- Revision History

- Overview

- Optional Uptake of New Features (Opt In)

- Feature Summary

- Collaboration Messaging Framework

- Financials Common

- Accounting and Control

-

- Budgetary Control

- General Ledger

-

- Future-Dated Journal Posting Control in Open Periods for Average Daily Balance Ledgers

- Improvements in Segment Attribute Labels in General Ledger Oracle Transactional Business Intelligence (OTBI) Subject Areas

- Legal Entity Dimension Display in General Ledger Subject Areas in Oracle Transactional Business Intelligence (OTBI)

- Operational Query Capability for Average Daily Balance Ledgers Using OTBI

-

- Joint Venture Management

- Subledger Accounting

- Payables and Expenses

- Receivables and Cash

- Asset and Lease Management

- Region and Country-Specific Features

- U.S. Federal Financials

This document will continue to evolve as existing sections change and new information is added. All updates appear in the following table:

| Date | Module | Feature | Notes |

|---|---|---|---|

| 13 MAR 2023 | General Ledger | Updated document. Delivered new feature in update 23A. | |

| 13 MAR 2023 | General Ledger | Updated document. Delivered new feature in update 23A. | |

| 24 FEB 2023 | Subledger Accounting | Exchange Gain or Loss Treatment in Foreign Currency Manual Subledger Journals | Updated document. Revised feature information. |

| 24 FEB 2023 | Payments | VAT Payment in Local Currency for Poland Foreign Currency Invoices | Updated document. Revised feature information. |

| 24 FEB 2023 | Budgetary Control | Budgetary Control Reservation of Invoice Payments When Cash Budget Has Insufficient Funds |

Updated document. Revised feature information. |

| 24 FEB 2023 | Payables | Fuzzy Matching of Description Between Invoice Lines and Purchase Orders |

Updated document. Delivered new feature in update 23A. |

| 17 JAN 2023 | Payables | Matching of Invoices with Purchase Order Lines with Vendor Credits | Updated document. Revised feature information. |

| 20 DEC 2022 | Common Financials | Get News Feed Suggestions On Your Next Likely Actions | Updated document. Delivered new feature in update 23A. |

| 02 DEC 2022 | Created initial document. |

HAVE AN IDEA?

HAVE AN IDEA?

We’re here and we’re listening. If you have a suggestion on how to make our cloud services even better then go ahead and tell us. There are several ways to submit your ideas, for example, through the Ideas Lab on Oracle Customer Connect. Wherever you see this icon after the feature name it means we delivered one of your ideas.

GIVE US FEEDBACK

We welcome your comments and suggestions to improve the content. Please send us your feedback at oracle_fusion_applications_help_ww_grp@oracle.com.

DISCLAIMER

The information contained in this document may include statements about Oracle’s product development plans. Many factors can materially affect Oracle’s product development plans and the nature and timing of future product releases. Accordingly, this Information is provided to you solely for information only, is not a commitment to deliver any material, code, or functionality, and should not be relied upon in making purchasing decisions. The development, release, and timing of any features or functionality described remains at the sole discretion of Oracle.

This information may not be incorporated into any contractual agreement with Oracle or its subsidiaries or affiliates. Oracle specifically disclaims any liability with respect to this information. Refer to the Legal Notices and Terms of Use for further information.

Optional Uptake of New Features (Opt In)

Oracle Cloud Applications delivers new updates every quarter. This means every three months you'll receive new functionality to help you efficiently and effectively manage your business. Some features are delivered Enabled meaning they are immediately available to end users. Other features are delivered Disabled meaning you have to take action to make available. Features delivered Disabled can be activated for end users by stepping through the following instructions using the following privileges:

- Review Applications Offering (ASM_REVIEW_APPLICATIONS_OFFERINGS_PRIV)

- Configure Oracle Fusion Applications Offering (ASM_CONFIGURE_OFFERING_PRIV)

Here’s how you opt in to new features:

- Click Navigator > My Enterprise > New Features.

- On the Features Overview page, select your offering to review new features specific to it. Or, you can leave the default selection All Enabled Offerings to review new features for all offerings.

- On the New Features tab, review the new features and check the opt-in status of the feature in the Enabled column. If a feature has already been enabled, you will see a check mark. Otherwise, you will see an icon to enable the feature.

- Click the icon in the Enabled column and complete the steps to enable the feature.

In some cases, you might want to opt in to a feature that's not listed in the New Features work area. Here's how to opt in:

- Click Navigator > My Enterprise > Offerings.

- On the Offerings page, select your offering, and then click Opt In Features.

- On the Opt In page, click the Edit Features (pencil) icon for the offering, or for the functional area that includes your feature.

- On the Edit Features page, complete the steps to enable the feature.

For more information and detailed instructions on opting in to new features for your offering, see Offering Configuration.

Opt In Expiration

Occasionally, features delivered Disabled via Opt In may be enabled automatically in a future update. This is known as an Opt In Expiration. If your cloud service has any Opt In Expirations you will see a related tab in this document. Click on that tab to see when the feature was originally delivered Disabled, and when the Opt In will expire, potentially automatically enabling the feature. You can also click here to see features with Opt In Expirations across all Oracle Cloud Applications.

Column Definitions:

Report = New or modified, Oracle-delivered, ready to run reports.

UI or Process-Based: Small Scale = These UI or process-based features are typically comprised of minor field, validation, or program changes. Therefore, the potential impact to users is minimal.

UI or Process-Based: Larger Scale* = These UI or process-based features have more complex designs. Therefore, the potential impact to users is higher.

Features Delivered Disabled = Action is needed BEFORE these features can be used by END USERS. These features are delivered disabled and you choose if and when to enable them. For example, a) new or expanded BI subject areas need to first be incorporated into reports, b) Integration is required to utilize new web services, or c) features must be assigned to user roles before they can be accessed.

Collaboration Messaging Framework

Collaboration Messaging Framework

Receive a Brazil Electronic Freight Other Services Invoice

Use the new secretaria de fazenda (SEFAZ) Brazil Electronic Freight Other Services Invoice V3.00 message (BR_CTEOS_3.00_IN) to receive electronic freight invoices for other transportation-related services.

This predefined message definition is available as an inbound message (ORA_SZ_BR_CTEOS_3.0_IN) for the SEFAZ service provider on the Manage Collaboration Messaging Service Providers page. This message is processed with other Brazilian messages when using the Import Brazil Electronic Documents scheduled process.

ORA_SZ_BR_CTEOS_3.00_IN

This new predefined message allows you to implement conhecimento de transporte eletrônico (CT-e) electronic bill of lading for other services by taking advantage of the information that can be extracted from XML, reducing user manual intervention.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

- Configuring and Managing B2B Messaging for Oracle Applications Cloud guide available on the Oracle Help Center.

Role And Privileges

You have a couple of options for giving people access to this feature, depending on whether you're assigning them predefined job roles or your own configured job roles.

- Users who are assigned this predefined job role can access this feature:

- Supply Chain Application Administrator (ORA_RCS_SUPPLY_CHAIN_APPLICATION_ADMINISTRATOR_JOB)

- Users who are assigned a configured job role that contains this privileges can access this feature:

- Manage Service Provider (CMK_MANAGE_SERVICE_PROVIDER_PRIV)

Send and Receive UBL PEPPOL Electronic Invoices

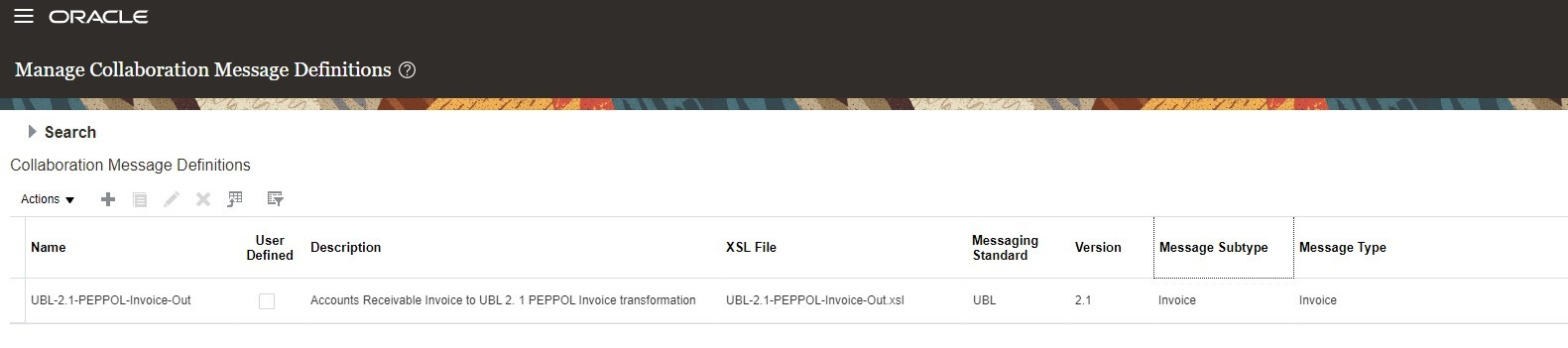

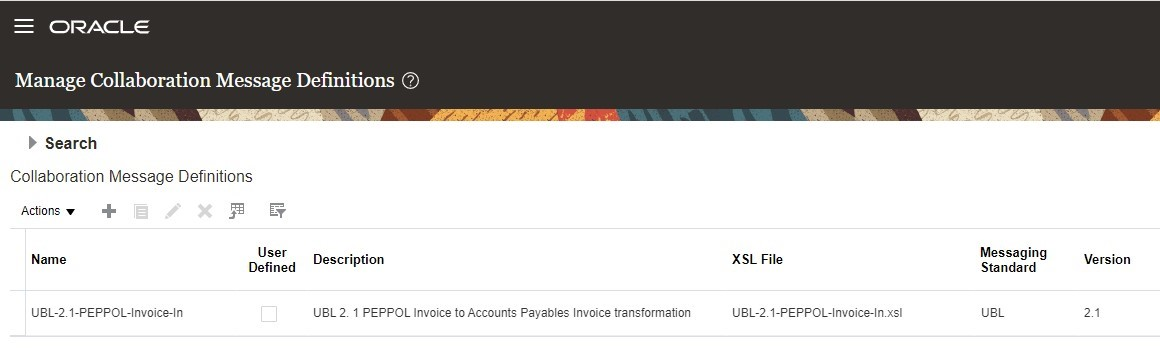

Use the new predefined message definitions UBL-2.1-PEPPOL-Invoice-Out and UBL-2.1-PEPPOL-Invoice-In to send and receive universal business language (UBL) pan-European public procurement online (PEPPOL) invoice messages to and from PEPPOL access points.

UBL-2.1-PEPPOL-Invoice-Out Message

UBL-2.1-PEPPOL-Invoice-In Message

Set up these message definitions as outbound and inbound collaboration messages for a trading partner. Associate the trading partner and the invoice outbound document with a customer by using the Manage Customer Account Collaboration Configuration task. Associate the trading partner and invoice inbound document with a supplier by using the Manage Supplier B2B Configuration task in the Collaboration Messaging work area.

These new messages enrich the e-invoicing process by providing additional data elements to meet PEPPOL standards and some country-specific requirements.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

You must create the following list of domain value maps before you can exchange UBL PEPPOL messages. Populate each domain value map with the values from the code lists.

| Domain Value Maps | Code Lists |

|---|---|

| CURRENCY_CODE |

|

| INVOICE_TYPE_CODE |

https://docs.peppol.eu/poacc/billing/3.0/codelist/UNCL1001-inv/ |

| INVOICE_TRX_TYPE_CODE |

https://docs.peppol.eu/poacc/billing/3.0/codelist/UNCL1001-inv/ |

| EAS_CODE |

|

| ICD_CODE |

|

| CHARGE_REASON_CODE |

|

| UOM_CODE |

https://docs.peppol.eu/poacc/billing/3.0/codelist/UNECERec20/ |

| COUNTRY_CODE |

|

| PAYMENT_METHOD |

|

| TAX_CATEGORY_CODE |

Key Resources

- Configuring and Managing B2B Messaging for Oracle Applications Cloud guide available on the Oracle Help Center.

Role And Privileges

You have a couple of options for giving people access to this feature, depending on whether you're assigning them predefined job roles or your own configured job roles.

- Users who are assigned this predefined job role can access this feature:

- Supply Chain Application Administrator (ORA_RCS_SUPPLY_CHAIN_APPLICATION_ADMINISTRATOR_JOB)

- Users who are assigned a configured job role that contains these privileges can access this feature:

- Manage B2B Supplier Trading Partners (CMK_B2B_SUPPLIER_TRADING_PARTNERS_PRIV)

- Manage B2B Trading Partners (CMK_B2B_TRADING_PARTNERS_PRIV)

- Manage Customer Account Collaboration Configuration (CMK_B2B_CUSTOMER_ACCOUNT_TRADING_PARTNERS_PRIV)

Resend Approval Email Notifications

You can now resend approval email notifications for in-progress transactions. You can select one or more transactions in the Transaction Console page or drill-down to the Transaction details page for a transaction and use Resend Email Notification in the Actions menu to notify assignees.

Resend Email Notification in Actions Menu on the Details Page

Confirmation Message Displays for Selected Transactions

When you click Resend Email Notification, if there are multiple tasks and assignees in the transaction then those tasks and assignees display in a dialog box. You can select the assignees to whom you want to send the notification. By default, all the assignees are selected in the dialog box.

After the notification is sent, the appropriate status displays in the Status dialog box.

Status Dialog Box for Submitted Process

This feature provides the ability to resend email notifications in the event of any email deletions or loss of email data.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

- This action is available only to administrators and for in-progress assigned transactions.

- If there’s a change in the email ID after the first notification then on the resend the new email ID is automatically used.

Key Resources

Role And Privileges

You need to grant administrators the Perform HCM Approval Transaction Actions (PER_PERFORM_APPROVAL_TRANSACTION_ACTIONS_PRIV) privilege.

Service Excellence Continuing Investments

Our ongoing investment in service excellence has a focus on overall usability, resiliency, performance, and security. This work is based on monitoring performance trends, reviewing common use patterns, analyzing service requests, and participating in many discussions with customers.

In this update, our ongoing investment in service excellence includes improvements in the following areas:

Usability:

- Enhanced the Payables Invoice UI so the interactive viewer can display documents with a NULL attachment content type as PDFs.

- Enhanced business validation in Import Payables Invoices to ignore the purchase order details on freight lines for image invoices.

- Enhanced the bank reconciliation process to use the From/To system transaction date parameters in the Bank Statement Autoreconciliation process to select a specific range of unreconciled system transactions for reconciliation processing.

- Improved the efficacy of Adaptive Learning for correct supplier detection from a purchase order.

- Enhanced Purchase Order Number recognition by using PO data to evaluate candidates where the PO Number cannot be differentiated against invoice data.

- Enhanced the Stuck Transaction process to handle transactions which are stuck due to Alerted and Out of Index issues.

- Enhanced the Synchronize Transaction Workflow Status process to consider the transactions which are in ASSIGNED, ALERTED, INFO_REQUESTED, or SUSPENDED workflow status to withdraw transactions from the approval process.

- Enhanced the Edit Receipt Class and Methods UI to query the Receipt Method name using query by example to review the receipt method details where larger numbers of receipt methods are associated to a particular receipt class.

Performance:

- Improved performance of the Validate Payables Invoices process if tax calculation is in error for a small number of invoices during the tax calculation for invoices in bulk mode.

- Improved performance of the Validate Payables Invoices process when deriving the approval status and hold count for every invoice.

- Improved performance of the Validate Payables Invoices process when generating the distribution lines for invoices.

- Improved performance of Create Accounting program for accounting business flow use cases.

Resiliency:

- Prevent generation of duplicate approval notifications for intercompany transactions when users submit the intercompany transactions both through ADFdi and UI simultaneously.

Steps to Enable

You don't need to do anything to enable this feature.

Workflow Rules Report for Financial Workflows

Use the enhanced Workflow Rules Report to review the rules configured in Oracle Business Process Management (BPM) for financial workflows. This report shows the details of rule conditions and approval routing for each rule. This report was first introduced in update 18C for Invoice Approval, Journal Approval, and Expense Report Approval workflows.

