procures catch weight items that vary in concentration or weight. These items are ordered and shipped in one unit of measure, for example Cases, and priced in a different unit of measure, for example Pounds. In existing functionality, receipt-matched invoices must be in the receiving unit of measure and not the pricing unit of measure. This enhancement allows the shipping and receiving in one unit of measure and buying in another for catch weight items.

For example, a buyer places an order for chicken in cases, the item's primary UOM. However, the supplier invoices the chicken in pounds, based on the actual quantity delivered.

- Each case weighs around 80 pounds on average.

- The price agreed is $ 1.25 per pound.

- Supplier delivers a case of chicken weighing 82 pounds.

- The invoice is based on the actual weight of item delivered in its secondary UOM (82 pounds).

Purchase Order Line Ordered in Primary UOM and Priced in Secondary UOM. Invoice Match Option is Receipt.

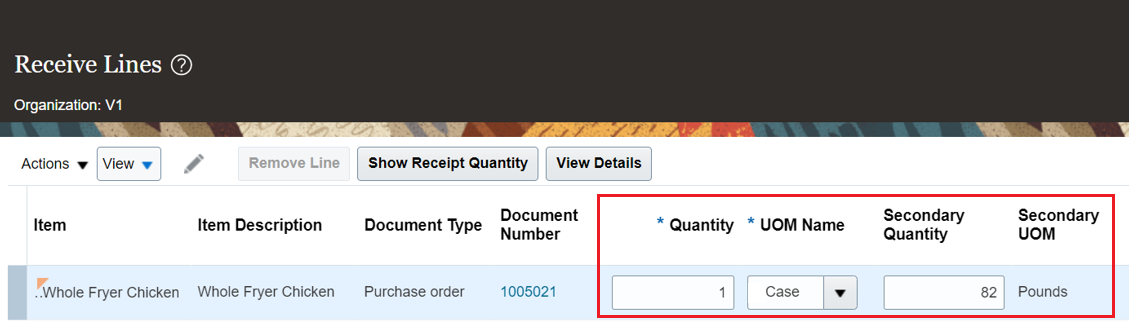

Receive in the UOM from the Order Line and Capture Exact Weight Delivered in Secondary UOM Quantity.

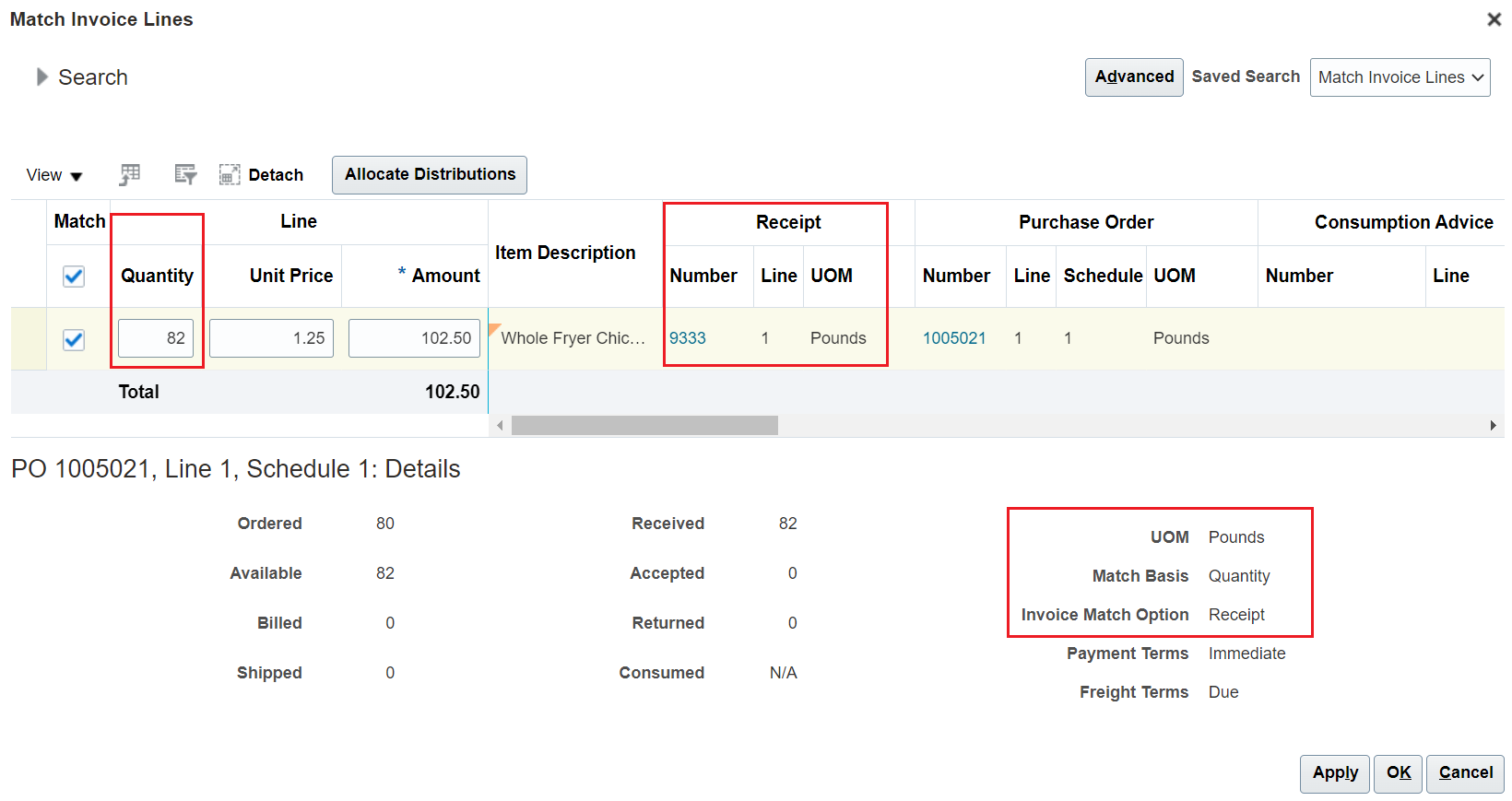

Invoice Matched to Receipt in the Item's Secondary UOM.

Business Benefit:

This feature enables you to accurately price and invoice the item based on the exact weight delivered, while ordering it in the UOM used for packing and shipping.

Steps to Enable

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Procurement

You don't need to do anything in Payables to enable this feature. However, you must enable the parent feature ‘Purchase Items That Are Priced in Their Secondary UOM’ via Opt In UI in Procurement.