Workflow administrators can use this report to ensure that any rules defined or modified in Oracle Business Process Management (BPM) adhere to recommended best practices. In update 23A, this report is enhanced for following financial workflows:

- Automatic or Manual Credit Request Processing

- Bank Account Transfer Approval

- Bankruptcy Request Approval

- Cash Advance Approval

- Credit Request Approval

- Credit Request Approval Postprocessing Action

- Delegation of Corporate Card Transactions for Inactive Employees

- Hold Resolution

- Incomplete Invoice Hold

- Intercompany Transaction Approval

- Intercompany Transaction Distribution Entry

- Invoice Account Coding

- Manually Entered Credit Request Completion

- Payment Approval

- Spend Authorization Approval

Steps to submit this report:

- Navigate to the Schedule Processes page.

- Click Schedule New Process.

- Search and select Workflow Rules Report.

- From the Workflow list, select the required workflow.

- Click Submit.

Workflow Rules Report Process Screenshot

You can view the report output in either spreadsheet or XML format.

Report Output in spreadsheet format:

Workflow Rules Report Output in Spreadsheet Format

Workflow administrators or business users can use this report to ensure that any rules defined or modified in Oracle Business Process Management (BPM) adhere to recommended best practices.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

For additional details about this feature, please click here.

Role And Privileges

- Users with Financials Application Administrator role can submit this report from ESS schedule process.

- To use this feature you need this privilege:

- Manage Financial Applications Workflow Rules (FUN_MANAGE_FINANCIAL_APPLICATIONS_WORKFLOW_RULES_PRIV)

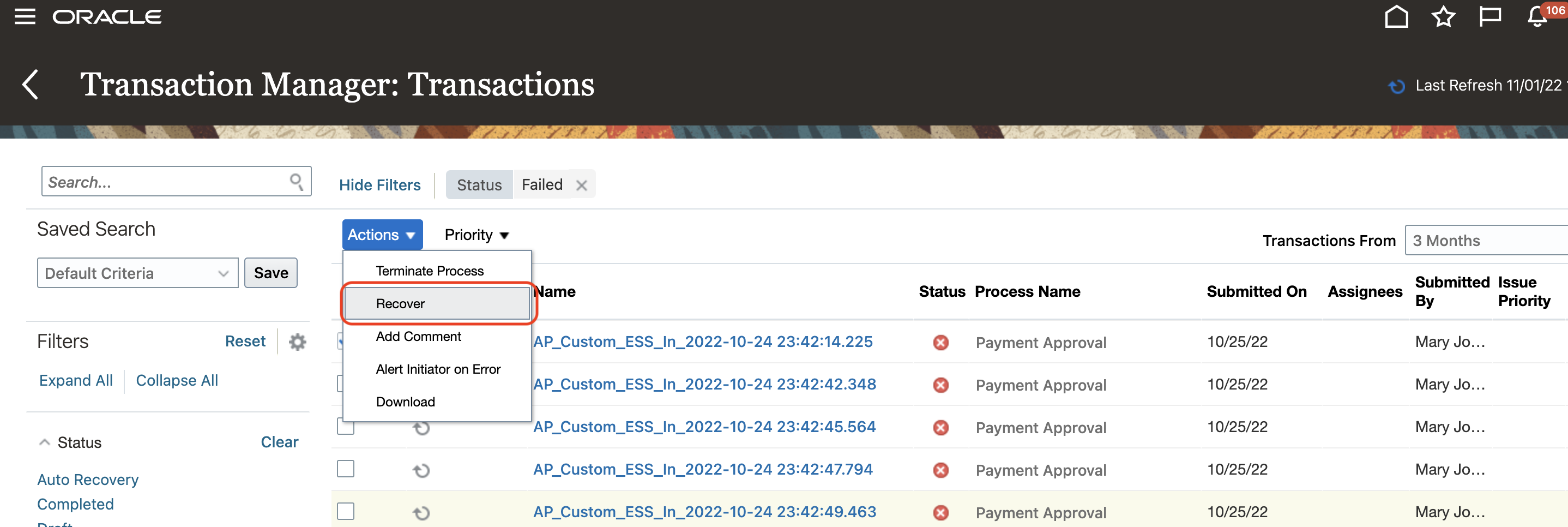

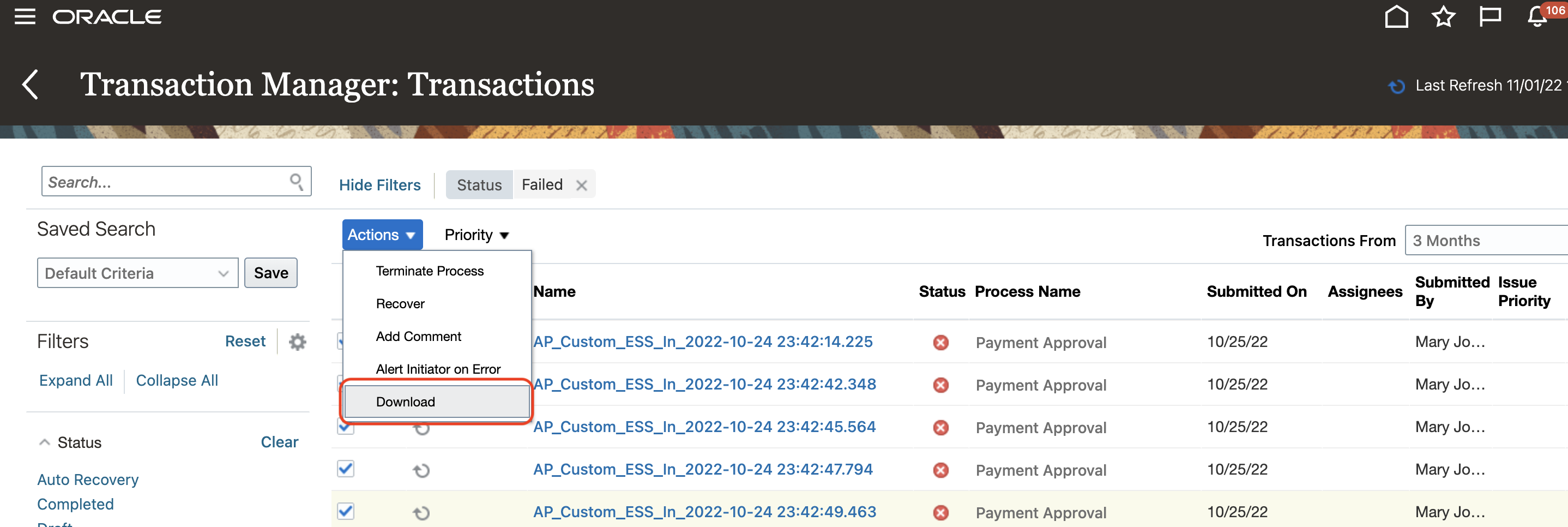

Use the Workflow Transaction Console to monitor workflow tasks and resolve exceptions for the Payment Approval workflow. The Workflow Transaction Console was introduced in update 19D for the Invoice, Expense, and Journal workflows. In update 23A, the Workflow Transaction Console is enhanced to display the workflow tasks related to the Payment Approval workflow.

The Workflow Transaction Console is a single dashboard that lets you monitor workflow tasks, resolve exceptions, and search using user-defined criteria.

Use the Workflow Transaction Console to:

- View the latest status of all the tasks in the system.

- Search based on the task name and user-defined criteria.

Search "Payment Approval" for Task Status

- Review the issue description and resolution for failed tasks.

Select a Failed task and Check the Issue Details

- Take appropriate actions based on the issue description and resolution. For example, you can recover a failed task after correcting the rule.

Recover a Failed Task After Correcting the Rule

- Download the search results to a spreadsheet in the CSV format.

Download Search Results

Steps to Enable

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Financials

Tips And Considerations

To display only financial-related tasks in the Workflow Transaction Console, enable the transaction security feature by performing the following steps:

- Go to Navigator > Setup and Maintenance > Manage Enterprise HCM Information.

- Click Edit > Correct.

- In the Transaction Console Information section, select Enable Transaction Security.

Key Resources

- For an overview of the Workflow Transaction Console feature, refer to the Manage Workflow Transactions topic on the Oracle Help Center.

Role And Privileges

- Financial Application Administrator

Get News Feed Suggestions On Your Next Likely Actions

Get suggestions on your next likely actions in your news feed layout. This feature is currently in Controlled Availability and is available in Oracle Fusion Cloud Financials and Oracle Fusion Cloud Project Management. Artificial intelligence and machine learning algorithms predict and suggest the actions each user is most likely to take during a session. The algorithms use historic navigation behavior and patterns of each user and users like them to determine which navigation target they’re most likely to visit.

Oracle Fusion Cloud Applications have a wide range of functionality and it can sometimes be difficult to know how to navigate to a task. With news feed suggestions, you can get to the tasks that matter faster. For example, if reviewing and approving expense reports is a task commonly performed by managers in your organization, new managers will receive a suggestion in their news feed to perform that task. Or if a few team members are entering performance goals, other members of that team see this task as a suggestion in their news feed.

Business benefits include:

- Receive recommendations in your news feed on your next likely actions during that session

- Discover actions that other users like you have taken within Fusion

- As an administrator, you can pin specific task flow pages as a suggestion to raise the visibility of the task

Suggestions Tab in the News Feed Layout Showing Six Recommendations

Steps to Enable

To enable this feature, you need to log a Service Request (SR) through My Oracle Support and request for a promotion code. This feature is currently in Controlled Availability and requires a promotion code. For details, see Fusion Global FIN/PPM: How to Apply for News Feed Suggestions Under Controlled Availability (Doc ID 2915308.1).