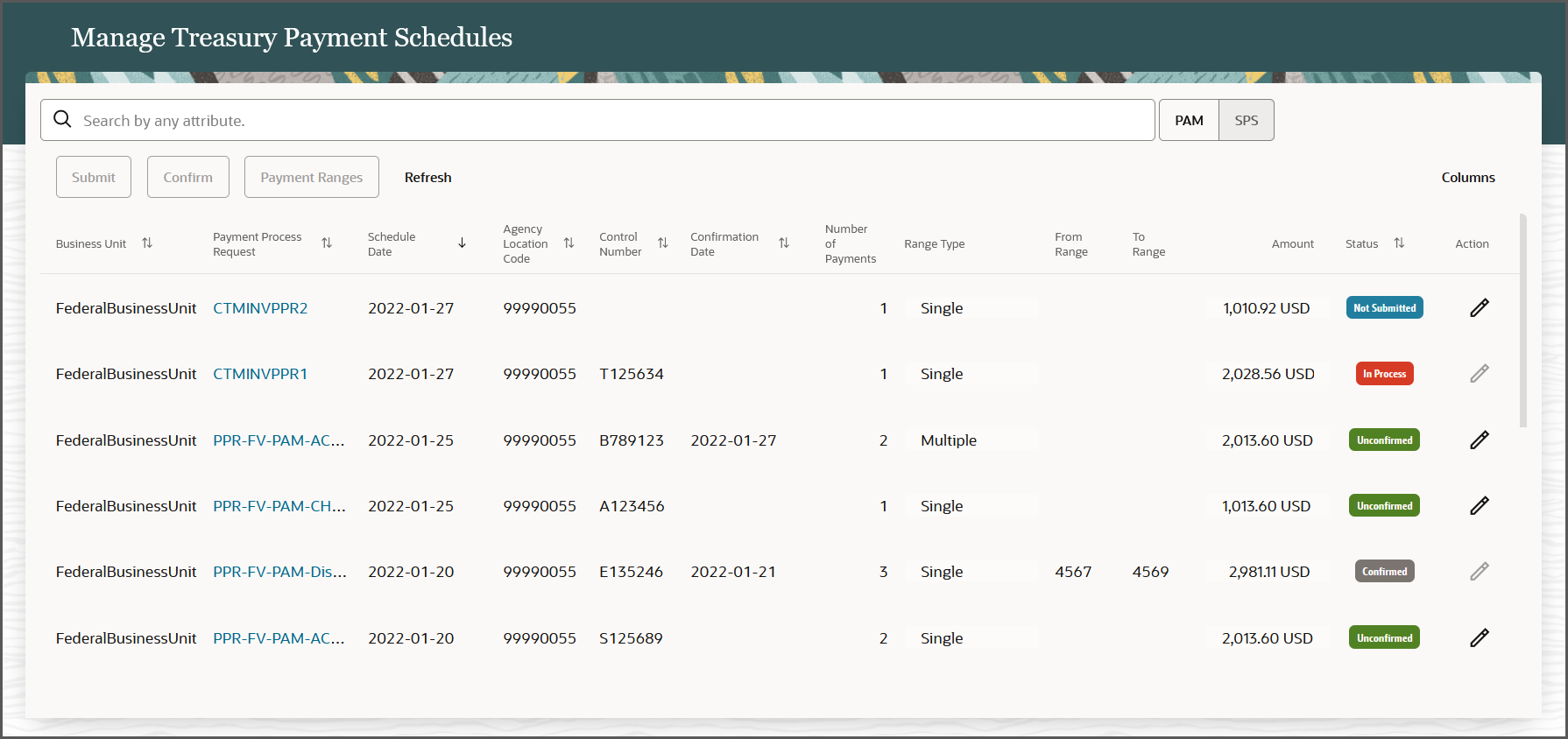

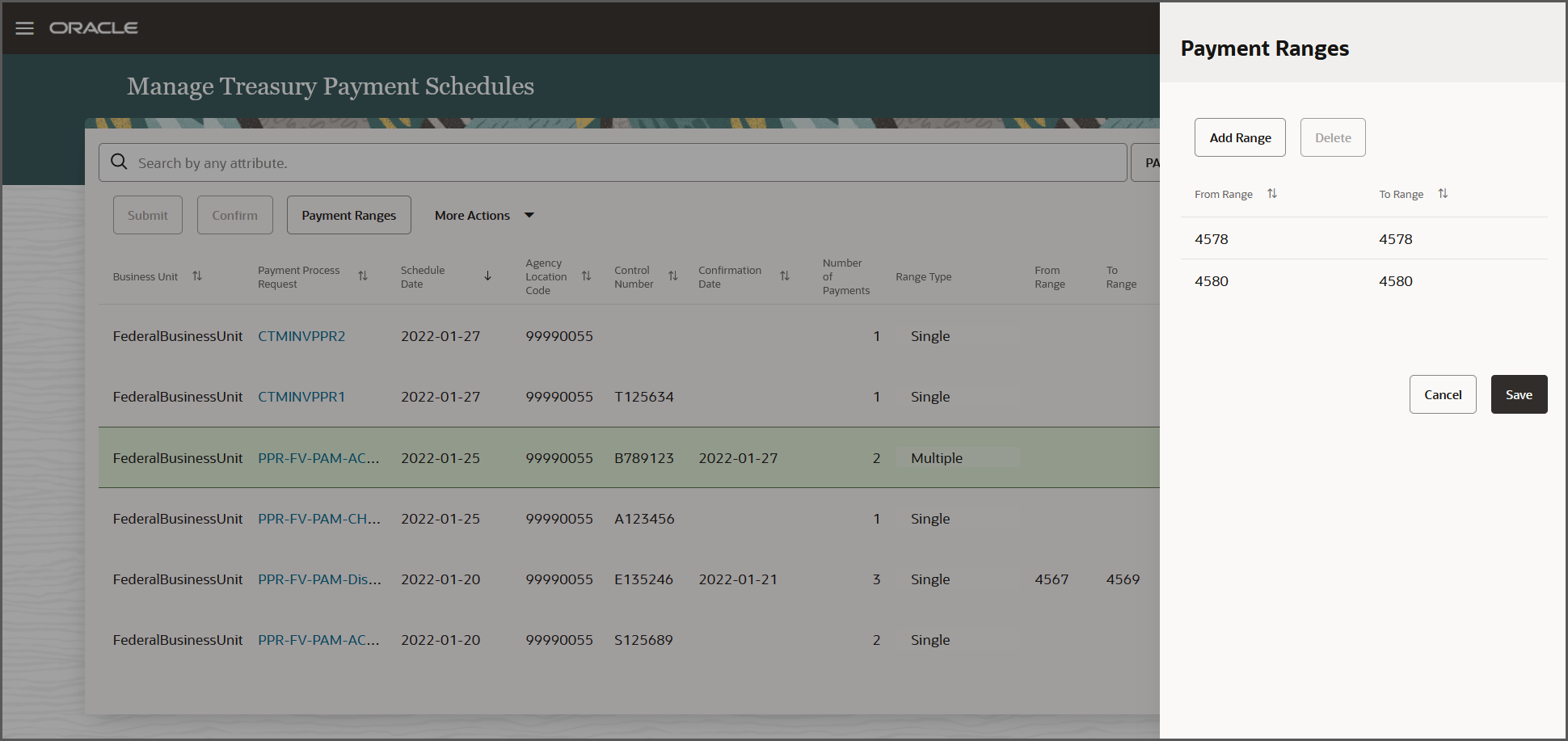