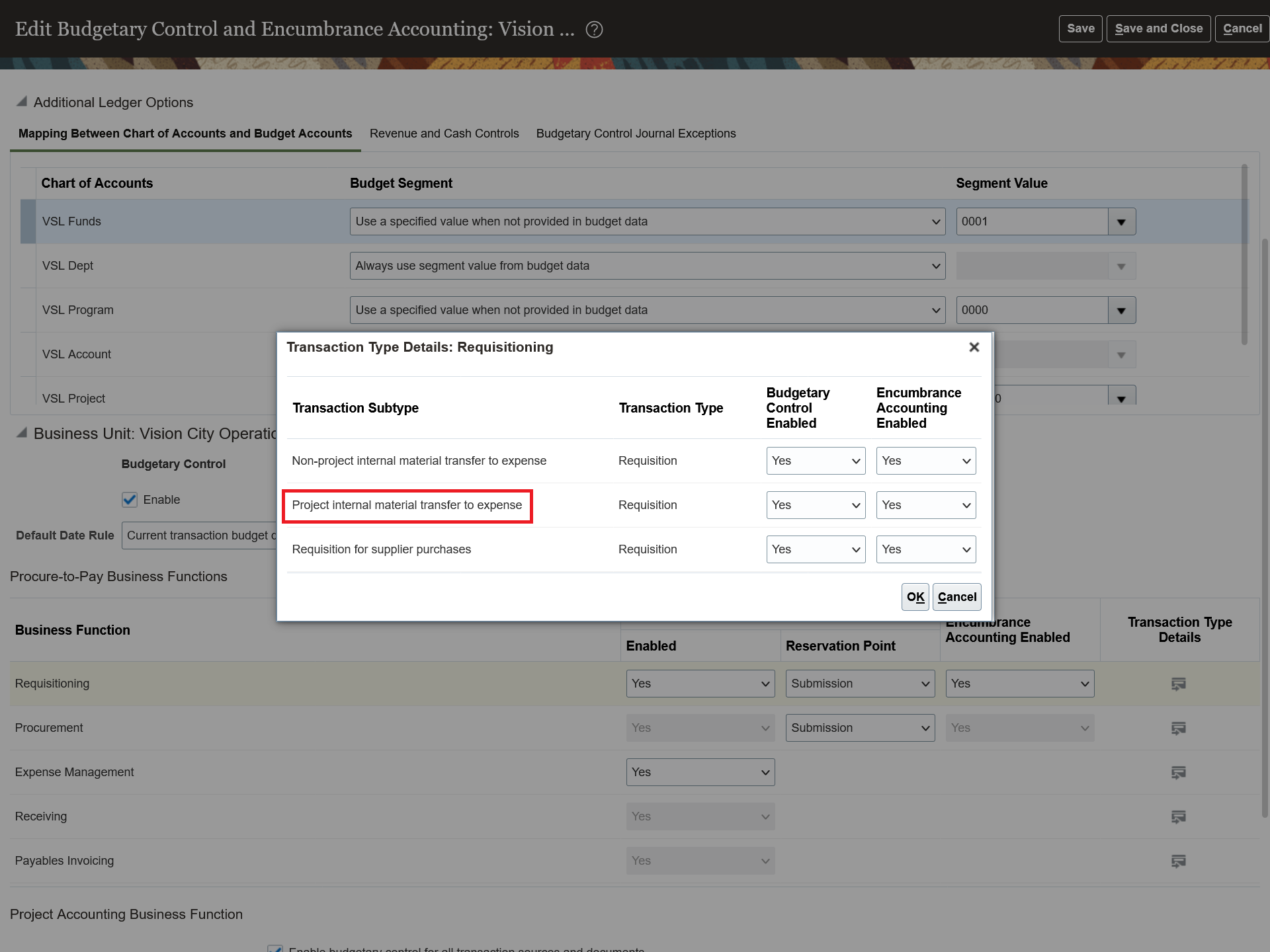

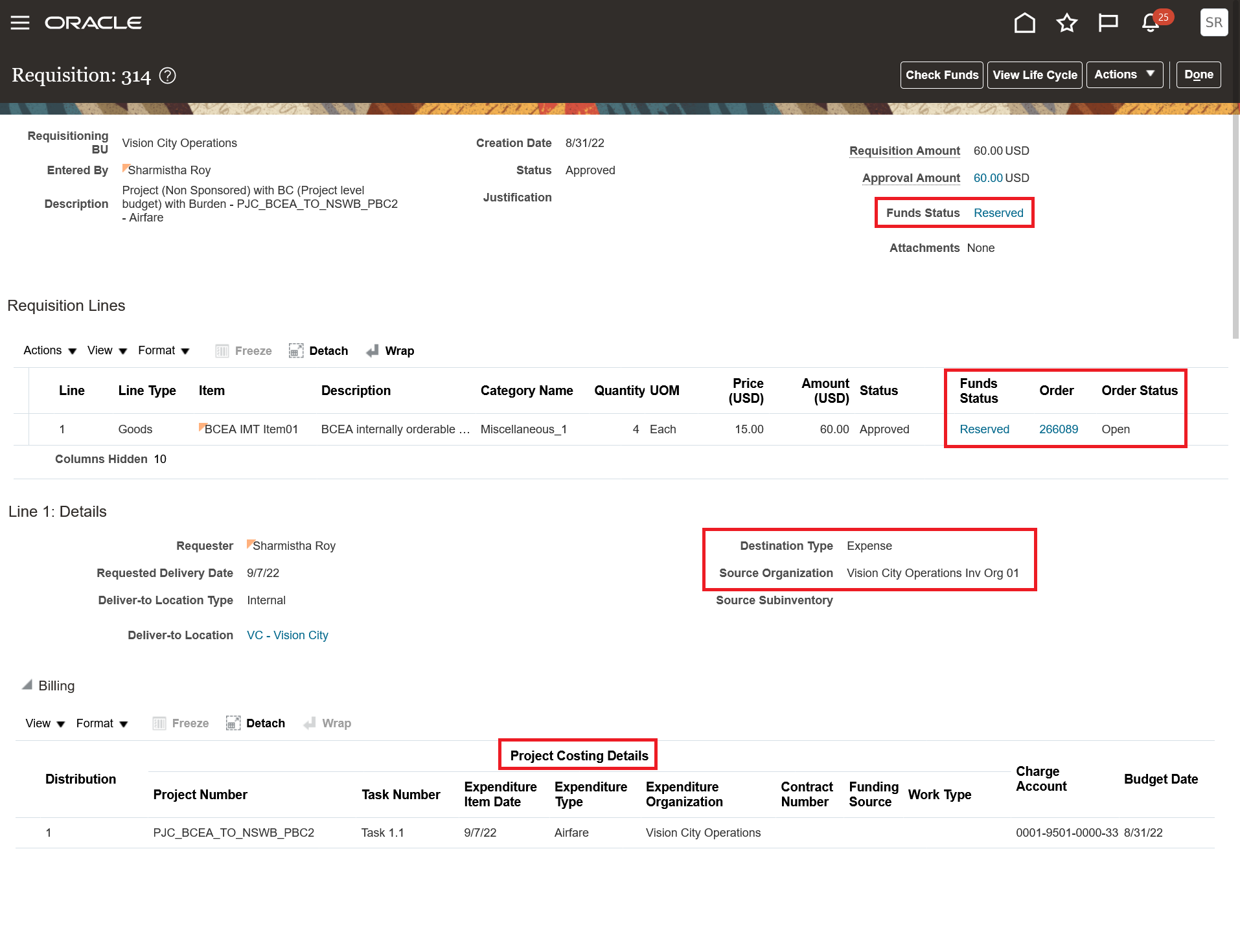

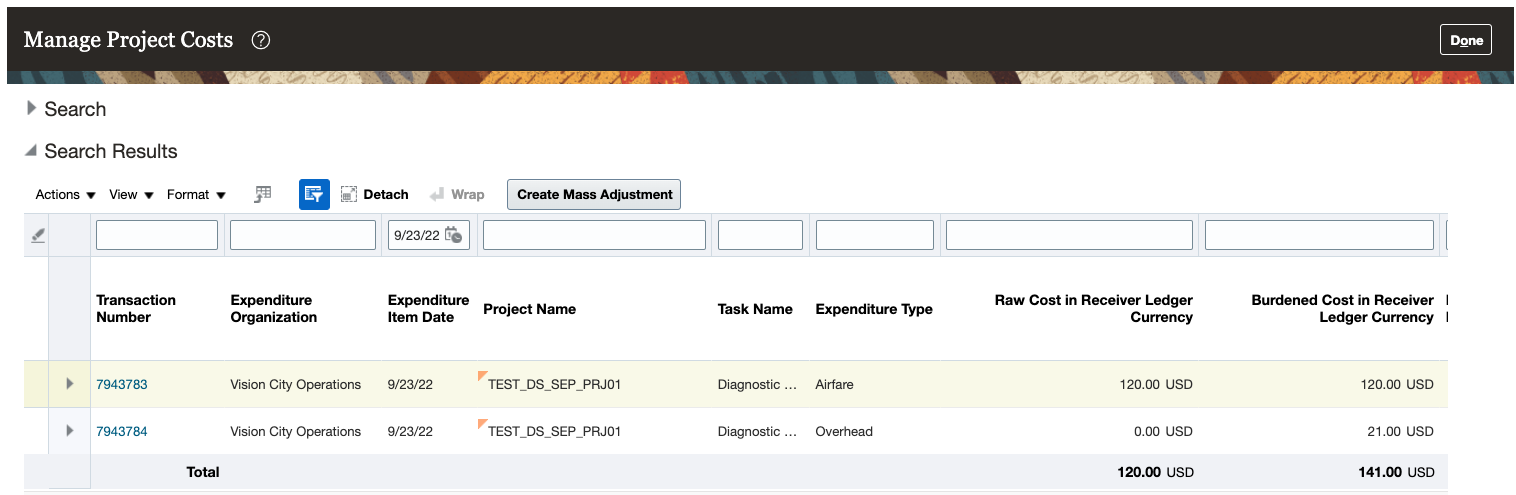

Apply Budgetary Control on Internally Sourced Requisitions Expensed to Projects

Check for funds availability, reserve funds against project control budgets, and account encumbrances, if applicable, when you raise internally sourced requisitions that are expensed to sponsored and nonsponsored projects. You can create internal requisitions for expense destination items and charge the transfer cost to the project by including project costing details in the distribution, but you must check funds availability before submitting the requisition. If budgetary control applies to your transaction, funds are reserved as a commitment either on approval or submission, based on the reservation point of the ledger and business unit budgetary control options. On receipt of the transfer order, the Create Receipt Accounting Distribution process reserves the receipt cost and liquidates the commitments. The Import cost process liquidates the receipt reservation and reserve funds, and imports the transfer order costs from the Supply Chain Inventory Receipts application as project costs. For sponsored projects, you can view control budget balances on the Manage Awards page, and for nonsponsored projects, you can use the Budgetary Control Analysis Report.

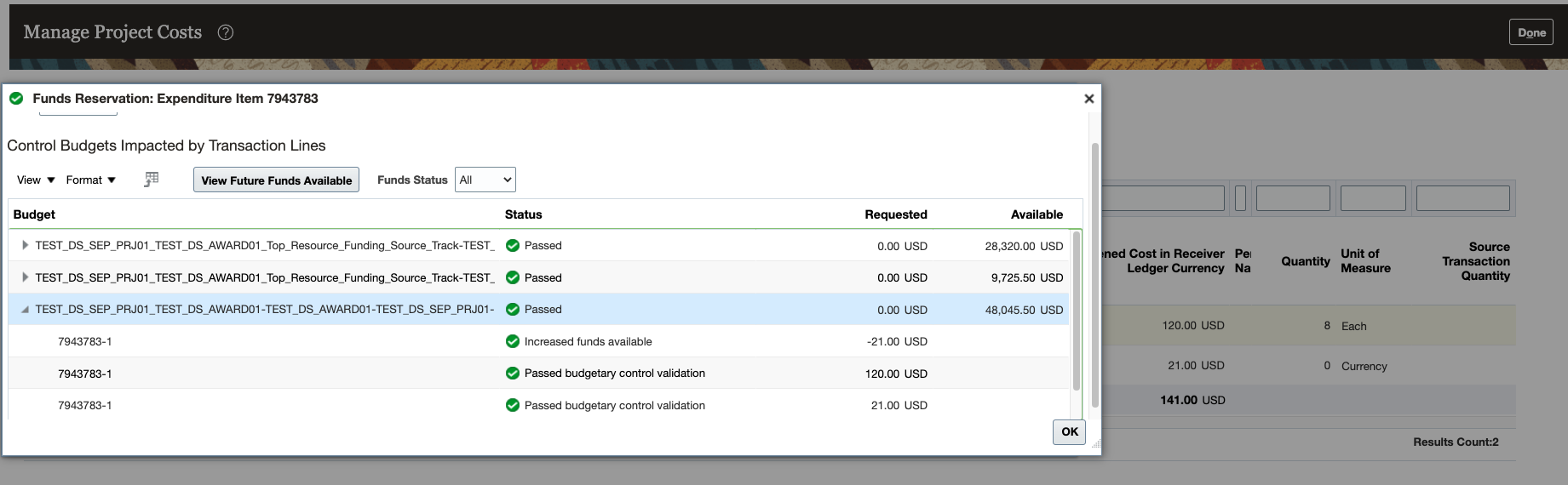

These screenshots illustrate the feature.

- For the Requisition transaction type, Project internal material transfer to expense subtype transaction type, enable the Budgetary Control and Encumbrance Accounting option.

- Create requisition for expense destination with project costing details.

- After the transfer order is shipped and received, and the transfer order receipts are accounted in Oracle Supply Chain Receipt Accounting, import and review transfer order costs as project costs.

Transfer Order Delivery Costs Imported as Project Costs and Viewed on the Manage Project Costs Page

Funds Reservation Details for Project Costs

View Project Control Budget Balances for Sponsored Projects

You can enable budgetary control and encumbrance accounting for the project internal material transfer to expense transaction subtype to:

- Track funds availability and funds consumption on critical project control budgets.

- Check for funds availability for internal material transfer requisitions that are expensed to projects.

- Track and account encumbrances on internal material transfer requisitions expensed to projects.

Steps to Enable

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Manufacturing and Supply Chain Materials Management

Feature: Project-Driven Supply Chain

After you opt in, you must perform additional steps to enable project-driven supply chain. For instructions, refer to the Steps to Enable section in the Segregate and Manage Project-Specific Inventory feature, available in the Oracle Inventory Management Cloud What's New, update 20A.

Below are the additional steps needed to apply budgetary control on internally sourced requisitions expensed to projects:

- Enable budgetary control for the ledger, business units assigned to the ledger, and the project accounting business function.

- Enable the Project internal material transfer to expense transaction subtype in Manage Budgetary Control for the business function Requisitioning.

- Additionally, ensure budgetary control is enabled for the receiving business function and the Receiving for internal expense transfer transaction type. This is also required for projects to perform the necessary budgetary control functions for these costs at the time of import to projects.

- Two new journal line rules are added for the Project Costing subledger application. These are the new rules:

- Same Line Project Encumbered Burden Cost Liquidation for Requisition for same line burdening enabled projects.

- Separate Line Project Encumbered Burden Cost Liquidation for Requisition for separate line burdening enabled projects.

These new rules ensure relieving of burden encumbrances for the requisition, since receipt accounting only relieves the encumbrance for the raw costs. If your ledger is assigned with a user-defined subledger accounting method, add these new journal line rules to your Burden and Inventory journal rule sets and recompile your subledger accounting method for encumbrances to be accounted successfully for internal material requisitions expensed to projects.

Tips And Considerations

- You can use this feature only for internal material transfer requisitions for expense destinations, with project costing details at the distribution level created in Self Service Procurement UIs.

- You can’t use this feature with requisition import (FBDI and Purchase Request Web Service) as requisition import doesn’t support internal material transfers.

- You can use this feature in REST resources, and Responsive Self Service Procurement application. But notice that, when applicable, funds are reserved only after approvals are completed.

- The requisition costs will be available as committed costs on the Manage Committed Costs page until the transfer order is received. After receipt of the transfer order is complete, the Manage Committed Costs page stops displaying these costs as commitments in projects and will also not be available as actual costs until these costs are imported into projects.

- Budgetary control can be set for a project, project and top resource, or award and funding source segments. When a resource-level budgetary control is being used, resources for a project that are used in the internal material transfer requisitions can be defined in the resource hierarchy and budgeted to prevent fund reservation failures.

- If you enable budgetary control for the transaction ledger and business unit, then budgetary control validation is performed against project control budgets existing within the same ledger.

- Any changes to the budgetary control enablement for the Project internal material transfer to expense transaction subtype impact the budgetary control for existing transactions of this subtype.

Any adjustments to existing project costs that are internal material transfer to expense destination, and weren't originally budgetary controlled, become eligible for budgetary control in projects after budgetary control is enabled as outlined in the Steps to Enable section. Adjustments made to previously nonbudgeted project costs related to internal material transfers to expense destinations will only have newly adjusted amounts budgeted.

Key Resources

- For more information on budgetary control and encumbrance accounting, refer to these topics:

Role And Privileges

- Users with any of the following predefined job roles are automatically able to participate in the project-driven supply chain process:

- Warehouse Operator (ORA_INV_WAREHOUSE_OPERATOR)

- Shipping Manager (ORA_WSH_SHIPPING_MANAGER)

- Shipping Agent (ORA_WSH_SHIPPING_AGENT)

- Receiving Agent (ORA_RCV_RECEIVING_AGENT_JOB)

- Cost Accountant (ORA_CST_COST_ACCOUNTANT_JOB)

- Project Manager (ORA_PJF_PROJECT_MANAGER_JOB)

- Project Administrator (ORA_PJF_PROJECT_ADMINISTRATOR_JOB)

- Project Accountant (ORA_PJF_PROJECT_ACCOUNTANT_JOB)

- Project Billing Specialist (ORA_PJF_PROJECT_BILLING_SPECIALIST)

- Supply Chain Application Administrator (ORA_RCS_SUPPLY_CHAIN_APPLICATION_ADMINISTRATOR)

- If you're maintaining your own configured job roles: no new privileges were introduced to support the Apply Budgetary Control on Internally Sourced Requisitions Expensed to Projects feature.

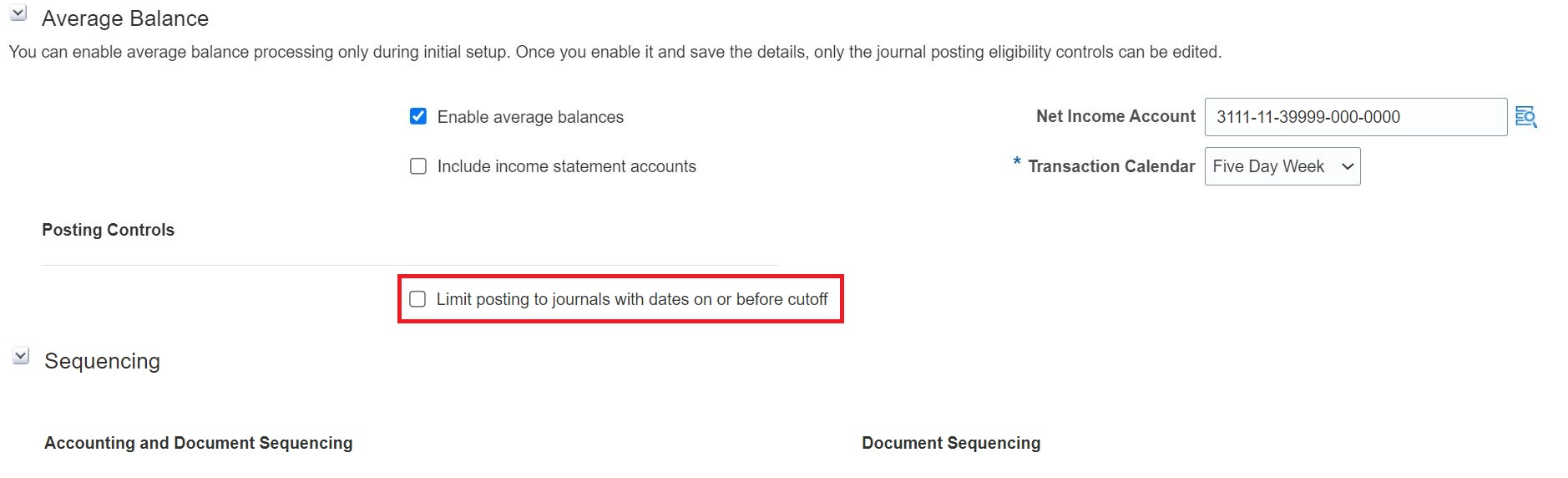

Budgetary Control Reservation of Invoice Payments When Cash Budget Has Insufficient Funds

When insufficient funds exist in the cash control budget, choose to pay an invoice. This helps in making critical payments even when budgetary control reservation fails.

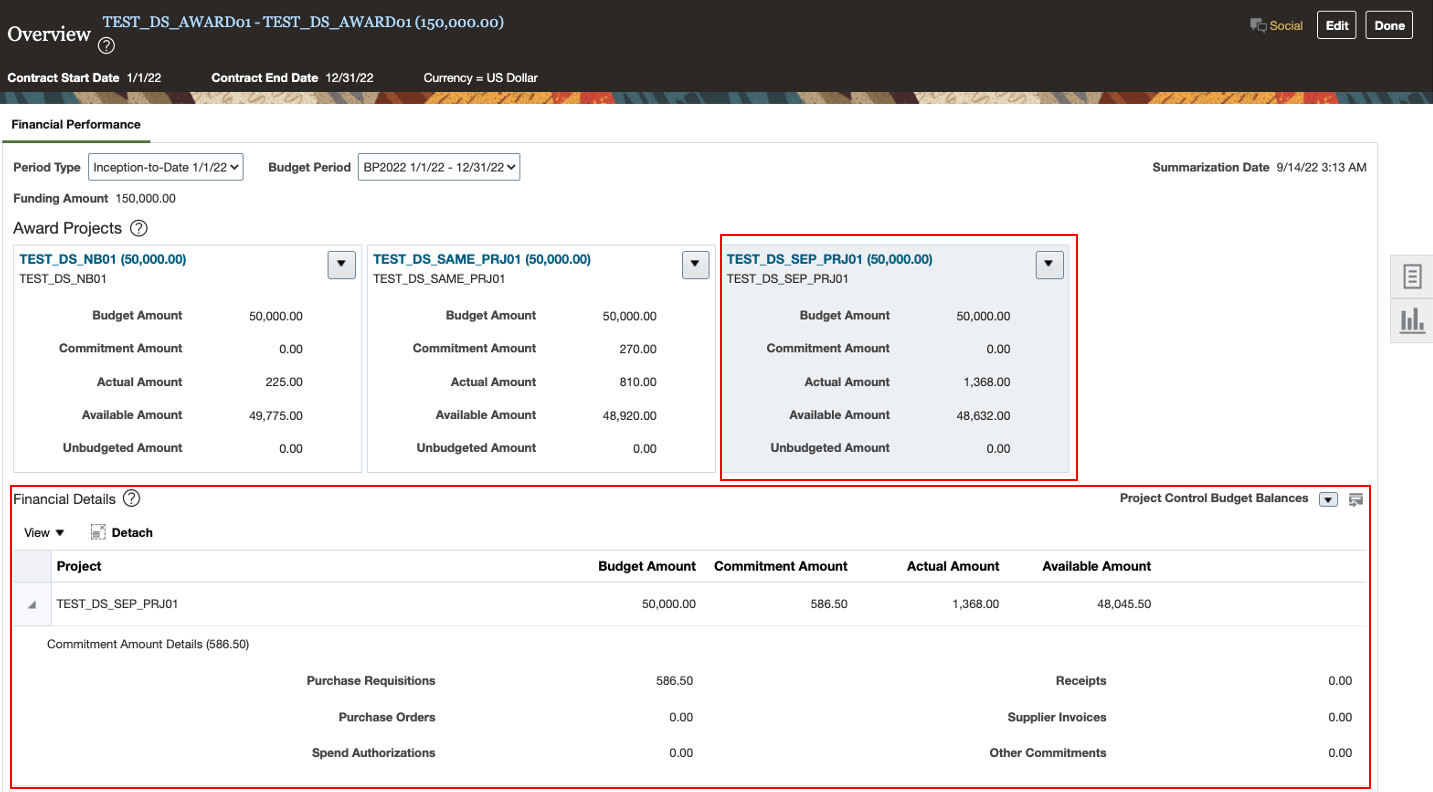

Reissue of payments is now supported for budgetary control validation against the cash control budget. This ensures the payment activity that makes up the cash control budget funds available reflects the reissued payment details instead of the original payment's details.

Use Quick Payments to Make Payments When There Are Insufficient Funds

To make a payment when there are insufficient funds, use the Allow payment with insufficient funds check box in the Advanced tab in the Options region of the Create Payment page.

Allow Payments with Insufficient Funds on Quick Payments

Budgetary Control Validation of Reissued Payments

Reissue of payments is supported for budgetary control validation against the cash control budget. The original payment is marked as voided and the payment amount is added back to the cash control budget funds available balance. The reissued payment is budgetary controlled and reduces the cash control budget funds available balance. There is no funds available impact from a reissued payment, but when viewing the activity that makes up the cash control budget funds available, the correct payment information is included. If reissue of a payment fails budgetary control validation, the payment is not reissued and the payment status remains negotiable. An error message is displayed with the reason for the failure.

Reissue of a Quick Payment

Steps to Enable

- Refer to the Steps to Enable section of this update 22C feature:

- Budgetary Control Invoice Payments for Cash Budgets in Manage Payment Process Requests feature.

- You don’t need to do anything to enable this feature.

Tips And Considerations

- If a critical payment within a payment process request fails because of insufficient funds, create a quick payment with the Allow payment with insufficient funds check box enabled to allow the payment amount to be reserved and pass budgetary control validation.

- The Allow Payments with Insufficient Funds privilege controls the display of the check box on the Create Payments page and is seeded for these roles:

- Accounts Supervisor

- Accounts Payable Payment Supervisor.

Create a custom role without this privilege, if you have users with these roles that shouldn’t have the ability to allow payments with insufficient funds.

- The Allow payment with insufficient funds option is not available on pay in full and payment process request payments.

- In update 22C, the Budgetary Control Invoice Payments for Cash Budgets in Manage Payment Process Requests feature was released. Refer to the update 22C What’s New document for additional information on creating and using cash control budgets.

- In update 22D, the Budgetary Control Invoice Payments for Cash Budgets in Quick Pay and Pay in Full feature was released. Refer to the update 22D What's New document for additional information on this feature.

- Payment features not supported for cash controls in the Payables subledger will be consumed against the cash control budget when the journals for these unsupported payments are reserved in General Ledger, for example, manual or refund payments.

Key Resources

- Revenue and Cash Controls in Using Financials for the Public Sector

- Cash Budgets for Payments in Using Payables Invoice to Pay

- Payments in Using Payables Invoice to Pay

Role And Privileges

- Budget Manager role is needed to manage budgetary control configuration.

- Accounts Payable Supervisor or Accounts Payable Payment Supervisor role is needed to create and manage payments.

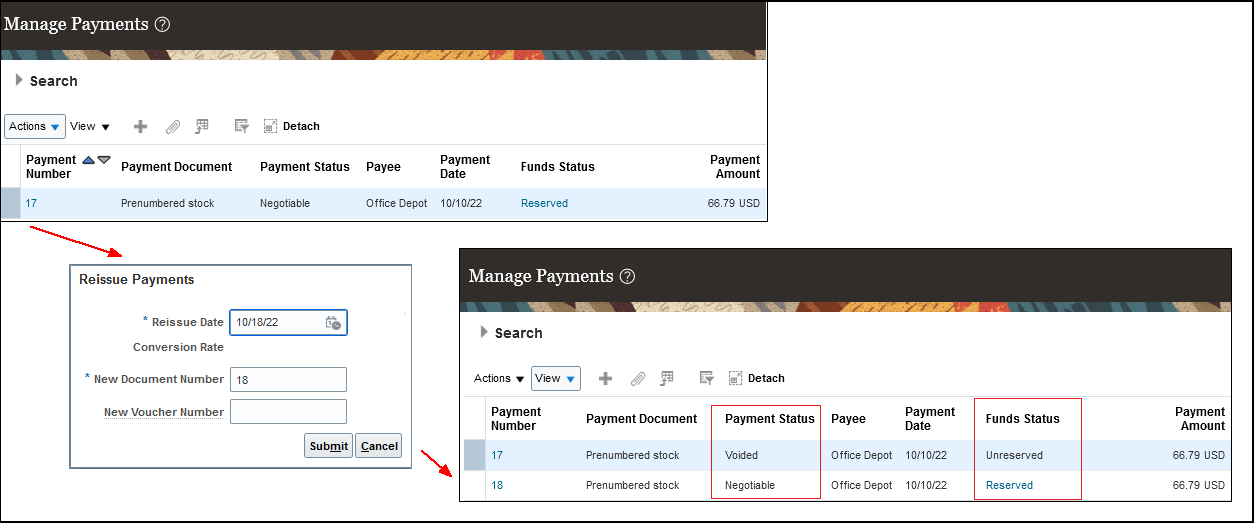

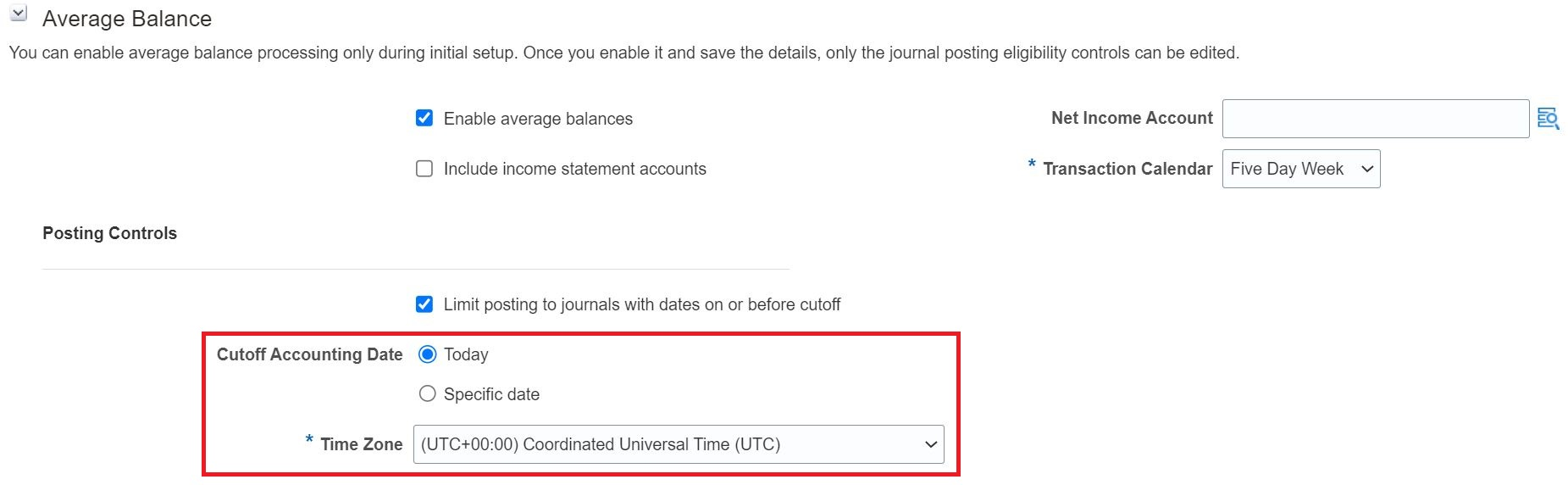

Future-Dated Journal Posting Control in Open Periods for Average Daily Balance Ledgers

Configure controls to prevent future-dated journals from posting to an open period in average daily balance ledgers. Specify a cutoff date within an open period for which journal batches with an accounting date after the cutoff date cannot be posted. This enables GL revaluation and translation to process account balances that do not include future-dated journals. The posting controls are set for the primary ledger and apply to its related secondary ledgers and reporting currencies.

Follow these steps to enable posting controls for average balance enabled primary ledgers:

Step 1: Enable the check box labelled as "Limit posting to journals with dates on or before cutoff"

Prerequisite: The "Enable average balances" check box must be selected for the primary ledger in the Specify Ledger Options page - Average Balance section.

In the Posting Controls subsection under the Average Balance section, select the "Limit posting to journals with dates on or before cutoff" check box.

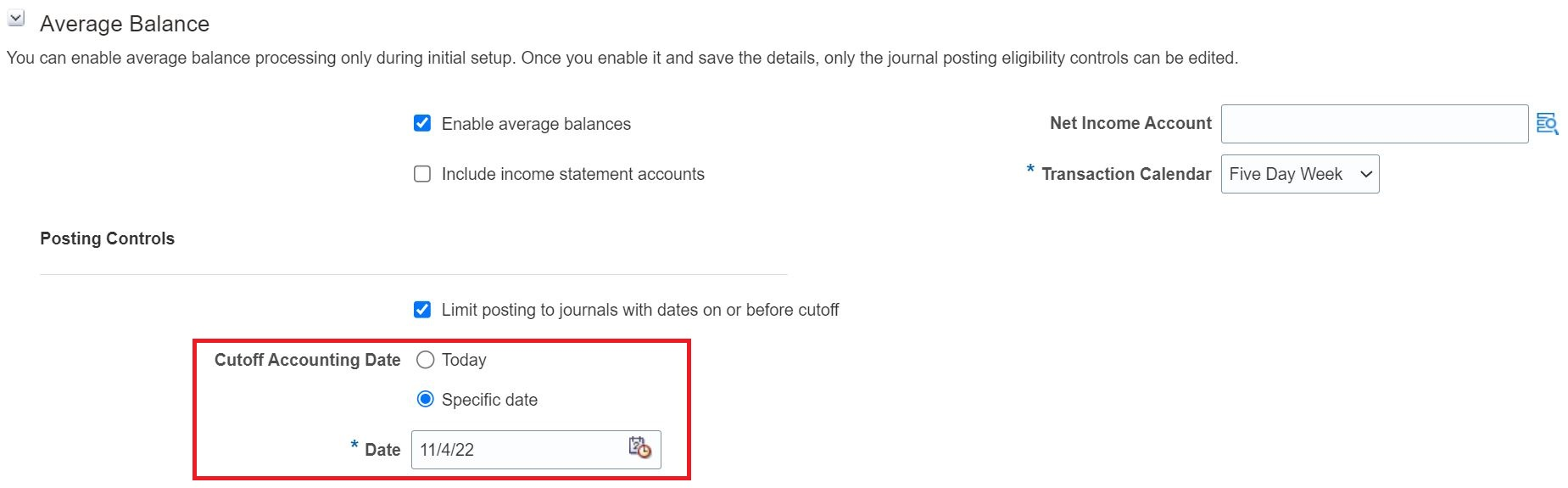

Step 2: Set the Cutoff Accounting Date

On enabling the "Limit posting to journals with dates on or before cutoff" check box, different options are presented to set the Cutoff Accounting Date.

By default, the Cutoff Accounting Date is set to "Today" with the default Time Zone set to "Coordinated Universal Time (UTC)" but you can select this to be any other time zone around the world. The selected time zone here will be used to determine when the clock passes 12:00 AM on that specified time zone, indicating the eligible date for posting of journal batches with accounting dates equal to or lesser than that date.

See illustration below as example -

| Time Zone | Date and Time | Today |

|---|---|---|

| Coordinated Universal Time (UTC) | 16-NOV-2021 5:00 PM | 16-NOV-2021 |

| Sydney Eastern Time (AEST) | 17-NOV-2021 3:00 AM | 17-NOV-2021 |

Set the Cutoff Accounting Date to "Specific date" when you want to set a fixed date as the cutoff for posting of journal batches. On setting the Cutoff Accounting Date to "Specific date", by default the current system date is populated in the Date field but it can be updated.

NOTE: A Journal batch becomes eligible for posting only when the accounting date for all journals in that batch is on or before the cutoff date.

Business benefits include:

-

Enhanced posting control of future-dated journal entries for average balance ledgers in an open period.

- Accurate as-of-date ledger balances to serve as the basis for processing daily accounting calculations, such as the revaluation of foreign currency balances, translation of ledger balances to a different reporting currency, allocation of balances from one account to another, and the transfer of one ledger's balance to a different ledger.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

Tips:

- In the Manage Journals page, review journal batches excluded from posting due to posting control settings by selecting the Postable Detail column from the View Columns menu in the Search Results table.

- Use the Posting Validation Report to review a summary of the journal batches that were excluded from posting by the corresponding Posting process due to Posting Controls setup.

- Use "Today" as the cutoff accounting date with a relevant time zone as per your journal processing window to ensure no future-dated journals are posted. With this option enabled, system automatically advances the cutoff accounting date whereas with the "Specific date" option, manual update is required to advance the cutoff accounting date.

- Use the ERP Integrations REST Endpoint to update the cutoff accounting date when it's set to "Specific date". This is particularly helpful to advance the cutoff accounting date after the required daily period close processes have completed.

Considerations:

-

The posting controls set for the primary ledger are applicable to its related secondary ledgers and reporting currencies, regardless of whether the secondary ledgers are enabled for average balance processing.

Key Resources

- Refer to the Set Up Average Balance Processing topic in the Implementing Enterprise Structures and General Ledger guide on Oracle Help Center.

Role And Privileges

No new privileges would be required to setup Posting Controls options.

Existing job roles with Setup access (Eg: Application Implementation Consultant, Financial Application Administrator) would be able to access the Posting Controls in Specify Ledger Options page.

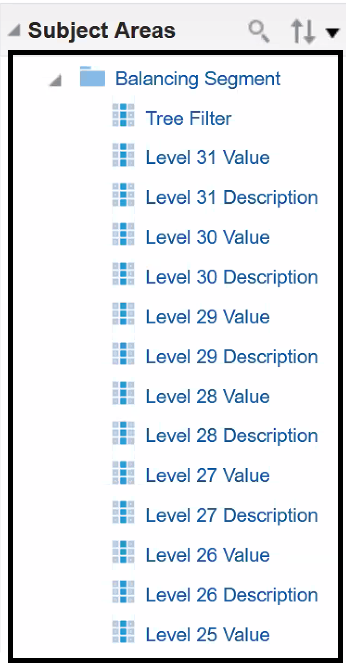

Improvements in Segment Attribute Labels in General Ledger Oracle Transactional Business Intelligence (OTBI) Subject Areas

The attribute names in the Balancing Segment, Cost Center, and Natural Account Segment folders for the General Ledger subject areas have been changed to Tree Filter, Value, and Description. This ensures consistency when viewing folders in the subject areas.