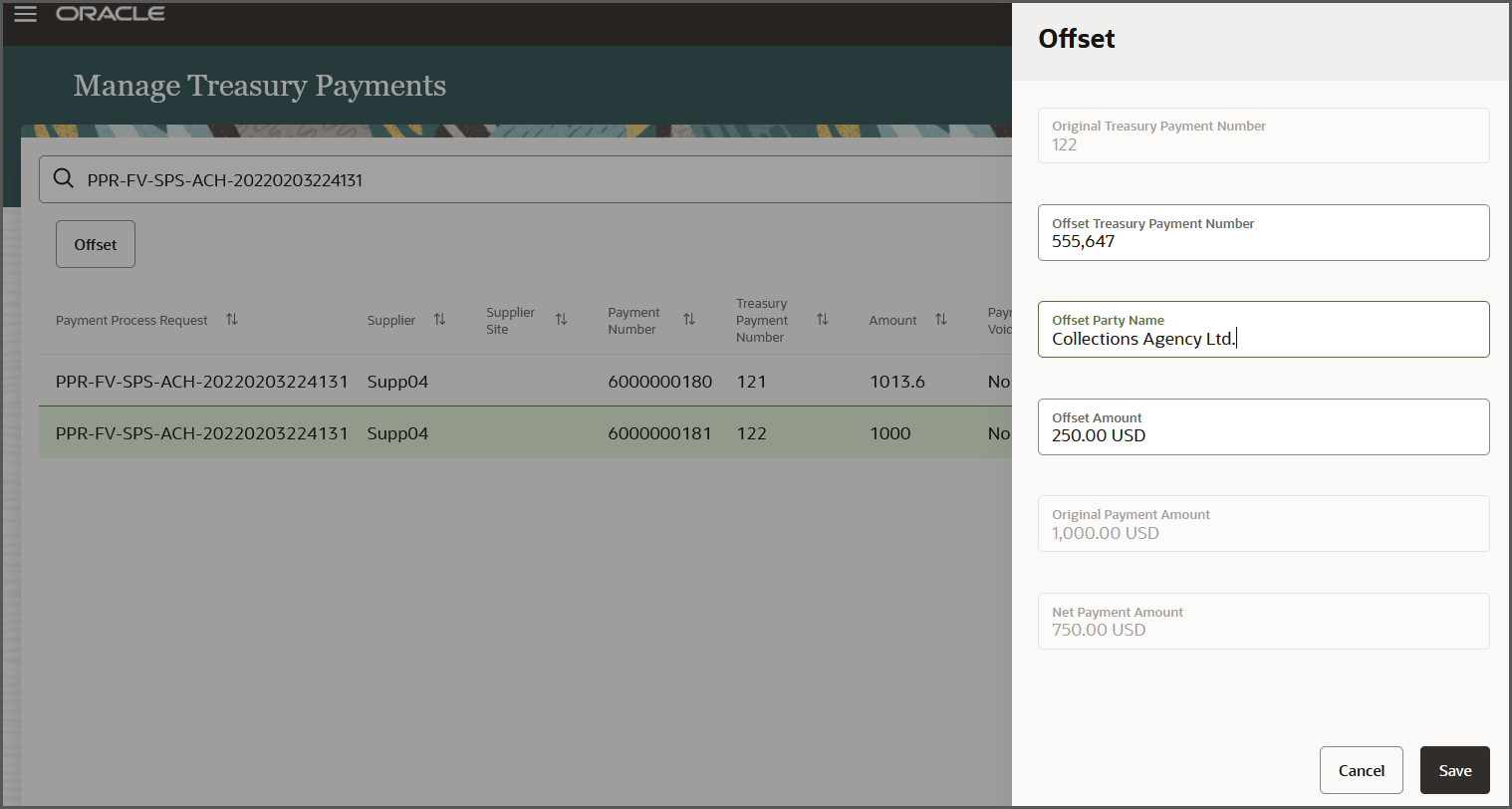

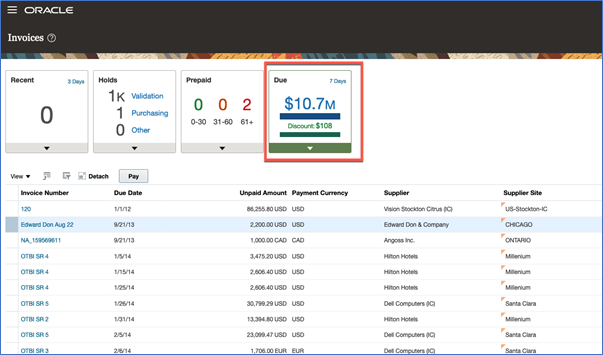

Tips And Considerations