The following subject areas have the attribute changes:

- General Ledger – Transactional Balances Real Time

- General Ledger – Transactional Average Daily Balances Real Time

- General Ledger – Balances Real Time

- General Ledger – Average Daily Balances Real Time

- General Ledger – Journals Real Time

The following attributes were changed.

| Folder | Attribute Name Before Change | Attribute Name After Change |

|---|---|---|

| Balancing Segment | Balancing Segment Tree Filter | Tree Filter |

| Balancing Segment |

Balancing Segment Code |

Value |

| Balancing Segment |

Balancing Segment Description |

Description |

| Balancing Segment |

Balancing Segment Level XX Code |

Level XX Value |

| Balancing Segment |

Balancing Segment Level XX Description |

Level XX Description |

| Cost Center Segment |

Cost Center Tree Filter |

Tree Filter |

| Cost Center Segment |

Cost Center Code |

Value |

| Cost Center Segment |

Cost Center Description |

Description |

| Cost Center Segment |

Cost Center Level XX Code |

Level XX Value |

| Cost Center Segment |

Cost Center Level XX Description |

Level XX Description |

| Natural Account Segment |

Account Tree Filter |

Tree Filter |

| Natural Account Segment |

Account Code |

Value |

| Natural Account Segment |

Account Description |

Description |

| Natural Account Segment |

Account Level XX Code |

Level XX Code |

| Natural Account Segment |

Account Level XX Description |

Level XX Description |

Attributes in the Balancing Segment Folder

Business Benefit:

The consistent attribute names helps in viewing the folders in the subject areas.

Steps to Enable

You don't need to do anything to enable this feature.

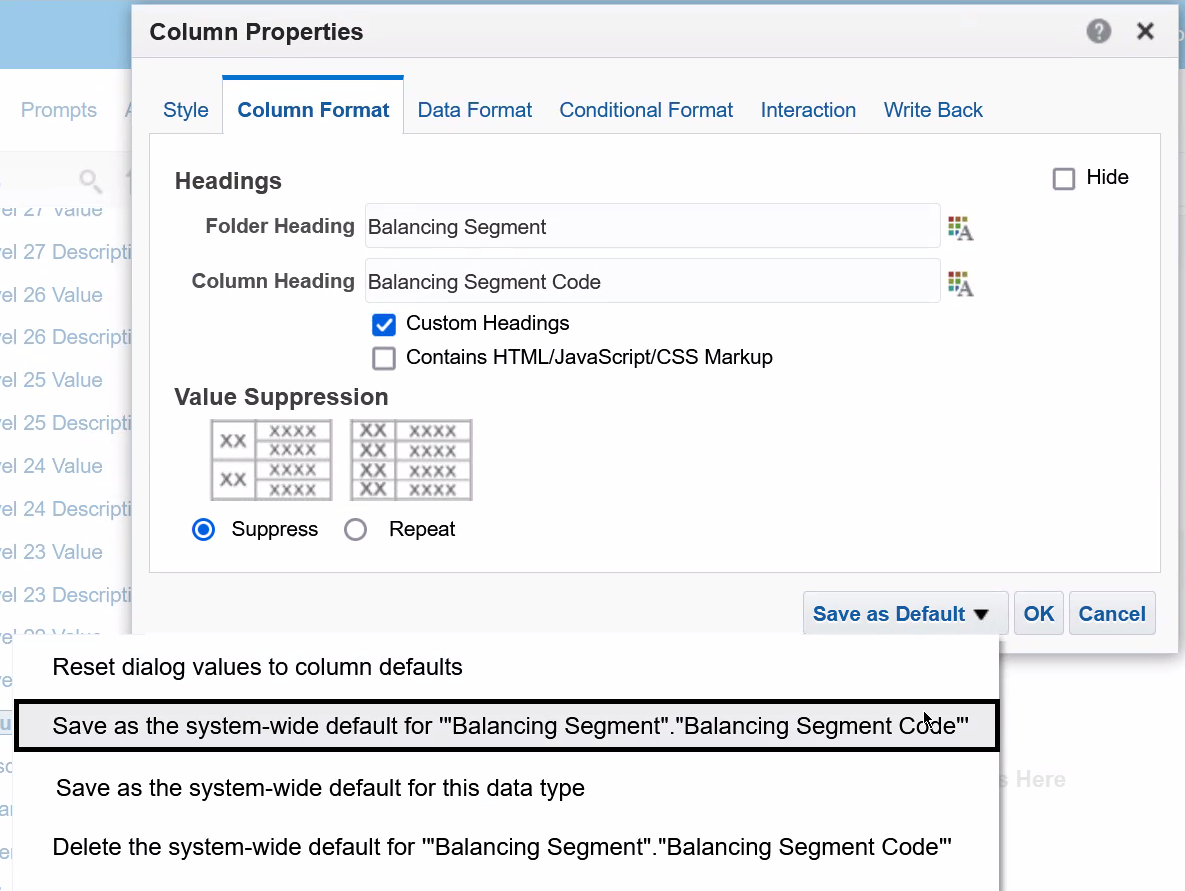

Tips And Considerations

You can set up a system-wide default custom label, if you continue to display the folders name without the changes.

- Create a new analysis.

- Add the column that requires the custom label into the analysis.

- Click the wheel icon and select Column Properties.

- In the 'Column Properties' - dialog box, click the Column Format tab.

- Click the check box adjacent to 'Custom Heading' and enter custom Folder Heading/Column Heading.

- Click Save as Default and Select - "Save as the system - wide default for <Column Name>.

- Click OK.

Column Properties Dialog Box

Key Resources

- Subject Areas for Transactional Business Intelligence in Financials guide on the Oracle Help Center.

- Creating and Administering Analytics and Reports for Financials guide on the Oracle Help Center.

Role And Privileges

No new roles/privileges are required to access the subject areas.

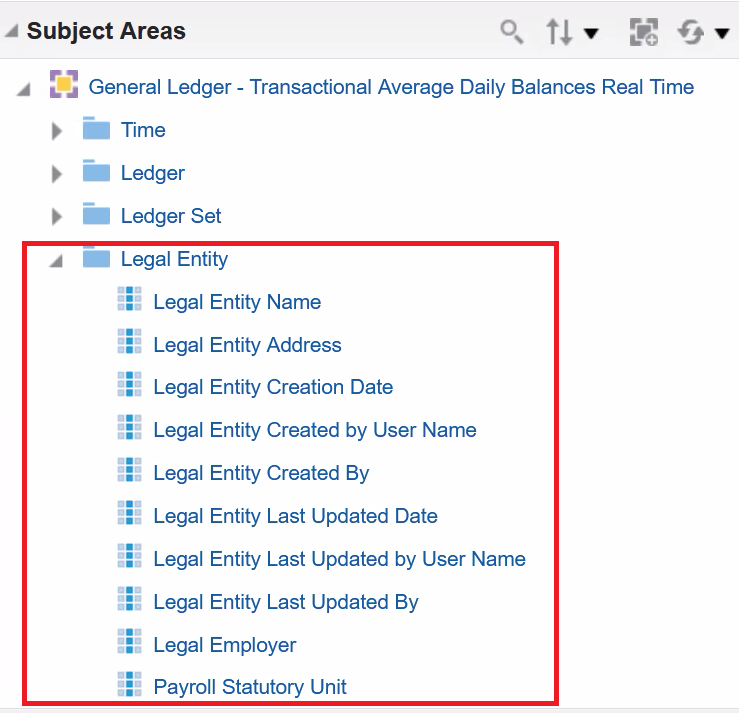

Legal Entity Dimension Display in General Ledger Subject Areas in Oracle Transactional Business Intelligence (OTBI)

View and report on the Legal Entity common dimension in the OTBI General Ledger - Transactional Balances Real Time and General Ledger - Transactional Average Daily Balances Real Time subject areas. This provides an immediate view of the Legal Entity dimension, similar to the other Financial subject areas.

The existing Legal Entity folder in the General Ledger- Transactional Balances Real Time and General Ledger - Transactional Average Daily Balances Real Time subject areas has been enhanced with additional attributes that can be used to filter the legal entity data.

Legal Entity Folder and Attributes for the General Ledger – Transactional Average Daily Balances Real Time Subject Area

Business Benefit:

Improved performance for prompts based on Legal Entity Name from the General Ledger - Transactional Balances Real Time subject area.

Steps to Enable

Leverage the attributes in the Legal Entity folder in the General Ledger - Transactional Balances Real Time and General Ledger - Transactional Average Daily Balances Real Time subject areas by adding them to existing reports or using them in new reports.

Key Resources

- Subject Areas for Transactional Business Intelligence in Financials guide on the Oracle Help Center.

- Creating and Administering Analytics and Reports for Financials guide on the Oracle Help Center.

Role And Privileges

No new roles/privileges are required to access the Legal Entity Folder in the subject areas "General Ledger - Transactional Balances Real Time" and "General Ledger -Transactional Average Daily Balances Real Time".

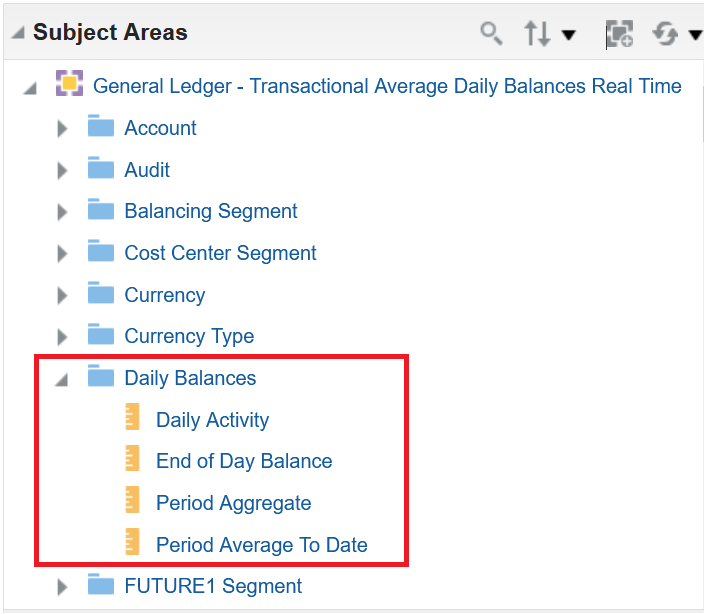

Operational Query Capability for Average Daily Balance Ledgers Using OTBI

Generate reports on the daily activity, average, and end-of-day balances using the General Ledger - Transactional Average Daily Balances Real Time OTBI subject area. Using this subject area, you can also report on the descriptive flexfields associated with the segment values.

The folder structure for the subject area is quite similar to the existing "General Ledger - Transactional Balances Real Time" subject area, which is used for reporting on standard balances. A new "Daily Balances" folder has been added with the average balance-related attributes to enable reporting for average balance ledgers.

Additionally, you can now also use the segment folders in the "General Ledger - Transactional Average Daily Balances Real Time" and "General Ledger - Transactional Balances Real Time" subject areas to report on 30 levels of hierarchy.

Business benefits include:

- Enhanced auditability due to the ability to report on the aggregate balances along with fiscal day detail.

- Leverage other benefits of OTBI solution, such as trending charts, etc.

Steps to Enable

Leverage new subject area(s) by adding to existing reports or using in new reports. For details about creating and editing reports, see the Creating and Administering Analytics and Reports book (available from the Oracle Help Center > your apps service area of interest > Books > Administration).

Key Resources

- Refer to the Subject Areas for Transactional Business Intelligence in Financials guide on the Oracle Help Center.

Role And Privileges

No new roles/privileges are required to access this subject area.

Carried Interest Configuration and Tracking

Distribute joint venture transactions according to the terms and conditions of a carried interest agreement. Carried interest agreement processing enables the tracking and reporting of amounts that consenting partners carry for nonconsenting partners in a carried interest agreement.

Business Benefit:

Timely and accurate processing of carried interest agreements eliminates errors associated with manual processing and ensures compliance to the joint operating agreement.

Watch a Demo.

Steps to Enable

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Financials

- Opt in to Carried Interest Configuration and Tracking in Joint Venture Management.

- Set up the components of carried interest using the following tasks under the functional area: Joint Venture Management

- Task: Manage Carried Interest Agreements

Create the carried interest agreement, carried interest stakeholder groups and carried interest ownership definitions

-

- Task: Manage Joint Venture Definitions

Associate the carried interest ownership definition as the default ownership definition

-

- Task: Manage Joint Venture Ownership Definition Assignment Rules

Associate the carried interest ownership definition

Watch a Setup Demo.

Key Resources

-

Watch Carried Interest Configuration and Tracking Readiness Training

- For more information, refer to

- Implementing Joint Venture Management guide and

- Using Joint Venture Management guide.

Role And Privileges

- Joint Venture Application Administrator

- Joint Venture Accountant

- Joint Venture Accounting Manager

Editing Status for Overhead Methods

Use the "Editing" status for joint venture overhead methods to make changes to the attributes of the overhead method. The existing "Pending" status is replaced with the "Editing" status.

This ensures consistency across joint venture applications with easier rules about which attributes can be changed at what state in the process.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

At a status of Editing -

- If no overhead transactions have been created from the overhead method, then all attributes of the overhead method are available for editing.

- If transactions have been created from the overhead method, only the attributes Status, Description, End Date, and Transaction Description are available for editing.

Key Resources

- For more information, refer to

- Implementing Joint Venture Management guide and

- Using Joint Venture Management guide.

Role And Privileges

- Joint Venture Application Administrator

- Joint Venture Accountant

- Joint Venture Accounting Manager

Nonoperated Joint Venture Invoicing

Pay the joint venture managing partner of a nonoperated joint venture for cost distributions.

This enables a nonoperating partner using Oracle Joint Venture Management to automatically create payments and settle the costs with the joint venture operator.

Watch a Demo.

Steps to Enable

Ensure the following is set up in the joint venture definition for the nonoperated joint venture:

- The joint venture is classified as nonoperated in the Joint Venture Definition application.

- The stakeholder representing the managing partner has the stakeholder classification as "Operator" in the Joint Venture Definition application.

- In the Invoicing Partner application, for the nonoperating partner, set up the managing partner as a supplier to create Payables invoices.

Watch a Setup Demo.

Key Resources

-

Watch Nonoperated Joint Venture Invoicing Readiness Training

- For more information, refer to

- Implementing Joint Venture Management guide and

- Using Joint Venture Management guide.

Role And Privileges

- Joint Venture Application Administrator

- Joint Venture Accountant

- Joint Venture Accounting Manager

Operational Reporting for Oracle Joint Venture Management

Oracle Transactional Business Intelligence (OTBI) for Joint Venture Management enables operational reporting of joint venture transactions along with their associated general ledger, subledger accounting, and overhead information. The reports provide insight into joint venture operations, with sorting and summarization by joint venture, stakeholder, account, and joint venture source transactions.

Business Benefit:

- Operational reporting helps ensure efficient and timely data review and reconciliation.

- Create custom report templates based upon specific business needs, to help ensure a quick financial close with better insight into overall joint venture operations.

Watch a Demo.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

-

Watch the Operational Reporting for Oracle Joint Venture Management Demo

- For more information, refer to

- Implementing Joint Venture Management guide and

- Using Joint Venture Management guide.

Role And Privileges

- Joint Venture Application Administrator

- Joint Venture Accountant

- Joint Venture Accounting Manager

Reversal of Processed Joint Venture Distributions

Reverse previously processed joint venture distributions. The reversal creates a credit or debit memo for distributed amounts and leaves the joint venture distribution eligible for assignment to another stakeholder and for downstream processing.

Business Benefit:

Reversals of processed joint venture distributions helps managing partners resolve disputes raised by partners, saves time, and reduces potential errors caused by manual processes used to settle disputes.

Watch a Demo.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

- For more information, refer to

- Implementing Joint Venture Management guide and

- Using Joint Venture Management guide.

Role And Privileges

- Joint Venture Accountant

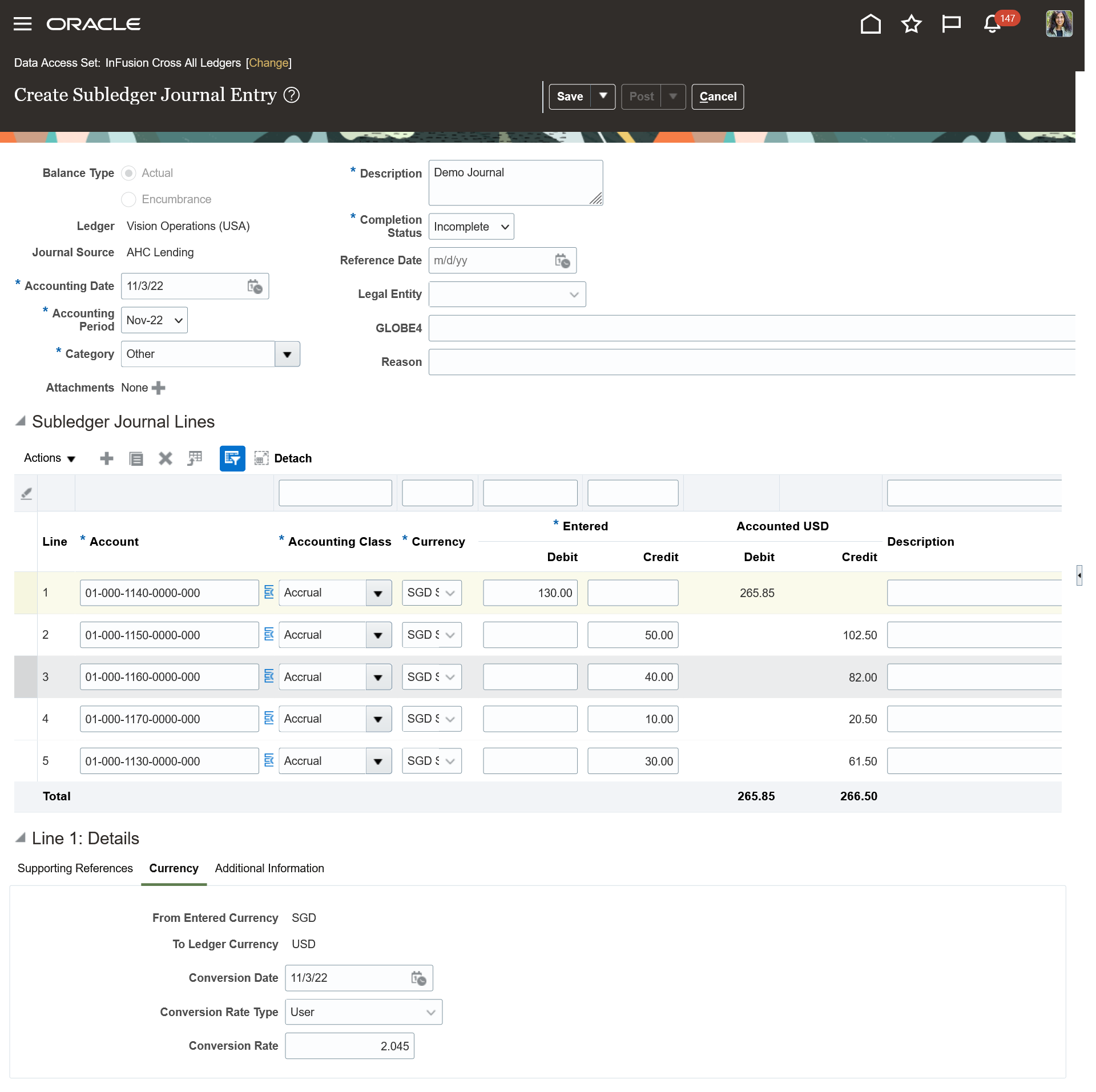

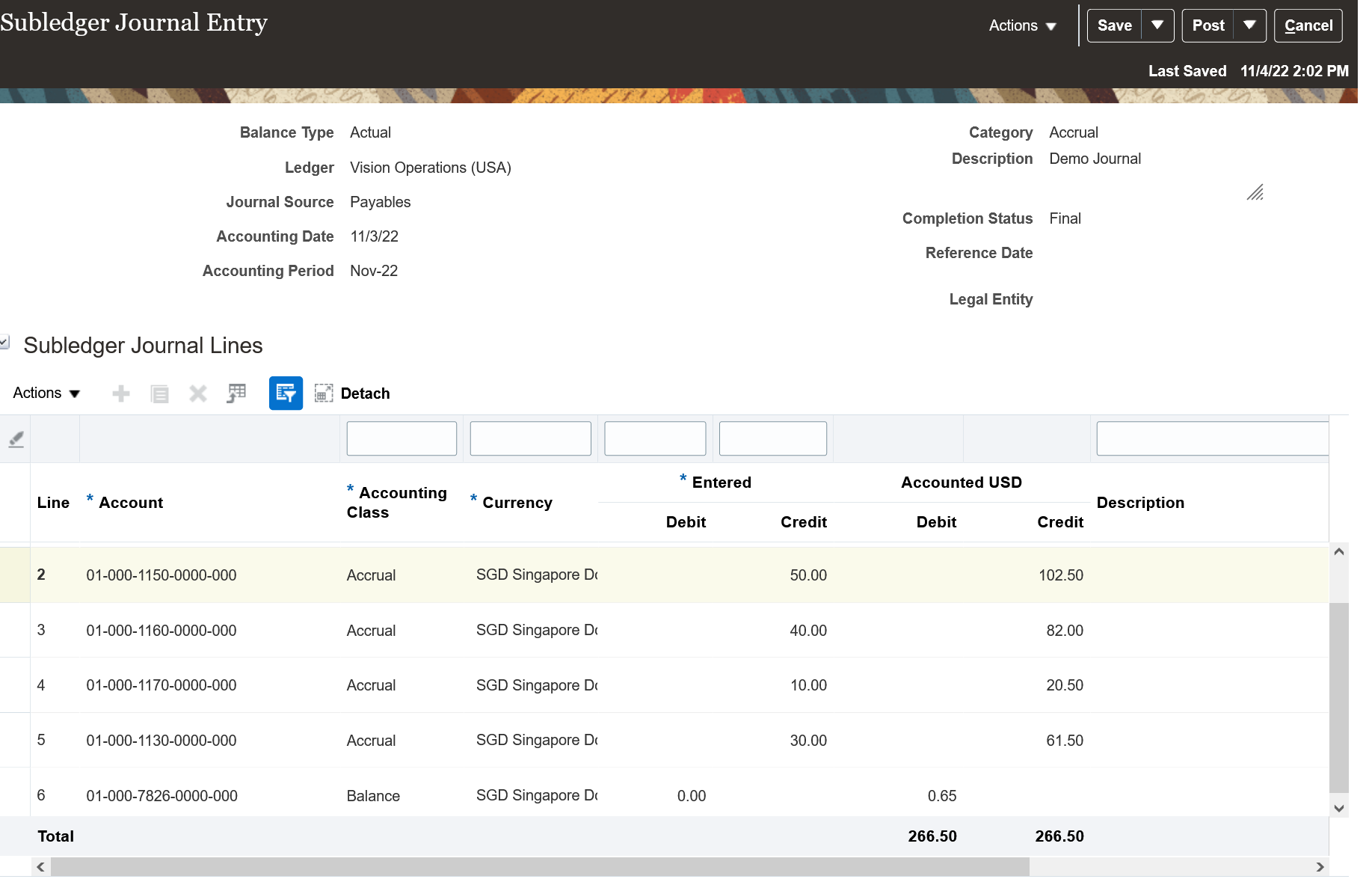

Exchange Gain or Loss Treatment in Foreign Currency Manual Subledger Journals

When entering a foreign currency journal in the Create Subledger Journal Entry page or spreadsheet, the system automatically calculates any currency exchange gain or loss and records it as a balancing line. This ensures foreign currency gains and losses are recorded when entering subledger manual journals.

The currency gain or loss balance is automatically recorded in a user-defined rounding account when, suspense is not enabled. Users can optionally transfer those currency exchange gain or loss balances to another account via a manual journal entry. However, when suspense is enabled, system will record the currency gain or loss against the suspense account.

Consider a foreign currency manual journal as shown below. The exchange rate for entered currency Singapore Dollar to ledger currency US Dollar is 2.045 on line 1 and 2.05 on the remaining lines. The journal is balanced in entered amounts but is out of balance in accounted amounts due to the currency exchange gain or loss.

Foreign Currency Journal Unbalanced on Accounted Amounts Due to Different Exchange Rates on Journal Lines

When journal is saved in final status, then system automatically calculates the currency exchange gain or loss and records it as a balancing line in the user-defined rounding account.

Foreign Currency Journal Automatically Balanced by Computing Exchange Gain or Loss

Business benefits include:

- Supports manual subledger journal entry with currency exchange gain or loss.

- Enables automatic recording of currency gain or loss when entering a foreign currency subledger manual journal.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

Define a rounding account for the ledger to automatically record any exchange gain or loss in a subledger manual journal.

Key Resources

- For more details on how to define the rounding account, refer to the section Specify Ledger Options in the Implementing General Ledger guide in Oracle Help Center.

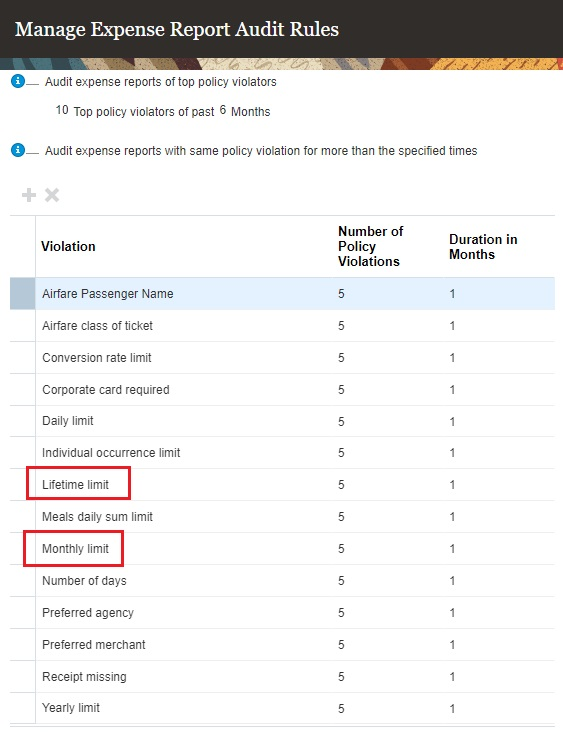

Monthly and Lifetime Rate Limit Enforcement for Miscellaneous Policies

Enforce monthly and lifetime rate limits for miscellaneous expenses. Use this feature to enforce policies where a certain expenditure is allowed only up to a certain limit within a specified time period. For example, set a limit for the maximum reimbursement allowed for internet charges every month.

Monthly Limit

You can enforce monthly limits on recurring expenses, such as mobile bills and internet charges. You can configure the rate limits based on role, gender, location or enforce the same rate limit for all employees.

For example, if you want to enforce 50 USD monthly limit on internet expenses for all employees, then you can set the rate limit as 50 USD and attach the policy to the expense type corresponding to the internet charges. If you want to enforce a varying monthly limit for mobile charges based on the employee's role, then select Role as a rate determinant and enter the rate limits for different roles using the Create Rates spreadsheet.

The application enforces the monthly limits on employees' expenses across all expenses submitted for a given month.

Lifetime Limit

Use the lifetime limit to enforce limits on expenses that employees incur during their employment with the organization, such as specific budgets allocated to work-from-home setup for remote workers. You can enforce lifetime limits based on role, gender, location or use the same limit for all employees. Define the policy and attach it to the corresponding expense type.

The application enforces the lifetime limit across all expenses of that expense type submitted by an employee.

Policy Enforcement and Audit

You can enforce the monthly and lifetime policies to display warnings to the employees or prevent them from submitting the reports when the expense amounts exceed the defined tolerance percentages.

When the employees submit these expenses, approvers can see the policy violation warnings in the approval notifications if the expense amounts exceed the defined warning tolerance limits. Approvers can then review the expense details and choose to approve or reject the reports based on the company's policies.

Auditors also have visibility into the monthly and lifetime limit policy violations when auditing the reports. If any of the reported expenses are violating the defined monthly or lifetime policy rates, then the application reports the policy violations against such expenses on the audit report page. Auditors can verify the allowed limits on the audit page and take an appropriate action on the report. Auditors can review further details related to the violations in the Audit Reasons Details column.

Auditors can also define audit rules to track the number of policy violations against these rate limits in a specified time period.

Business benefits include:

- Companies have more control over the enforcement of miscellaneous policies with the introduction of additional rate limits. These new rate limits simplify the enforcement of recurring or more frequently used policies.

- The ability to configure monthly and lifetime limits also provides more flexibility in defining the policies for various expense types and help provide better policy guidance to the employees.

- Approvers and auditors have visibility into the policy violations if employees are submitting the expenses above the defined limits.

Steps to Enable

To define monthly or lifetime limits in miscellaneous policies, perform the following steps:

- Sign in as the Expense Manager.

- From the Setup and Maintenance work area, navigate to the Manage Policies by Expense Category page.

- Select Create Policy > Miscellaneous.

- Enter the policy name and description and select the Miscellaneous Eligibility Rule if you want to enforce minimum number of days for the expense reimbursement.

- Choose the rate type as Rate limit or Percentage reimbursement with upper limit if you want to enforce rate limits.

- From rate limit, select Monthly limit or Lifetime limit depending on the policy you want to enforce. Select the rate currency.

- Choose the rate determinants - role, gender, location if you want to enforce rate limits based on any of these criteria.

- Configure the policy enforcement and save the policy.

- In the Create Rates window or spreadsheet, enter the rate limits you want to enforce for the policy.

- Save the policy and activate it from the Manage Policies by Expense Category page.

- Navigate to the Manage Expense Report Templates page, search for the template and select the expense type to which you want to associate the policy.

- In the Policies tab of the expense type setup page, select the policy you created in step 10. Enter the start and end dates and save the expense type setup.

The defined rate limits will be enforced based on the policy configuration when employees submit their expenses.

Key Resources

- This feature originated based on the Idea Labs on Oracle Customer Connect: https://community.oracle.com/customerconnect/discussion/589116

Role And Privileges

To define monthly or lifetime limits for miscellaneous policies, you need one of these roles:

- Expense Manager

- Application Implementation Consultant

Preconfigured Merchant Category Code Mapping to Expense Types

Use preconfigured mapping of merchant category codes to corporate card expense types. This reduces implementation effort as customer do not need to create the mapping.

Merchant Category Codes (MCC) and Standard Industrial Classification (SIC) codes are used to set up corporate card expense type mapping rules for automatically deriving the expense types for corporate card charges. This feature provides predefined MCC and SIC lookup types, each with a comprehensive list of lookup codes for mapping to corporate card expense types.

The new lookup types are:

| Lookup Type | Lookup Meaning |

|---|---|

| ORA_EXM_MCC_CODES | Expense Merchant Category Codes |

| ORA_EXM_SIC_CODES | Expense SIC Codes |

Also, additional card expense types are added to the list available in the EXM_CARD_EXPENSE_TYPE lookup codes. These additional card expense types are available for use in the Corporate Card Expense Type Mapping Rules, as well as in the Card Expense Type Mapping tab in the Manage Expense Report Templates task.

Additionally, 2 new Corporate Card Expense Type Mapping Rules are available with preconfigured mappings of the newly predefined Merchant Category Codes (MCC) and Standard Industrial Classification (SIC) codes to card expense types. The predefined rules are:

- Merchant Category Codes

- Expense SIC Codes

Administrators can use these preconfigured mapping rules as is, when setting up the corporate credit card program or they can modify the mappings as per business requirements.

The predefined MCC and SIC codes and the mapping rules simplify the configuration of the corporate card upload process.

The wider range of card expense types gives administrators greater flexibility in mapping the card expense types to the company defined expense types, thus improving the accuracy of the expense type derivation for expenses created using corporate card charges.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

- To view the new MCC and SIC codes, and additional card expense types, use the Manage Standard Lookups task in Functional Setup Manager and search using the required lookup type.

- To view the new mapping rules, use the Manage Corporate Card Expense Type Mapping Rules task in Functional Setup Manager in the Setup and Maintenance work area.

- Administrators can use the new mapping rules as is, or modify the mappings as per business requirements.

Key Resources

- For additional information about Corporate Card Expense Type Mapping rules, refer to the Mapping Rules topic in the Implementing Expenses guide on Oracle Help Center.

Role And Privileges

You need Corporate Card Administrator role to review preconfigured mapping rules.

Print Preview for PDF and MS Office Document Attachments in Expense Reports

Generate a print preview of an expense report and any pdf, image, .doc and .xls attachments. Employees and auditors can use this to view and print the expense report and related attachments as a single PDF document.

Prior to update 23A, only image attachments could be printed along with the expense report.

The single PDF document containing the report and the attachments makes it easy for users to review and print the expense report.

Steps to Enable

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Financials No Longer Optional From: Update 23C

Tips And Considerations

- This feature is delivered enabled by default for all new customers in update 23A.

- For all existing customers upgrading to 23A, refer to the Steps to Enable section to enable the feature.

Role And Privileges

You don't need any additional privileges to view reports with attachments.

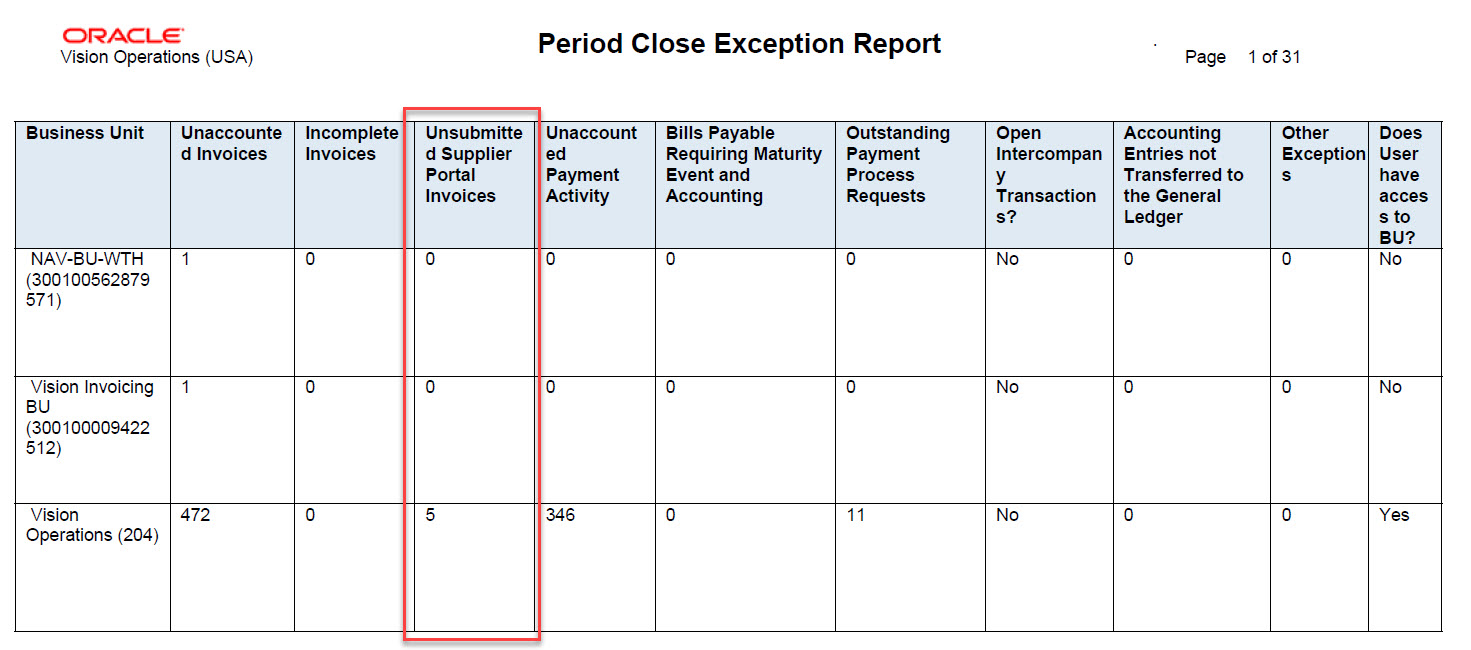

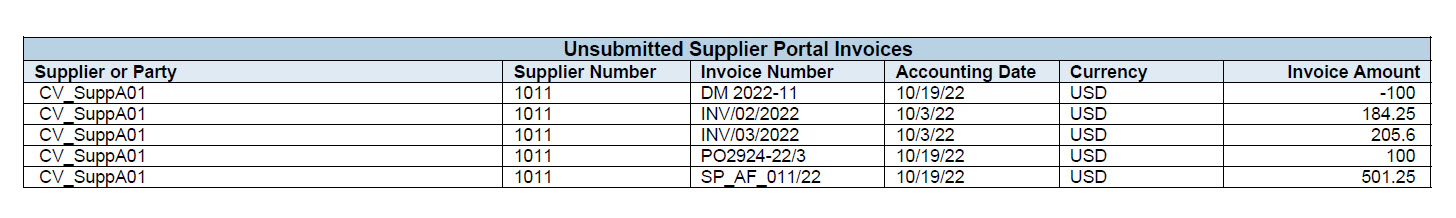

Cancellation of Unsubmitted Invoices to Expedite Period Closure

Provide Payables supervisors with the ability to cancel unsubmitted supplier portal invoices. This helps improve supplier portal management without having to contact supplier users.

A Payables supervisor can identify incomplete supplier portal invoices for cancellation either by querying the invoices in the Manage Invoices page or by running the Period Close Exception Report, which lists details of each invoice.

Changes in Period Close Exception Report

- The summary section of the report lists the count of Unsubmitted Supplier Portal Invoices separately

- In the Detail Section the incomplete invoices from supplier portal are listed in a separate table.

Changes in Payables Unaccounted Transactions and Sweep Report

Incomplete supplier portal invoices not yet submitted by the supplier are now listed in the report.

Payables users can act on incomplete invoices from supplier portal without having to contact suppliers.

Steps to Enable

You don't need to do anything to enable this feature.

Role And Privileges

Users with following Payables seed job roles will be able to cancel the incomplete supplier portal invoices

- Accounts Payable Supervisor

- Accounts Payable Manager

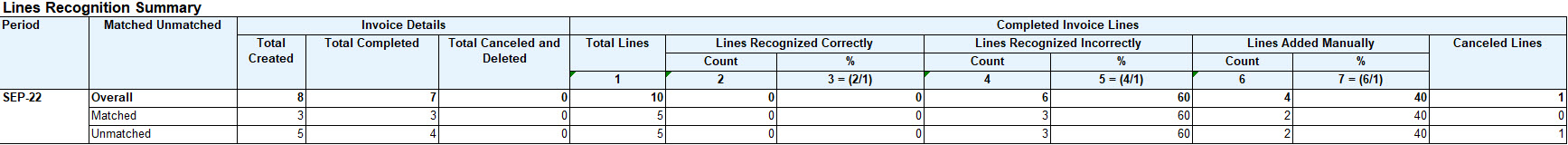

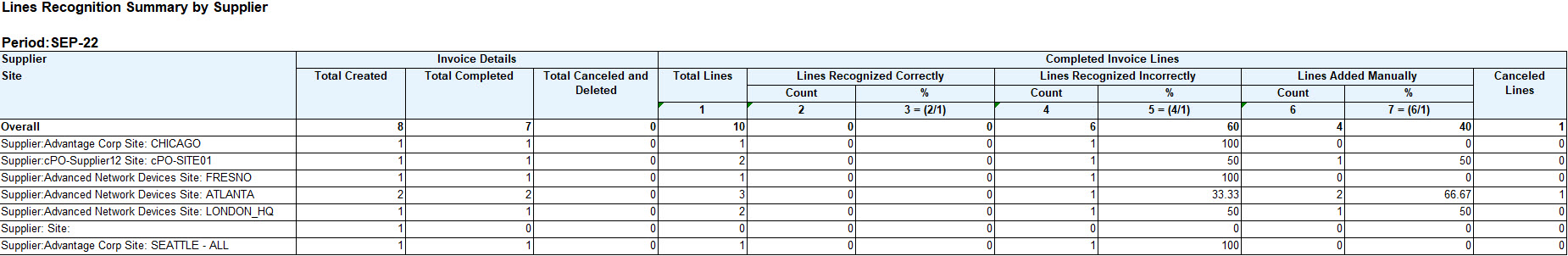

Invoice Line Recognition Rate Details for Monitoring Accuracy

Use the Invoice Lines Recognition Rate Report to track the accuracy of invoice line recognition for invoice documents processed by Intelligent Document Recognition.

Submit the Invoice Documents Recognition Rate report to obtain the details of the line recognition. The report is available in three formats, explained below, where the first two formats are for header line recognition and third format is the new format introduced to generate the line recognition details.

- Invoice Header Supplier Summary. Previously known as Supplier Summary.

- Invoice Header Details. Previously known as Invoice Details.

- Invoice Line Summary.

The report has three sections:

- Lines recognition summary: Displays line recognition rate details for every calendar period grouped by the type of the invoice (Unmatched and Matched).

- Lines recognition summary by supplier: Displays recognition rate details for every calendar period grouped by the combination of supplier and supplier site. The overall recognition rate for a period in lines recognition summary section matches with the overall rate displayed in this section for the given period.

- Attributes recognition summary: While the previous two sections focus on the accuracy of the lines as a complete entity, this section provides the details at the individual attribute level. It displays the line attributes recognition rate details for every calendar period grouped by the type of the invoice (Unmatched and Matched).

Business benefits include:

- Identify the supplier/sites with low line recognition rate and use adaptive learning to improve the recognition rate.

- Track suppliers with invoices that have a poor recognition rate for line-level attributes and help improve recognition through line-level adaptive learning.

- Use the Ledger parameter to run the report for the primary ledger, instead of submitting separate reports for each business unit belonging to the ledger and manually consolidating them into one report.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

The report analyzes the lines of invoices with the status Complete. Only invoices without an active Incomplete Invoice hold are considered for reporting. Invoices with an active Incomplete Invoice hold are excluded from all report counts.

Terminology used in Lines Recognition Summary and Lines Recognition Summary by Supplier

- Lines Recognized Correctly: Count of invoice lines where all attributes of the line are recognized correctly and not modified by the user.

- Lines Recognized Incorrectly: Count of invoice lines where at least one attribute of the line was recognized incorrectly or modified by the user.

- Lines Added Manually: Count of invoice lines that are manually created by the users from the Edit Invoice page.

Terminology used in Attribute Recognition Summary

-

Recognized Correctly: Count of line attributes that are recognized correctly and not modified by the user. These attributes are related with the invoice lines that are recognized by the IDR and not manually added by the user.

-

Recognized Incorrectly: Count of line attributes that aren't recognized correctly and modified by the user. These attributes are related with the invoice lines that are recognized by the IDR and not manually added by the user.

-

Manually Added: Count of invoice line attributes related with the invoice lines that are manually created by the user from the Edit Invoice page.

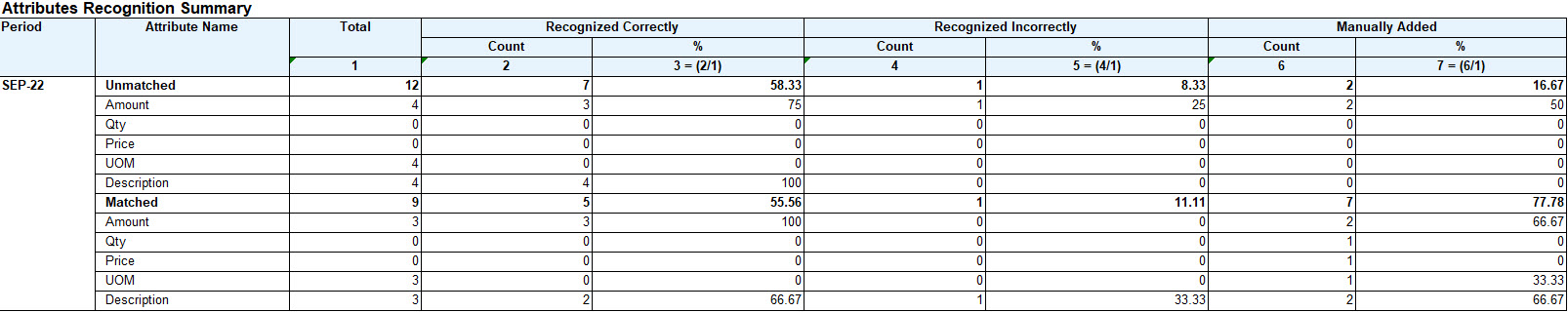

Matching of Invoices with Purchase Order Lines with Vendor Credits

Match invoices to purchase order lines with vendor credits. For example, if a buyer trades in older equipment when purchasing new equipment, the value of the equipment traded in is created as a negative line on the purchase order. Match the invoice to negative lines in the purchase order to record the vendor credit.

Match to Negative PO Line

Matching invoice lines separately to item lines and vendor credit on the purchase order ensures that an invoice reflects the cost of the item accurately.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

- Taxes are applicable on negative purchase order lines

- You can capture the project attributes for negative PO lines and transfer them to project costing.

Key Resources

-

For more details on creating purchase order lines with negative amounts, see the Readiness document for Oracle Procurement.

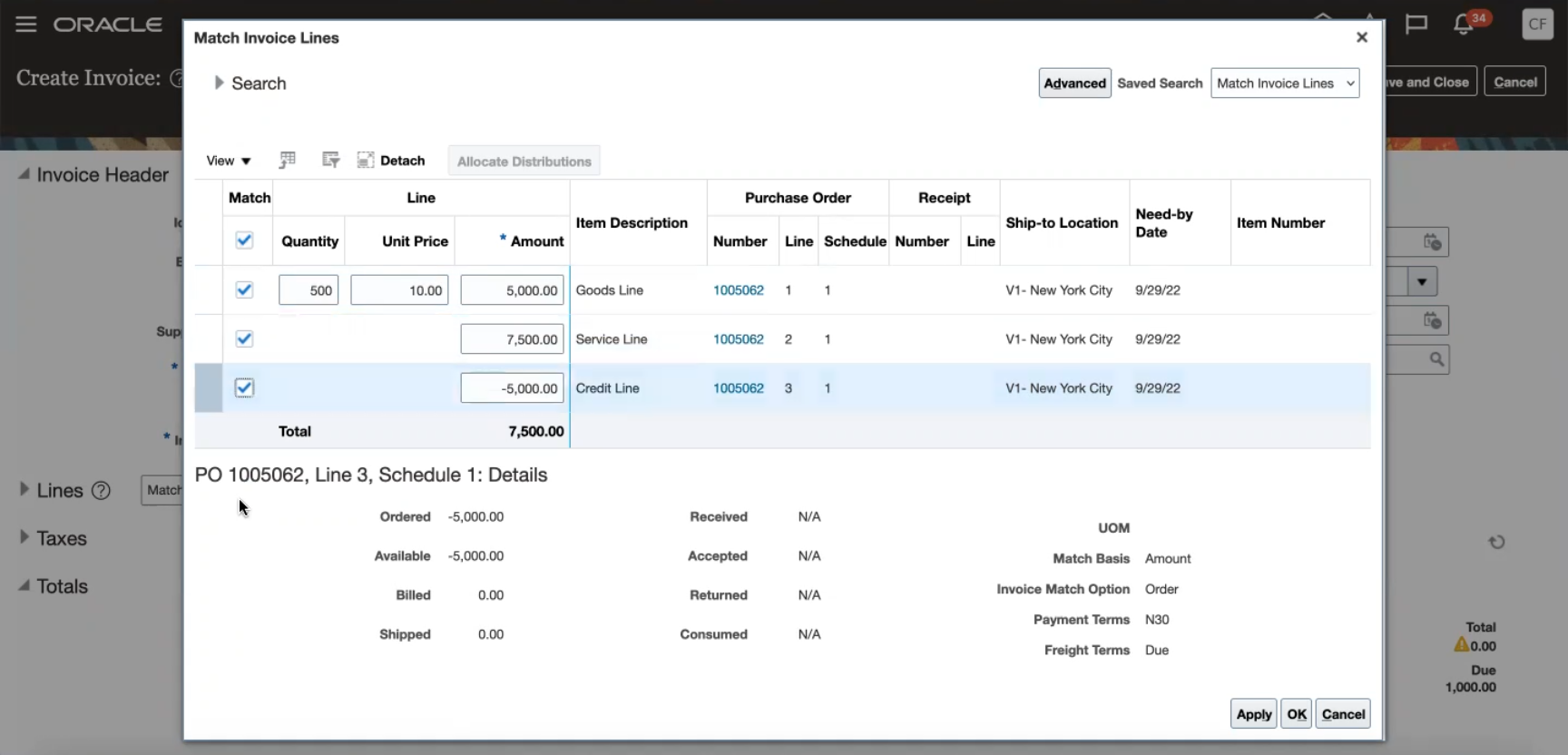

Fuzzy Matching of Description Between Invoice Lines and Purchase Orders

Use the fuzzy matching capability to match invoice lines to purchase orders when multiple lines have the same price and quantity but have minor differences in the description. This feature improves the performance of the matching rules by using the fuzzy matching algorithm to ignore minor discrepancies in the description while matching invoice lines to purchase orders.

The invoice line descriptions in Payables image invoices are matched to the line descriptions on the purchase orders. An exact description match may not work if the line descriptions in invoice and purchase order have a different order of words, extra spaces between words, plural or singular words, special characters, and so on. This leads to a low PO matching rate and more manual work for users. Supplementing the exact matching rules with fuzzy matching reduces manual updates and improves the overall efficiency of invoice to Purchase Order matching rules.

Business benefits include:

- Combined use of fuzzy matching and exact matching leads to higher invoice to Purchase Order matching rates.

- Reduces manual intervention on PO-matched invoices processed using Intelligent Document Recognition (IDR).

Steps to Enable

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Financials No Longer Optional From: Update 23D

VAT Payment in Local Currency for Poland Foreign Currency Invoices

Split payments against foreign currency invoices with a VAT tax line into two payments, one for the line amount in the foreign currency and one for the VAT amount in the ledger currency. This allows the payee bank to credit the VAT amount in the ledger currency to a separate bank account.

The scope of this feature includes only the foreign currency invoices where the installments are manually split into VAT and non-VAT amounts.

- How to create VAT installment

After entering the line details, navigate to the manage Installment page. Select the Pay group as ‘VAT Split Pay Group’. A new field with the column heading ‘VAT Split Bank Account’ is included at installment level. When the pay group is selected as ‘VAT Split Pay Group’, this new field will be displayed as read only field.

Split the installments in two: one with the VAT lines total amount, and the other with the invoice total amount balance. Select payment method as ‘VAT Split Payment Method’. When the payment method is selected as ‘VAT Split Payment Method’ , the ‘VAT Split Bank Account’ field will be enabled and value will be defaulted based on the supplier bank account setup. User can modify the defaulted value.

- How to set off a credit memo with a VAT split installment marked as pay alone

VAT split installments are marked with pay alone. This is in order to handle the VAT split bank account details.

When an invoice is marked as pay alone, it cannot be combined with other standard invoices or credit memos. In order to adjust the VAT specific credit memo against the VAT specific standard invoice (with pay alone marked), a minor change has been done in the create (quick) payment flow. In the create payment, system will allow associating one standard invoice with one credit memo if both are created with VAT specific payment method.

- How to adjust prepayment against a standard invoice with VAT split installment

Prepayment invoice is created without VAT lines. When a prepayment is applied against a standard invoice with VAT and Line items, the amount will be automatically adjusted off against the line installment or a VAT installment. To prevent this from happening, the VAT installment should be created with a later due date. While applying the prepayment application will automatically adjust the amount against the earlier due date installment.

- New XML tags included

Following additional tags have been included to meet the VAT Split requirement. Using these tags, customers can configure their payment file template.

- Invoice exchange rate

Included the following tags after the tag <DocumentCreationDate> under the tag <DocumentPayable>.

<InvoiceExchangeRate>

<RateType>Corporate</RateType>

<Rate>4.5</Rate>

</InvoiceExchangeRate>

- Invoice Pay group

Invoice pay group code is included under the <DocumenPayable> with the following name.

<PayGroup>Code</PayGroup> after the <DocumentCreationDate> under <DocumentPayable>

- VAT split bank account

VAT Split Bank Account details will be fetched as the payee bank account details.

- VAT split amount

VAT installment amount will be converted into the ledger currency and are fetched with these new tags under <OutboundPayment> after the <PaymentAmount> tag

<VATSplitPaymentAmount>

<Value>45</Value>

<Currency>

<Code>PLN</Code>

<Name>Polish Zloty</Name>

</Currency>

<VATSplitPaymentAmountText>Forty Five Polish Zlotych**** </VATSplitPaymentAmountText>

</VATSplitPaymentAmount>

This feature improves compliance with local regulatory requirements, such as in Poland, for reporting foreign currency invoices with the VAT amount reported in the local currency.

Steps to Enable

You need to follow the below mentioned steps to start using the VAT split payment functionality.

- Enable the feature.

- Attach the VAT split bank account at supplier setup.

- Create a new payment method.

- Create a new pay group.

1). Enable the feature

- Search for the task Manage Standard Lookups.

- Search for Lookup Type as ORA_ERP_CONTROLLED_CONFIG. Create a new lookup with the following values -

- Lookup Code – IBY_34548052

- Enabled – Checked

- Start Date – Select system date

- Meaning – VAT Split payment feature

- Description – VAT split payment feature

2). Attach the VAT split bank account at supplier setup

A new field with label ‘VAT Split Bank Account’ is included in the supplier bank account setup. Based on the business scenario, the VAT split bank account (in ledger currency) needs to be mapped at the profile or address or site level foreign currency bank account. Based on the foreign currency bank account defaulted on the invoice installment, the VAT split bank account will be defaulted automatically.

NOTE: This field is displayed only when the bank account approval is disabled through 'Approve Internal Changes on Supplier Profile'.

3). Create a new payment method

- Create a new payment method with the following attributes.

- Header attributes:

- Name: VAT Split Payment Method

- Code: VAT_SPLIT_PM

- Alias: TRF

- From Date: Accept the defaulted value

- Usage Rules tab:

- Do NOT select check box for 'Automatically assign payment method to all payees'. This will make sure that this special payment method which will be used only for the VAT split is not available to all the suppliers.

- Validations, Bills Payable and Additional Information tabs:

- No selection

- Payables tab:

- Select the check box 'Enable for use in Payables'

- Accept the default values for all other fields.

- Receivables for customer refunds and Cash management tab:

- Do NOT select the check boxes 'Enable for use in Receivables' and 'Enable for use in Cash Management'

4). Create a new Lookup code under pay group

Search for the task Manage Payables Lookups

Search for Lookup Type as Pay Group. Create a new lookup with the following values -

- Lookup Code – VAT_SPLIT

- Reference Data Set – Common Set

- Meaning – VAT Split Pay Group

- Enabled – Checked

- Start Date – Select system date

- Description – Enter some meaningful description

Tips And Considerations

You need to enable the feature and create the invoice with the specific payment method and specific pay group to use this functionality. This is in order to convert the foreign currency invoices with VAT lines into ledger currency and to create separate payments for the VAT installments.

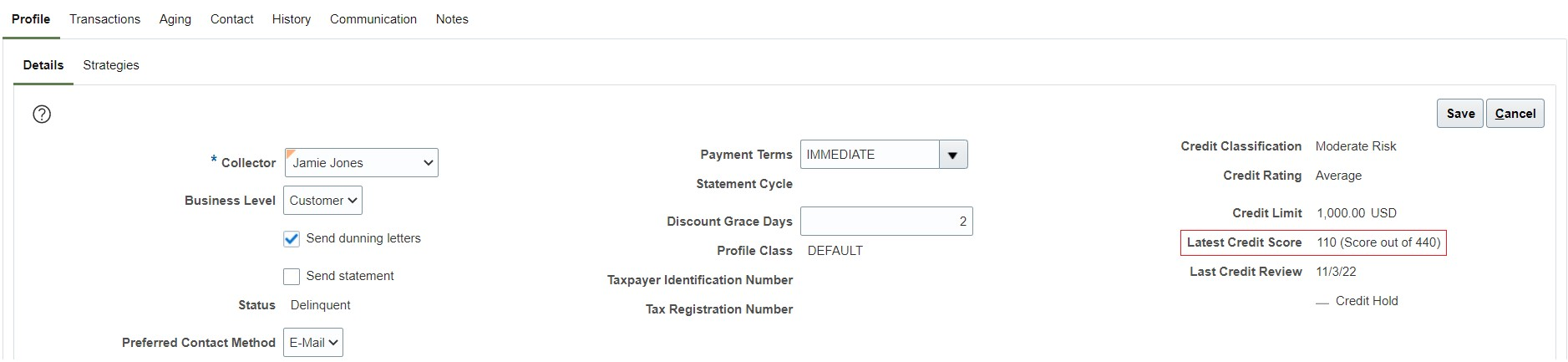

Credit Score Addition to Collections Customer Profiles

Display credit score information for customers on the corresponding Collections Customer Profile page to improve collections efficiency.

Credit score information is available on the Collections Customer Profile page at both the customer and account level. The Latest Credit Score field displays the score from the customer's most recent credit case folder in the Approved status.

Business benefits include:

- Provides access to current customer credit information.

- Enhances collector analysis of delinquent customers to improve business decisions.

Steps to Enable

Complete these prerequisite steps to use this feature.

- Click Navigator > Setup and Maintenance > Manage Standard Lookups.

- Define the lookup code with below details:

Lookup type: IEX_FEATURES

Lookup code: IEX_DISPLAY_CREDIT_ATTRIBUTES

Flexible Wait Time Settings for Collections Strategy by Transaction Type

Specify pre-wait and post-wait times for collection strategies by transaction type. This helps to support more flexible and targeted strategy tasks.

Use the Manage Strategy Tasks page to specify the pre-execution and post-execution wait times when the transaction level condition is set to Not Applicable. Define the tasks with strategy execution wait times based on transaction type. The strategy background process first evaluates whether a task has an execution wait time, and if so, the process waits and then runs the strategy task for the transaction according to the task definition.

Define Transaction Level Strategy Task

- From the Setup and Maintenance work area, access the Manage Collections Strategy Tasks task.

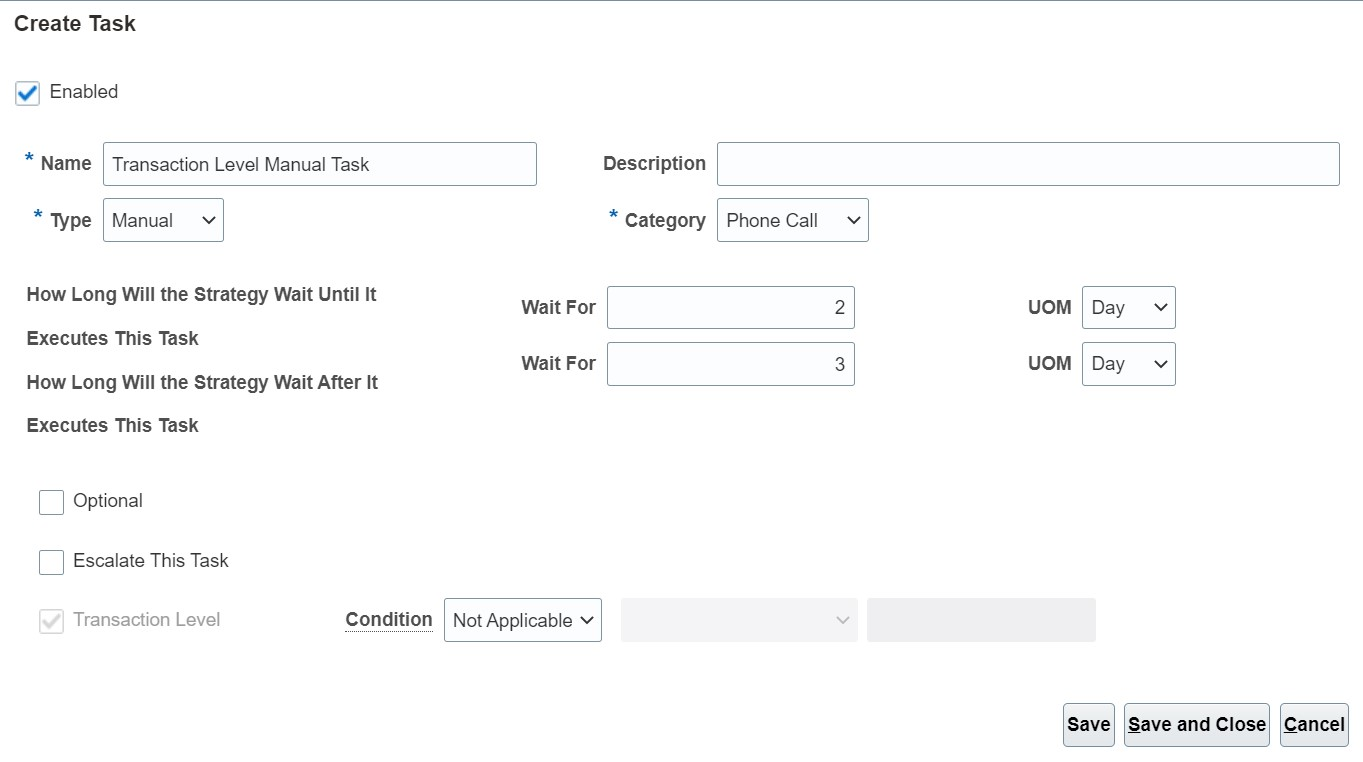

- Use the Create Task page to create a strategy task. Define the execution wait time when the condition is set to Not Applicable for transaction-level strategy tasks.

Manage Strategy Tasks - Create Task

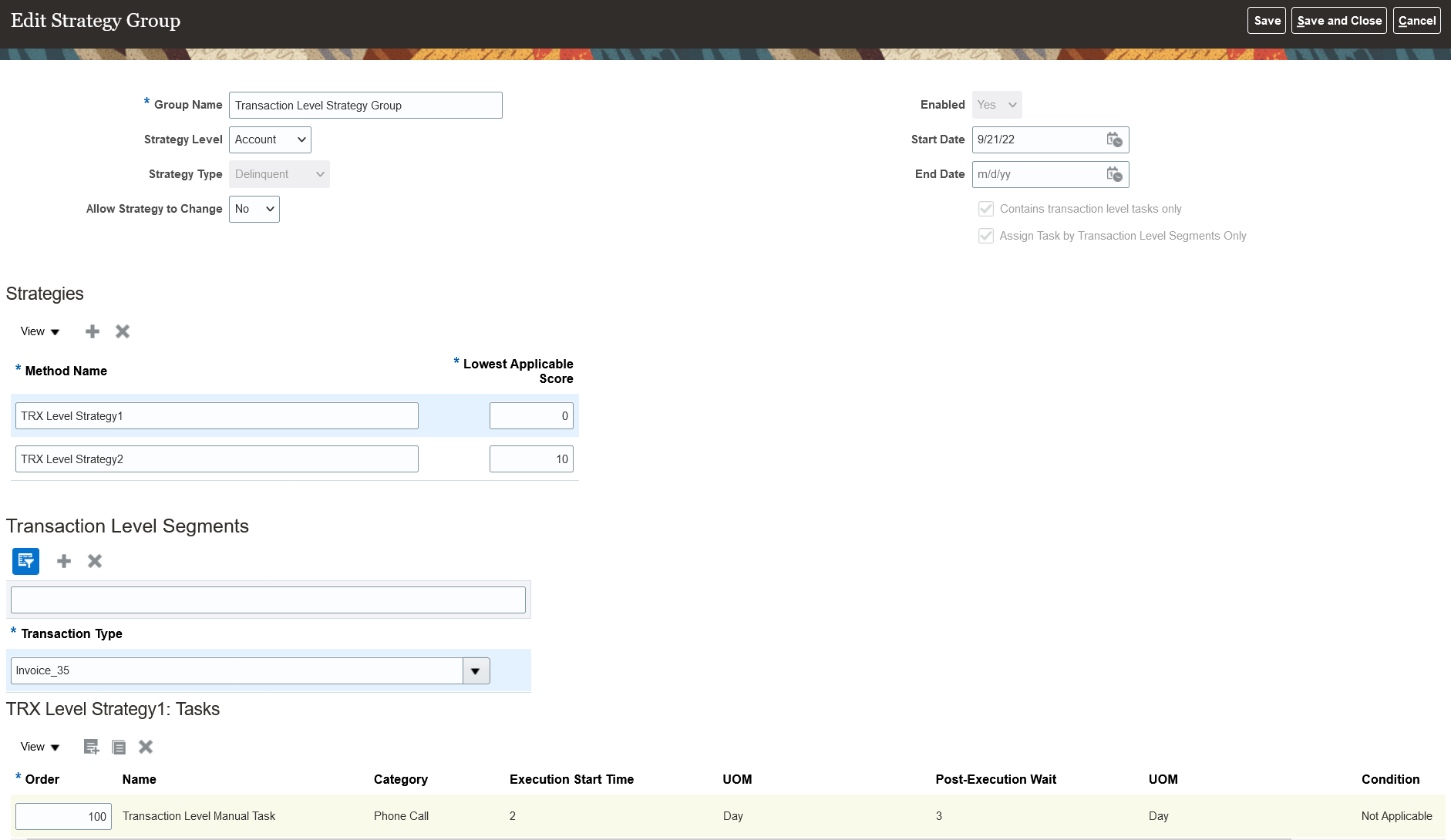

Define the tasks with execution wait times for strategies based on transaction type.

Define Transaction Level Strategy Group